Are you looking to file your KRA Tax Returns on iTax before the 30th June Deadline? Learn and get to know How To File KRA Tax Returns On iTax.

Many taxpayers in Kenya have KRA PIN Numbers but a majority do not know How To File KRA Tax Returns on iTax or KRA Portal. This in turn leads many to fail to file their KRA Returns on time before the 30th June Deadline, therefore ending up getting penalized by KRA for failing to File KRA Returns on iTax.

In this article, I will be sharing with you the step by step process that all Kenyans who have an active KRA PIN Number need to follow so as to file their Tax Returns on iTax. Particularly, this article will be of great benefit to the majority of Kenyan who don’t have any source of income i.e. the Students and those who are Unemployed. So each year between 1st January and 30th June, you are supposed to file your KRA Nil Returns.

READ ALSO: How To File KRA Returns For Employed

The key concepts and terms that this article will seek to address includes: KRA Tax Returns, What Is KRA Tax Returns, Types Of KRA Tax Returns For Individuals In Kenya, Deadline For Filing KRA Tax Returns, Requirements Needed To File KRA Tax Returns On iTax and How To File KRA Tax Returns On iTax. We shall look at these terms and concepts from a wider perspective below. At the beginning of each year, any person with an active KRA PIN Number is supposed to file his or her Tax Return on iTax.

This process has in turned come of age to be known and referred to as the KRA Returns Filing Season or Tax Returns Filing Season (Period) because it runs form 1st of January to 30th of June of each year. There has been a great misconception about Filing KRA Returns by most of Kenyan some of whom think that only those who are employed are the ones who are supposed to file their KRA Returns on iTax. This is quite the opposite, because as long as you have an active KRA PIN Number, which you can get here at Cyber.co.ke Portal through our KRA PIN Registration services, you are supposed to File KRA Returns on iTax.

Failure to File KRA Tax Returns normally attracts a penalty of Kshs. 2,000 for each year that you did not file your Tax Returns. The good thing is that Cyber.co.ke Portal offers KRA Returns Filing Services to Kenyans daily. So if you need either Filing of KRA Nil Returns or Filing of KRA Employment Returns, our experienced Support Team will gladly File your Tax Returns on iTax quickly for you.

What Is KRA Tax Returns?

KRA Tax Returns is an online form filed by a taxpayer in Kenya who has an active KRA PIN and either has a source of Income be it Rental, Employment or Business that reports income, expenses and other important tax information. KRA Tax Returns allows taxpayers to calculate their tax liability, schedule tax payments or request refunds for the overpayment of taxes.

Just as I had mentioned earlier above, Tax Returns are filed by both those who have source of Income and those who do not have any source of income. These two categories are linked up wholly in the Tax Return Filing process as both have to file KRA Returns on iTax.

As mentioned before failure to File Tax Returns attracts a hefty penalty from KRA. So, to be on the good books with KRA, you always need to ensure that you file your KRA Returns on iTax before the 30th June Deadline catches up with you. The earlier you File Tax Returns the better as you will avoid the last minute rush that is accustomed to many Kenyans.

Types Of KRA Tax Returns For Individuals In Kenya

KRA Tax Returns in Kenya are normally categorized into two two main groups i.e. KRA Nil Returns and KRA Employment Returns. I am going to briefly highlight on what each one entails briefly below.

-

KRA Nil Returns

The first type of KRA Tax Return is what we normally refer to as KRA Nil Returns. This type of Tax Return is filed by individuals who have active KRA PIN Number but no source of income i.e. Rental. Employment of Business. So, if you know that you don’t have any income that is derived from the aforementioned, then you need to File KRA Nil Returns on iTax.

If you need help with filing KRA Nil Returns on iTax, you can simply fill and submit your KRA Nil Returns Filing order online here at Cyber.co.ke Portal and our support team will gladly assist you in filing your KRA Nil Returns on iTax.

-

KRA Employment Returns

The other type of KRA Tax Return is what we refer to as the KRA Employment Returns. Just as the name suggests, this type of KRA Return is filed by individuals who have Employment as their source of income. So, if you are employed, then you need to ensure that you file your KRA Employment Returns on iTax.

If you need help with filing KRA Employment Returns on iTax, you can simply fill and submit your KRA Employment Returns Filing order online here at Cyber.co.ke Portal and our support team will gladly assist you in filing your KRA Employment Returns on iTax.

Deadline For Filing KRA Tax Returns

Tax Returns in Kenya have a set deadline imposed by KRA of 30th June of each year. That means that the Returns Filing Season (Period), runs from 1st January to 30th June, a total of 6 months to File your KRA Tax Returns on iTax Portal. The earlier you File KRA Returns on KRA Portal the better you are.

