The eTIMS Taxpayer Portal is tailored exclusively for taxpayers operating in the service sector, where goods are not part of the equation. The eTIMS Taxpayer Portal provides a dedicated platform for service-oriented businesses to manage their invoicing requirements with precision and clarity. If you fall under this category, then you are required to sign up for eTIMS using eTIMS Taxpayer Portal and start issuing eTIMS Invoices.

READ ALSO: How To Sign Up for eTIMS Lite using eCitizen

The process of signing up for eTIMS using eTIMS Taxpayer Portal requires that you have with you KRA PIN Number and the mobile number that is linked to your KRA PIN Number. Once you have with you these two requirements, you can follow the steps outlined in this blog post on How To Sign Up for eTIMS using eTIMS Taxpayer Portal.

How To Sign Up for eTIMS using eTIMS Taxpayer Portal

The following are the 12 main steps involved in the process of How To Sign Up for eTIMS using eTIMS Taxpayer Portal that you need to follow.

Step 1: Visit eTIMS Taxpayer Portal

To be able to sign up for eTIMS, you first need to visit the eTIMS Taxpayer Portal using https://etims.kra.go.ke/basic/login/indexLogin

Step 2: Click on Sign Up Button

In this step, you need to click on the “Sign Up” button located at https://etims.kra.go.ke/basic/login/indexLogin to start the process of signing up for eTIMS using the eTIMS Taxpayer Portal.

