Do you own and run a business in Kenya? Learn How To Add Turnover Tax Obligation To KRA PIN On iTax. Get to know How To Add Turnover Tax Obligation.

In this article, I am going to share with you the steps involved in How To Add Turnover Tax Obligation To KRA PIN On iTax Portal. Get to know how to add this tax obligation to your KRA PIN on iTax Portal if your business qualifies for Turnover Tax Payment.

This article will be of great value if you own and run a business in Kenya especially if that business is a sole proprietorship business and qualifies for both Presumptive Tax and Turnover Tax payments. By the end of this article, you will be able to know how to add TOT obligation on KRA iTax Portal.

READ ALSO: The Complete Beginner’s Guide To KRA OTP Verification Codes

By know you already know that starting this year 2020, businesses whose gross sales per year are less that Kshs. 5,000,000.00 are eligible to start paying both Presumptive Tax and Turnover Tax to Kenya Revenue Authority (KRA). So, if you know that your business gross sales for a year does not exceed or is not expected to exceed Kshs. 5,000,000.00 then that puts you in the Turnover Tax bracket.

Just to refreshen your memory, I am going to brush over what we mean by the term Turnover Tax. You can learn more about the Turnover Tax by checking out our article on The Complete Beginner’s Guide To KRA Turnover Tax (TOT) In Kenya, where by I talk more about the KRA Turnover Tax in Kenya.

Also, if you want to know more about the Presumptive Tax in Kenya, you can check out our beginners guide, where I have addressed all the information that you need to know about KRA Presumptive Tax in Kenya. You can check the article on The Complete Beginner’s Guide To KRA Presumptive Tax In Kenya. Now, let us brush over some basic information pertaining to KRA Turnover Tax in Kenya. I am of the assumption that by now, you have already gone through our Beginner’s Guide to KRA Turnover Tax in Kenya and have an understanding of Turnover Tax in relation to Businesses in Kenya.

What Is Turnover Tax?

Turnover Tax (TOT) is tax that is payable by small businesses whose gross sales does not exceed or is not expected to exceed Kshs. 5,000,000.00 per year (annum). The Turnover Tax (TOT) is payable on a monthly basis at the rate of 3% of the gross sales of the business amd is paid on or before the 20th day of the following month.

In accordance with the Finance Act, 2019, the Turnover Tax (TOT) was re-introduced and is payable from 1st January 2020. For example, if you run a business in January 2020 and are eligible for Turnover Tax (TOT), then you will declare this tax by filing and paying for it in February 2020 for the sales that you made in January 2020. You will pay 3% of the gross sales to Kenya Revenue Authority (KRA).

I will not dwell much on the definition as I have covered this Turnover Tax topic in details on our Beginner’s Guide to Turnover Tax. My main focus today will be on How To Add the Turnover Tax to KRA PIN on iTax Portal. We shall look at the requirements that were going to need in this process of Adding Turnover Tax Obligation on iTax.

Just to keep you abreast with the latest updates on KRA iTax Portal, on Monday 3rd February 2020, the option to add Turnover Tax obligation was introduced on iTax so as to allow all taxpayers who have an active KRA PIN and are running a business in Kenya to be able to add the Turnover Tax Obligation.

So, before being able to add the Turnover Tax Obligation on KRA iTax Portal, you are going to need two key requirements in this process. That is, KRA PIN Number and KRA iTax Password. I have covered these two key requirements that taxpayers need to have before logging into their KRA iTax Web Portal. So, I am going to highlight on these two key requirements needed in the process of adding the Turnover Tax Obligation.

Requirements Needed In The Process Of Adding Turnover Tax Obligation To KRA PIN On KRA iTax Portal

As described above, to be able to login to KRA iTax Portal, you need to ensure that you have with you KRA PIN Number and KRA iTax Password. I am going to explain each requirement in brief descriptions below.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable your Reset KRA iTax Password.

Now that you have the above two key requirements that are needed in this process, I need to mention and highlight on one important factor. You need to ensure that you have added Business as a Source of Income on iTax by entering the Business Registration details. I had previously covered the steps to take in How To Add Sole Proprietorship Business On KRA iTax Portal.

So, whether you will be adding your Business to KRA iTax Portal at the same time that you are adding the Turnover Tax Obligation or if you choose to first Amend the source of Income on iTax, the choice is yours. I have found that Amending the Source of Income to Business and then adding Turnover Tax Obligation after Approval of the first Amendment to be working just fine.

