One of the most important document that taxpayers in Kenya need to apply for immediately after filing their KRA Returns and paid any taxes due to Kenya Revenue Authority (KRA) is the Tax Compliance Certificate (TCC). This is a very important document in that it certifies that a taxpayer whose details are contained on the Tax Compliance Certificate has filed all his or her KRA Returns and also has paid any taxes due thus resulting in the taxpayer being issued with the Tax Compliance Certificate immediately they apply for one using iTax (KRA Portal).

You need to take note that issuance of Tax Compliance Certificate is only for those taxpayers who are compliant and application for Tax Compliance Certificate (TCC) is made online using iTax (KRA Portal). To be able to apply for Tax Compliance Certificate (TCC), you need to ensure that you have with you both your KRA PIN Number and KRA Password (iTax Password) which you are going to need in the process of iTax account login. In this blog post, I will cover the main steps that you need to take in the whole process of How To Apply For Tax Compliance Certificate (TCC).

READ ALSO: Step-by-Step Process of Downloading KRA Clearance Certificate

How To Apply For Tax Compliance Certificate (TCC)

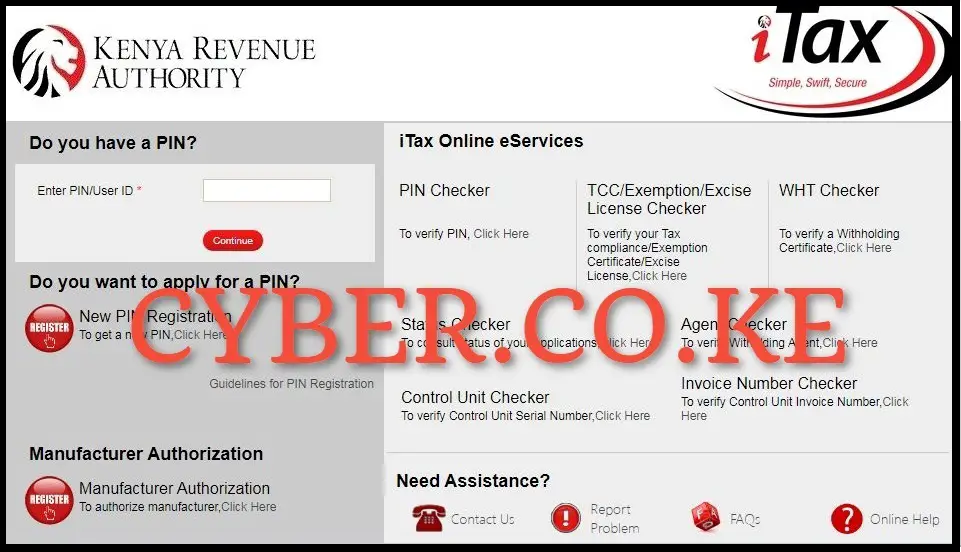

Step 1: Visit iTax (KRA Portal)

The application process for getting Tax Compliance Certificate (TCC) normally starts by first visiting iTax (KRA Portal) using https://itax.kra.go.ke/KRA-Portal/

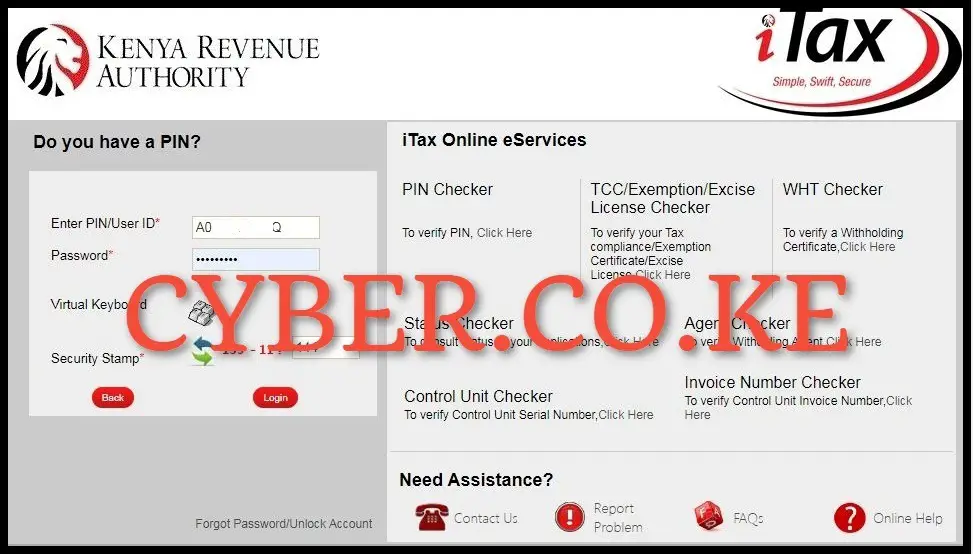

Step 2: Login Into iTax (KRA Portal)

In this step, you need to enter your KRA PIN Number, KRA Password (iTax Password), solve the arithmetic question (security stamp) and click on the “Login” button to access your iTax account (KRA Portal account).

