Get to know How To Apply For KRA Tax Refund Using iTax Portal online today. Learn the application process of Tax Refund from KRA.

When you file your KRA Employment Returns using your P9 Form and Excel Sheet, getting a negative figure simply means that you are due for a Refund from Kenya Revenue Authority (KRA). Getting to know How To Apply for KRA Tax Refund on iTax Portal is essential so as to get your KRA Refund in your bank account.

Today, I am going to share with you the steps involved in applying for Tax Refund from Kenya Revenue Authority (KRA). Before we go any further, wee need to look at and understand certain terminologies. We are going to look at the key steps that you need to follow in applying for KRA Refund on iTax Portal.

READ ALSO: How To Add Employment As Source Of Income To KRA PIN On iTax

After filing KRA Returns, if you find that you have a negative figure, then that simply means that you overpaid your taxes to Kenya Revenue Authority (KRA) and you need to apply for KRA Refund so as to be refunded the overpaid amount. You will need to login to your iTax Account using both your KRA PIN Number and iTax Password.

Logging into KRA Portal or iTax is a process that requires you to have both your KRA PIN Number Number and iTax Password. To be able to access and view all the resources on iTax, you need to be logged into your iTax Account. The problem is that not that many Kenyans know the process that they need to follow.

The good thing is that incase you have forgotten your KRA PIN Number or even iTax Password (KRA Password), here at Cyber.co.ke Portal we can gladly assist you with that. Incase you have forgotten your KRA PIN, then you can request for KRA PIN Retrieval and have both your KRA PIN Number and KRA PIN Certificate sent to you. Incase you have forgotten your iTax Password, you can request for KRA PIN Change of Email Address so that you can be able to change your KRA Password.

What Is KRA Tax Refund?

KRA Tax Refund is a reimbursement of excess tax paid in a given period. During the process of filing your income tax returns using your P9 form, when you get a negative figure on your returns, then that means you are due for a refund from Kenya Revenue Authority (KRA). Please note a negative amount implies a tax refund.

NOTE: Please verify if you filled the return form correctly and included personal relief and defined pension before requesting for a Tax Refund from Kenya Revenue Authority. Immediately after filing a tax return for the respective year, initiate the refund via iTax. Upon approval of a claim, the taxpayer automatically receives an approval order via email.

Who Is Eligible for KRA Tax Refund?

The following are the groups of taxpayers in Kenya who are eligible for tax refund from Kenya Revenue Authority (KRA).

- An individual who has insurance policies on life and education who has not been granted relief by the employer on the same.

- An individual with a mortgage of home ownership plan from specific financial institutions (as listed on the 4th schedule on Income Tax Act) on owner occupied property who has not been granted relief by the employer on the same.

- A resident individual who was not granted personal relief during the year.

- A person who has paid tax deducted at source in access of final liability.

How Long Does Tax Refund by Kenya Revenue Authority take?

Please note that it takes at least 90 working days. Do not get confused here. The 90 working days means Monday to Friday in that sequence. You will receive a Refund Acknowledgement Receipt number that you can use to follow up on the status of the Tax Refund application.

NOTE: Please note that after applying for the refund on iTax and providing the supporting documents, the refund process takes 90 days.

Now that we are done with the basic explanation of the key terminologies, we need to look to look at the requirements for applying for a KRA Tax Refund on iTax.

Documents That You Will Require To Apply For KRA Tax Refund

The following are the main documents that you will require when applying for Tax Refund by Kenya Revenue Authority (KRA).

- Tax deduction card (P9 Form) for claims relating to excess PAYE deductions.

- Insurance policy certificates for claims relating to insurance relief.

- Mortgage certificate from a financial institution for claims relating to interest on mortgage or home ownership plan.

Requirements for Applying for a KRA Tax Refund on iTax Portal

The following are two requirements that you need to have before amending your KRA PIN on iTax Portal. This includes the following:

-

KRA PIN number

-

iTax Password

First and foremost, you will need to have with you the KRA PIN Number. If you don’t remember or have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal. If you are looking for a new KRA PIN, you can also request for KRA PIN Registration here.

The next item that you need to have is your iTax Password to enable you login to the iTax Portal. If you have forgotten your iTax Password, you can check our guide on How To Reset iTax Password and a new KRA Password will be sent to your iTax registered email address.

