If you are a student or unemployed individual in Kenya having a KRA PIN Number, the Law states that you are supposed to file your returns on or before the set deadline of 30th June of each year. The type of return that you are to file on iTax is the Nil Returns meaning you do not have any source of income. By not having source of income, we mean you don’t have any income from Business, Employment or Rental, thus you need to file Nil Returns on iTax before the set deadline.

Failure to file Nil Returns attracts a penalty of Kshs. 2,000/= which is imposed by Kenya Revenue Authority (KRA). This penalty will prevent you from getting issued with a Tax Compliance Certificate (TCC) until you file the Nil Returns and make payment to the penalty imposed. So, it is quite important to always file your KRA Returns especially if you have a KRA PIN Number but don’t have any source of income. The category of the KRA Returns that you need to file is the Nil Returns and you file it by accessing your iTax account.

As mentioned above, for you to be able to file your Nil Returns on iTax, there are a set of two key requirements that the process of filing Nil Returns on iTax requires. This is the KRA PIN Number and KRA Password (iTax Password), which makes these two requirements collectively known as iTax Login Credentials, as you need to use both so as to access your iTax account and be able to file your Nil Returns online on iTax Portal.

READ ALSO: How To Generate Payment Slip On iTax (In 5 Steps)

Requirements Needed In Filing Nil Returns On iTax

For one to be able to file Nil Returns on iTax, both the KRA PIN Number and KRA Password (iTax Password) are needed to access the iTax Portal account. Below is a brief description of what the KRA PIN Number and KRA Password (iTax Password) entails.

-

KRA PIN Number

The KRA PIN Number is the most important requirement that you need to have with you when you want to login to iTax so as to be able file KRA Nil Returns online. If by any chance you have forgotten or you don’t remember your KRA PIN Number, you can submit KRA PIN Retrieval request online here at CYBER.CO.KE and our support team will be able to assist with the retrieval of your lost or forgotten KRA PIN Number.

At the same time, if you are looking for a new KRA PIN Number, you can get it here in less than 3 minutes by submitting your KRA PIN Registration request at CYBER.CO.KE. Your new KRA PIN Number and KRA PIN Certificate will be sent to your Email Address once the request for KRA PIN Registration has been done and processed by our support team.

-

KRA Password (iTax Password)

The next requirement that you need to have with you in the process of filing Nil Returns on iTax is your KRA Password (iTax Password), which you will need to access your KRA Portal account. If you don’t know or have forgotten your KRA Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for KRA Password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at CYBER.CO.KE and have your Email Address changed so as to enable your Reset KRA Password.

Did you know that you can easily apply and get your KRA PIN Number and KRA PIN Certificate online in less than 5 minutes by using CYBER.CO.KE today. Get it via email address or even WhatsApp upon submission.

Here at, CYBER.CO.KE, we offer unmatched KRA PIN Registration, KRA PIN Retrieval, KRA PIN Update and KRA PIN Change of Email Address services to Kenyans daily. Fill and submit your request online today.

How To File Nil Returns On iTax (In 6 Steps)

