Downloading of KRA Payment Slip is important in scenarios whereby you want to use the payment slip to make tax payments for various obligations such as Turnover Tax (TOT), Monthly Rental Income (MRI), Pay As You Earn (PAYE) or Value Added Tax (VAT) among other tax obligations on iTax (KRA Portal).

The KRA Payment Slip contains important details such as the amount that a taxpayer needs to pay for a given tax obligation and also the mode of payment that the taxpayer can use either the M-Pesa Paybill Number 222222 or even the listed KRA Partner Banks in Kenya. To be able to download KRA Payment Slip on iTax (KRA Portal), a taxpayer needs to ensure that they had already generated the KRA Payment Slip and now want a copy of the KRA Payment Slip for purposes of making payments to Kenya Revenue Authority (KRA).

Also, a taxpayer needs to ensure that they have both the KRA PIN Number and KRA Password (iTax Password) that is required for purposes of logging into iTax (KRA Portal) account. Once you have these mentioned requirements, you can follow the steps that are outlined in this blog so as to download your KRA Payment Slip easily using iTax (KRA Portal).

READ ALSO: Step-by-Step Process of Generating KRA Payment Slip

How To Download KRA Payment Slip

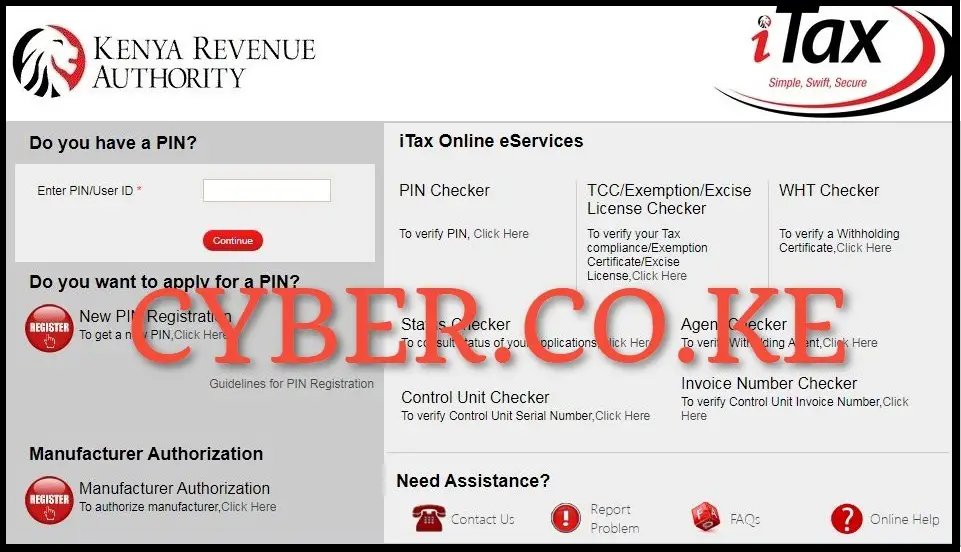

Step 1: Visit iTax (KRA Portal)

To be able to download KRA Payment Slip online, you first need to visit iTax (KRA Portal) by using https://itax.kra.go.ke/KRA-Portal/

