Are you looking to file your KRA Returns and need to Download Withholding Certificate? Learn How To Reprint KRA Withholding Certificate On iTax Portal.

It that time of the year when there is a huge rush to file KRA Returns before the KRA Returns Deadline of 30th June reaches. One group of taxpayers that might require help is those who have been issued with Withholding Certificates form Kenya Revenue Authority (KRA) and they need to Reprint KRA Withholding Certificates of Download KRA Withholding Certificates.

In this article, I am going to share with you the step by step process of How To Reprint KRA Withholding Certificate On iTax Portal. By the end of this article, you will have learn and known How To Reprint Withholding Certificate on iTax and at the same time How To Download KRA Withholding Certificate using KRA iTax Portal.

READ ALSO: How To Reprint PIN Certificate On iTax Portal In 2020

Not that many taxpayers in Kenya know the process involved in Reprint or Downloading KRA Withholding Certificate using iTax Portal. That is whereby this article will seek to address that issue to the fullest. We shall look at key terms and concepts including: What Is KRA Withholding Certificate, What Is iTax Portal, Features Of KRA Withholding Certificate, Requirements Needed To Reprint KRA Withholding Certificate and How To Reprint KRA Withholding Certificate On iTax Portal.

To be able to reprint your Withholding Certificate on iTax, you need to be logged in and the only way is by using your KRA PIN Number and iTax Password. These two for an integral part of the KRA Portal login process that all taxpayers in Kenya need to follow. So, before you can reprint your KRA Withholding Certificate on iTax, ensure that you have with you both iTax Password and KRA PIN Number.

The good thing is that incase you have forgotten your KRA PIN Number or even iTax Password (KRA Password), here at Cyber.co.ke Portal we can gladly assist you with that. Incase you have forgotten your KRA PIN, then you can request for KRA PIN Retrieval and have both your KRA PIN Number and KRA PIN Certificate sent to you. Incase you have forgotten your iTax Password, you can request for KRA PIN Change of Email Address so that you can be able to change your KRA Password.

What Is KRA Withholding Certificate?

KRA Withholding Certificate is a document a taxpayer is issued with when an Employer or Withholder withholds Income Tax from the wages or commissions of employees or taxpayers and pays them directly to the government. The term Withholding Certificate means the same in relation to Kenya Revenue Authority (KRA)

Withholding Certificate is a document that is issued to a taxpayer by the Kenya Revenue Authority (KRA) that shows the details of the Tax that is withheld by the employer and remitted to Kenya Revenue Authority (KRA). It is the duty and responsibility of the taxpayer to declare the amount of Withheld Tax during the process of Filing KRA Returns Using P9 Form.

So, when let say you get paid commission the Withholder will withhold a certain amount and remit the same to Kenya Revenue Authority (KRA) and the button will now lie with the taxpayer to declare the amount that was Withheld during the process of KRA Returns Filing. This in turn means that you will have to Download KRA Returns Form and use the same together with your P9 Form to File your Returns on iTax Portal.

I will not dwell much on the definition of KRA Withholding Certificate or Withholding Certificate. You can check out our article on How To Verify KRA Withholding Certificate Using WHT Checker. Now that we have looked at the definition of Withholding Certificate above, we now need to understand What is iTax Portal since we shall be using iTax to Download and Reprint Withholding Certificate.

What Is iTax Portal?

iTax Portal or KRA Web Portal, is an online system by Kenya Revenue Authority (KRA) that allows Kenyans to get various Tax related services by using the iTax Portal i.e. itax.kra.go.ke which is the url of the KRA Web Portal. With the iTax Portal, a taxpayer can be able to perform a myriad of tasks and requests through his or her own KRA Web Portal Account.

To be able to Download and Reprint Withholding Certificate you need to access iTax Portal. This is where the KRA Withholding Certificate is located and you can do that only if you have with you the iTax Login Credentials i.e. KRA PIN Number and KRA iTax Password. I won’t dwell much on the other functionalities of iTax Portal, as that will form a basis for our future articles here at Cyber.co.ke Portal Blog.

Now that we have addressed the meaning of Withholding Certificate and iTax Portal above, we now need to look at the Features of KRA Withholding Certificate. You can also refer to this as the various parts or sections that make up the Withholding Certificate that is issue by KRA to taxpayers in Kenya.