But you can choose to kill two birds with one stone, by Adding Turnover Tax and Amending Business Income at one go i.e at the same time. But in this article, we are just going to Add Turnover Tax Obligation since we had already Amended our Source of Income to Business and the process was Approved by Kenya Revenue Authority (KRA). So our work has been simplified for us by Approval of the Business Income Amendment Process. (Refer to: How To Add Sole Proprietorship Business On KRA iTax Portal).

How To Add Turnover Tax Obligation To KRA PIN On iTax

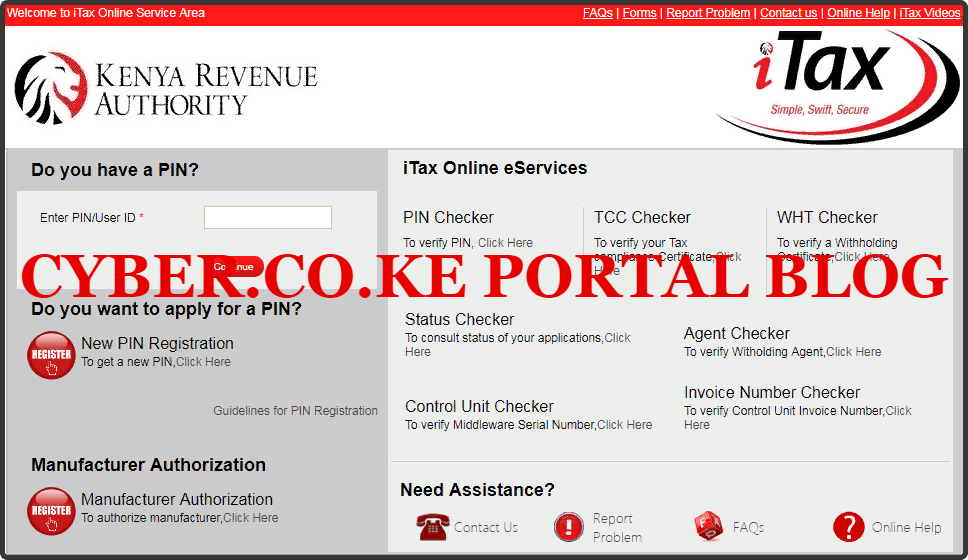

Step 1: Visit iTax Portal

The first step that you need to take is to ensure that you visit the KRA iTax Web Portal using the link provided above in the title.

Step 2: Enter Your KRA PIN Number

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

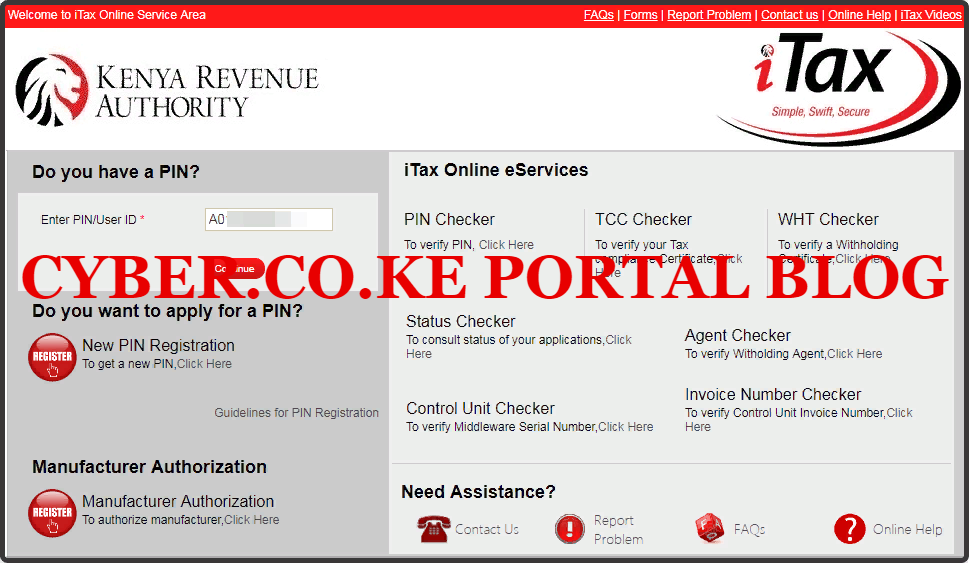

Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: KRA iTax Web Portal Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA iTax Web Portal Account Dashboard.

Now that we are halfway through the process of Adding Turnover Tax Obligation, you need to take note that this process is PIN Amendment in iTax. This is because we are Amending the existing PIN Details so as to add the KRA Turnover Tax (TOT) Obligation. Let’s proceed to Step 5.