Kinldy you need to take note that there is no extension to the KRA Tax Returns Deadline of 30th June of each year. This is because KRA believes that the window period period of 6 months is quite sufficient for all Kenyans who have active KRA PIN Numbers to file their KRA Tax Returns on KRA Portal or simply File Returns on iTax.

Requirements Needed To File KRA Tax Returns On iTax

To be able to file your Tax Returns on iTax, you need to ensure that you have with you a set of key and important requirements i.e. KRA PIN Number and KRA Password (iTax Password). These two play an important role in the process of Filing Tax Returns on iTax Portal.

One thing that you need to take note of id that in this article, we shall be filing the first and most common type of KRA Tax Return on iTax i.e. KRA Nil Returns. So, if you are employed, I encourage you to check out our article on How To File KRA Returns For Employed (Employees). As for those who are either Students or Unemployed, this article will help and serve you better.

Just as I mentioned above, for you to able to file your KRA Tax Returns on iTax, you need to ensure that you have with you two key requirements i.e KRA PIN Number and KRA Password. We are going to look at each of these Tax Returns Filing requirements in brief details below.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable your Reset KRA iTax Password.

Having looked at the main requirements needed to File Tax Returns on iTax above, we can now look at the step by step process of How To File KRA Tax Returns On iTax.

How To File KRA Tax Returns On iTax

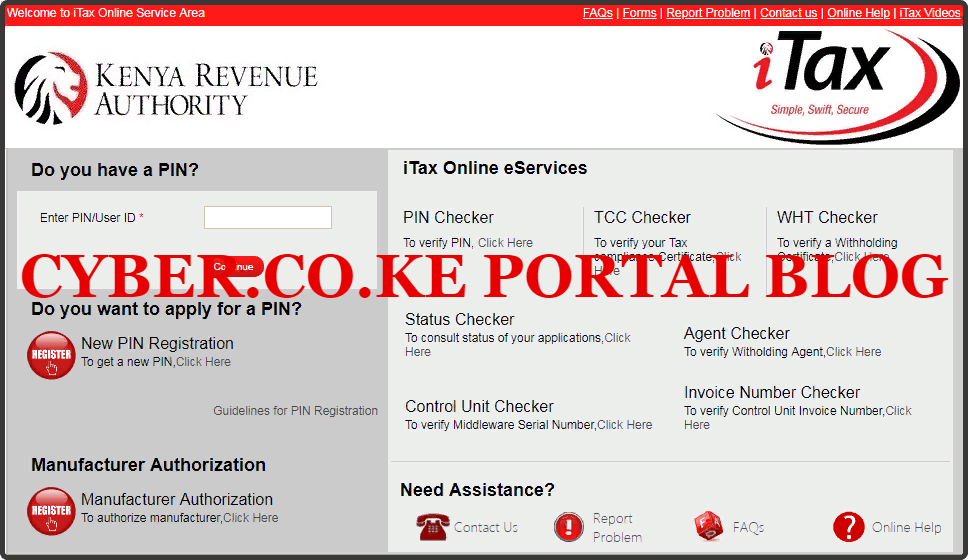

Step 1: Visit iTax Portal

The first step that you need to take in the process of How To File KRA Tax Returns on iTax is to ensure that you visit the iTax using the link provided above in the above description. Note, the above is an external link that will take you to the iTax Portal.