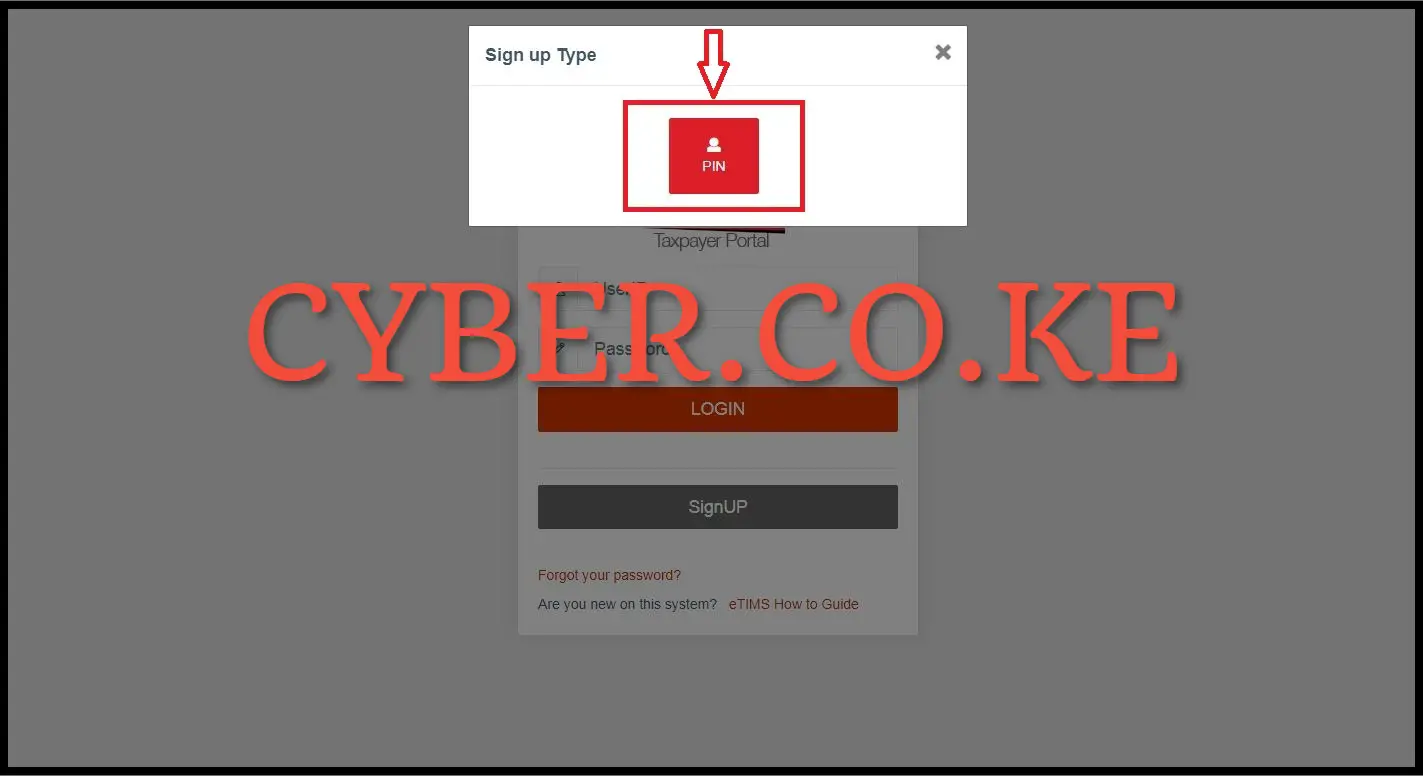

Step 3: Under Sign Up Type, click on the PIN button

Next, under the eTIMS sign up type, click on the “PIN” button to use your KRA PIN Number to sign up for eTIMS on eTIMS Taxpayer Portal.

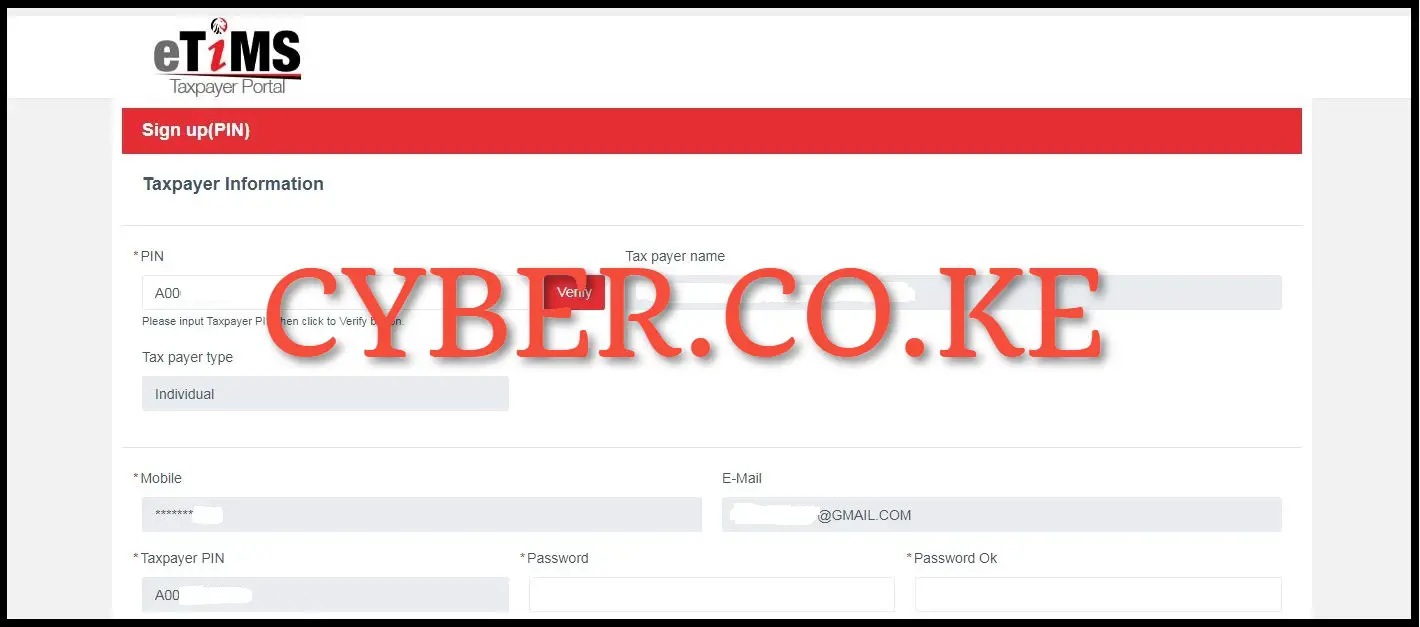

Step 4: Enter your KRA PIN Number and click on the Verify button

In this step, you need to enter your KRA PIN Number (Taxpayer PIN) and then click on the “Verify” button to verify the KRA PIN on the eTIMS Taxpayer Portal.

Step 5: eTIMS Taxpayer Information

Next, after clicking on the “Verify” button in step 4 above, the taxpayer details will auto-populate the eTIMS registration form. From here, you can confirm if the details being displayed on the eTIMS Taxpayer portal are accurate. Some taxpayers will see an error such as “There is no tax payer information” which means that Data Migration has to be done by the eTIMS Support Team. The data migration takes up to 24 hours after which you will be able to verify and proceed with signing up for eTIMS using eTIMS Taxpayer Portal.