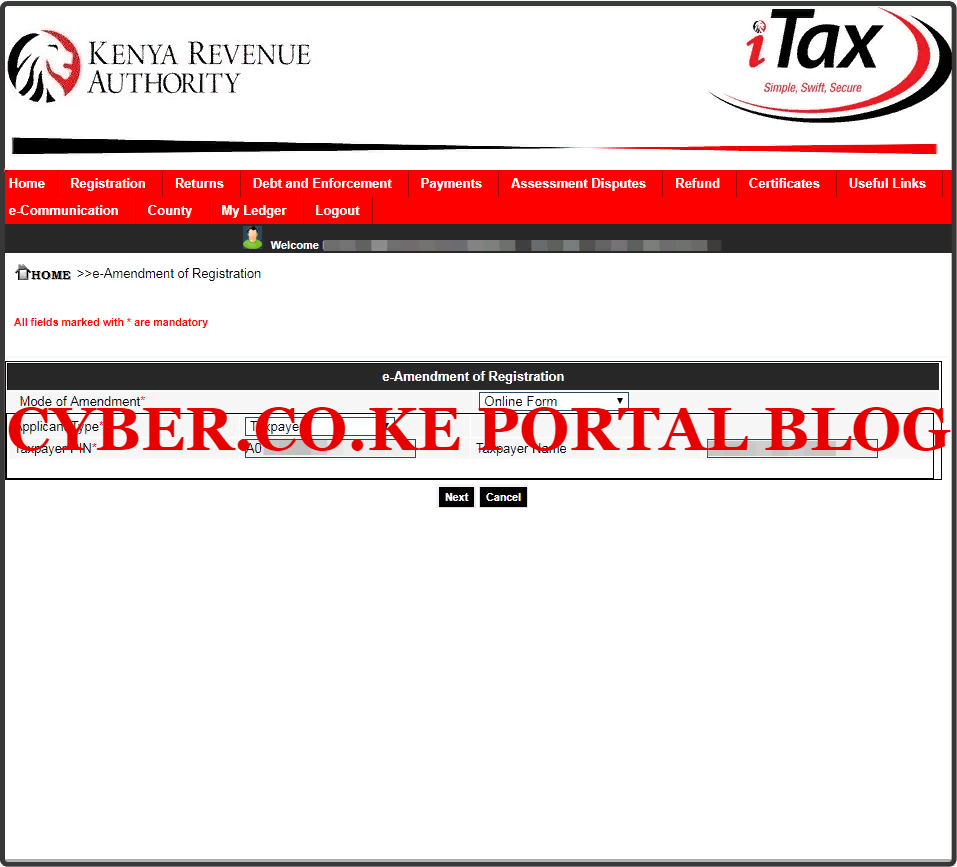

Step 5: Click On Amend PIN Details Under Registration Menu

In this step, we start the process of PIN Amendment by clicking on the “Amend PIN Details” under the Registration menu tab and from the drop down list, select the “Amend PIN Details” menu. This is as illustrated below.

Step 6: Select Mode of Amendment

In this step, you will need to select the Mode of Amendment that you are going to use. The fastest and easiest Mode of Amendment is the Online Form option. Once you have selected the “Online Form” option, click on the “Next” button.