If you don’t know, no longer use or have forgotten your iTax email address, you can request for Change of Email Address here also. If you have a KRA PIN that is not on iTax, you can request for KRA PIN Update and have your KRA PIN Number migrated to iTax so as to enable you file your iTax Returns with ease.

Having addressed the key requirements for KRA Tax Refund application, we can begin the process of How To Apply For KRA Tax Refund Using iTax Portal.

How To Apply For KRA Tax Refund Using iTax Portal

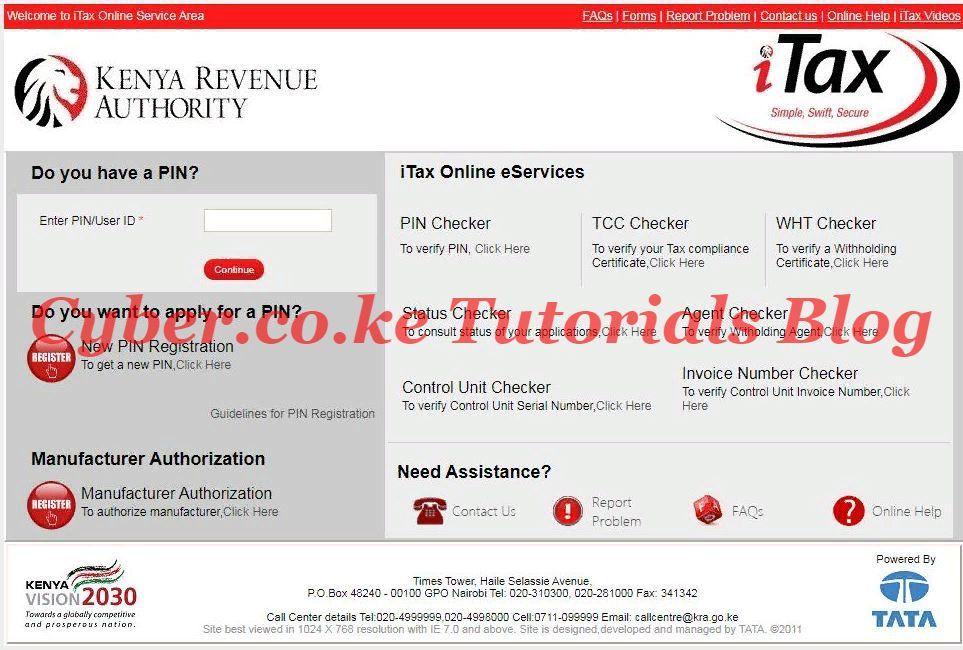

Step 1: Visit iTax Portal

The first thing you need to do is to access the KRA iTax Web Portal using the link provided in the above description.

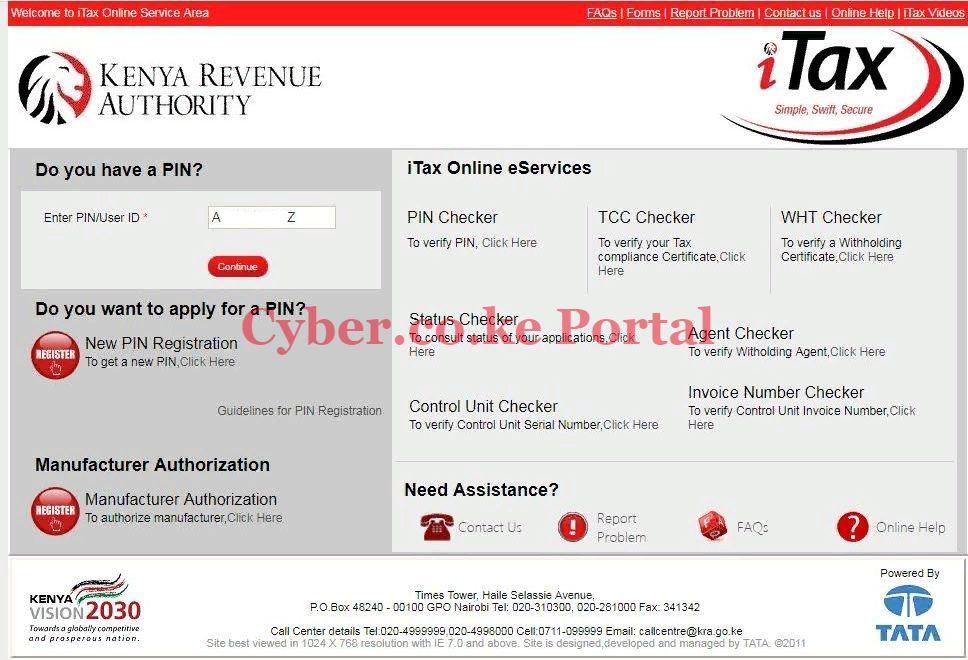

Step 2: Enter KRA PIN Number

Next, you will be required to enter your KRA PIN Number. Once you have entered the KRA PIN, click on the “Continue” button.