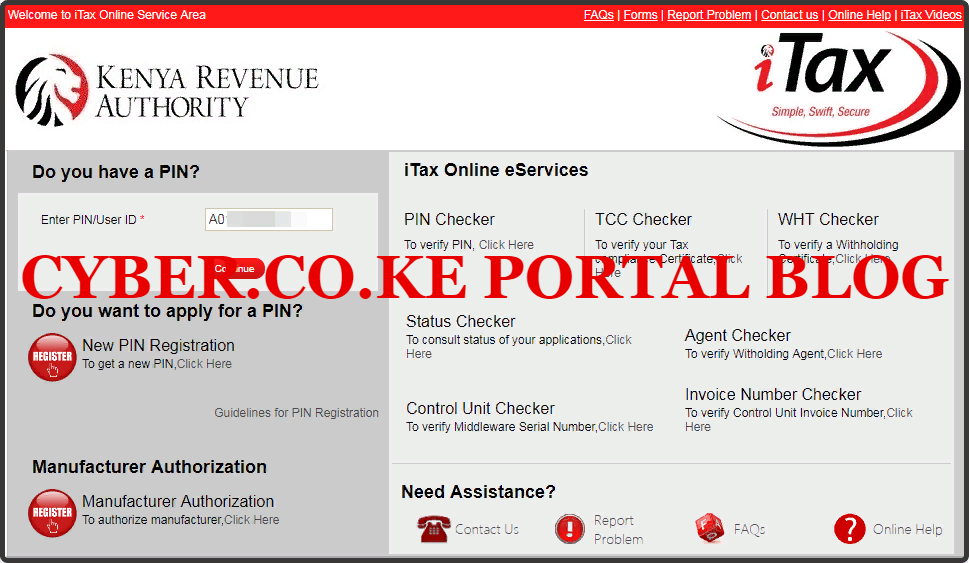

Step 2: Enter Your KRA PIN Number

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

Step 3: Enter KRA Password and Solve Arithmetic Question

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: KRA Tax Returns Portal Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA iTax Account Dashboard. Here upon successful login process, you are able to view a wide range of iTax Portal functionalities.

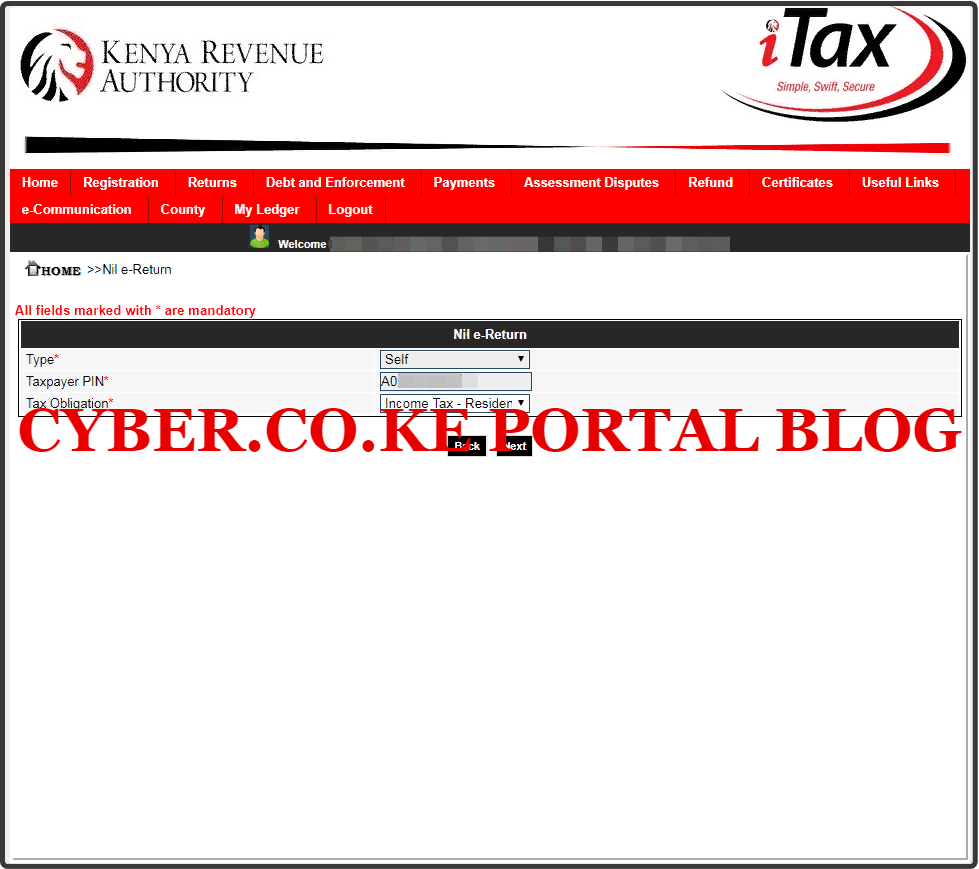

Step 5: Click On The Tax Returns Menu Tab Followed By File Nil Tax Return

In this step, on the iTax Account menu list, navigate to “Returns” menu tab and click on “File Nil Return” from the drop down menu list. This is as illustrated in the screenshot below.

Step 6: Select KRA Tax Obligation As Income Tax Resident Individual

In the Nil e-Return Form, under the Tax Obligation part, select Income Tax Resident Individual since we are filing KRA Nil Return for a Resident Individual. The other two fields i.e Type and Taxpayer are automatically pre-filled by the system.

