The functionality of the KRA PIN Checker on iTax holds significant importance for taxpayers in Kenya. This PIN Checker functionality facilitates the quick and easy online verification of an individual’s KRA PIN, providing a sense of reassurance by offering details about the KRA PIN Number and its status on iTax.

While possessing a KRA PIN in Kenya doesn’t automatically ensure its validity and active status, it is crucial to grasp the process of utilizing the KRA PIN Checker. This ensures that your KRA PIN Number is not only valid and active but also correctly registered for the appropriate KRA Tax Obligation on iTax.

You can also send us an email using: [email protected] for quick assistance.

The KRA PIN Checker enables users to effortlessly review Taxpayer Details, including the KRA PIN, KRA PIN Status, Taxpayer Names, and iTax Status. Additionally, this tool allows users to access Obligation Details, providing information about the specific obligations associated with the registered KRA PIN on iTax.

These details encompass the Obligation Name, Current Status, Effective From Date, and Effective To Date. The comprehensive information provided by the KRA PIN Checker makes it the preferred choice for checking KRA PIN and KRA PIN Certificate details online in Kenya, offering a display of the most vital taxpayer information associated with the KRA PIN on iTax.

To utilize the KRA PIN Checker functionality and verify your KRA PIN details online using iTax, there is a primary requirement that you must fulfill i.e. having the KRA PIN that you wish to check on iTax. The primary purpose of the KRA PIN Checker on iTax is to swiftly and easily confirm whether the details presented align with those on the taxpayer’s KRA PIN Certificate.

YOU MIGHT BE INTERESTED IN: GETTING YOUR KRA PIN NUMBER

This article offers a detailed guide for Kenyan taxpayers to verify their KRA PIN status through the iTax portal. Ensuring the validity and active status of your KRA PIN is essential for compliance with the Kenya Revenue Authority (KRA) regulations.

Key Highlights from the Article:

-

Importance of Verifying Your KRA PIN:

- Confirms the validity and active status of your KRA PIN, ensuring it’s properly registered for the appropriate tax obligations.

- Provides peace of mind by displaying essential taxpayer information associated with your KRA PIN on iTax.

-

Requirements for Verification:

- KRA PIN Number: The unique identifier assigned to every taxpayer. If forgotten, retrieval services are available through CYBER.CO.KE.

-

Step-by-Step Guide to Using the KRA PIN Checker:

- Step 1: Visit the iTax portal at https://itax.kra.go.ke/KRA-Portal/.

- Step 2: Click on the “KRA PIN Checker” link labeled “To verify PIN, click here.”

- Step 3: Enter your KRA PIN and solve the arithmetic question (security stamp).

- Step 4: Click the “Submit” button to view your KRA PIN details.

Upon submission, the system will display your taxpayer details, including KRA PIN, status, taxpayer names, iTax status, and obligation details such as obligation name, current status, and effective dates. This comprehensive information allows taxpayers to confirm that their KRA PIN is active and correctly registered for the necessary tax obligations.

YOU MIGHT BE INTERESTED IN: GETTING YOUR KRA PIN CERTIFICATE

This article also highlights services offered by CYBER.CO.KE, including Registration, Retrieval, Update and Change of Email Address, providing support for individuals who may encounter challenges during the verification process.

Requirements Needed In Checking Your KRA PIN Using KRA PIN Checker

To check and confirm your KRA PIN Number on iTax using the KRA PIN Checker functionality, you need to have the specific KRA PIN you wish to check and verify online. Here’s a concise overview of the role of the KRA PIN in the entire process of using the KRA PIN Checker on iTax to check your KRA PIN Number.

1. KRA PIN Number

The KRA PIN is the most important requirement that you need to have with you when you want check and confirm your KRA PIN online using KRA PIN Checker on iTax. If by any chance you have forgotten or you don’t remember your KRA PIN Number, you can submit KRA PIN Retrieval request online here at CYBER.CO.KE and our support team will be able to assist with the retrieval of your lost or forgotten KRA PIN Number.