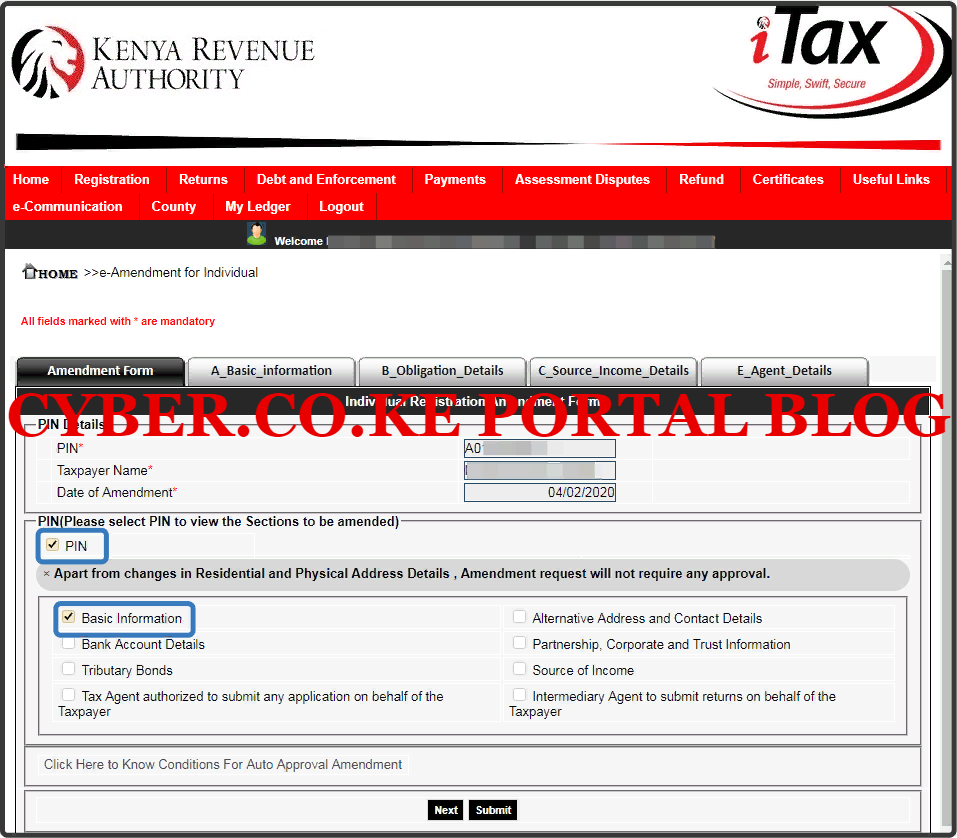

Step 7: Tick The Check box For PIN and Basic Information in the Amendment Form

In the Amendment Form, you will need to tick the check boxes next to the PIN option and the Basic Information option. This is because we are adding Turnover Tax Obligation to the KRA PIN. This is as illustrated below. Once you have checked the two boxes, click on “Next” button.

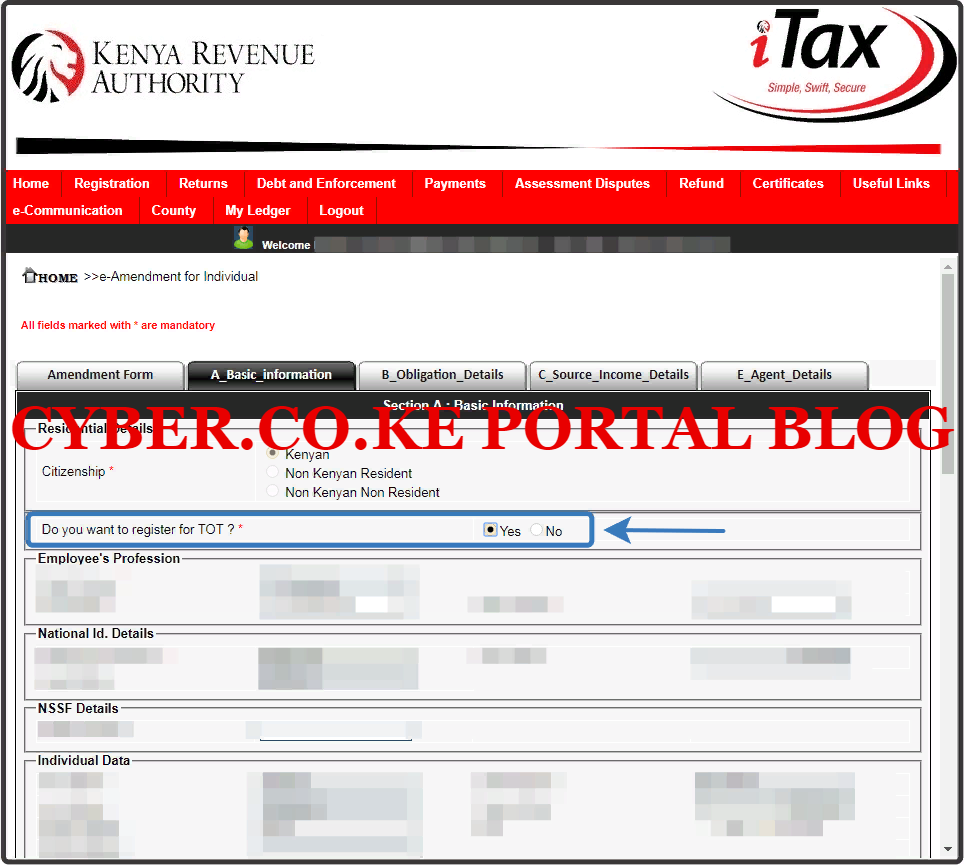

Step 8: Do You Want To Register For Turnover Tax (TOT)?

