Did you know that if you are a pensioner in Kenya you need to be filing your KRA Returns each and every year on or before the elapse of the set deadline of 30th June by Kenya Revenue Authority (KRA)? If you are a pensioner and don’t have any active source of income and there are no ledger entries on the general ledger report on iTax (KRA Portal) or any withholding tax, then as a pensioner you are supposed to file KRA Nil Returns on iTax (KRA Portal).

This is a type of KRA Return for those who don’t have employment, business or rental as their source of income in Kenya. For you to be able to file KRA Returns for Pensioners on iTax (KRA Portal), you need to have with you KRA PIN Number and KRA Password (iTax Password) that you need to use so as to be able to access your iTax (KRA Portal) account.

In this blog post, I am going to share with you all the main steps that you need to follow so as to file KRA Returns for Pensioners online in Kenya quickly and easily by using iTax (KRA Portal).

READ ALSO: Step-by-Step Process of Filing KRA Returns: For Retirees

How To File KRA Returns for Pensioners

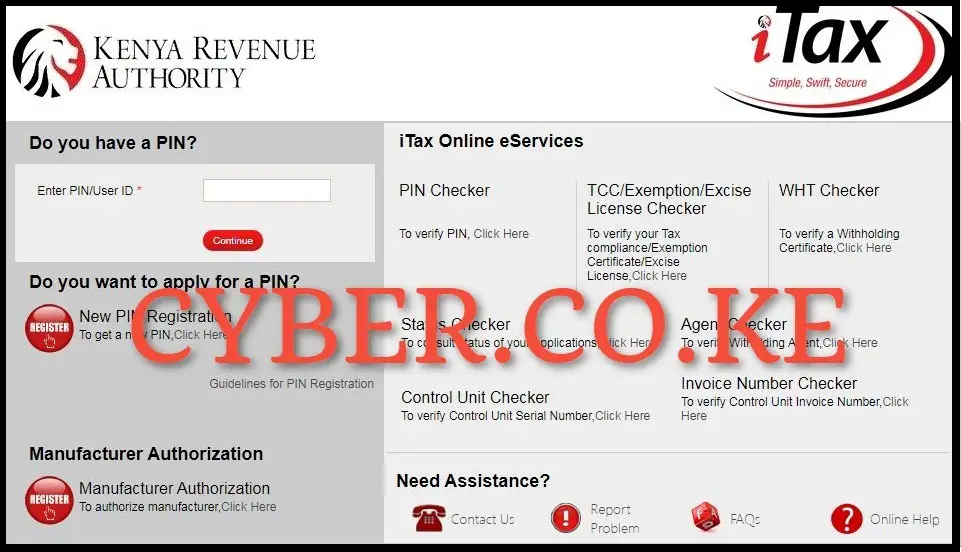

Step 1: Visit iTax (KRA Portal)

To be able to file KRA Returns for Pensioners online in Kenya, you first need to visit iTax (KRA Portal) by using https://itax.kra.go.ke/KRA-Portal/