At the same time, if you are looking for a new KRA PIN, you can get it here in less than 3 minutes by submitting your KRA PIN Registration request at CYBER.CO.KE. Your new KRA PIN Number and KRA PIN Certificate will be sent to your Email Address once the request for KRA PIN Registration has been done and processed by our support team.

Did you know that you can easily apply and get your KRA PIN Number and KRA PIN Certificate online in less than 5 minutes by using CYBER.CO.KE today. Get it via email address or even WhatsApp upon submission.

Here at, CYBER.CO.KE, we offer unmatched KRA PIN Registration, KRA PIN Retrieval, KRA PIN Update and KRA PIN Change of Email Address services to Kenyans daily. Fill and submit your request online today.

You can also send us an email using: [email protected] for quick assistance.

How To Check Your KRA PIN Using KRA PIN Checker

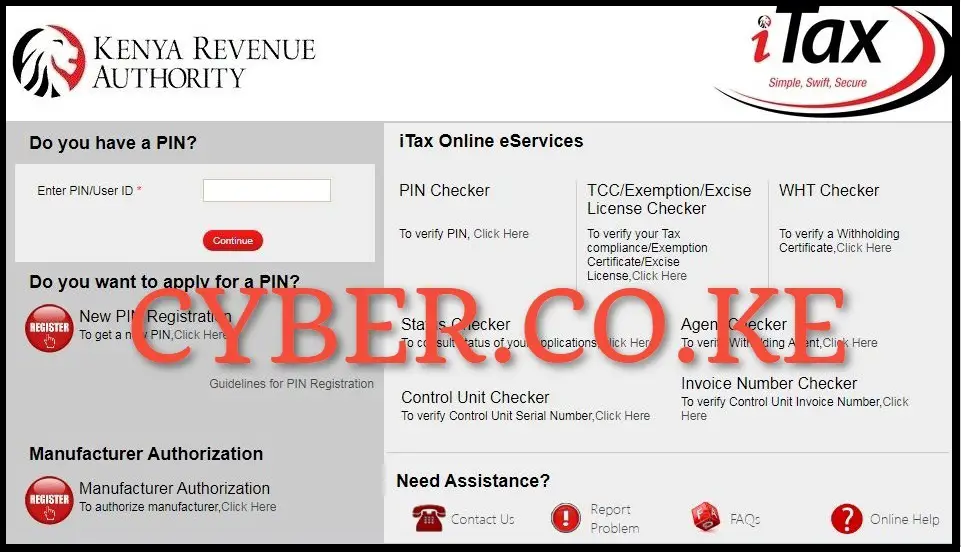

Step 1: Visit iTax

For you to be able to check your KRA PIN using KRA PIN Checker, you first need to visit iTax by using https://itax.kra.go.ke/KRA-Portal/