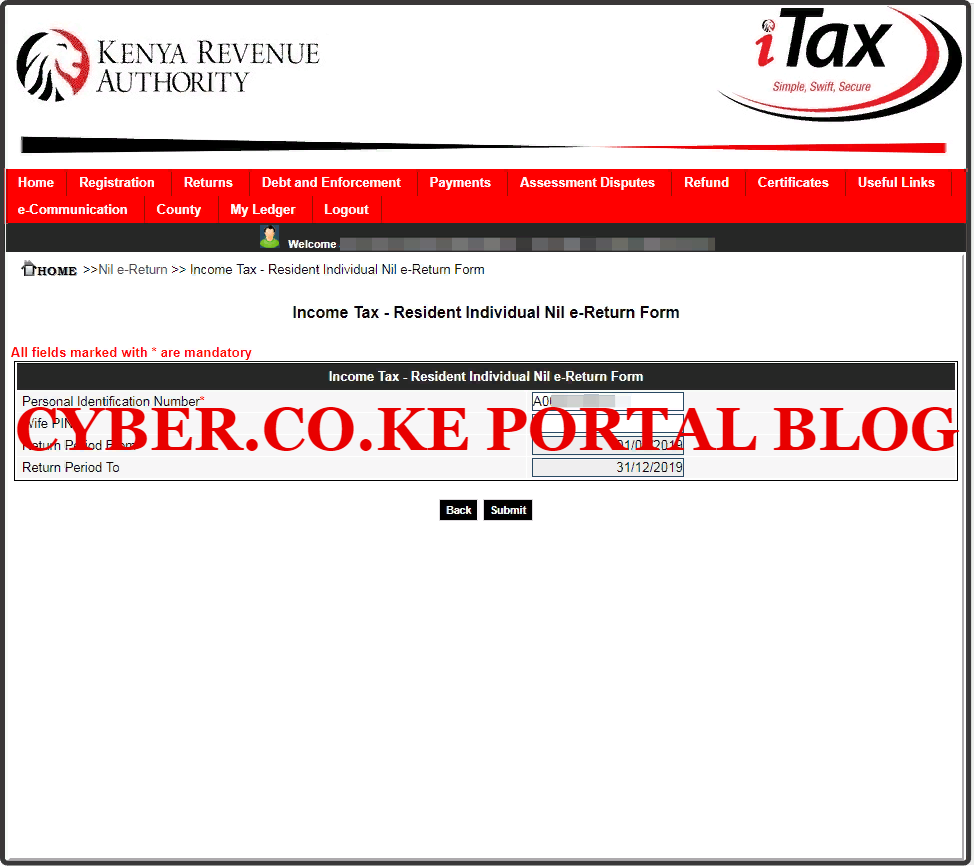

Step 7: Fill In The Income Tax Resident Individual Nil e-Return Tax Form

In this step, on the KRA Nil e-Return Form, you need to select the date for the Return Period From part. Since we are in 2020, we are filing KRA Nil Returns for 2019. So the Return Period From date will be 01/01/2019 and the Return Period To date will be automatically pre-filled by the system to 31/12/2019.