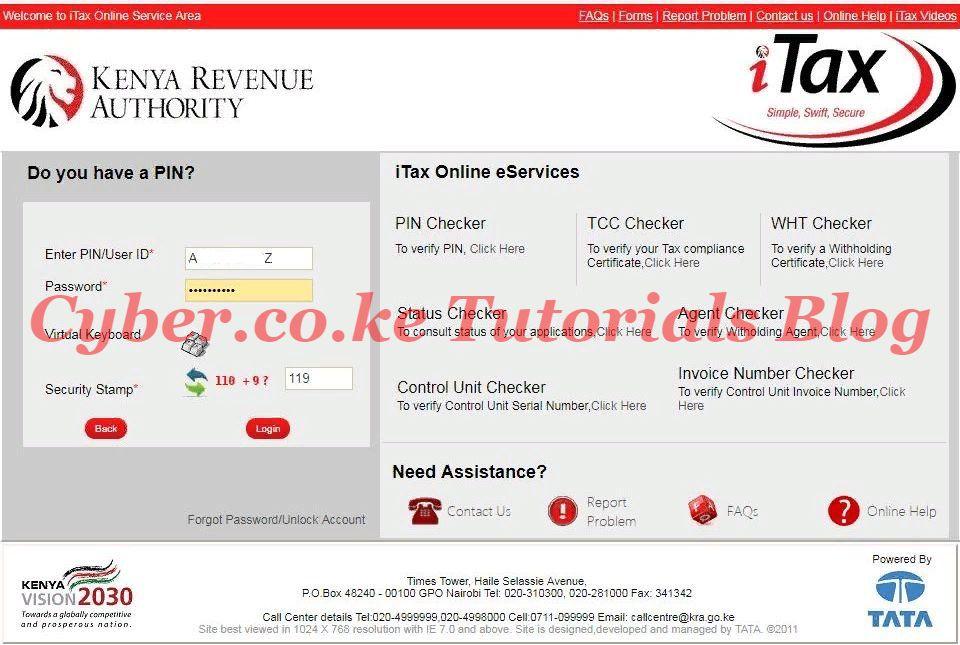

Step 3: Enter KRA iTax Password and Security Stamp (Arithmetic Question)

Next, you will need to enter your KRA iTax Password and solve the arithmetic question (security stamp). Once done, click on the “Login” button.

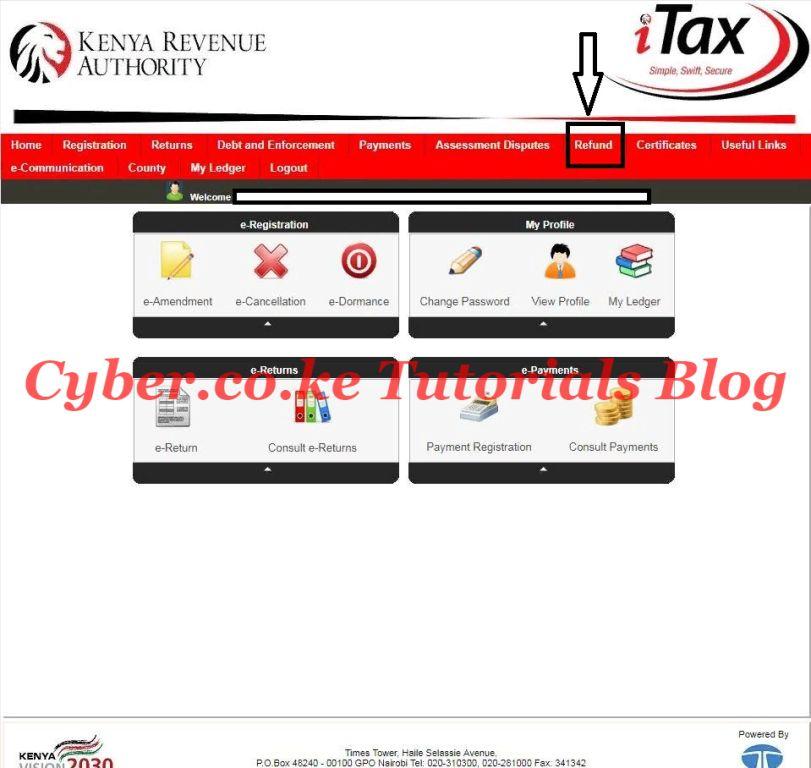

Step 4: iTax Account Dashboard

Upon successful login, you will be able to see your iTax iPage Account Dashboard that is loaded with various functionalities.

