The KRA Acknowledgement Receipt serves as document that is generated by iTax (KRA Portal), signifying the successful submission of a registration request, return filing or amendment application to the Kenya Revenue Authority (KRA) for processing and approval. This acknowledgement receipt acts as a verification that the application, request or task that has been submitted through iTax (KRA Portal) has been officially received by the Kenya Revenue Authority (KRA). There exist three primary categories of Acknowledgement Receipts: e-Registration Acknowledgement Receipt, e-Return Acknowledgement Receipt, and e-Amendment Acknowledgement Receipt.

The e-Registration Acknowledgement Receipt is issued during KRA PIN Registration (for non individuals), the e-Return Acknowledgement Receipt is issued upon filing of KRA Returns and finally the e-Amendment Acknowledgement Receipt is issued when you make an amendment to a KRA PIN Number on iTax (KRA Portal). In this blog post, we will delve into the process of downloading the e-Return Acknowledgement Receipt on iTax (KRA Portal) which is a type of the acknowledgement receipts that are generated on iTax (KRA Portal). As the name suggests, the e-Return Acknowledgement Receipt is a specific type of Acknowledgement Receipt that taxpayers get issued with after successfully completing the filing of KRA Returns on iTax (KRA Portal). So, this is the the basis on this blog post as we shall be looking at the steps to follow in order to download the acknowledgement receipt online using iTax (KRA Portal).

Whether one is filing individual or non-individual KRA returns on iTax (KRA Portal), it is imperative to download the e-Return Acknowledgement Receipt upon concluding the filing of KRA Returns process. To download your Acknowledgement Receipt, specifically the e-Return Acknowledgement Receipt on iTax (KRA Portal), there are two essential prerequisites that must be met. These requirements include possessing your KRA PIN Number and KRA Password (iTax Password). These credentials are typically essential for logging into your iTax (KRA Portal) account, enabling you to download the Acknowledgement Receipt, i.e. the e-Return Acknowledgement Receipt for the KRA Returns that you have filed on iTax (KRA Portal).

READ ALSO: How To File KRA Nil Returns For Unemployed On iTax

Downloading KRA Acknowledgement Receipt involves the following; Visit iTax (KRA Portal), Login Into iTax (KRA Portal), Click on Useful Links then Consult and Reprint Acknowledgement Receipt and Certificates, Fill the Consult and Reprint Acknowledgement Receipt Form and finally Download KRA Acknowledgement Receipt. Below is an in depth step-by-step process that you need to follow.

How To Download KRA Acknowledgement Receipt

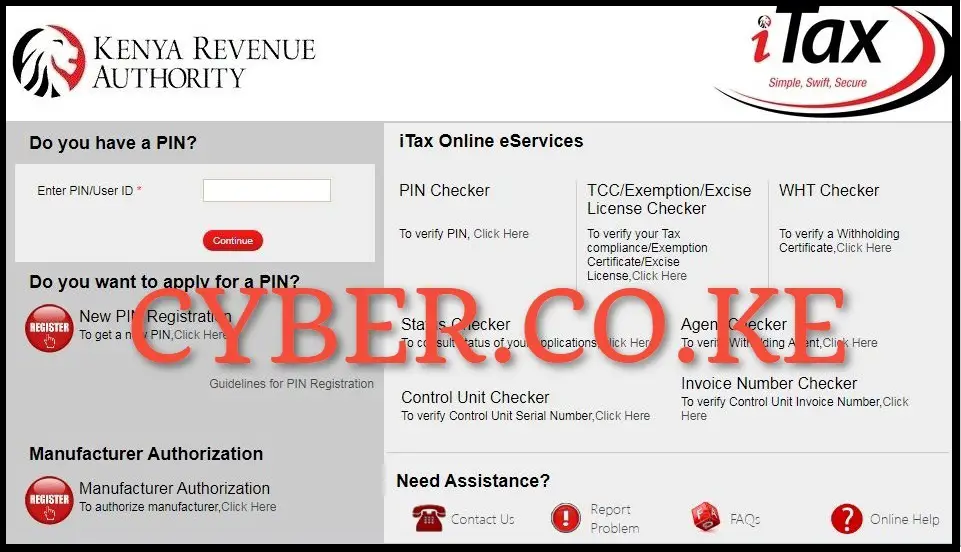

Step 1: Visit iTax (KRA Portal)

To be able to successfully download Acknowledgement Receipt (e-Return Acknowledgement Receipt), you first need to visit iTax (KRA Portal) by using https://itax.kra.go.ke/KRA-Portal/