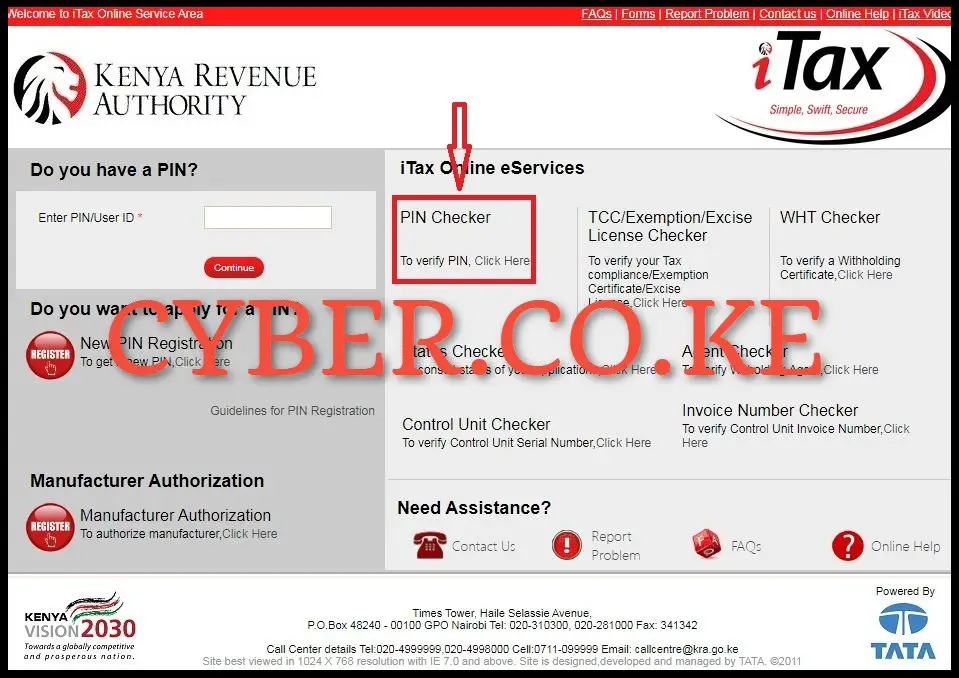

Step 2: Click On KRA PIN Checker

In this step, once you are on iTax, click on the KRA PIN Checker titled “To verify PIN, click here” to start the process of checking, confirming and verifying your KRA PIN using the KRA PIN Checker functionality/module on iTax.

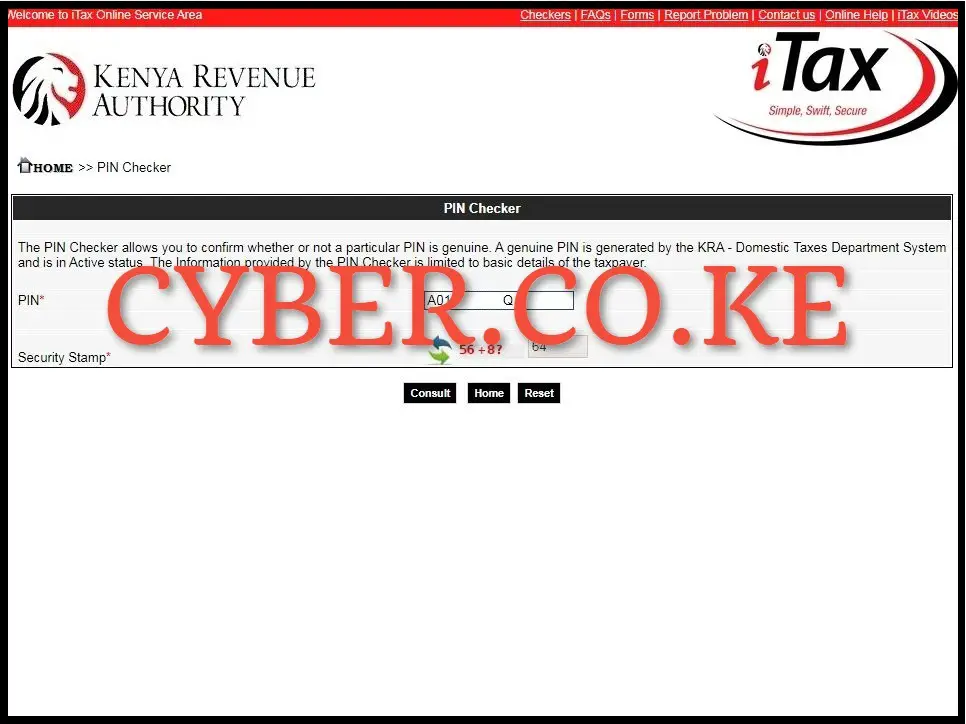

Step 3: Enter Your KRA PIN and Solve Arithmetic Question (Security Stamp)

Next, in this step you need to enter your KRA PIN Number and solve the arithmetic question (security stamp). Once you have entered your KRA PIN Number and have successfully solved the arithmetic question (security stamp), click on the “Submit” button.