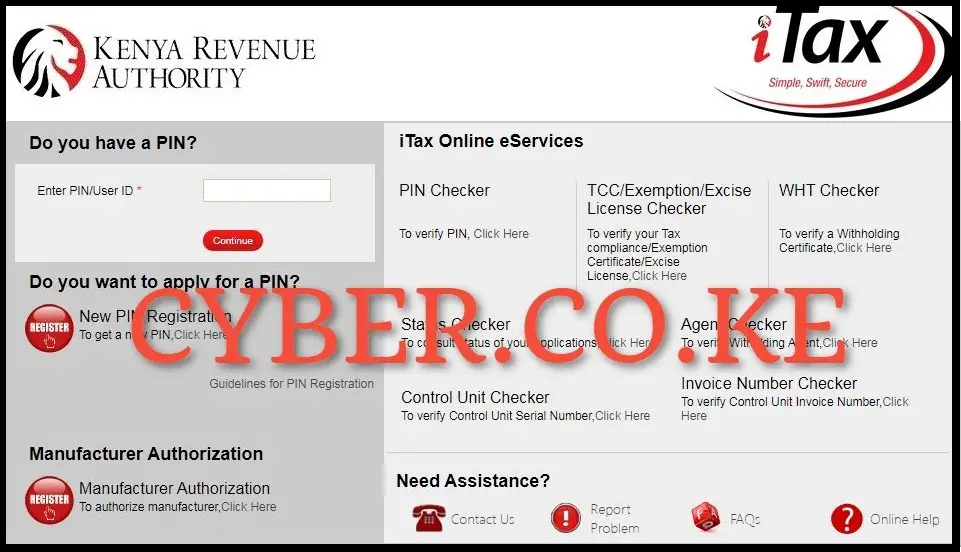

Step 1: Visit iTax Portal

For you to be able to file Nil Returns on iTax, you first need to visit the iTax Portal using https://itax.kra.go.ke/KRA-Portal/

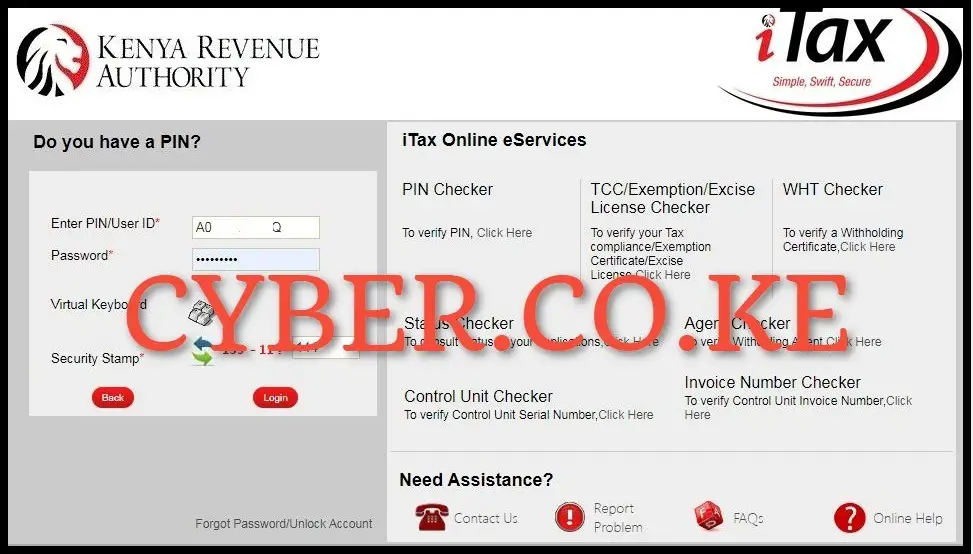

Step 2: Login to iTax Portal

Next, using both your KRA PIN Number and KRA Password (iTax Password), solve the arithmetic question (security stamp) and click on the “Login” button.

Step 3: Click on Return the File Nil Return

In your iTax account dashboard, click on the “Return” menu and from the drop down menu list appearing, click on “File Nil Return” so as to start the process of filing Nil Returns on iTax Portal.

Step 4: Select Tax Obligation

Next, select the tax obligation that you are filing the Nil Returns for. In this case, you need to select “Income Tax – Resident Individual” and click on the “Next” button.