Features Of KRA Withholding Certificate

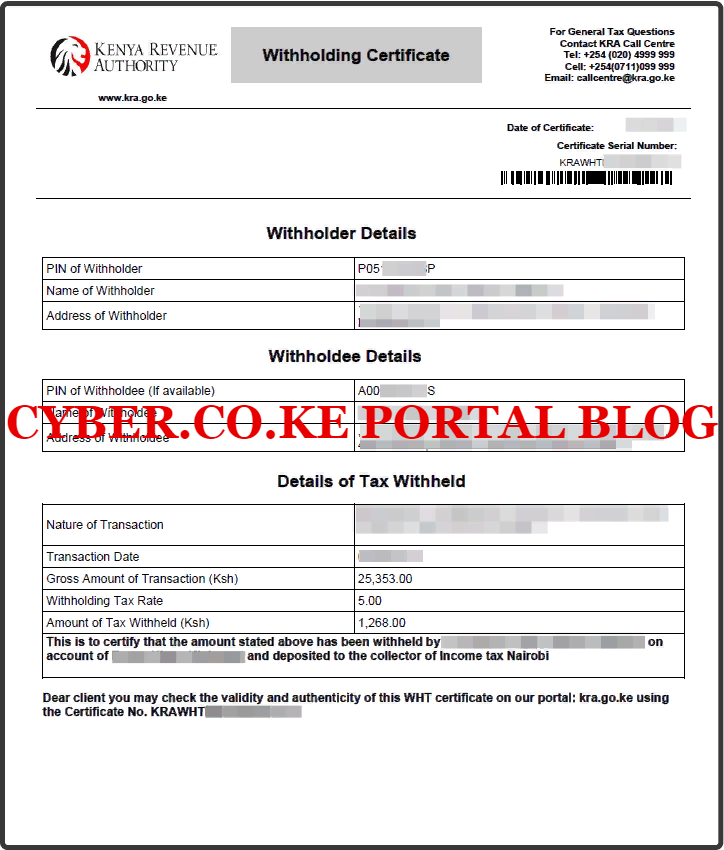

Just like any other document that is issued by KRA to taxpayers through iTax, the Withholding Certificate has some unique features or parts (sections) that make up the whole KRA Withholding Certificate that is downloaded from iTax by a taxpayer who has an amount that is Withheld by KRA. Below is a screenshot of Withholding Certificate issued by KRA to taxpayers in Kenya.

From the above screenshot of the Withholding Certificate, you will note that it is made up of 4 important sections or parts (features) i.e. Certificate Serial Number, Withholder Details, Withholdee Details and Details of Tax Withheld. I will briefly highlight on each of the sections of the KRA Withholding Certificate below.

-

Withholding Certificate Serial Number

The first section of the Withholding Certificate is the Certificate Serial Number. You need to take note that the Certificate Serial Number plays an important role when one needs to confirm the validity and authenticity of the Withholding Certificate using the KRA WHT Checker.

-

Withholder Details

The next section is the Withholder Details. Just as from the name, this is simply the details of the Withholder. It is normally comprised of PIN of Withholder, Name of Withholder and the Address of the Withholder. In most cases, the Withholder is a company in Kenya.

-

Withholdee Details

The Withholdee Details are basically the details of the taxpayer who was issued with the Withholding Certificate. The Withholdee Details is normally comprised of PIN of the Withholdee, Name of the Withholdee and the Address of the Withholdee.

-

Details of Tax Withheld By The Withholder

The last section is what is referred to as the Details of Tax Withheld. This is comprised of Nature of Transaction, Transaction Date, Gross Amount of Transaction (in Kenya Shillings), Withholding Tax Rate and the Amount of Tax Withheld. Note that the Withholding Tax Rate in Kenya is 5% of the Gross Amount of Transaction in Kenya Shillings (Kshs.).

Having looked at the features that make up the Withholding Certificate issued by KRA, we now need to look at the Requirements Needed To Reprint KRA Withholding Certificate. By now now you know that to be able to Login to iTax, you need to ensure that you have with you KRA PIN Number and KRA iTax Password as illustrated below.

Requirements Needed To Reprint KRA Withholding Certificate

In order for a taxpayer to Download KRA Withholding Certificate on iTax, they need to ensure that they have with them iTax Login Credentials that comprises of the KRA PIN Number and KRA iTax Password. These two form the main requirements needed to Reprint Withholding Certificate on iTax Portal. This is as described below.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same as the one you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable you Reset KRA iTax Password.

Now that we have looked at the main requirements needed to Download Withholding Certificate on iTax, we can proceed towards the homestretch and look at How To Reprint KRA Withholding Certificate On iTax Portal.