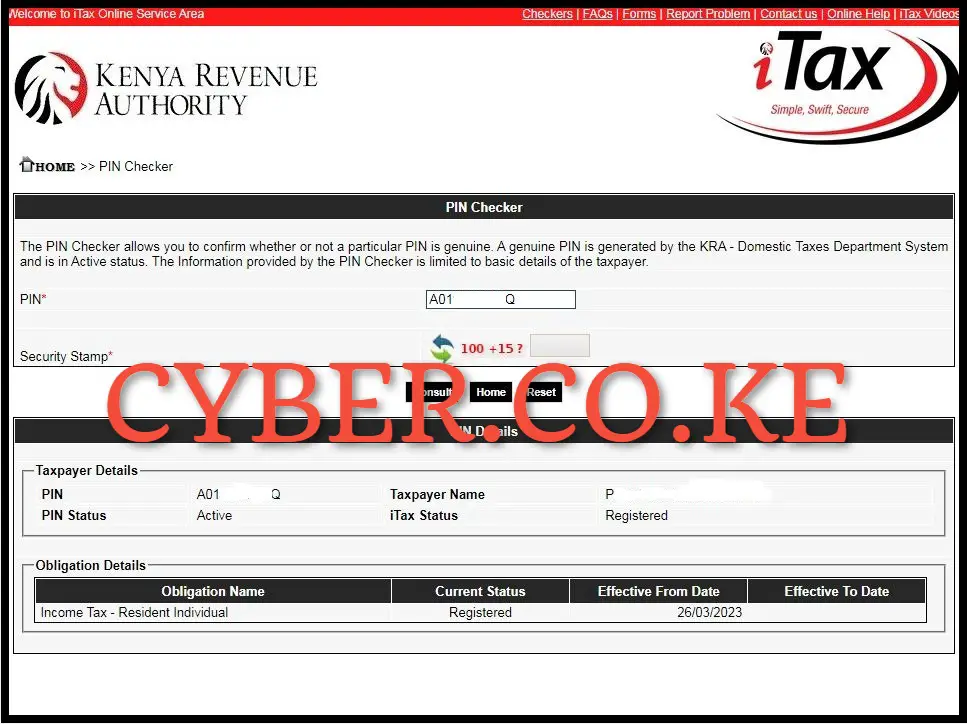

Step 4: KRA PIN Checker Taxpayer Details

The conclusive and pivotal step in the verification process for your KRA PIN through the iTax platform’s KRA PIN Checker is the presentation of results detailing the taxpayer’s information and obligations.

You can also send us an email using: [email protected] for quick assistance.

Typically, the KRA PIN Checker results page will outline the following:

- KRA PIN Details, encompassing Taxpayer Information such as the KRA PIN Number, Taxpayer Names, KRA PIN Status, and iTax Status.

- Obligation Information, including the Tax Obligation for which the taxpayer is registered on iTax, the current status of the KRA PIN Number, and the effective dates – both from and to – of the KRA PIN Number.

You need to ensure that the taxpayer and obligation details shown on the results page are current and up-to-date as your KRA PIN Certificate.

The above 4 steps sums up the process that you need to follow in order to check, confirm and verify your KRA PIN using the KRA PIN Checker functionality that is found on iTax. It is important to check your KRA PIN as you will be able to know it’s current status and the various KRA Tax Obligation(s) the the KRA PIN Number is registered for on iTax.

Ensure that your KRA PIN is always up to date and registered for the correct tax obligations in Kenya. So, next time you want to check, confirm or even verify your KRA PIN, you can simply follow the above step-by-step process of checking your KRA PIN online using KRA PIN Checker functionality on iTax.

DON’T MISS OUT. CHECK OUT OUR TRENDING BLOG POSTS IN KENYA NOW.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

CLICK HERE TO REGISTER KRA PIN NUMBER

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

CLICK HERE TO RETRIEVE KRA PIN CERTIFICATE

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

CLICK HERE TO UPDATE KRA PIN NUMBER

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

CLICK HERE TO CHANGE KRA PIN EMAIL ADDRESS

Stay tax compliant in Kenya - contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.