Do you need to Download a copy of your KRA Tax Clearance Certificate? Learn How To Reprint KRA Clearance Certificate On iTax Portal today.

There are certain times when you might be asked to bring a copy of your KRA Compliance Certificate either during a job application or even tender application. Knowing how to download and reprint the KRA Tax Clearance Certificate is very important.

In this article, I am going to share with you the step by step guide on How To Reprint KRA Clearance Certificate On iTax Portal. By the end of this article, you will have known the process and steps that you need to follow when you need to reprint your KRA Clearance Certificate on iTax Portal.

READ ALSO: How To Download KRA Returns Excel Sheet On iTax Portal

Knowing how to reprint your Clearance Certificate on KRA iTax Portal is quite important as it will make the process of getting a copy of your KRA Tax Compliance much easier. I won’t talk much about the process of applying for KRA Tax Compliance Certificate since I already wrote an article about How To Apply for KRA Tax Compliance Certificate, you can check it out. Our main focus will be on the process involved in reprinting KRA Clearance Certificate.

You will only be issued with a KRA Clearance Certificate only if you have been filing your KRA Returns and don’t have any pending liabilities or unpaid taxes. During the process of application, the KRA Clearance Certificate is issued immediately upon request on iTax for all compliant taxpayers in Kenya. To be able to reprint your KRA Clearance Certificate, you need to login to your iTax Account using both your KRA PIN Number and iTax Password.

The good thing is that incase you have forgotten your KRA PIN Number or even iTax Password (KRA Password), here at Cyber.co.ke Portal we can gladly assist you with that. Incase you have forgotten your KRA PIN, then you can request for KRA PIN Retrieval and have both your KRA PIN Number and KRA PIN Certificate sent to you. Incase you have forgotten your iTax Password, you can request for KRA PIN Change of Email Address so that you can be able to change your KRA Password.

What Is KRA Clearance Certificate?

KRA Clearance Certificate is a document that is issued to a taxpayer by Kenya Revenue Authority (KRA) upon successful filing and paying any taxes due as stipulated by law. It shows that a taxpayer is compliant and the Clearance Certificate is valid for a period of 12 months from the date of issue.

So, if a taxpayer does not owe KRA any taxes, then when he or applies applies for a Tax Compliance Certificate, it will be issued immediately at the point of application. This is because, starting this year, the process of KRA Tax Compliance Certificate has been simplified. You can read about this on our article where we talk about KRA Tax Compliance Certificate Application Simplified Process.

Now that we have looked at the definition of the KRA Clearance Certificate, we need to look at the key areas where the Clearance Certificate might be needed in Kenya. There are many areas where you might be asked to come or bring a copy of your KRA Clearance Certificate.

Key Areas Where KRA Clearance Certificate Is Needed

There exists many areas that your KRA Clearance Certificate might be needed in Kenya. But only 2 are the most important one. This includes: Job Application and Tender Application. I am going to discuss each one in brief details below.

-

Job Application

If there is one area where definitely you are going to need your Clearance Certificate is during a job application process. Apart for presenting your CV, Testimonials and Certificates, you will also be required to present a copy of your KRA Clearance Certificate. Most private companies or even Government might ask you to attach this Tax Clearance Certificate together with your other documents before submission.

-

Tender Application

If you apply for any Tender in the Private or Public Sector in Kenya. a Clearance Certificate for your Business or Company will be required in the process of Tender Document Submissions. Research has established that 15% of tender submissions normally don’t have a Tax Compliance Certificate which is also vital in the tender application process.

Now that we have highlighted the two key areas that a KRA Clearance Certificate is needed the most, we need to look at the requirements that you need to have with you in the process of downloading and reprinting your KRA Clearance Certificate from KRA Web Portal Account. I have covered this so many times here, so I will just be brushing through these two requirements i.e. KRA PIN Number and KRA iTax Password.

Requirements Needed In The Process Of Reprinting KRA Clearance Certificate On iTax Portal

For you to be able to Reprint KRA Clearance Certificate on iTax Portal, you need to ensure that you have with you both your KRA PIN Number and KRA iTax Password. These are the two key requirements that are needed when you need to Login to your KRA iTax Web Portal Account. This is as illustrated below.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable your Reset KRA iTax Password.

