The KRA Excel Sheet (also known as KRA Returns Excel Sheet) is an excel workbook that is used in the process of filing KRA Returns by taxpayers here in Kenya. Normally, filing of individual KRA Returns can be done either using the KRA Excel Sheet or using the ITR for Employment Income only. The choice of the type of method lies with the taxpayer. Those filing using the KRA Returns Excel Sheet need to download the latest version of the KRA Excel Sheet version 18.0.9 that is now available on iTax (KRA Portal).

The rule of thumb when it comes to filing KRA Returns using the Excel Sheet is to ensure that you have downloaded the latest version that is in your iTax account (KRA Portal) i.e. KRA Returns Excel Sheet version 18.0.9. To be able to download KRA Returns Excel Sheet version 18.0.9 on iTax (KRA Portal), you need to ensure that you have with you both your KRA PIN Number and KRA Password (iTax Password) which normally form part of the iTax login credentials.

You need to use both your KRA PIN Number and KRA Password (iTax Password) to first login into your iTax account (KRA Portal account) then proceeding to download KRA Returns Excel Sheet version 18.0.9 quickly and easily. In this blog post, we shall cover the main steps that all taxpayers need to follow so as to be able to successfully download KRA Excel Sheet on iTax (KRA Portal) and use the same to file their KRA Returns online.

READ ALSO: Step-by-Step Process of Filing Nil Returns

How To Download KRA Excel Sheet (version 18.0.9)

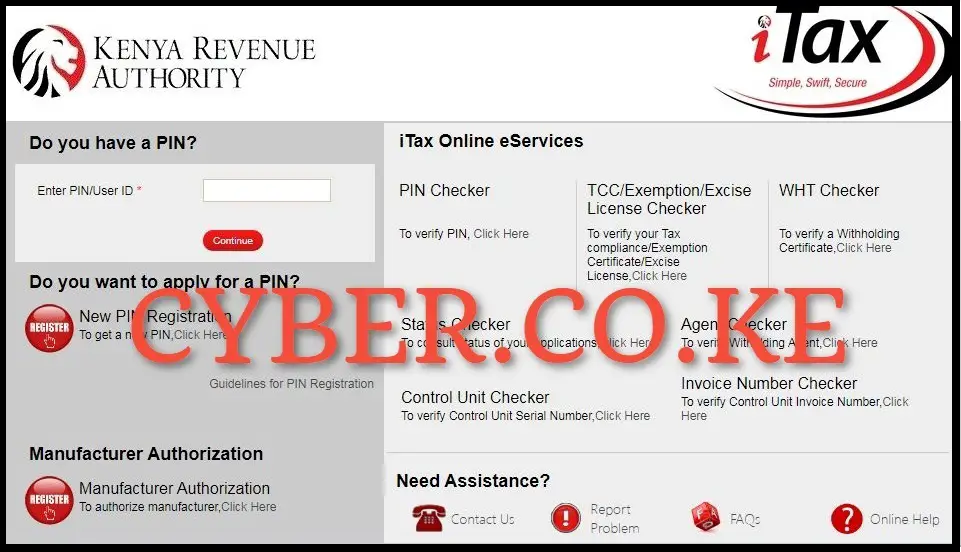

Step 1: Visit iTax (KRA Portal)

To be able to download the latest version of the KRA Returns Excel Sheet, you first need to visit iTax (KRA Portal) by using https://itax.kra.go.ke/KRA-Portal/

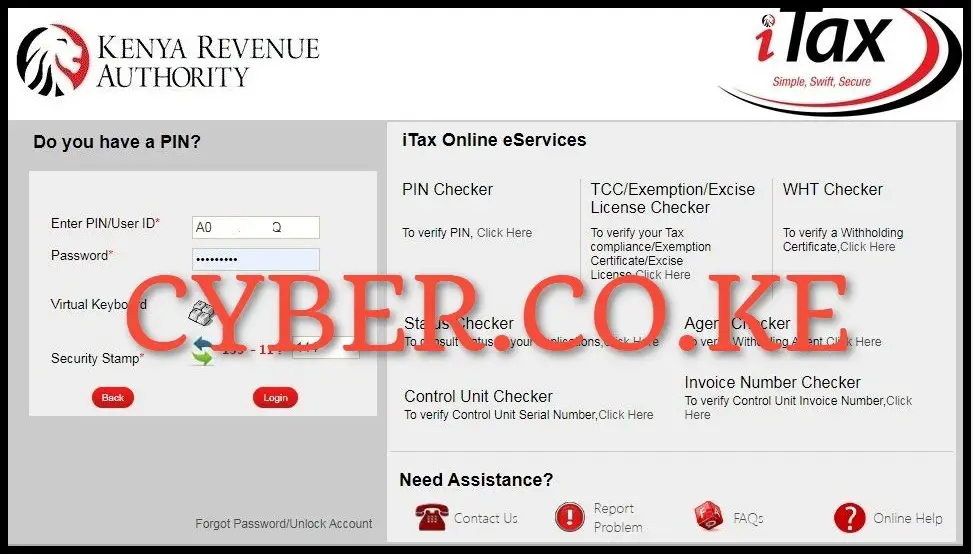

Step 2: Login Into iTax (KRA Portal)

Once you are on iTax (KRA Portal), enter your KRA PIN Number, KRA Password (iTax Password), solve the arithmetic question (security stamp) then click on the “Login” button.