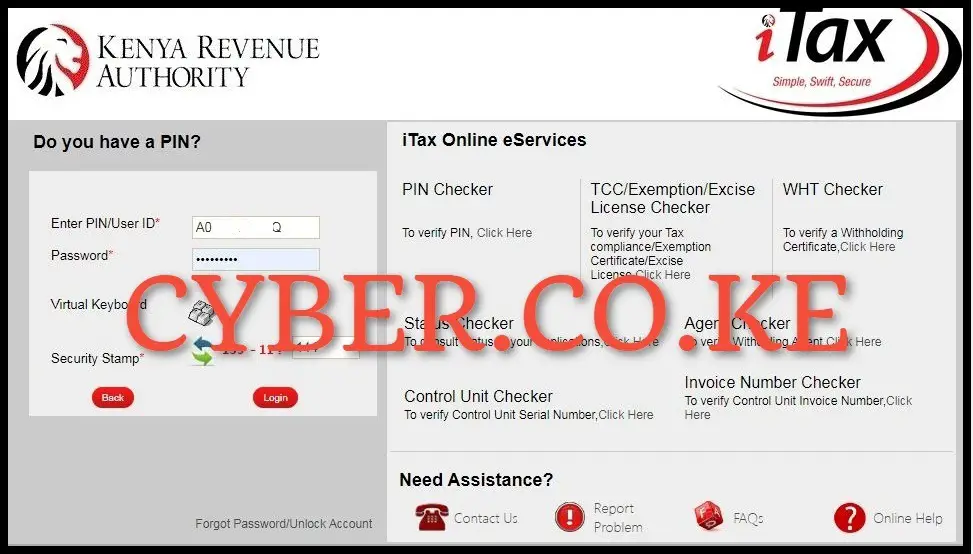

Step 2: Login Into iTax (KRA Portal)

Next, you need to enter your KRA PIN Number, KRA Password (iTax Password), solve the arithmetic question and then click on the “Login” button so as to access your iTax (KRA Portal) account and begin the process of filing KRA Returns for Pensioners in Kenya.

Step 3: Click on Returns then File Nil Return

Once you are logged into iTax (KRA Portal) account, on the top menu click on “Returns” and then click on “File Nil Return” from the drop down list so as to initiate the process of Pensioners Returns Filing on iTax (KRA Portal).

Step 4: Select KRA Tax Obligation

In this step, you need to select the tax obligation that you are filing the KRA Returns for. In our case, since we are filing KRA Returns for Pensioners in Kenya, the tax obligation that we need to select is the “Income Tax – Resident Individual” and then proceed to click on the “Next” button.

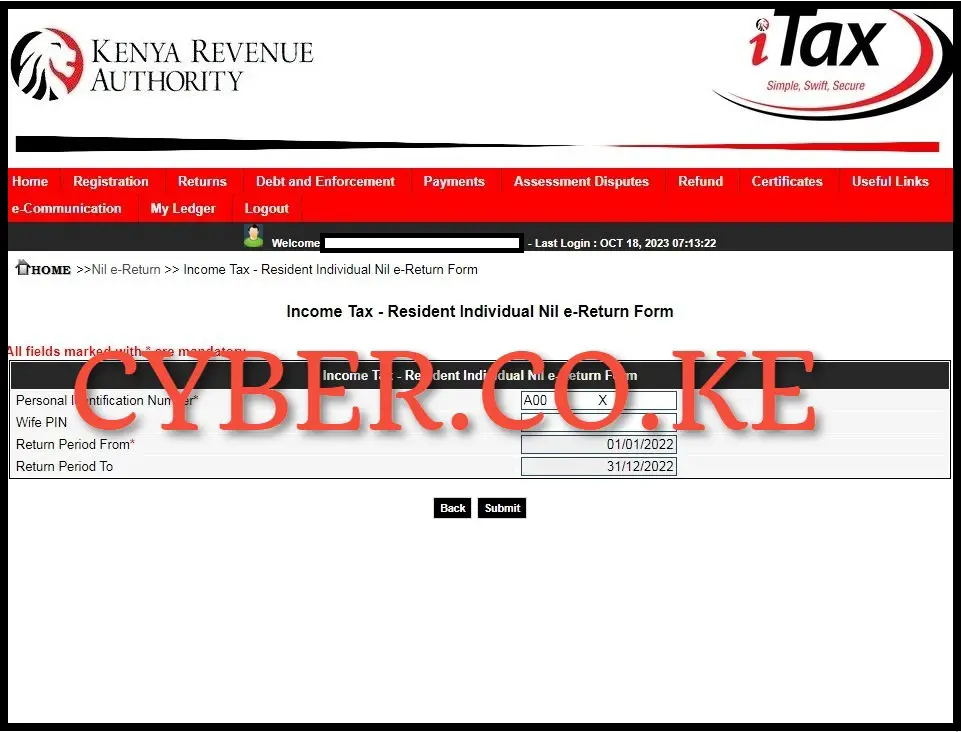

Step 5: Fill In The Income Tax Resident Individual Nil e-Return Form

This is the most important step in the process of filing KRA Returns for Pensioners online in Kenya using iTax (KRA Portal). In this step, you need to fill in the Income Tax Resident Individual Nil e-Return Form by entering the “Return Period From” which will auto-fill the “Return Period To” i.e if you are filing KRA Returns for 2023 and we enter 01/01/2023 on the return period from section, it will auto-fill the return period to as 31/12/2023. Once you have filled in the Income Tax Resident Individual Nil e-Return Form, click on the “Submit” button.

