Get to know How to Apply for KRA Tax Compliance Certificate today. Tax Compliance Certificate (TCC) is an important for any person with a KRA PIN.

In this blog post, I am going to show the ultimate step by step guide on How to get a KRA Tax Compliance Certificate straight from Kenya Revenue Authority (KRA). Tax Compliance Certificate is one those documents that as a Kenyan, you need to have to show that you have been tax compliant for a period of the last 12 months.

Kindly note that starting this year 2020, Kenya Revenue Authority has simplified the process of issuance of Tax Compliance Certificate. The KRA Tax Compliance Certificate will be issued immediately upon application to Taxpayers who have filed and paid all their Tax Returns and do not have any Tax Liability at KRA. You can refer to the article below for the new Simplified Tax Compliance Certificate Application 2020 procedure.

READ ALSO: How To Apply For Tax Compliance Certificate (Simplified Process)

Where is KRA Tax Compliance Certificate Needed?

Tax Compliance Certificate is one of those documents that you will need when applying for a Job in Kenya, Applying for Tenders in Kenya and any other form of business transaction that will require the document.

Many job applications in Kenya require a person to fulfill the requirements of Chapter (6) six of the Constitution of Kenya by having the following documents:

- Certificate of Good Conduct from the Directorate of Criminal Investigation (DCI)

- Clearance Certificate from Higher Education Loans Board (HELB)

- Tax Compliance Certificate from Kenya Revenue Authority (KRA)

- Clearance from the Ethics & Anti-Corruption Commission (EACC)

- Clearance from Credit Reference Bureau (CRB)

The KRA Tax Compliance Certificate (TCC) is a document that is issued to compliant taxpayers by Kenya Revenue Authority (KRA). In the context of “Compliant Taxpayers” meaning those who have filed both their Employment Income Tax Return and also the Nil Income Tax Returns.

Normally, KRA rejects applications for Tax Compliance Certificate by people who have not filed any of the above returns for a certain period. In this case, you have to apply for a waiver on your penalties, then if approved you can request for the KRA Tax Compliance Certificate.

How to Apply for KRA Tax Compliance Certificate

Now, lets start the process of How to Apply for KRA Tax Compliance Certificate online using your iTax Account. There are two things that you need to have with you before you bet started on the step by step guide. This is as described below:

- KRA PIN Number

- iTax Account Password

Once you have the two items with you then you can get started. But if you don’t have any of the above or both, here at Cyber.co.ke Portal, we offer a variety of KRA PIN services to all our customers in Kenya.

Need a new KRA PIN number –> Get one Here today

Forgotten your KRA PIN number –> Retrieve it Here today

Update your KRA PIN to iTax Portal –> Update it Here today

Change Email Address for your KRA PIN number –> Change it Here today

Now if you are all set and have with you KRA PIN number and iTax password we can get started. Please note the following if you have forgotten your iTax Account password.

To reset your password, go to iTax Portal, enter your PIN and click on Forgot Password/Unlock Account. Your new password will be sent to your registered email address.

If you don’t know your email address or have forgotten the email address password, you can always change the email address on your KRA PIN to a new one through our Change of Email Address Service.