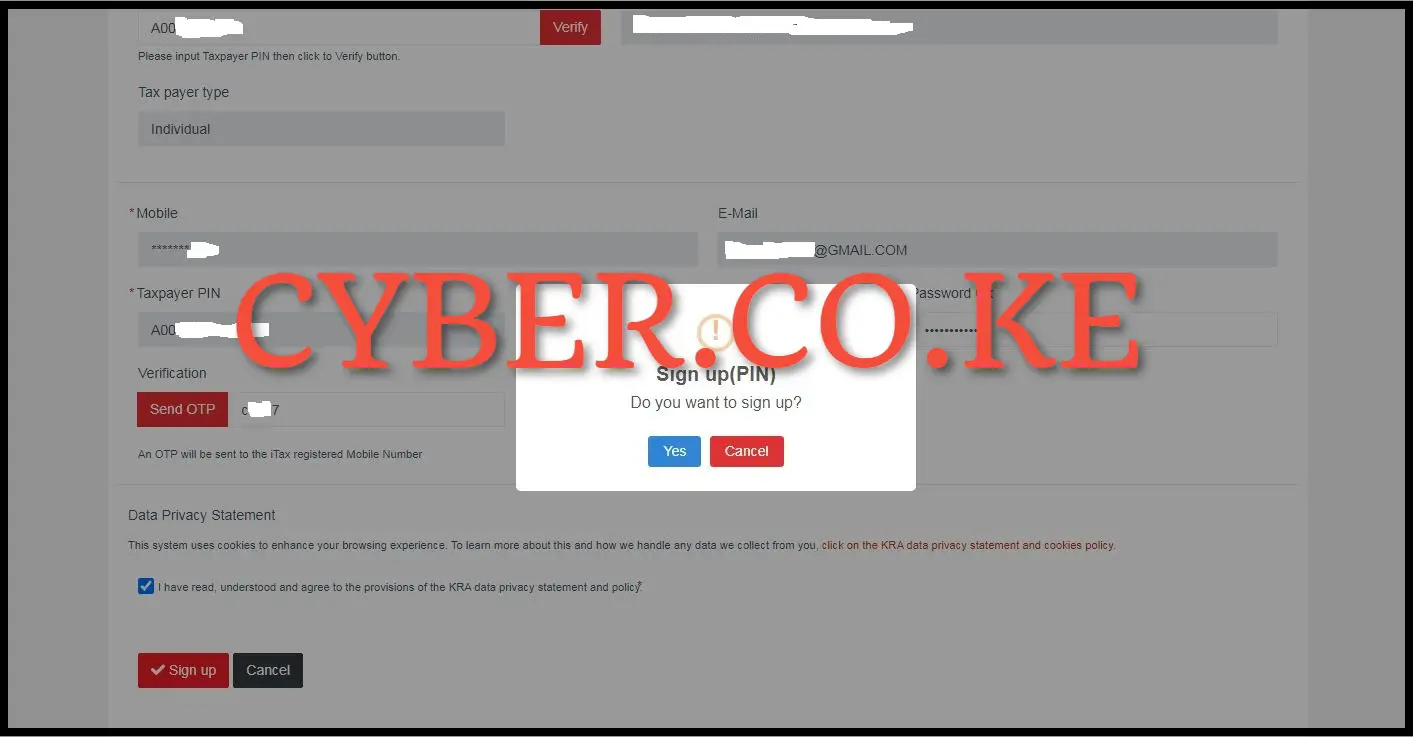

Step 6: Enter and Confirm Password then click on the Send OTP button

In this step, you need to enter the password that you will be using on the eTIMS Taxpayer Portal. After entering the password and confirming the same, click on the “Send OTP” button which will initiate the sending OTP to the iTax registered Mobile Number. You will receive the OTP from KRA Internal and you need to enter the eTIMS OTP verification code. After entering the OTP that was sent to your iTax registered mobile number, check the box to confirm that you have gone through the “Data Privacy Statement” and then proceed to click on the “Sign Up” button.

Step 7: Click on the Yes button on eTIMS Sign Up

Next, a sign up confirmation message populates (appears). Click on “Yes” to complete the sign up process for eTIMS using eTIMS Taxpayer portal. You will the message “eTIMS Sign up is completed” meaning that you have successfully signed up or registered for eTIMS using the eTIMS Txpayer portal. The eTIMS sign up process using the eTIMS taxpayer portal ends in this step and the next phase continues in step 8 below.