Step 3: Click on the Certificates Functionality

Upon successful iTax login, on the top right hand side in the account dashboard, click on “Certificates” functionality and then proceed to click on “Apply for Tax Compliance Certificate (TCC)” from the drop down menu so as to begin applying for KRA Tax Compliance Certificate (TCC). You will get a notification from iTax saying “Please be informed that you are entitled for the Tax Compliance Certificate (TCC) without any workflow. Please click ‘OK’ to continue” (this means that you will be issued with the KRA Tax Compliance Certificate immediately you submit the application) will appear, you are to click on “OK” to proceed to the next step.

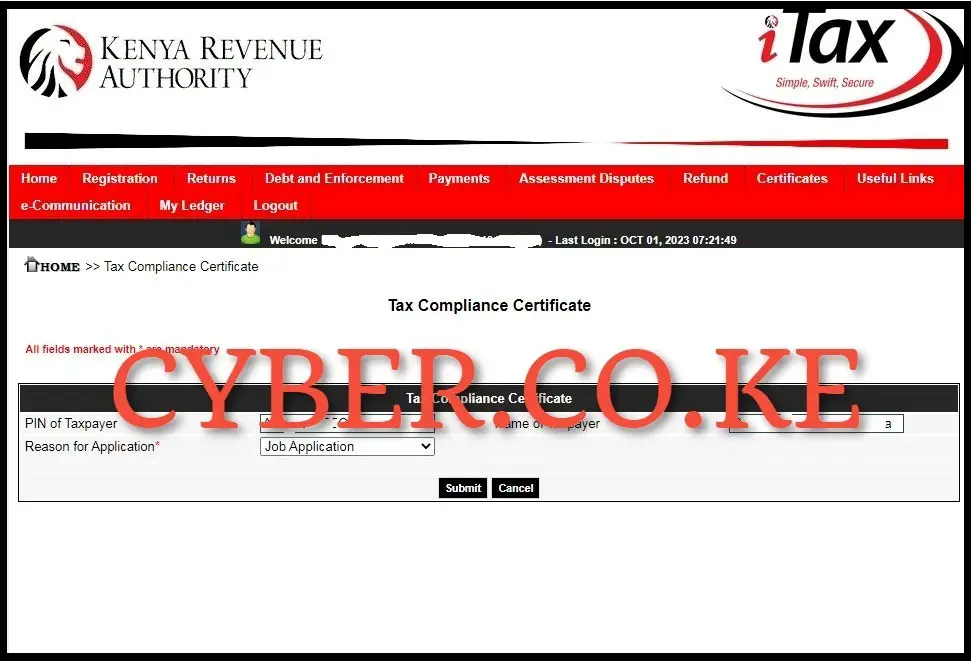

Step 4: Provide Reason for Application of Tax Compliance Certificate (TCC)

In this step, you need to select the reason why you are applying for Tax Compliance Certificate (TCC). Each individual might be having a different reason for applying for KRA Tax Compliance Certificate (TCC), but the most common reason for application of TCC on iTax (KRA Portal) is Job Application i.e. this is due to the fact that employers and recruiters require each and every job seeker to attach their Tax Compliance Certificate on the job applications. Choose the reason for application that suits your needs and click on the “Submit” button.

Step 5: Download Tax Compliance Certificate (TCC)

The process of How To Download Tax Compliance Certificate (TCC) ends with the downloading of the generated Tax Compliance Certificate (TCC) on iTax (KRA Portal). To download the Tax Compliance Certificate (TCC), click on the text link labeled “Click here to download KRA Clearance Certificate” so as to download your new KRA Tax Compliance Certificate (TCC). You need to take note that the message “Approval Receipt for KRA Clearance Certificate Generated Successfully” means that the application process for Tax Compliance Certificate (TCC) has been approved by Kenya Revenue Authority (KRA). At this point once you have downloaded your Tax Compliance Certificate (TCC), you can either save a soft copy or even print out a hard copy of the same.

READ ALSO: Step-by-Step Process of Applying for KRA Clearance Certificate

The above 5 steps form part of the Tax Compliance Certificate (TCC) application process that all Kenyans need to follow in order to be issued with a Tax Compliance Certificate by KRA. It is important to take note that you will only be issued with KRA Tax Compliance Certificate (TCC) if you have filed all your KRA Tax Returns and paid any taxes due. So, when you make an application for Tax Compliance Certificate (TCC), you will be issued with the same immediately. Also ensure that you are able to login into iTax (KRA Portal) using both your KRA PIN Number and KRA Password (iTax Passwords). Afterwards, you can follow the 5 main steps in applying for Tax Compliance Certificate (TCC) online using iTax (KRA Portal).

Matthews Ohotto is an Article Writer at CYBER.CO.KE and a Video Creator at Video Tutorials Kenya (YouTube). He specializes in crafting insightful Blog Posts and Video Tutorials that empower Kenyans with practical digital skills. He is a holder of Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT).

KRA INDIVIDUAL SERVICES

SUBMIT SERVICE REQUEST

KRA PIN REGISTRATION

Are you looking for KRA PIN Registration services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN RETRIEVAL

Are you looking for KRA PIN Retrieval services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN UPDATE

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN CHANGE OF EMAIL ADDRESS

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA RETURNS SERVICES

SUBMIT SERVICE REQUEST

KRA NIL RETURNS

Are you looking for KRA Nil Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA EMPLOYMENT RETURNS

Are you looking for KRA Employment Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA AMENDED RETURNS

Are you looking for KRA Amended Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA WITHHOLDING TAX RETURNS

Are you looking for KRA Withholding Tax Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.