Step 5: Click on the Refund button

In this step, you will click on the “Refund” menu button and then select “Income Tax” from the drop down menu.

Step 6: Income Tax Refund Application Form

In this step, there are three parts that we are going to look at. This is as outlined below:

- Basic Info

- Bank Details

- Claim Details

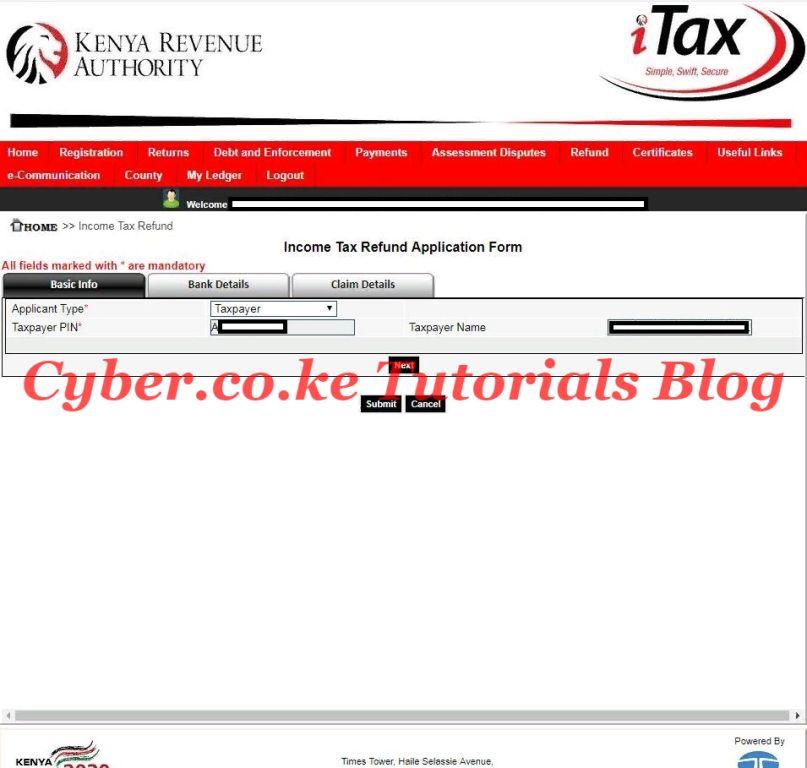

Part 1: Basic Info

The basic info part of the Income tax application form comprises of: applicant type, taxpayer PIN and taxpayer name. These field are pre-selected, meaning there is nothing to add here. Click on the “Next” button to proceed to Bank Details.