How To Reprint KRA Withholding Certificate On iTax Portal

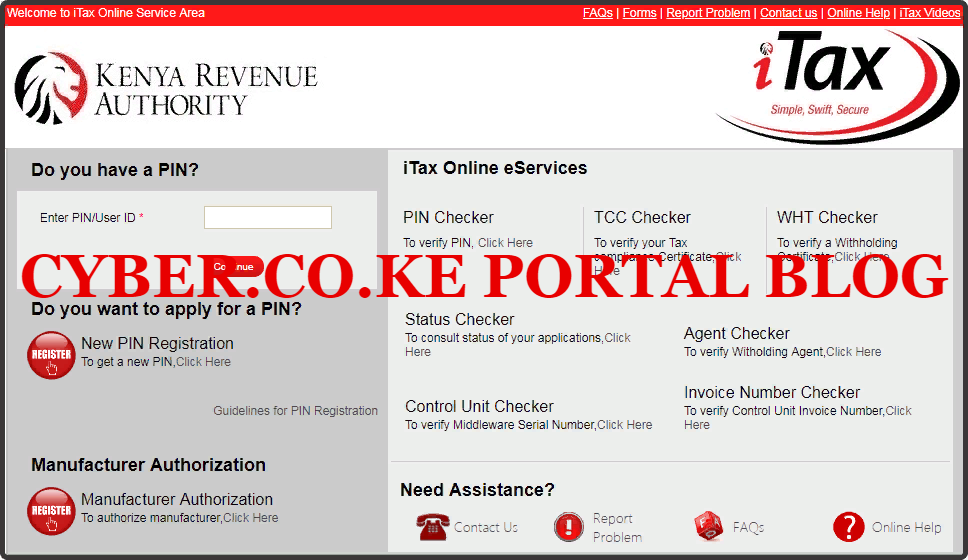

Step 1: Visit iTax Portal

The first step that you need to take in the process of How To Reprint or Download KRA Withholding Certificate On iTax Portal is to ensure that you visit the KRA iTax Web Portal using the link provided above in the title.

Step 2: Enter Your KRA PIN Number

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

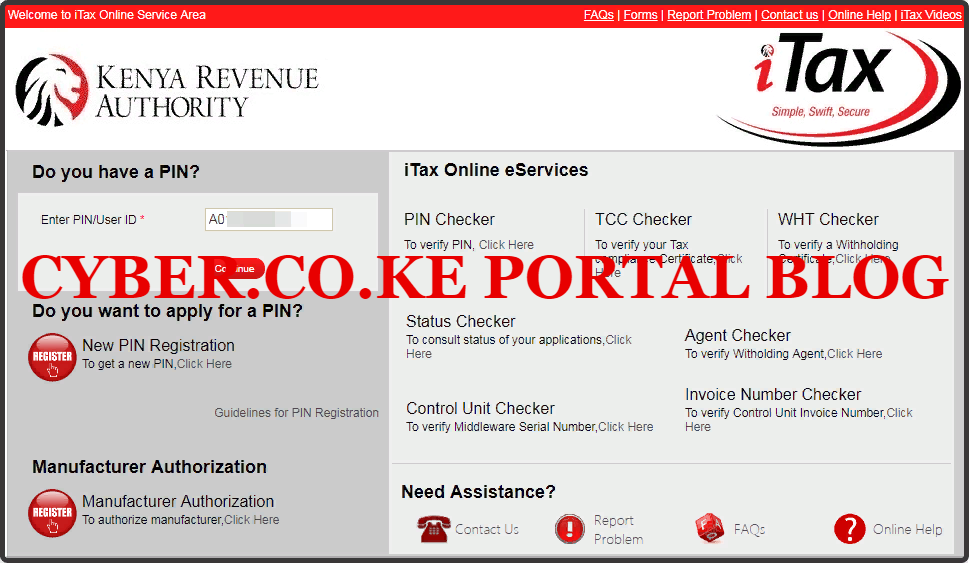

Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: iTax Portal Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA iTax Web Portal Account Dashboard. Since in this article we need to Download Withholding Certificate, we proceed to “Step 5” below.