In the Basic Information tab (A_Basic_Information), on the question, Do you want to Register for TOT? Click on the “Yes” check box. This is because we want to register our KRA PIN for Turnover Tax payment. So you will need to click on the Yes option.

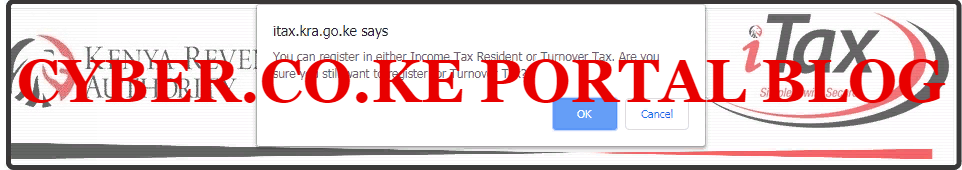

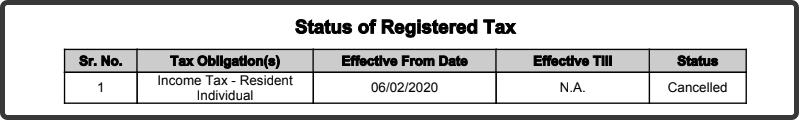

You need to take note of one thing. If you choose to register your KRA PIN Number for Turnover Tax (TOT), that simply means that the Income Tax Resident obligation that your KRA PIN was registered under will be removed.

This is because you can only register either in Income Tax Resident or Turnover Tax. Since in our case we are adding the TOT obligation, so the Turnover Tax Obligation will be the one associated with the KRA PIN from now henceforth. If you can recall, taxpayers who register for Turnover Tax Obligation will no longer need to File their Income Tax Returns since they will be filing their monthly Turnover Tax which is the Final Tax.

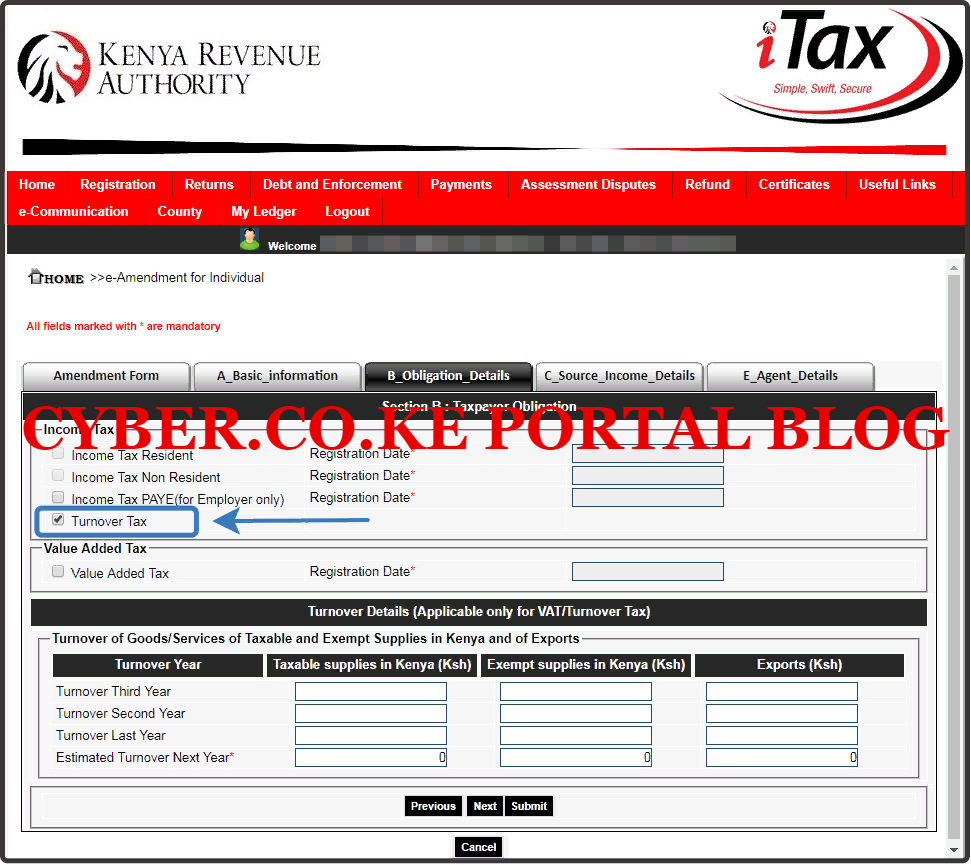

Step 9: Select Turnover Tax Obligation

In this step, in the Obligation Details tab (B_Obligation_Details), you will need to tick the checkbox next to Turnover Tax. This is as illustrated below.