Now that we have looked at the requirements needed for reprinting the KRA Clearance Certificate on KRA iTax Portal, we can now jump into and look at the steps that you need to follow so as to download your KRA Clearance Certificate on your KRA Web Portal Account or if you like iTax Portal.

How To Reprint KRA Clearance Certificate On iTax Portal

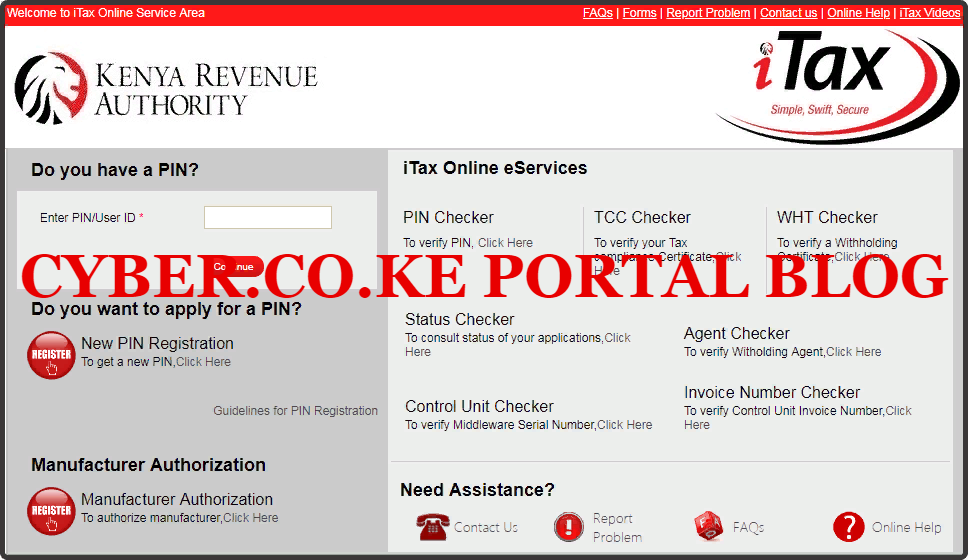

Step 1: Visit iTax Portal

The first step that you need to take is to ensure that you visit the KRA iTax Web Portal using the link provided above in the above description. Note, the above is an external link that will take you to the KRA iTax Portal.