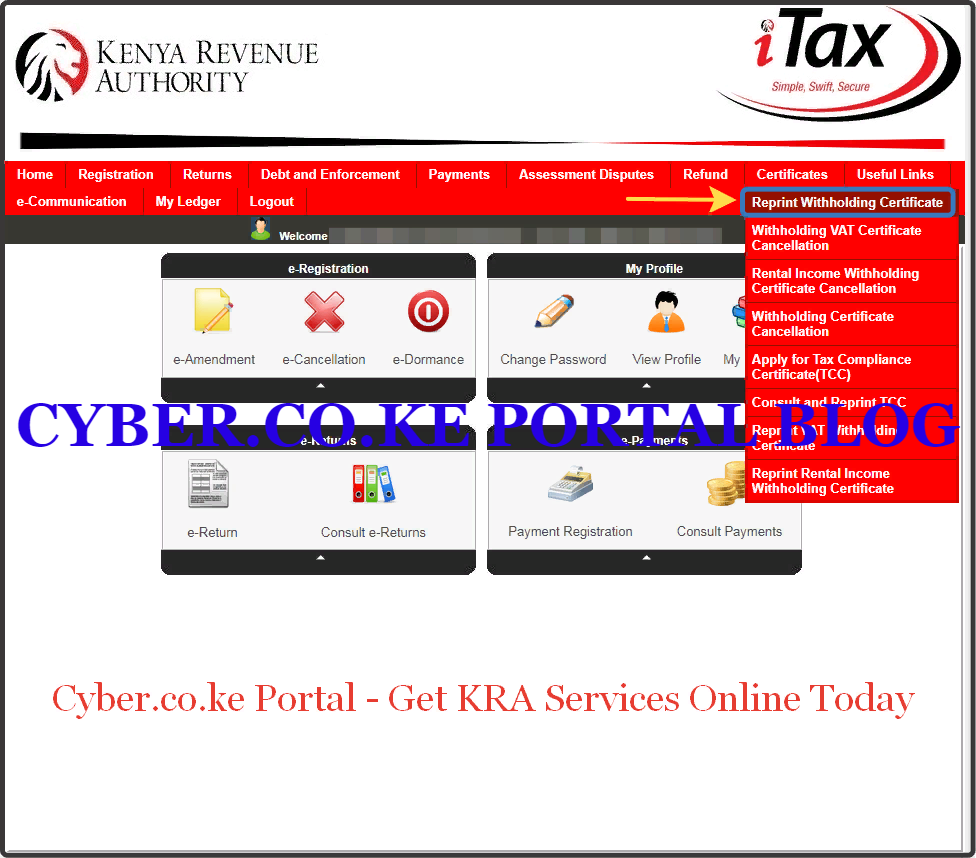

Step 5: Click On Certificate Menu Tab

From your iTax Account dashboard, you will need to hover your mouse towards the “Certificates” menu tab and click on Reprint KRA Withholding Certificate. This is as illustrated in the screenshot below.

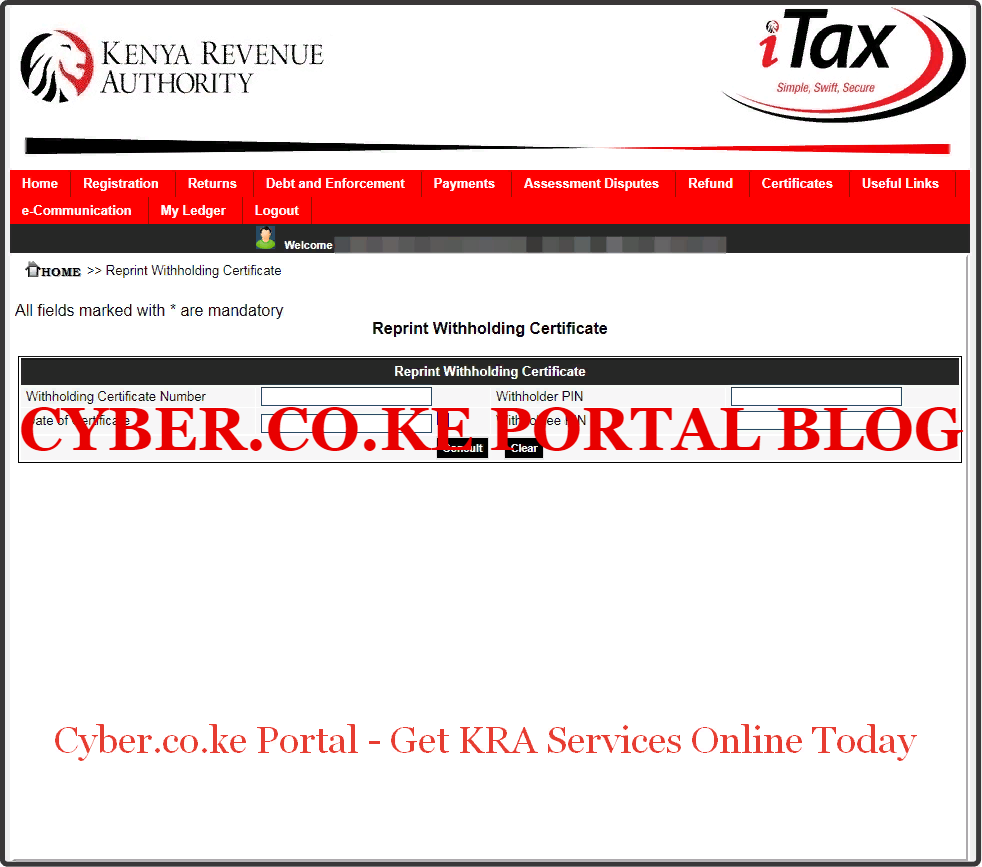

Step 6: Click Consult To Reprint Withholding Certificate

In this step, there is not much to do but just clicking on the “Consult” button so as to load the Withholding Certificates lists. This is as illustrated in the screenshot below.