Quick question; Are you observant? Well, by now you need to have noted that the Income Tax Resident obligation is removed since we are adding the Turnover Tax Obligation. Also, we can’t select the Date of the Turnover Tax. Why? This is because this Amendment of Adding Turnover Tax Obligation to KRA PIN, will require Approval from KRA. So the commencement Date of the Turnover Tax will be active the day and date that the Turnover Tax Obligation addition is Approved. Once you have selected the Turnover Tax Obligation, click on the “Submit” button.

Step 10: Download Turnover Tax Amendment Acknowledgement Receipt

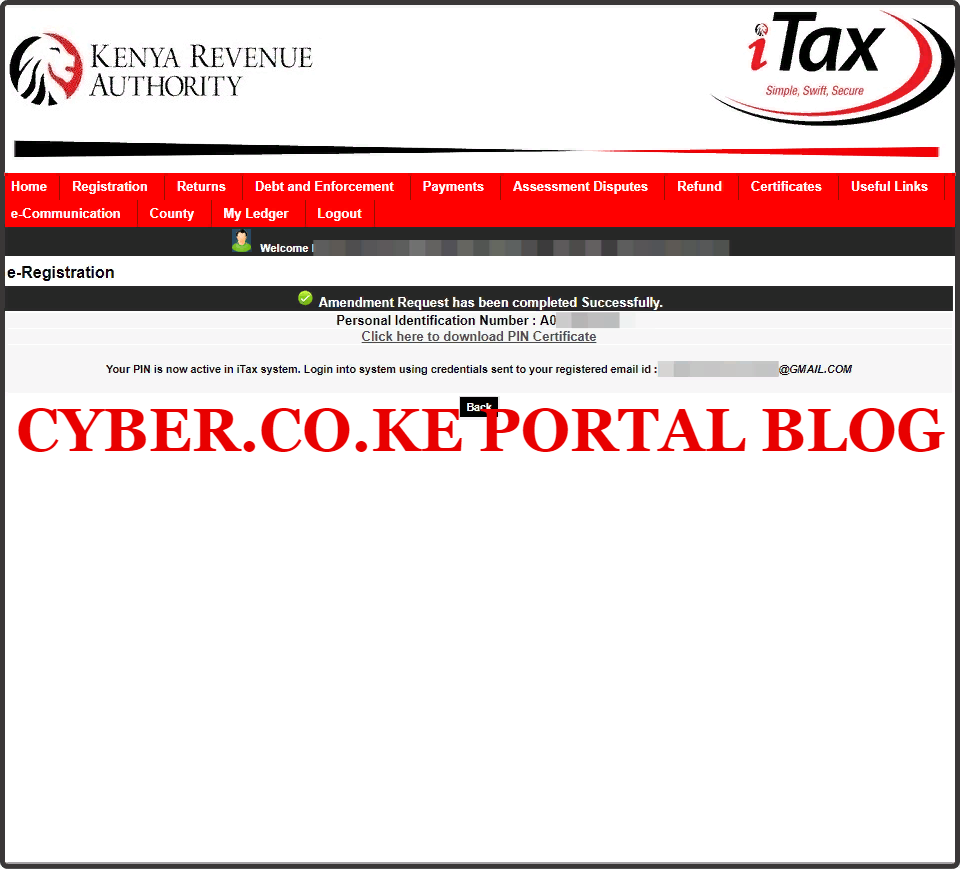

In this last step, once you have successfully submitted your request to KRA for Registration of Turnover Tax Obligation on KRA iTax Portal, you will need to download the Acknowledgement Receipt that you can use to track the status of the Turnover Tax Registration Amendment.