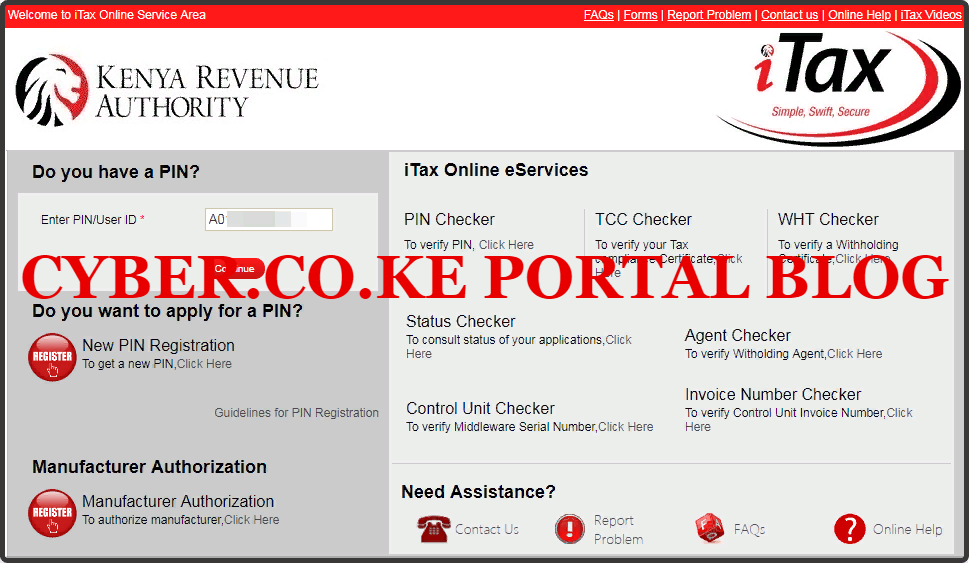

Step 2: Enter Your KRA PIN Number In the PIN/User ID Section

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

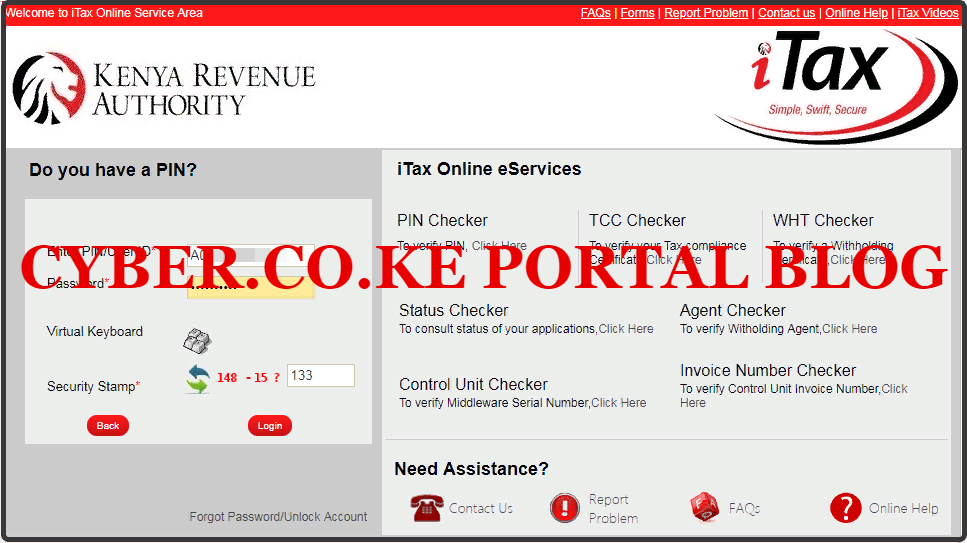

Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: KRA iTax Web Portal Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA iTax Web Portal Account Dashboard. Here upon successful login process, you are able to view a wide range of iTax Portal functionalities. Since we need to download and reprint a copy of KRA Clearance Certificate, we proceed to step 5.

Step 5: Click on Certificates Followed By Consult And Reprint TCC

In this step, you will need to click on the “Certificates” menu tab and from the drop down list appearing, click on “Consult and Reprint TCC” Don’t get confused here, TCC stands for Tax Compliance Certificate or in other term KRA Clearance Certificate. This is is illustrated below.

