Learn about the Frequently Asked Questions About KRA Returns By Taxpayers in Kenya. Get to know all details and information about KRA Returns in Kenya.

Before we begin, I just want to wish you all a “Happy New Month February 2020” We are already done with January 2020 and now we have just entered February 2020. In this article, I am going to share with you all the Frequently Asked Questions about KRA Returns.

Being the second month of KRA Returns Filing Season, there are some basic questions that I know most of you have have concerning KRA Returns in Kenya. So be it KRA Nill Returns or KRA Employment Returns, this article will offer you the answers to the most asked questions about KRA Returns by taxpayers.

READ ALSO: How To Receive New KRA Password For Locked iTax Account

Filing of KRA Returns is an important practice that each and every Kenyan who has an active KRA PIN needs to undertake using their iTax Accounts. Filing of KRA Returns and Paying any Taxes due to Kenya Revenue Authority (KRA) is part of nation building committment as it is those taxes paid that lead to development of the country as a whole and also running of Government of Kenya.

You need to take note and understand that any Kenyan with a KRA PIN is supposed to file his or her iTax Returns on or before the deadline. So, whether you are employed or unemployed, as long as you have a KRA PIN Number, filing KRA Returns is a must and failure to do so means that you will receive a penalty from Kenya Revenue Authority (KRA).

Any person who has an active KRA PIN Number and does not have any income is supposed to file his or her KRA Nil Returns between 1st January and 30th June of each year. So, you need to forget about the old notion that KRA Returns is for those who are employed, but rather any Kenyan with an active KRA PIN is supposed to be filing KRA Returns each year.

History of KRA Returns Filing In Kenya

Filing of KRA Returns is not a new concept in Kenya. Since the year 1992 (28 years ago), every individual taxpayer with an Active KRA PIN Number has always been required to file their KRA Income Tax Returns for every year of income by 30th June of the following year. So, in this case taxpayers have 180 days between 1st January to 30th June of each year to file their KRA Returns for the previous year.

This is a statutory requirement that if not met will attract penalties. What is the penalty for not filing Returns? Well the penalty for not filing your KRA Returns is a whopping Kshs. 2,000/= only. In these tough economic times in Kenya, you just don’t want to dish out Kshs. 2,000/= for paying KRA Penalties because of your ignorance of refusing and ignoring to file Returns. As Martin Luther King Jr. once said “Nothing in the world is more dangerous than sincere ignorance and conscientious stupidity.” Dont take these small things for granted. File your KRA Returns today.

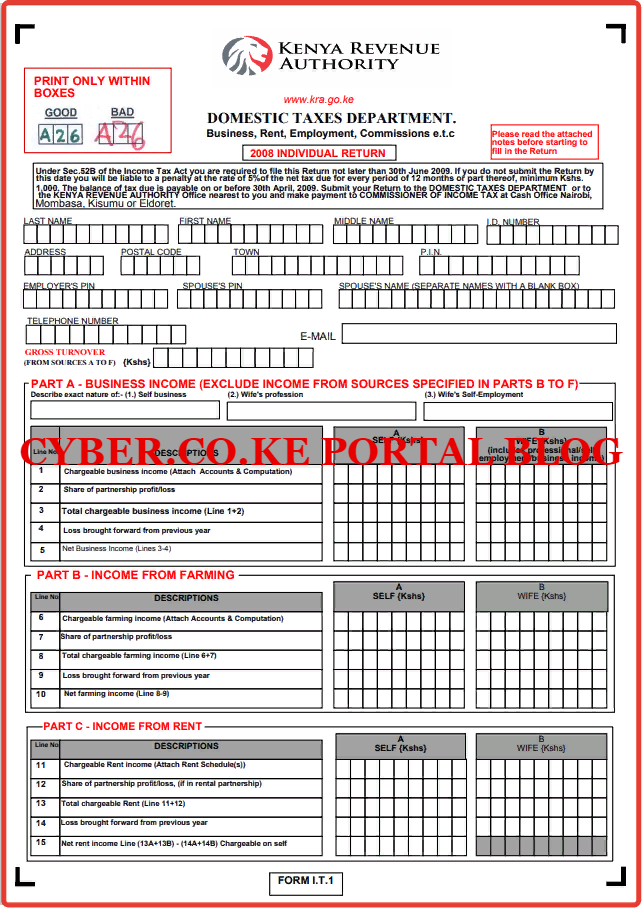

Filing of KRA Returns helps you to ascertain that what was deducted from your income as tax by your employer was actually remitted to KRA for those who have an active source of income (employed). Back in August 2015 (early days of the KRA iTax Portal), Kenya Revenue Authority (KRA) issued a public notice making it mandatory for all persons (taxpayers) to file their Income Tax Returns online via iTax Portal, which replaced the manual and tedious way of filing KRA Returns using the IT1 Forms (by filling the Returns Forms manually with a Pen) and submitting the same KRA Returns Forms to KRA Offices and Stations countrywide.