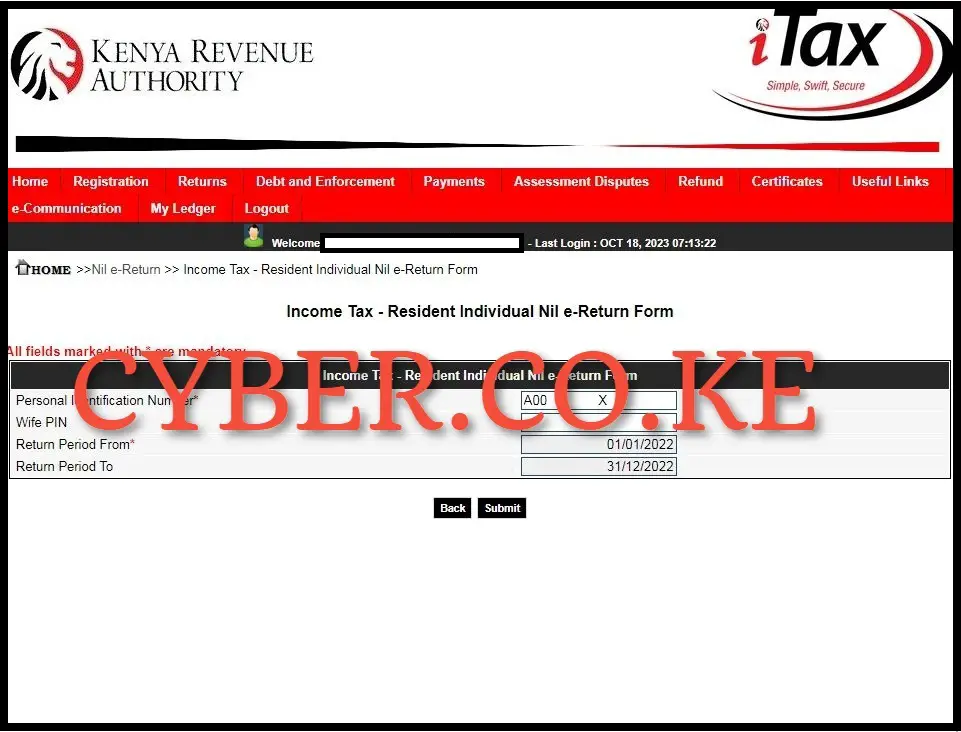

Step 5: Income Tax Resident Individual Nil e-Return Form

In this step, enter the Return Period from and the Return Period To. If your returns are up to date, when you enter the Return Period from it will populate the Return Period to field. The periods runs from 1st January to 31st December. Click on “Submit” button to submit your Nil Returns to KRA.

A pop up window will appear showing “Dear Taxpayer filing of NIL returns is only applicable in cases where you have NO transactions to declare for the period, Are you sure you want to file Nil Return?” Click on the “OK” button to file your Nil Returns online on iTax Portal.

Step 6: Download Nil Returns Acknowledgement Receipt

The last step in the process of Filing Nil Returns on iTax involves downloading the Nil Returns Acknowledgement Receipt or simply the Nil Returns Receipt on iTax Portal. Once you have filed Nil Returns, you need to download the Nil Returns Receipts which has been generated by iTax Portal. To download the Nil Returns Acknowledgement Receipt, just click on the “Download Returns Receipt” link, this will in turn download and save the Nil Returns Receipt PDF version.

READ ALSO: How To Print KRA PIN Certificate Online (In 5 Steps)

The above 6 steps marks the whole process of filing Nil Returns on iTax that all taxpayers in Kenya need to follow. As a reminder filing of Nil Returns is for students and those who are unemployed and have active KRA PIN Numbers. To be able to file Nil Returns online, you need alseo to ensure that you have with you the KRA PIN Number and KRA Password (iTax Password) as you will need these two to login to your iTax Portal account and follow the above outlined steps in Filing Nil Returns on iTax.

TRENDING BLOG POSTS IN KENYA

CYBER.CO.KE

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

CLICK HERE TO REGISTER KRA PIN NUMBER

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

CLICK HERE TO RETRIEVE KRA PIN CERTIFICATE

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

CLICK HERE TO UPDATE KRA PIN NUMBER

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

CLICK HERE TO CHANGE KRA PIN EMAIL ADDRESS