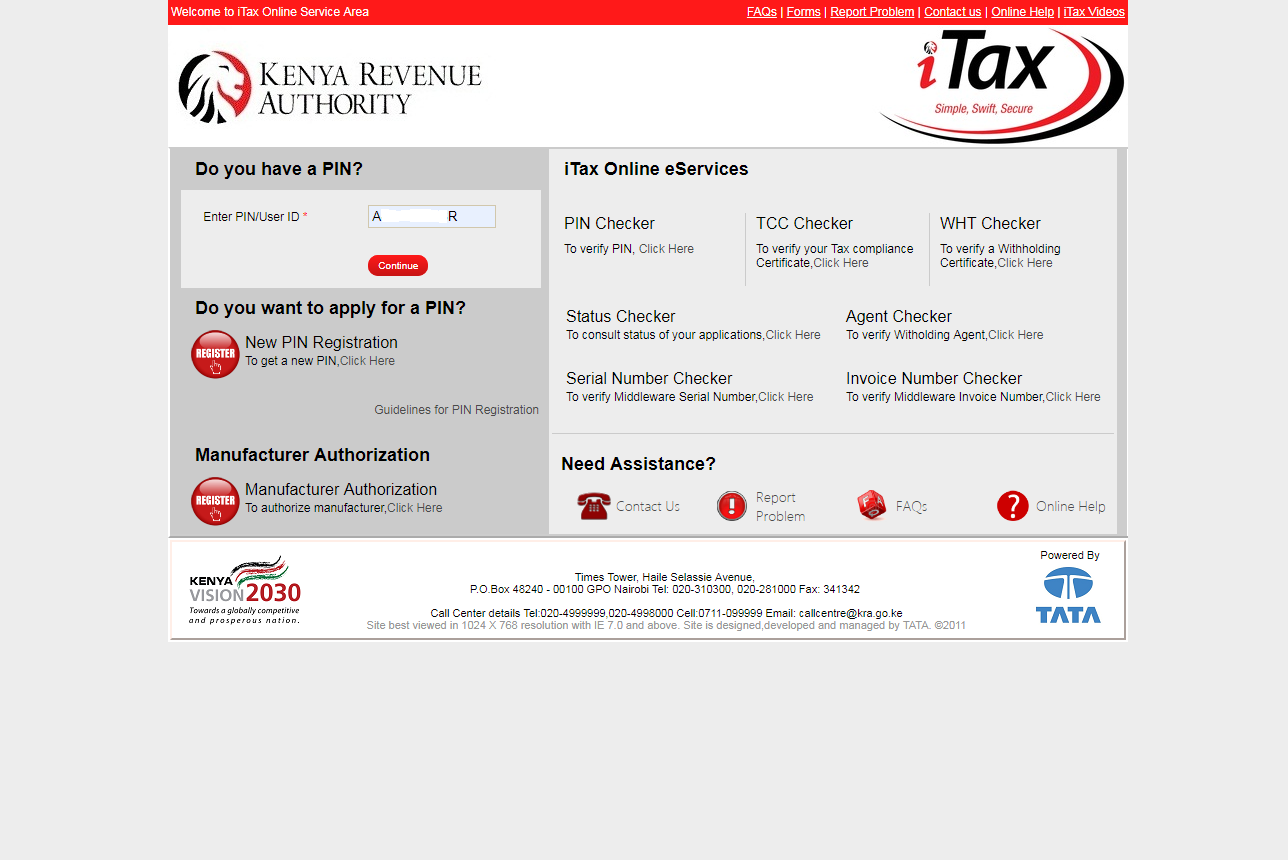

Step 1: Log into your iTax Account

The first step in this process of Applying for Tax Compliance Certificate will be by heading over to iTax Portal and entering your login credentials to login.