For all those newbies who never got a chance or were not yet registered as taxpayers in the days of filing Returns using a pen, you can click on the link below to view the old IT1 Forms that were being used before iTax Portal came into existence. Below is a screenshot of the Old KRA Returns Form that was called the IT1 Form.

LINK: Download Old KRA Returns Form For IT1 Individual

KRA iTax Portal was meant to simplify the filing process of KRA Returns by giving taxpayers a chance to file their KRA Tax Returns from the comfort of their homes, businesses or offices. Filing of KRA Tax Returns is still an uphill task for many Kenyans. Probably because some of the basic concepts behind income tax filing are not clear and concise. So in this article, I am going to address all the frequently asked questions about KRA Returns that most Kenyans don’t understand.

Frequently Asked Questions About KRA Returns By Taxpayers in Kenya

Now that we have briefly looked and the History of KRA Returns in Kenya, we need to get down to business and look at the frequently asked questions about Returns in Kenya. Since we have two categories of Individual Taxpayers in Kenya i.e those who are Unemployed (don’t have a source of income) and those who are Employed (have a source of income). Those who are unemployed file what is called KRA Nil Returns while those who are employed file KRA Employment Returns.

Frequently Asked Questions About KRA Nil Returns

The first category of KRA Returns that we are going to answer the commonly asked questions about is the KRA Nil Returns. I am going to highlight the key questions that most Kenyans ask about KRA Nil Returns. Now let us looks at the most frequently asked questions about KRA Nil Returns in Kenya.

What is KRA Nil Returns?

KRA Nil Returns is a type of return that is filed and declared by the group of taxpayers who have an active KRA PIN Number but don’t have a source of income. This group is sometimes called the the Unemployed. It also filed by students (College or University) who have KRA PIN Numbers but are still learning.

What Do I Need To Have To File KRA Nil Returns?

To be able to file KRA Nil Returns you need to ensure that you with you KRA PIN Number and iTax Password. If you don’t know or have forgotten your KRA PIN Number, you can submit your order online here at Cyber.co.ke Portal for KRA PIN Retrieval services.

Incase you have forgotten your KRA iTax Password, you can follow the steps on How To Reset KRA iTax Password and have a new password sent to your email address. If you need to change that email address on iTax, you can but KRA PIN Change of Email Address order here at Cyber.co.ke Portal.

When Am I Supposed To File My KRA Nil Returns?

KRA Nil Returns are filed between 1st January to 30th June of the current year. So you have a period of 6 months totalling to about 180 days to file your KRA Nil Returns. You will be filing the returns for the previous year starting from 1st January to 30th June.

What Happens When I Fail To File My KRA Nil Returns?

If you fail to file your KRA Nil Returns before the 30th June deadline, a penalty of Kshs. 2,000/= will be imposed on you as a result of late filing of the KRA Nil Returns. It is prudent to be filing your Nil Returns so as to avoid being slapped with penalties by KRA.

Is There An Extension On The KRA Nil Returns Filing Date?

There is normally NO extension of the deadline for filing KRA Nil Returns. So, the best thing you can do is to schedule a specific day and time that you will have time availability to file your KRA Nil Returns. A Return period of 6 months is quite sufficient for everyone.

Where Do I File My KRA Nil Returns?

KRA Nil Returns are filed online using the KRA iTax Portal whereby you will be required to login to your KRA iTax Web Portal account and file your Nil Returns.

Do You Need to Visit KRA Office Once You File KRA Nil Returns?

No, you do not. Once you file your KRA Nil Returns you will receive Returns Acknowledgement Receipt in your email. You can download a copy from your online profile and you do not need to visit any offices or centres.

Do You Need To File Your KRA Nil Returns If You Registered For A KRA PIN This Year?

Your Individual Income Tax Returns are due immediately after the end of each year i.e. 31st December. So, if you applied and got your KRA Number and KRA PIN Certificate this year at Cyber.co.ke Portal, you will start filing your Returns next year.

I Don’t Know How To File KRA Nil Returns. Where Can I Get Help?

If you don’t know how to file Nil Returns, you can refer to our in depth article on How To File KRA Nil Returns. Alternatively, you can submit order online here at Cyber.co.ke Portal for KRA Nil Returns Filing and our support team will gladly assist you in filing your Nil Returns within 5 minutes.

The above sum up the most frequently asked questions about KRA Nil Returns by taxpayers who do not have a source of income (unemployed). If you feel your question is not amongst the above frequently asked questions on KRA Nil Returns, you can email your question(s) to [email protected] or send the question(s) to our WhatsApp Support number +254 723 737 740.

Frequently Asked Questions About Employment Returns

The second category of KRA Returns that we are going to look at the frequently asked questions is the KRA Employment Returns. This is sometimes called the Income Tax Employment Returns. This comprises of all taxpayers who are employed (have employment as a source of income). Now lets looks that most frequently asked questions about Employment Returns below.