Step 8: Login Into eTIMS Taxpayer Portal

In this step, after you have successfully signed up or registered for eTIMS and clicked on the “Yes” button you will be re-directed to the eTIMS Taxpayer Portal login page where you now need to login into eTIMS by using your User ID (KRA PIN Number) and eTIMS Password. Once you have entered your eTIMS User ID and eTIMS Password, click on the “Login” button to access your eTIMS Taxpayer Portal account.

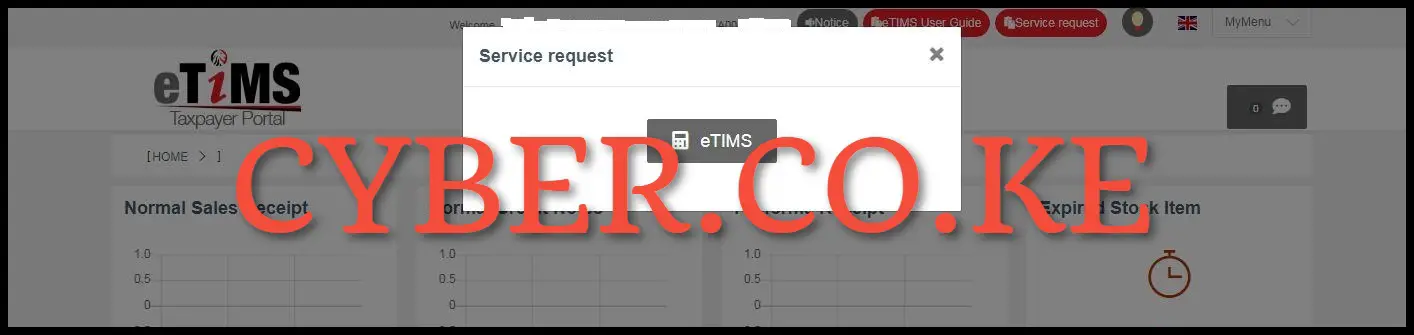

Step 9: Click the Service Request button on the top right corner

Upon successful login into eTIMS Taxpayer Portal, click on the “Service Request” button located on the top right corner of the eTIMS Taxpayer portal account dashboard.

Step 10: Click on the eTIMS button

Next, you need to click on the “eTIMS” button that will appear from the pop up window on eTIMS Taxpayer portal account dashboard after you have clicked on the “Service Request” button in step 8 above.