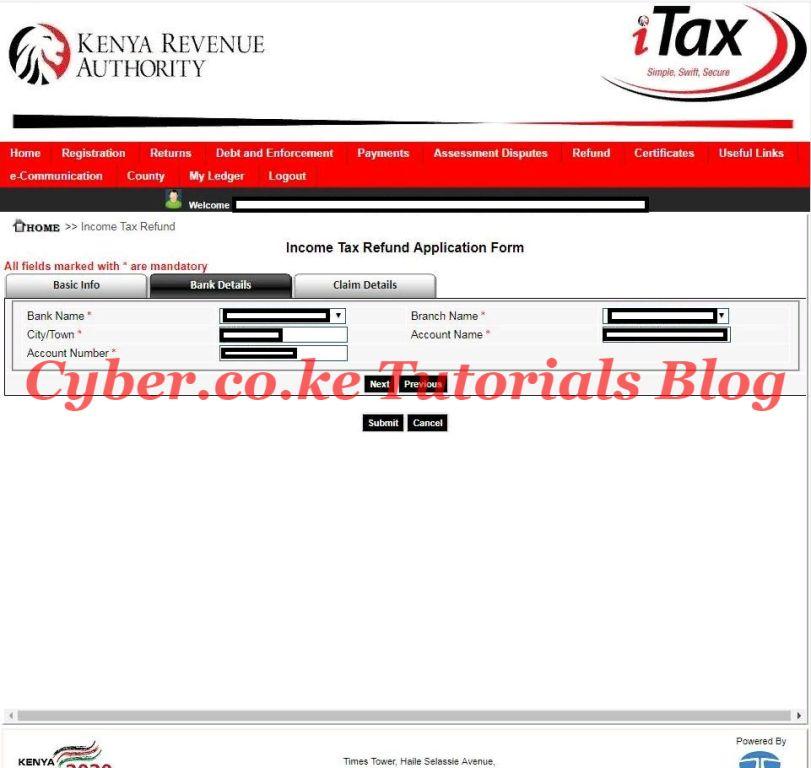

Part 2: Bank Details

In this section, you will be required to enter your bank details that includes: bank name, branch name, city/town, account name and account number. Once you have entered your bank details, click on the “Next” button to proceed to Claim Details.

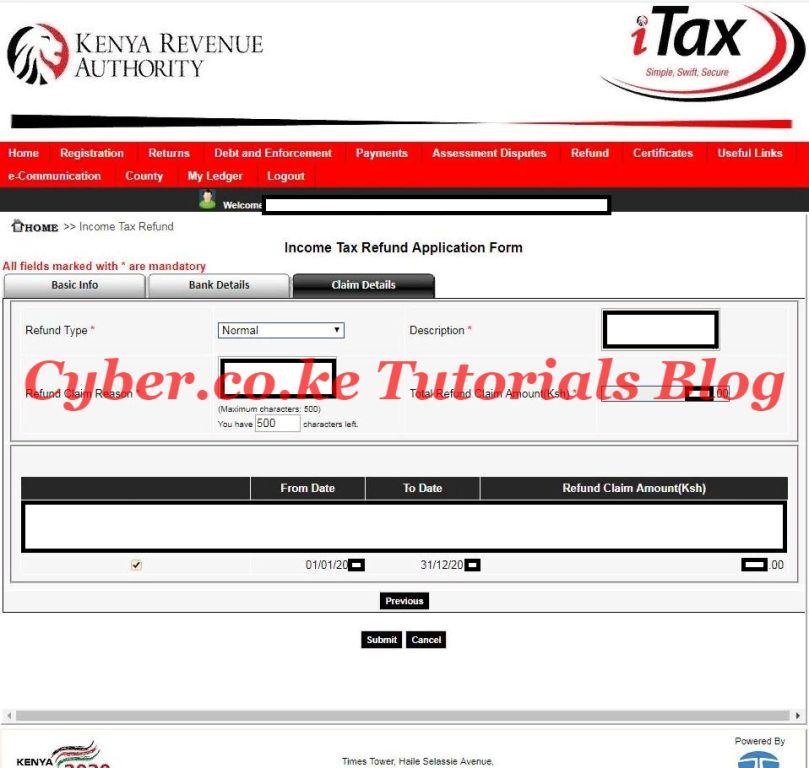

Part 3: Claim Details

The last section is the Claim Details. Here, you have to select the refund type (normal), description and the refund claim reason. When you select Normal on the refund type, it will load all tax refunds that you currently have due. If you don’t have any tax refund, then no records will be displayed. You need to select the checkbox for the refund period and click on the “Submit” button to submit the Income Tax Refund Application form to Kenya Revenue Authority (KRA) for validation and processing.

Step 7: Download the Refund Acknowledgement Receipt

The last step after submitting the refunds application form is to download the refund acknowledgement receipt. You will receive a Refund Acknowledgement Receipt number that you can use to follow up on the status of the Tax Refund application.

READ ALSO: How To Change KRA Password For Locked iTax Account

The above are the steps that are involved in applying for Tax Refund on iTax Portal. Next time you file your returns and get a negative value, you should apply for KRA Tax Refund by following the procedures outlined above.

TRENDING BLOG POSTS IN KENYA

CYBER.CO.KE

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

CLICK HERE TO REGISTER KRA PIN NUMBER

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

CLICK HERE TO RETRIEVE KRA PIN CERTIFICATE

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

CLICK HERE TO UPDATE KRA PIN NUMBER

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

CLICK HERE TO CHANGE KRA PIN EMAIL ADDRESS