What Is Employment Returns?

This is a type of KRA Return that is filed by taxpayers who are in employment. They file Income Tax Returns based based on the PAYE that was deducted from the source.

What Do I Need To Have To File Employment Returns?

To file your Employment Returns, you need to ensure that you have with you KRA PIN Number, iTax Password and P9 Form. If you have forgotten your KRA PIN Number, you can submit KRA PIN Retrieval request here at Cyber.co.ke Portal and have your KRA PIN Number and KRA PIN Certificate sent to your Email Address.

On the other hand, incase you have forgotten your KRA iTax Password, you can follow the steps on How To Reset KRA iTax Password and have a new password sent to your email address. If you need to change that email address on iTax, you can submit KRA PIN Change of Email Address order here at Cyber.co.ke Portal.

A P9 Form is a form containing total income received in a year and may include the following depending on the structuring by the employer; basic salary, allowances and benefits, gross salary, pension contribution, PAYE charged and personal relief entitlement.

What Is Gross Pay And Pension Contribution In Employment Returns?

Gross pay is the sum of your basic pay and any other taxable allowances and benefits received as a result of employment. Contributions towards a defined contribution fund such as a registered pension fund, individual retirement fund or the National Social Security Fund (NSSF) is allowable up to a maximum of Kshs. 20,000 per month (Kshs. 240,000 per annum). The deductible amount is however limited to the lesser of:

- 30% of your pensionable(basic) income

- Actual contribution

- Kshs 240,000 (i.e. equivalent to Kshs. 20,000 per month)

What Is Tax Relief In Employment Returns?

As a resident individual you are entitled to a personal relief which is a tax incentive that reduces the amount of tax payable. The current rate of personal relief is Kshs. 16,896 per annum (i.e. Kshs 1, 408 per annum) with effect from 1st January 2018.

If you have a life, health or an education insurance policy, you are entitled to an insurance relief of 15% of the amount of premiums paid for self, spouse or child. However, it shall not exceed Kshs. 60,000 per annum.

When Am I Supposed To File My Employment Returns?

Just like those filing KRA Nil Returns, if you are in employment you need to ensure that your returns are filed between 1st January to 30th June of the current year. So you have a period of 6 months totalling to about 180 days to file your Employment Returns.

What Happens When I Fail To File My Employment Returns?

If you fail to file your Employment Returns before the 30th June deadline, a penalty of Kshs. 2,000/= will be imposed on you as a result of late filing of the KRA Employment Returns.

Is There An Extension On The Employment Returns Filing Date?

There is normally NO extension of the deadline for filing Employment Returns. So, the best thing you can do is to schedule a specific day and time that you will have time availability to file your Employment Returns.

Where Do I File My Employment Returns?

Employment Returns are filed online using the KRA iTax Portal whereby you will be required to login to your KRA iTax Web Portal account and file your Employment Returns using the Excel Sheet and P9 Form.

I Worked For Two Companies In A Span Of A Year. How Do I File The Employment Returns?

In a scenario whereby you have worked in two companies within a year, you are going to need both the P9 Forms so as to be able to file the Returns. You will capture the details of the two companies when you filling in the Returns Excel Sheet.

Do You Need to Visit KRA Office Once You File Employment Returns?

No, you do not. Once you file your Employment Returns you will receive Returns Acknowledgement Receipt in your email. You can download a copy from your online profile and you do not need to visit any offices or centres.

I Don’t Know How To File Employment Returns. Where Can I Get Help?

If you don’t know how to file Employment Returns, you can refer to our in depth article on How To File KRA Returns Using P9 Form. Alternatively, you can submit order online here at Cyber.co.ke Portal for KRA Employment Returns Filing and our support team will gladly assist you in filing your Employment Returns within 10 minutes.

The above are some of the frequently asked questions about KRA Employment Returns by taxpayers who have a source of income (employed). If you feel your question is not amongst the above frequently asked questions on KRA Employment Returns, you can email your question(s) to [email protected] or send the question(s) to our WhatsApp Support number +254 723 737 740.

READ ALSO: The Complete Beginner’s Guide To KRA iTax Login Procedure

Now that you know about the frequently asked questions about KRA Returns, with the above tax filing questions and answers, you are now ready to file your KRA Returns both Employed and Unemployed. It is important to start the filing process early so that in case you face any challenges that require Cyber.co.ke Portal‘s assistance or help, you have ample time to get it sorted out prior to the 30th June deadline.

TRENDING BLOG POSTS IN KENYA

CYBER.CO.KE

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

CLICK HERE TO REGISTER KRA PIN NUMBER

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

CLICK HERE TO RETRIEVE KRA PIN CERTIFICATE

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

CLICK HERE TO UPDATE KRA PIN NUMBER

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

CLICK HERE TO CHANGE KRA PIN EMAIL ADDRESS