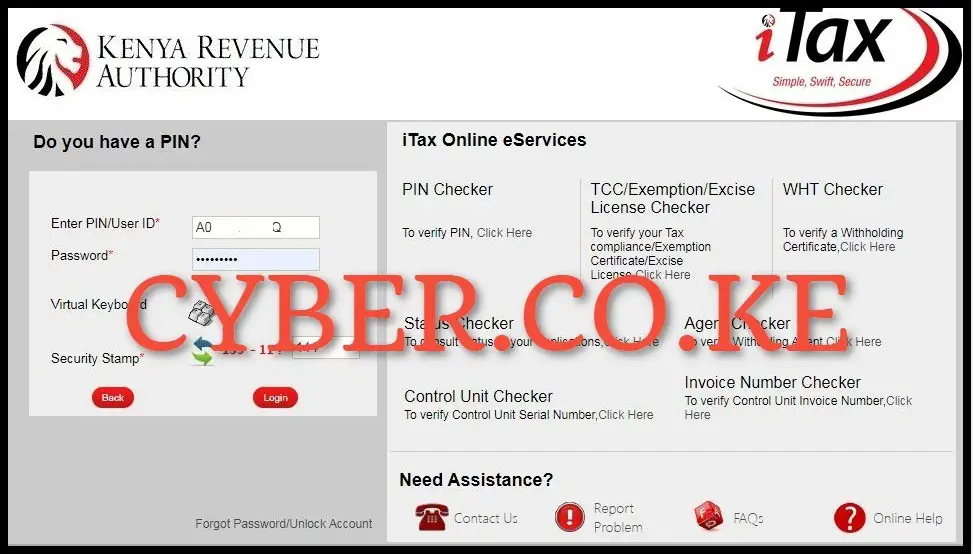

Step 2: Login Into iTax (KRA Portal)

In this step, you need to enter both your KRA PIN Number and KRA Password (iTax Password), then solve the arithmetic question (security stamp) thereafter click on the “Login” button to access your iTax (KRA Portal) account.

Step 3: Click on Useful Links then Consult and Reprint Acknowledgement Receipt and Certificates

Upon successful iTax (KRA Portal) account login, on the top right menu, click on “Useful Links” followed by “Consult and Reprint Acknowledgement Receipt and Certificates” from the drop down menu items list.

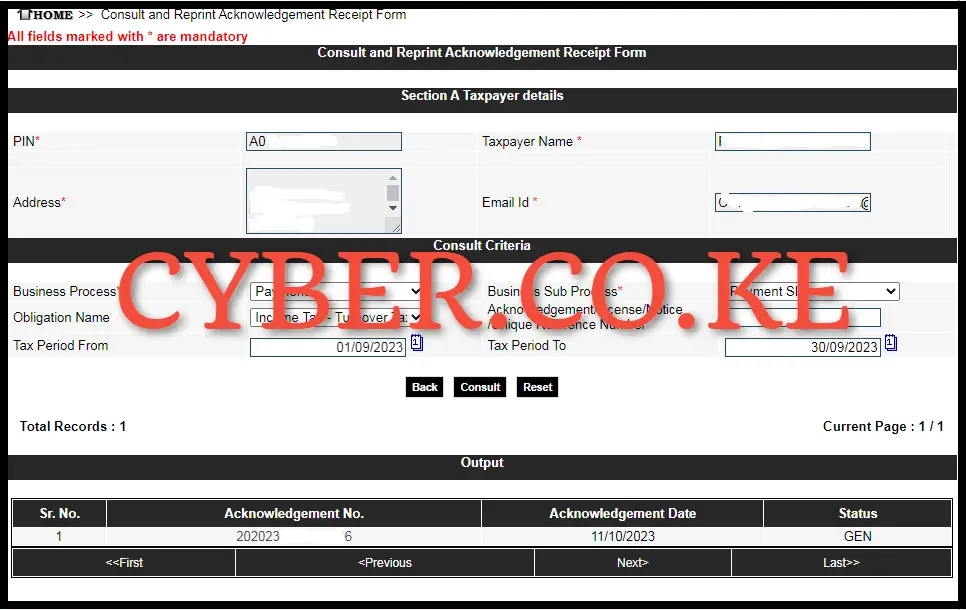

Step 4: Fill In The Consult and Reprint Acknowledgement Receipt Form

In this step, you need to fill in the consult and reprint acknowledgment receipt form on iTax (KRA Portal). In this example, I will be sharing with you How To Download KRA Payment Slip for the Turnover Tax (TOT) obligation. The main fields that you need to fill on the form are as follows; Business Process – Payment; Business Sub Process – Payment Slip; Obligation Name – Income Tax – Turnover Tax; Tax Period From; 01/01/2024 and Tax Period To; 31/01/2024. Once you have filled in all the details above, click on the “Consult” button. The KRA Payment Slip will be displayed in the “Output” section of the form.