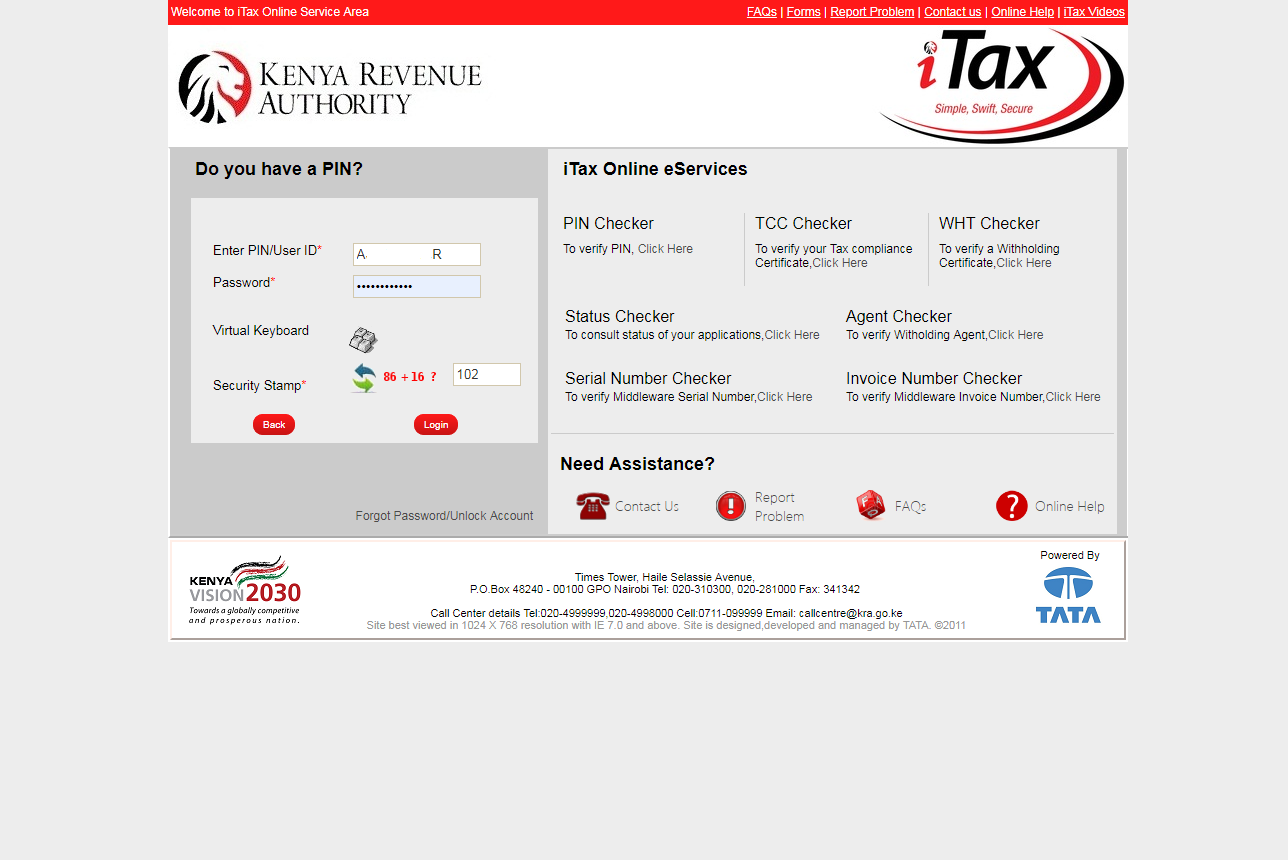

Once you have entered you KRA PIN number, click on the Continue button to proceed and enter your KRA PIN Password.

Once you have input your KRA PIN and Password on the iTax Login page, click login to access your iTax Account.

Step 2: iTax iPage Account Dashboard

Once you have successfully logged in to your iTax Account, you should see the following layout.

You will probably see a popup telling you to Update Your iTax Profession if you have not done so. This is as shown below:

Don’t panic when you see the above pop up. This was a change that Kenya Revenue Authority (KRA) recently made to iTax as part of their ongoing user data cleaning initiatives. So you are required to update your profession in iTax before continuing using the iTax account. We wrote about How to Update your Profession in iTax. You can read the full step by step guide on the above link.