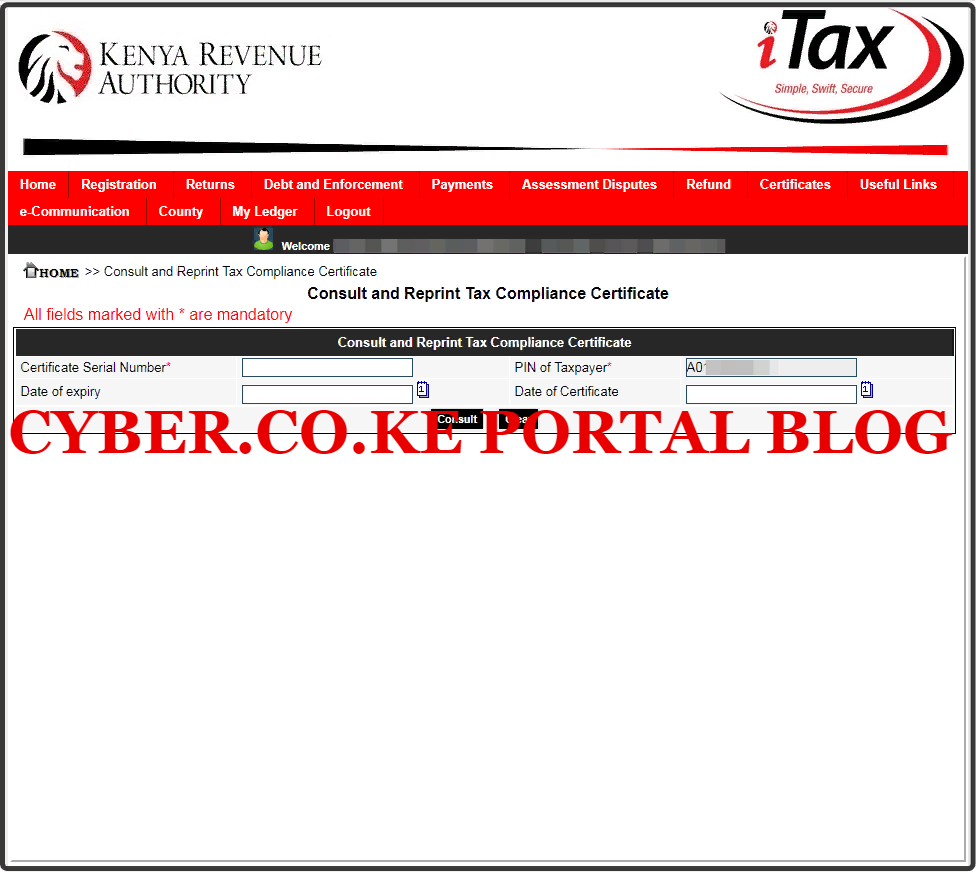

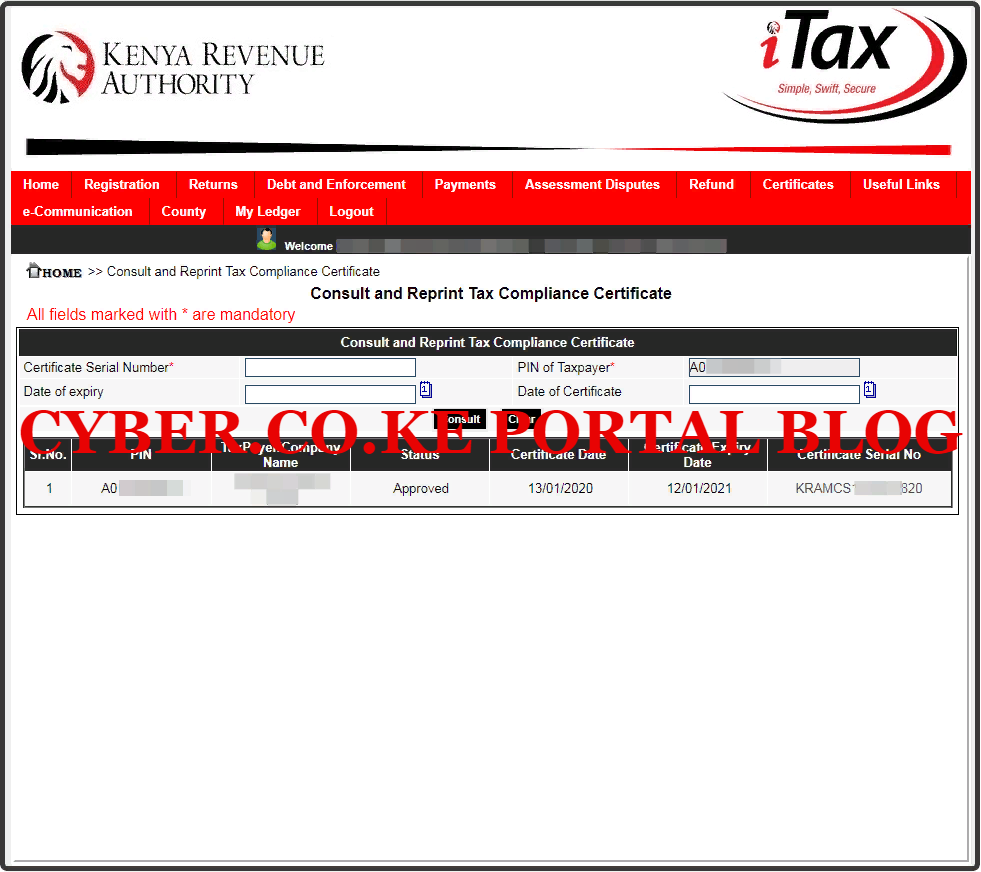

Step 6: Consult And Reprint KRA Clearance Certificate

This is the most important part in the process of downloading and reprinting the Tax Clearance Certificate on iTax Account. You will notice 4 fields i.e. Certificate Serial Number, PIN of Taxpayer, Date of Expiry and Date of Certificate. The PIN of Taxpayer field is automatically prefilled with the KRA PIN Number of the taxpayer. There is nothing much to do but just click on the “Consult” button as illustrated below.