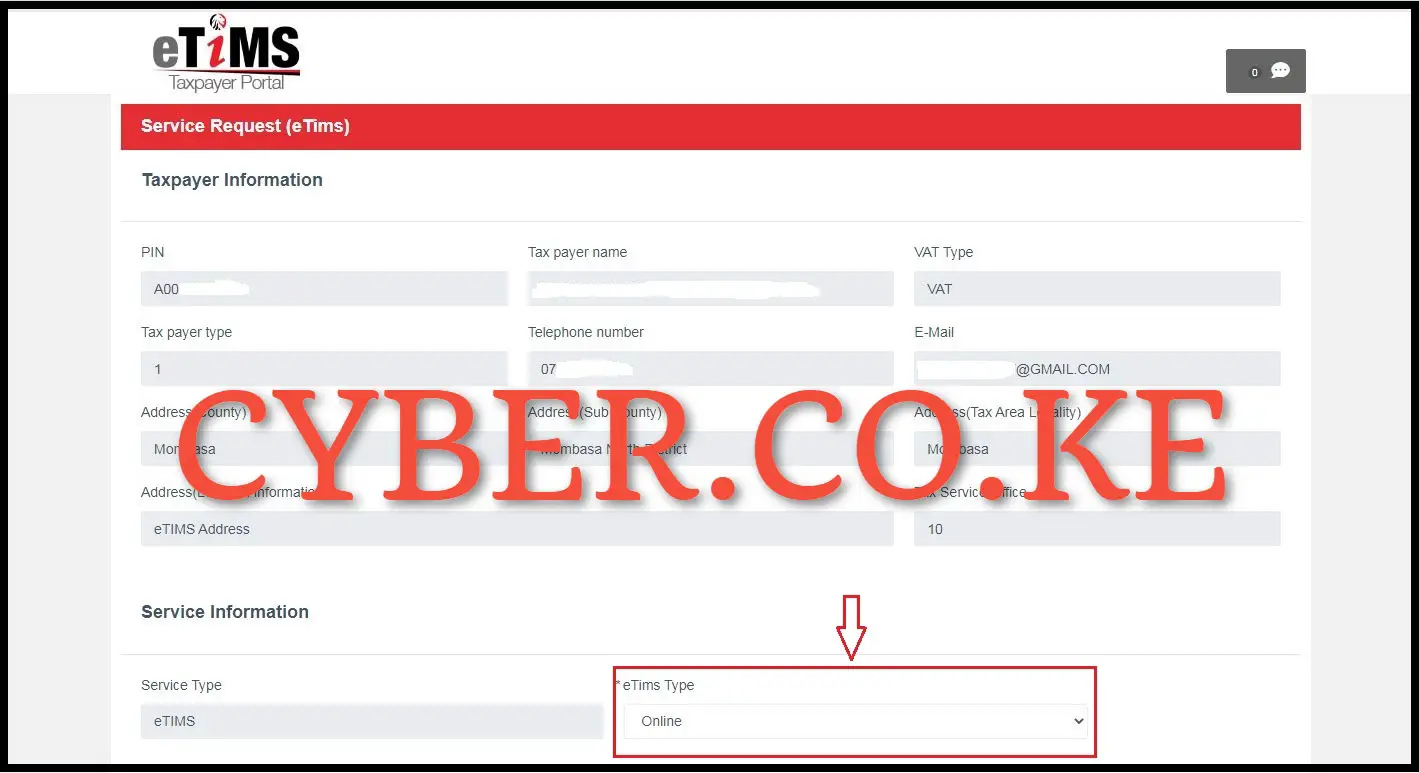

Step 11: Select eTIMS Solution Type

In this step, the taxpayer’s data should be displayed as follows. Click the drop down arrow under the “eTIMS Type” and select eTIMS solution that is suitable for your business. The service type is eTIMS and the eTIMS type can either be: eTIMS Client, Online, VSCU or OSCU.

Step 12: Attach required documents and click on Send button

Lastly, you need to attach the required documents i.e. Directors(s) National ID and the Signed Commitment Letter. You need to take note that if applying for eTIMS Client you will be required to provide the serial number of the device you intend to download the software on. Once you have uploaded all the required eTIMS application documents, click on the “Send” button to submit the eTIMS application request.

Download and Print the: eTIMS Acknowledgement and Commitment Form

A pop up window will appear displaying: “Service Request – Would you like to apply?” click on the “Yes” button. At this step, that marks the end of eTIMS registration process using the eTIMS taxpayer portal. Once the eTIMS application and the submitted documents have been reviewed and approved by Kenya Revenue Authority (KRA), you will now start using the eTIMS solution that you selected and start issuing eTIMS Invoices.

READ ALSO: How To Onboard on eTIMS Lite via eCitizen

The above 12 main steps sums up the whole process of signing up for eTIMS using eTIMS Taxpayer Portal. For you to successfully sign up for eTIMS on the eTIMS Taxpayer Portal, you need to ensure that you have with you KRA PIN Number and also the mobile number that is linked to your KRA PIN Number on iTax (KRA Portal). Once you have these two with you, you can follow the above outlined steps that are involved in the process of How To Sign Up for eTIMS using eTIMS Taxpayer Portal.

Matthews Ohotto is an Article Writer at CYBER.CO.KE and a Video Creator at Video Tutorials Kenya (YouTube). He specializes in crafting insightful Blog Posts and Video Tutorials that empower Kenyans with practical digital skills. He is a holder of Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT).

KRA INDIVIDUAL SERVICES

SUBMIT SERVICE REQUEST

KRA PIN REGISTRATION

Are you looking for KRA PIN Registration services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN RETRIEVAL

Are you looking for KRA PIN Retrieval services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN UPDATE

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN CHANGE OF EMAIL ADDRESS

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA RETURNS SERVICES

SUBMIT SERVICE REQUEST

KRA NIL RETURNS

Are you looking for KRA Nil Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA EMPLOYMENT RETURNS

Are you looking for KRA Employment Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA AMENDED RETURNS

Are you looking for KRA Amended Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA WITHHOLDING TAX RETURNS

Are you looking for KRA Withholding Tax Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.