Step 3: Click on the Certificates Tab on the right hand side

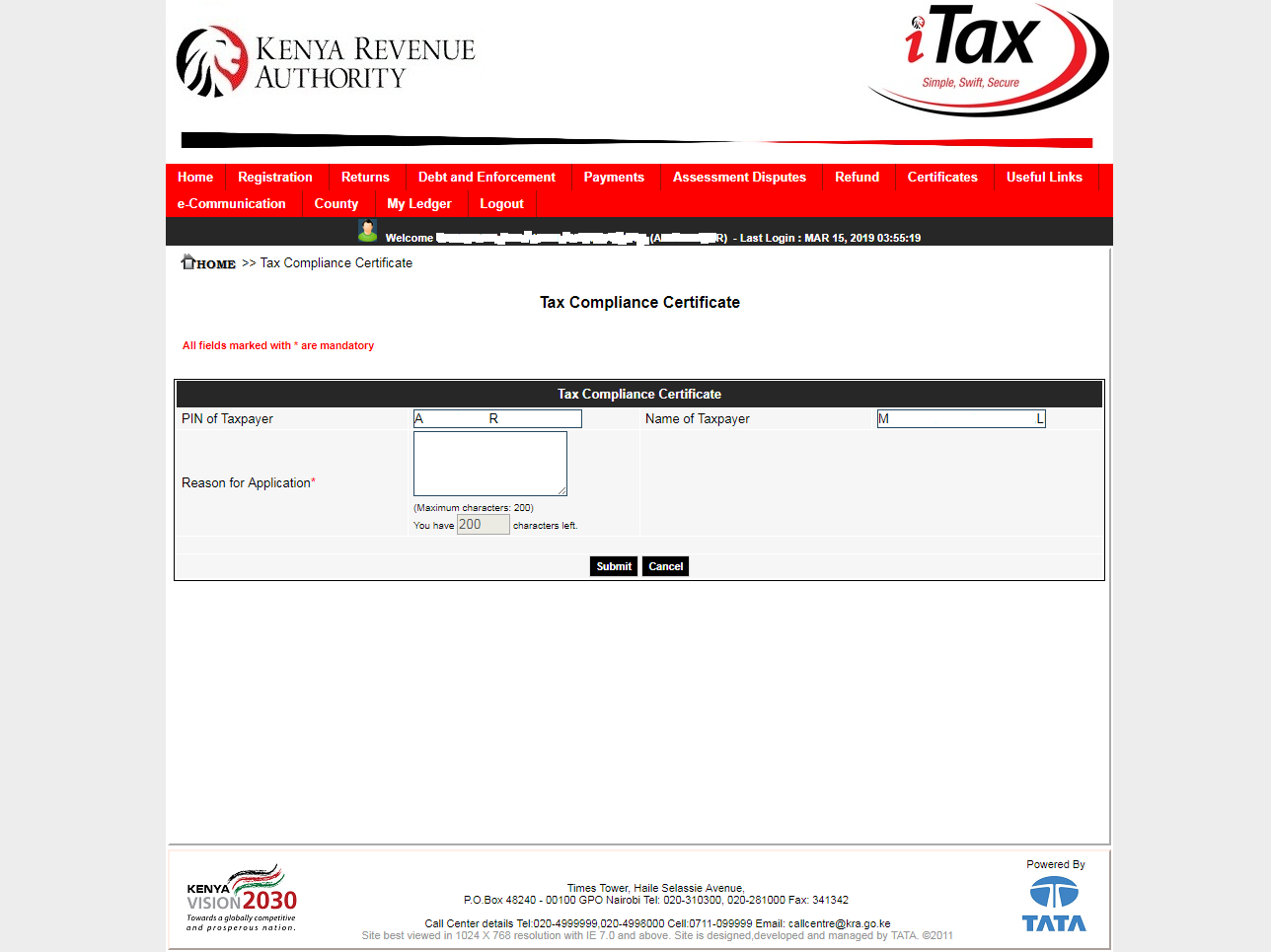

Step 4: Apply for Tax Compliance Certificate (TCC)

Once you have clicked on the Certificate Tab, click on Apply for Tax Compliance Certificate (TCC) tab. Once successful, the following screen will appear.