Step 7: Download KRA Clearance Certificate

The last step in the process of reprint the Tax Clearance Certificate on iTax Portal involves clicking on the Certificate Serial Number i.e. KRAMCS********20. You will notice that there is no download button but rather the Certificate Serial Number is a link which is the one you need to click so as to download the Clearance Certificate. This is as shown below.

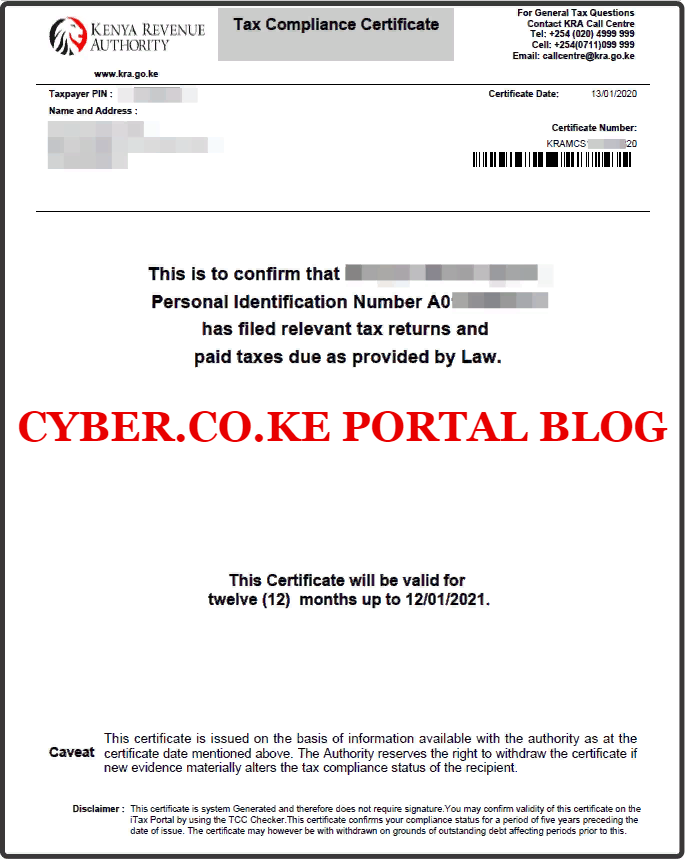

Below is a screenshot of a copy of the KRA Tax Clearance Certificate that we have just downloaded from our KRA Web Portal Account. You need to take note that the certificate is only valid for a period of 12 months from the date it was issued to the taxpayer.

READ ALSO: How To Access KRA Web Portal Account Using Login Credentials

Also you need to take note that a copy of the KRA Clearance Certificate will also be sent to your iTax Registered Email Address, so you do need to worry about scanning the same KRA Tax Clearance Certificate whenever you are asked to send or forward a soft copy version of the Clearance Certificate.

Matthews Ohotto is an Article Writer at CYBER.CO.KE and a Video Creator at Step-by-Step Tutorials Kenya (YouTube). He specializes in crafting insightful Blog Posts and Video Tutorials that empower Kenyans with practical digital skills. He is a holder of Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT).

KRA INDIVIDUAL SERVICES

SUBMIT SERVICE REQUEST

KRA PIN REGISTRATION

Are you looking for KRA PIN Registration services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN RETRIEVAL

Are you looking for KRA PIN Retrieval services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN UPDATE

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN CHANGE OF EMAIL ADDRESS

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA RETURNS SERVICES

SUBMIT SERVICE REQUEST

KRA NIL RETURNS

Are you looking for KRA Nil Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA EMPLOYMENT RETURNS

Are you looking for KRA Employment Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA AMENDED RETURNS

Are you looking for KRA Amended Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA WITHHOLDING TAX RETURNS

Are you looking for KRA Withholding Tax Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.