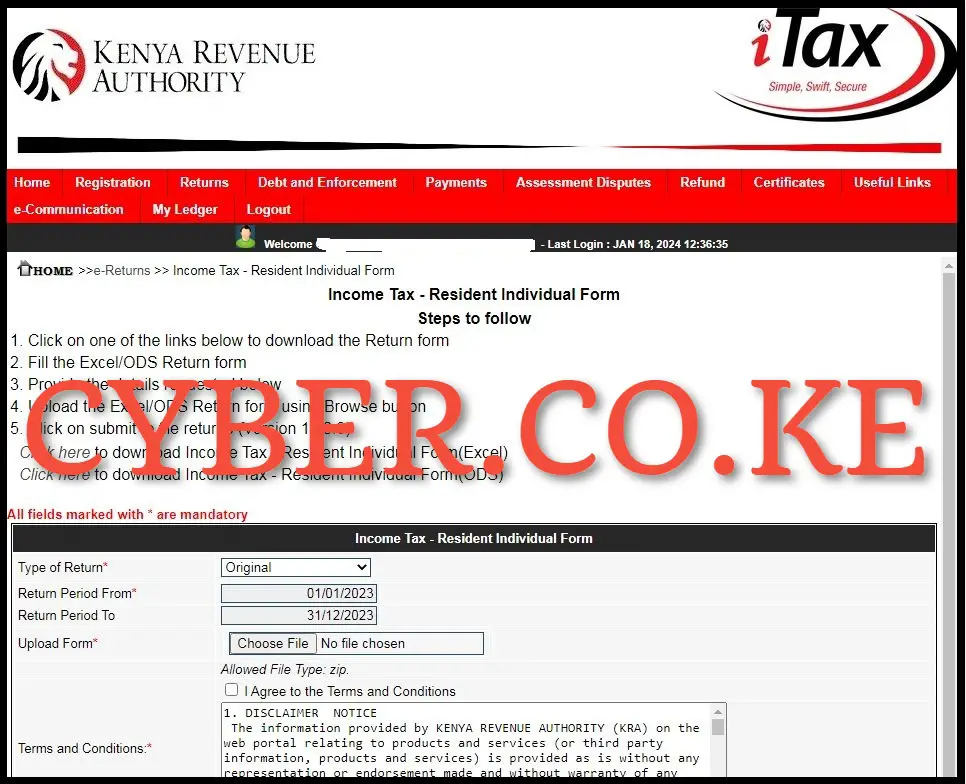

Step 3: Click on Returns then File Return

In this step, on the top menu items list, click on the “Returns” module and then click on “File Return” from the drop-down list to begin the process of downloading KRA Returns Excel Sheet version 18.0.9 on iTax (KRA Portal).

Step 4: Select KRA Tax Obligation

Next, select the KRA Tax Obligation that you are downloading the KRA Excel Sheet version 18.0.9 for. Since the KRA Excel Sheet is foling KRA Employment Returns, select the KRA tax obligation as “Income Tax – Resident Individual” then click on the “Next” button to proceed to the next step.

Step 5: Download Income Tax – Resident Individual Form (KRA Excel Sheet version 18.0.9)

In this step, you need to download the Income Tax Resident Individual Form version 18.0.9 on your iTax account (KRA Portal account). In simple terms, download KRA Returns Excel Sheet latest version 18.0.9 from your account. To download the latest KRA Returns Excel Sheet Template version 18.0.9, just click on the text link titled “Click here to download Income Tax – Resident Individual Form (Excel Sheet).”

This will in turn download and save the KRA Excel Sheet latest version 18.0.9 to your device. You can also download the latest KRA Returns Excel Sheet here using – KRA Returns Excel Sheet version 18.0.9 for filing 2023 KRA Returns on iTax (KRA Portal). As mentioned earlier, ensure that you get and download the latest version of the KRA Excel Sheet (Income Tax Resident Individual Form) before filing your KRA Returns on iTax (KRA Portal).

The above 5 steps sums up the process that all taxpayers in Kenya need to follow in order to download KRA Returns Excel Sheet version 18.0.9 from their iTax accounts (KRA Portal accounts). Just as a reminder, KRA Returns Excel Sheet download requires that you first login into your iTax account (KRA Portal account) by using both your KRA PIN Number and KRA Password (iTax Password).

READ ALSO: Step-by-Step Process of Downloading KRA PIN Certificate

Once you have these two login credentials with you, you can follow the above 5 main steps that are involved in the process of downloading KRA Returns Excel Sheet version 18.0.9 on iTax (KRA Portal) so as to be able to file your KRA Returns before the elapse of the 30th June deadline as set out by Kenya Revenue Authority (KRA).

DON’T MISS OUT. CHECK OUT OUR TRENDING POPULAR BLOG POSTS IN KENYA.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

KRA PIN REGISTRATION

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

KRA PIN RETRIEVAL

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

KRA PIN UPDATE

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

KRA PIN CHANGE OF EMAIL ADDRESS

Stay Tax Compliant in Kenya

Contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.