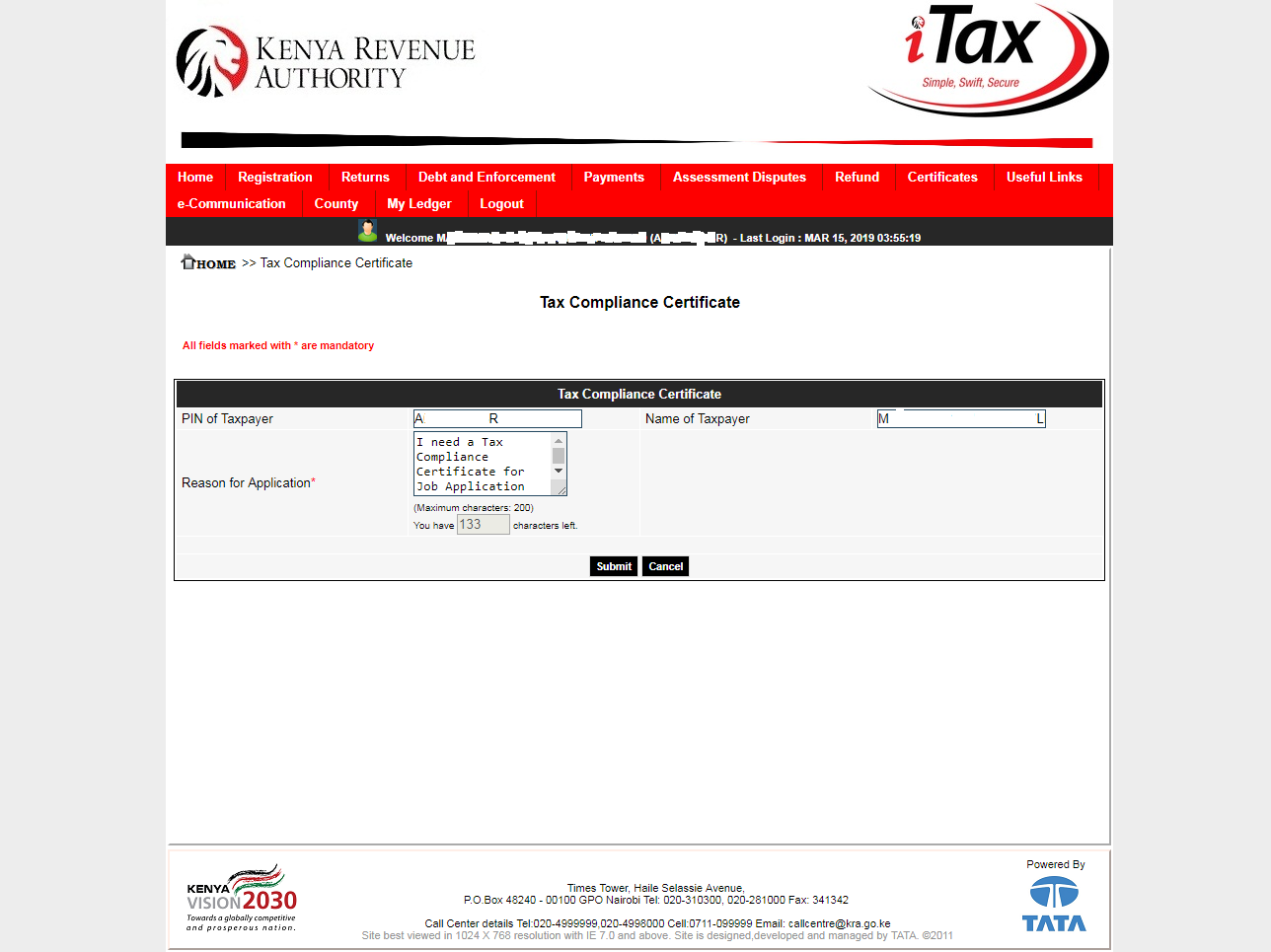

Step 5: Fill in the Reasons for Application of Tax Compliance Certificate (TCC)

In this example, I am going to use Job Application as the reason for Tax Compliance Certificate application. You are supposed to write the reasons for application of the TCC in not more than 200 character. So I recommend you be brief and straight to the point.

The two major reasons that you would need a Tax Compliance Certificate from Kenya Revenue Authority may include:

- Job Application Requirement

- Tender Application Requirement

Once you have filled in the reasons for your application, click on the submit button.

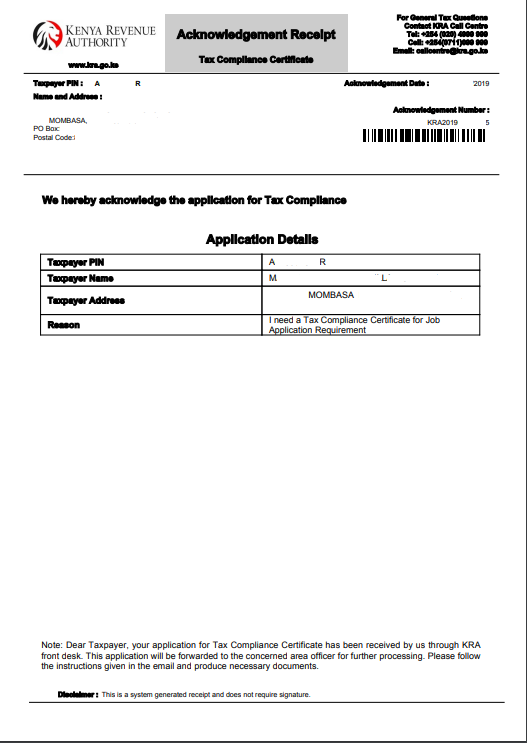

Step 6: Download and Print Acknowledgement Receipt for Tax Compliance Certificate

Once you have filled in your application, you need to download your Acknowledgement Receipt for Tax Compliance Certificate. The receipt will have your Acknowledgement number for tracking the status of your application.