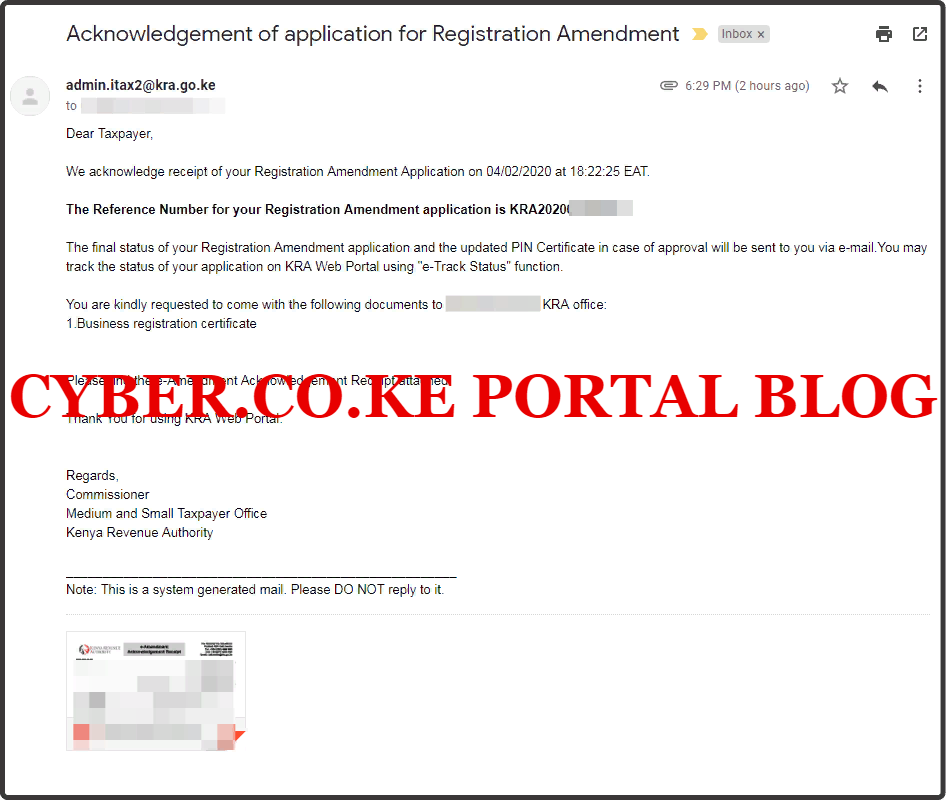

As the final confirmation that the process of adding Turnover Tax Obligation has been submitted to KRA, an email will also be sent to you. Now, you will just have to await Approval of the Turnover Tax Obligation form KRA. This process can take upto 2 working days.

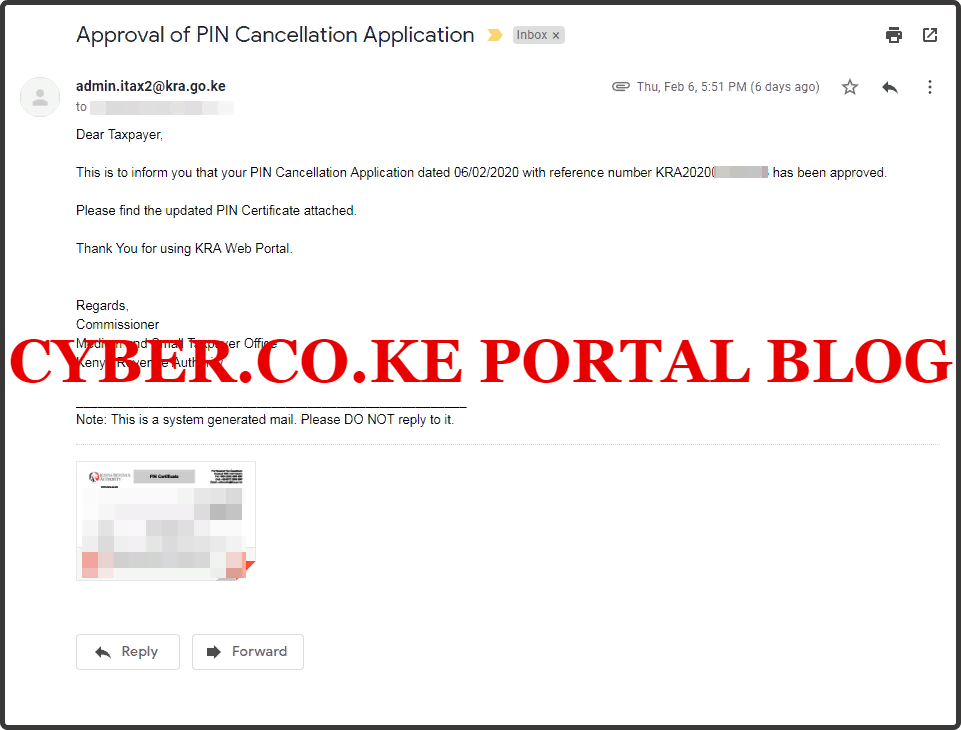

There are are two Approval messages that will be sent to your iTax Registered Email Address from Kenya Revenue Authority i.e. Approval of PIN Cancellation Application and Approval of Registration Amendment. I am going to highlight on each below.