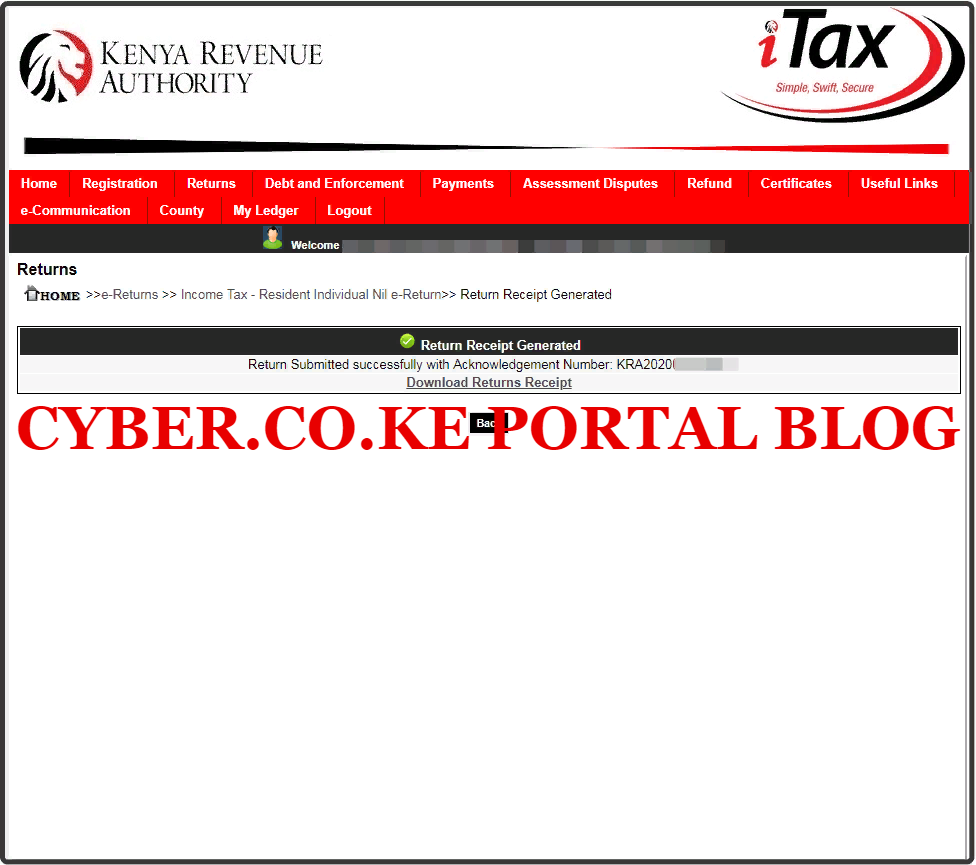

Step 8: Download KRA Tax Returns Acknowledgement Receipt

In this last step, you will need to download the KRA Tax Returns Acknowledgement Receipt that has been generated by the iTax system successfully. This is a final confirming that your KRA Nil Return has been successfully submitted to Kenya Revenue Authority (KRA). An Acknowledgement Number will also be generated for that KRA Nil Return that we have just filed.

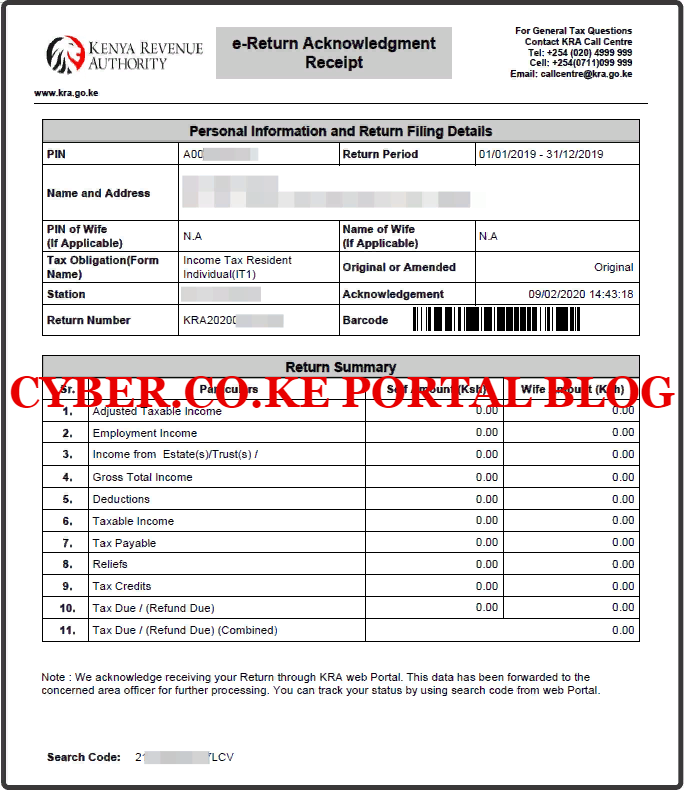

Below is the KRA Tax Returns Acknowledgement Receipt that is a final confirmation that we have successfully filed the KRA Tax Returns on iTax which marks the end of the process of filing Tax Returns using iTax.

Once you have downloaded the above KRA Tax Returns Acknowledgement Receipt, then you have successfully finished the process of Filing KRA Tax Returns on iTax. You have now become compliant and can wait for another year or period of Filing KRA Returns on iTax.

READ ALSO: KRA Returns Portal Login Steps

The important thing that you need to ensure that you have are the KRA PIN Number and KRA Password. If you need any help in Filing KRA Tax Returns on iTax, you can submit your order online here at Cyber.co.ke Portal for KRA Nil Returns Filing whereby we shall File your Tax Returns and sent you the Acknowledgement Receipt to your email address.

DON’T MISS OUT. CHECK OUT OUR TRENDING BLOG POSTS IN KENYA NOW.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

CLICK HERE TO REGISTER KRA PIN NUMBER

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

CLICK HERE TO RETRIEVE KRA PIN CERTIFICATE

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

CLICK HERE TO UPDATE KRA PIN NUMBER

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

CLICK HERE TO CHANGE KRA PIN EMAIL ADDRESS

Stay tax compliant in Kenya - contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.