Please note that it takes up to 5 business days to get your KRA Tax Compliance Certificate from Kenya Revenue Authority (KRA). It might taker longer depending on your ledger which KRA goes through before accepting or rejecting your application.

NOTE: Request for Tax Compliance Certificate Email Notification

Once you submitted the application successfully, you will also receive an email confirmation on the same.

You can download and print the Acknowledgement receipt from KRA. You will use this receipt to track your application status should there be any delays in approval of the KRA Tax Compliance Certificate.

Once you have followed the above step by step guide, you have to wait for 5 business days for Kenya Revenue Authority (KRA) to go through your tax ledger and if approved, you will be issued with a Tax Compliance Certificate and a copy of the same be sent to your email address.

Step 7: Approval of Application for Tax Compliance Certificate

If your application for a KRA Tax Compliance Certificate has been successful, you will receive a confirmation email from Kenya Revenue Authority (KRA) on the same in your registered email address.

The above email notification is the one that you will get when the application of your KRA Tax Compliance Certificate (TCC) has been approved. It contains the PDF attachment of your Tax Compliance Certificate that you need to download and print out.

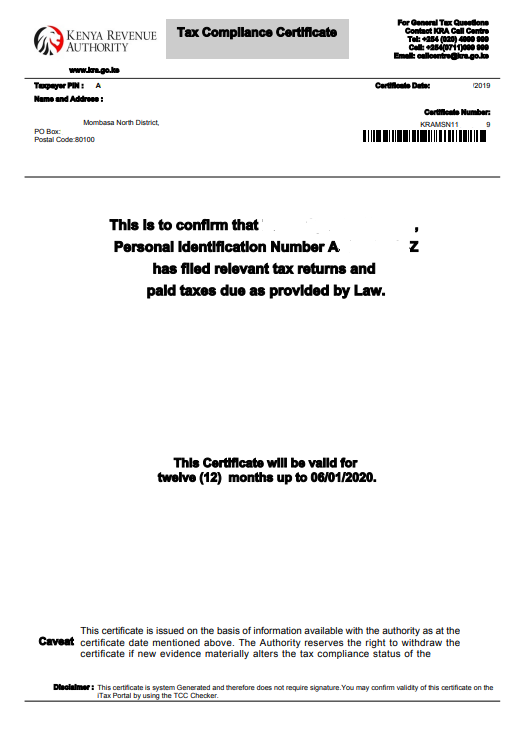

Step 8: Download and print KRA Tax Compliance Certificate

The final step will be download and print out your KRA Tax Compliance Certificate that is valid for a period of twelve (12) months from the date that it was issued.

If your application for KRA Tax Compliance Certificate has not been successful, you will get a notification from Kenya Revenue Authority (KRA) with reasons why your application was rejected.

Normally you have to ensure you have rectified and complied with KRA before re-applying again. Some of the reasons for rejection of Application for Tax Compliance Certificate includes:

- Outstanding Liabilities (You have unpaid taxes/penalties/interests)

- Non-Filer (You have never filed returns)

The above two are the most common reasons that Kenya Revenue Authority (KRA) gives for rejection of may applications for tax compliance certificate. So, be tax compliant today, you never know when you will need a KRA Tax Compliance Certificate.

DON’T MISS OUT. CHECK OUT OUR TRENDING POPULAR BLOG POSTS IN KENYA.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

REGISTER KRA PIN NUMBER

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

RETRIEVE KRA PIN CERTIFICATE

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

UPDATE KRA PIN NUMBER

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

CHANGE EMAIL ADDRESS

Stay Tax Compliant in Kenya

Contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.

Our dedicated team is ready to assist you immediately you fill and submit your service request online. Whether you need help with Registering KRA PIN Number, Retrieving KRA PIN Certificate, Updating KRA PIN Number or Changing KRA PIN Email Address, we are here to assist you.

Get in touch with us today and experience professional online customer support.