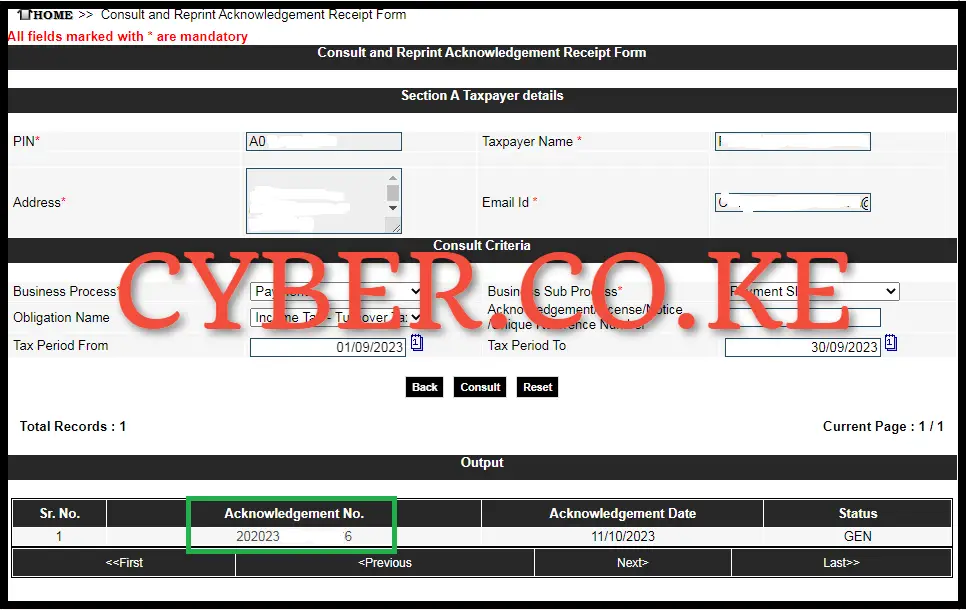

Step 5: Download KRA Payment Slip

After finishing up with step 4 above, the last step is to Download the KRA Payment Slip on iTax (KRA Portal). For you to be able to download the KRA Payment Slip, you need to click on the “Acknowledgment Number” part on the Output section of the form. This will initiate the downloading of the KRA Payment Slip to your device and from there you can either print out a copy of the KRA Payment Slip or even save a soft copy of the KRA Payment Slip PDF version (format).

READ ALSO: Step-by-Step Process of Getting KRA PIN Certificate

As outlined in the steps above, to be able to download KRA Payment Slip using iTax (KRA Portal), you need to ensure that you had already generated the KRA Payment Slip and now want to get a copy of the same payment slip for purposes of making payments to KRA using either M-Pesa Paybill Number 222222 or making payment at any of the authorized KRA Partner Banks in Kenya. Also ensure that you are able to login into iTax using KRA PIN Number and KRA Password (iTax Password), thereafter follow the above 5 main steps on How To Download KRA Payment Slip on iTax (KRA Portal).

DON’T MISS OUT. CHECK OUT OUR TRENDING POPULAR BLOG POSTS IN KENYA.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

REGISTER KRA PIN NUMBER

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

RETRIEVE KRA PIN CERTIFICATE

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

UPDATE KRA PIN NUMBER

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

CHANGE EMAIL ADDRESS

Stay Tax Compliant in Kenya

Contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.

Our dedicated team is ready to assist you immediately you fill and submit your service request online. Whether you need help with Registering KRA PIN Number, Retrieving KRA PIN Certificate, Updating KRA PIN Number or Changing KRA PIN Email Address, we are here to assist you.

Get in touch with us today and experience professional online customer support.