A pop up from itax.kra.go.ke will appear asking you: Are you sure you want to reprint? Click on the “Yes” button because we need to Reprint Withholding Certificate on iTax.

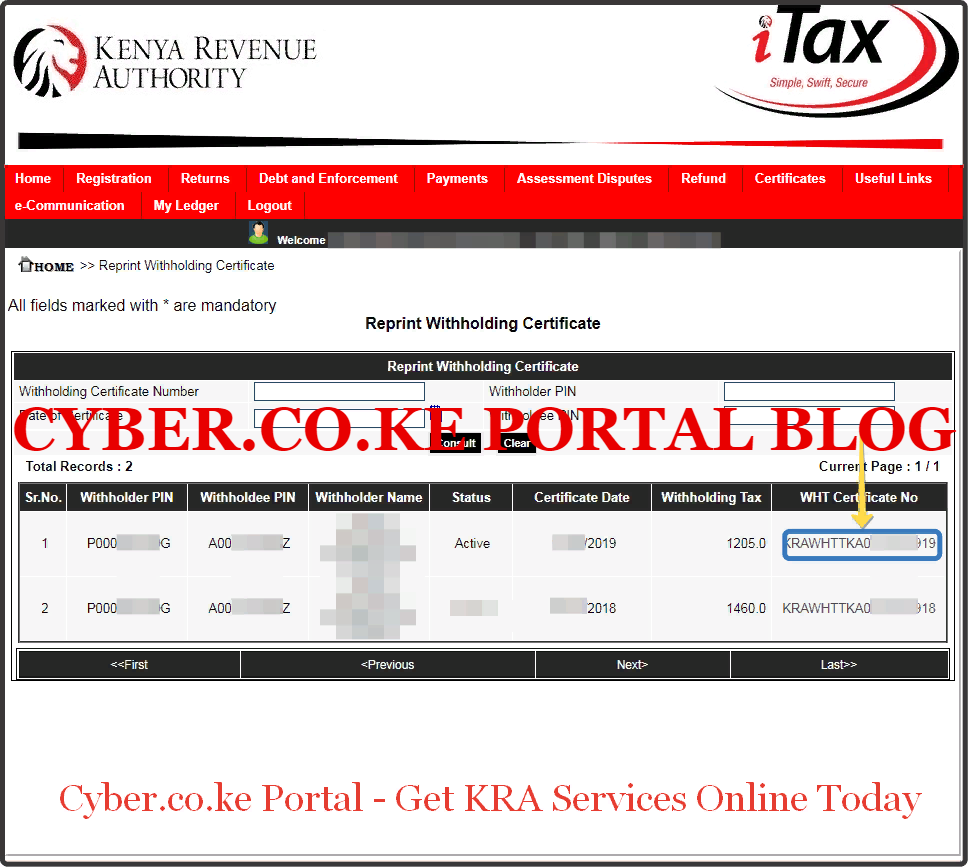

Step 7: Reprint Withholding Certificate

This being the last step in the process of How To Reprint KRA Withholding Certificate on iTax, you will notice the results pages of the Withholding Certificate on iTax. This is what we refer to as Withholding Certificate Records on iTax. This is because you will see the total number or records i.e. How many Withholding Certificates you have on iTax, Withholder KRA PIN, Withholdee KRA PIN, Withholder Name, Certificate Date, Withholding Tax and Withholding Tax (WHT) Certificate Number. To Reprint and Download KRA Withholding Certificate, you will need to click on the link under WHT Certificate Number column i.e. KRAWHTTKA0*******19. This is as illustrated below.

READ ALSO: How To Check KRA Tax Obligations Using PIN Checker

Once you click on the link under WHT Certificate Number, this will prompt you to download KRA Withholding Certificate and save it. At this point, that will mark the end of the process of How To Reprint KRA Withholding Certificate on iTax Portal. With the Withholding Certificate, you can proceed and file your KRA Returns on iTax. If you need help filing KRA Returns if you have a Withholding Certificate from KRA, then you can submit your order online for KRA Employment Returns Filing here at Cyber.co.ke Portal.