- Approval of PIN Cancellation Application

The first email that you will get from KRA once you add the TOT Obligation on your KRA PIN, is the Approval of PIN Cancellation email notification. Why Cancellation? Since you are adding Turnover Tax Obligation as your Tax Obligation, the previous Income Tax Resident has to be removed and this process involves the temporary cancellation of your KRA PIN Number.

On the KRA PIN Certificate that was sent to you by KRA in your iTax Registered Email Address you will note that indeed the Income Tax Resident Obligation has been Cancelled. This is as illustrated below:

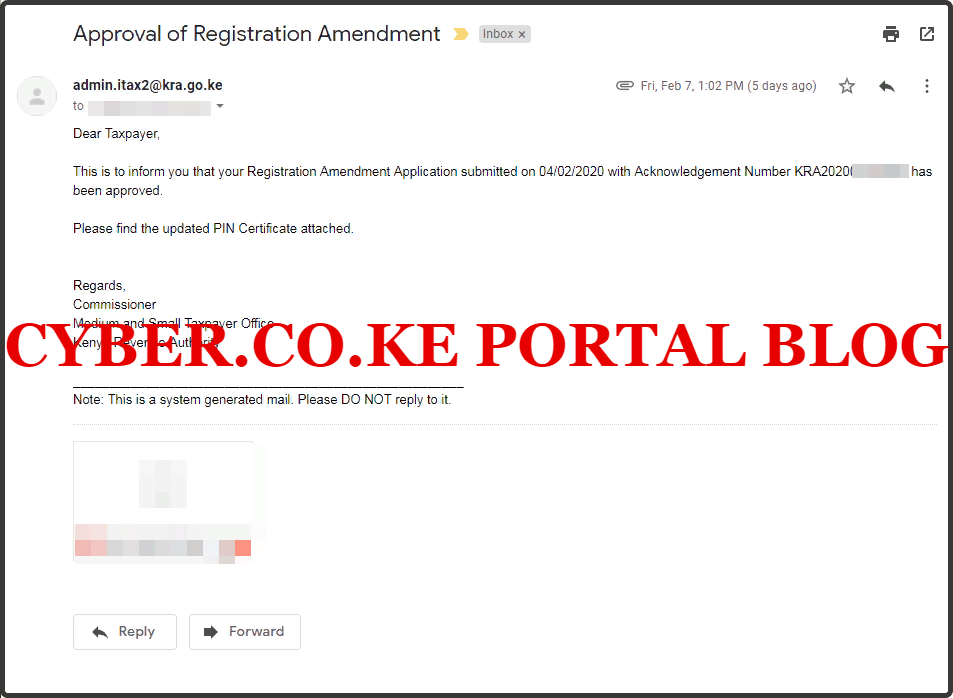

- Approval of Registration Amendment

The last and final email that you will get from KRA after Approval of the addition of Turnover Tax Obligation on your KRA PIN Number is the Approval of Registration Amendment. Since the process of adding TOT obligation is an Amendment process, once approved you will get an email notification of the same. This will serve as the final and last notification that the process of adding Turnover Tax Obligation on KRA PIN using iTax Portal is complete.

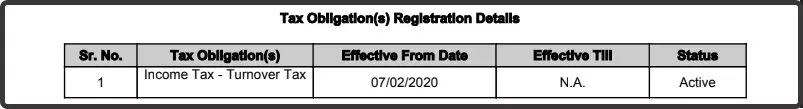

On the KRA PIN Certificate that was sent to you by KRA in your iTax Registered Email Address you will note that indeed the Turnover Tax Obligation has been Added. This is as illustrated below:

Once your request for Turnover Tax Obligation registration has been Approved by KRA, then you need to ensure that you start filing your Turnover Tax on or before the 20th day of each month so as not to be fined by KRA for late filing and payment of Turnover Tax for your Business.

READ ALSO: KRA PIN Number Download Procedure On KRA iTax Portal

In our case, since the Approval of the Turnover Tax Obligation was on 07/02/2020, we shall begin filing and paying Turnover Tax for the month of February 2020 in March 2020. This should be done before the 20th day of March 2020. So, if you need to add Turnover Tax Obligation to KRA PIN, just follow our outlined steps and procedures on How To Add Turnover Tax (TOT) Obligation on KRA iTax Portal.

DON’T MISS OUT. CHECK OUT OUR TRENDING POPULAR BLOG POSTS IN KENYA.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

KRA PIN REGISTRATION

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

KRA PIN RETRIEVAL

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

KRA PIN UPDATE

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

KRA PIN CHANGE OF EMAIL ADDRESS

Stay Tax Compliant in Kenya

Contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.