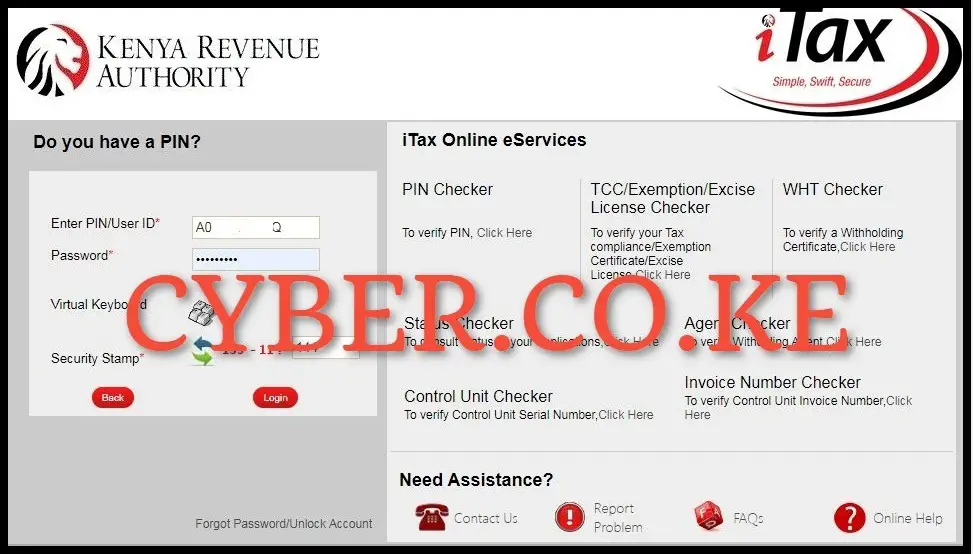

Step 2: Login Into iTax (KRA Portal)

In this step, enter your KRA PIN Number, iTax Password (KRA Password), solve the arithmetic question (security stamp) and click on the “Login” button.

Step 3: Click on Useful Links then Consult and Reprint Acknowledgement Receipt and Certificates

Once you are logged into iTax (KRA Portal), click on “Useful Links” then from the drop down menu list, click on “Consult and Reprint Acknowledgement Receipt and Certificate” to begin the process of Acknowledgement Receipt download on iTax (KRA Portal).

Step 4: Fill the Consult and Reprint Acknowledgement Receipt Form

Next, you need to complete the Consult and Reprint Acknowledgement Receipt form on iTax (KRA Portal). Input the essential information in the specified fields, including Business Process (Taxpayer Return Processing), Business Sub Process (Original Return Filing), Obligation Name (Income Tax Resident Individual), Tax Period From (01/01/2023), and Tax Period To (31/12/2023). Select the desired return period for the KRA Acknowledgement Receipt. After providing these details, click on the “Consult” button to download KRA Acknowledgement Receipt online. Be sure to confirm your consultation by clicking the “OK” button when prompted on the pop-up window asking, “Do you want to consult with the given details?“

Step 5: Download KRA Acknowledgement Receipt

Finally, you need to download the Acknowledgment Receipt that has been generated by iTax (KRA Portal). To download the Acknowledgement Receipt on iTax (KRA Portal), on the output section of the form just under the “Acknowledgement Number” column, click on the acknowledgement serial number i.e KRA2024***********8, which will in turn initiate the download of the Acknowledgement Receipt on iTax (KRA Portal). As mentioned in the introduction above, this post will be focussing on the process of downloading the e-Return Acknowledgement Receipt that is one of the 3 types of acknowledgment receipts that are normally generated on iTax (KRA Portal).

READ ALSO: How To Reprint KRA Nil Returns Receipt On iTax

To sum up the whole process, you need to ensure that you are able to first login into your iTax (KRA Portal) account by using both the KRA PIN Number and KRA Password (iTax Password) which form part of the iTax login credentials. Also, ensure that you had already filed your KRA Returns online using iTax (KRA Portal) and are now looking for a copy of your Acknowledgement Receipt (the e-Return Acknowledgement Receipt). Once you have with you these requirements, you can follow the above outlined 5 main steps to be able to successfully download KRA Acknowledgement Receipt.

DON’T MISS OUT. CHECK OUT OUR TRENDING POPULAR BLOG POSTS IN KENYA.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

KRA PIN REGISTRATION

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

KRA PIN RETRIEVAL

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

KRA PIN UPDATE

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

KRA PIN CHANGE OF EMAIL ADDRESS

Stay Tax Compliant in Kenya

Contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.