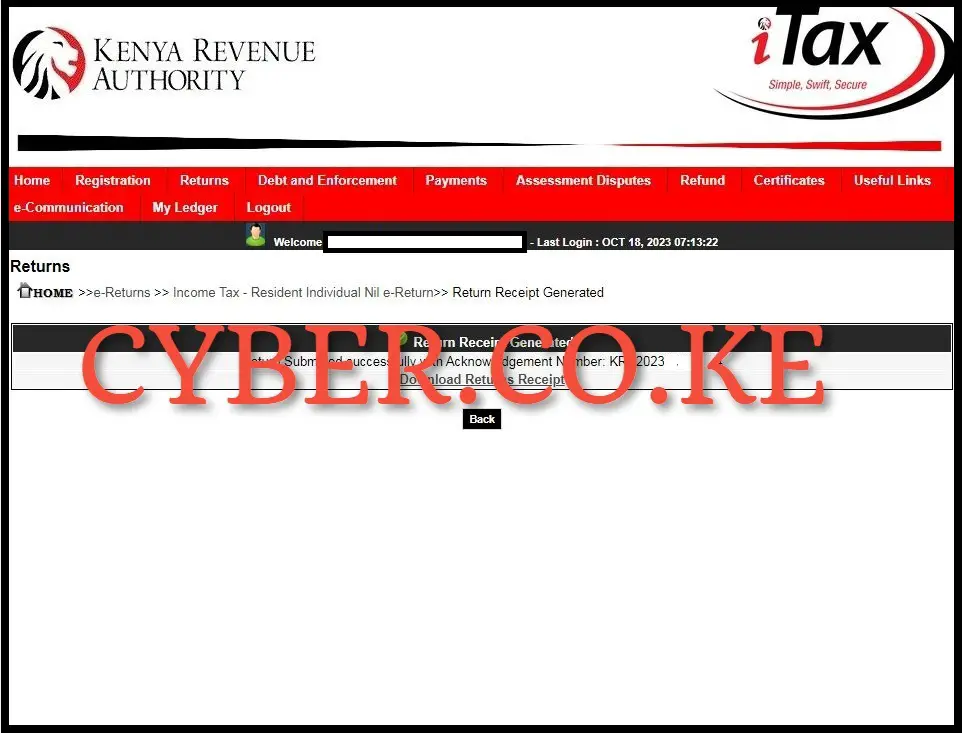

Step 6: Download e-Return Acknowledgement Receipt

In this last step, after successfully filing KRA Returns for Pensioners, you now need to download the e-Return Acknowledgement Receipt that serves as a confirmation of successful filing of KRA Returns on iTax (KRA Portal). To download the KRA e-Return Acknowledgement Receipt, click on the link labeled “Download Returns Receipt” to download and save the e-Return Acknowledgement Receipt to device.

READ ALSO: Step-by-Step Process of Filing KRA Returns: For Unemployed

The process of filing KRA Returns for Pensioners requires that you first ensure that you don’t have any active source of income and there are no ledger entries on the general ledger report on iTax (KRA Portal) or any withholding tax. Afterwards, ensure that you are able to login into iTax (KRA Portal) by using your KRA PIN Number and KRA Password (iTax Password). Once you have met all these requirements, you can follow the above 6 main steps that are involved in the process of How To File KRA Returns for Pensioners online using iTax (KRA Portal).

DON’T MISS OUT. CHECK OUT OUR TRENDING POPULAR BLOG POSTS IN KENYA.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

REGISTER KRA PIN NUMBER

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

RETRIEVE KRA PIN CERTIFICATE

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

UPDATE KRA PIN NUMBER

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

CHANGE EMAIL ADDRESS

Stay Tax Compliant in Kenya

Contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.