If you are Student in Kenya with an active KRA PIN Number, you are required to file your KRA Returns on or before the elapse of the 30th June deadline as set out by Kenya Revenue Authority (KRA). Students normally file KRA Nil Returns on iTax (KRA Portal) as they don’t have any source of income. Failure to file KRA Returns for Students normally atrracts a penalty of Kshs. 2,000 per year not file (late filing).

As a student, you can avoid the KRA Penalties by ensuring that you file your KRA Returns as early as possible and you don’t need to wait till the last minute to file your KRA Returns. To be able to file KRA Returns for Students, you need to ensure that you have with you both the KRA PIN Number and KRA Password (iTax Password) which you will need to use to access your account and file KRA Returns.

If you don’t know your KRA Password (iTax Password), you can easily reset it or you can also request for KRA PIN Change of Email Address so as to be able to easily reset the password and be able to file KRA Returns for Students online easily. In this blog post, I will be sharing with you the main steps that you need to follow on How To File KRA Returns for Students on iTax (KRA Portal).

READ ALSO: Step-by-Step Process of Filing KRA Returns: KRA Nil Returns

How To File KRA Returns for Students

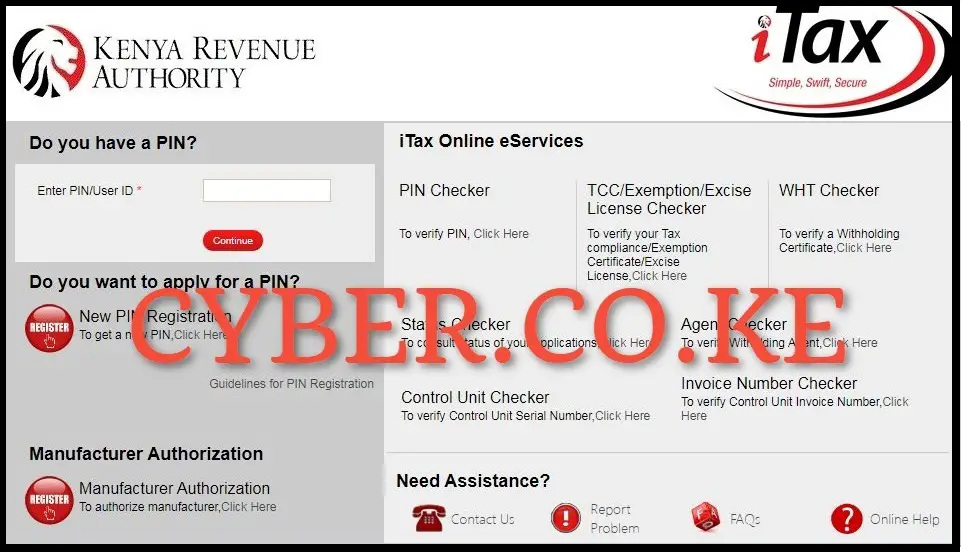

Step 1: Visit iTax (KRA Portal)

To be able to file KRA Returns for Students, you first need to visit iTax (KRA Portal) by using https://itax.kra.go.ke/KRA-Portal/

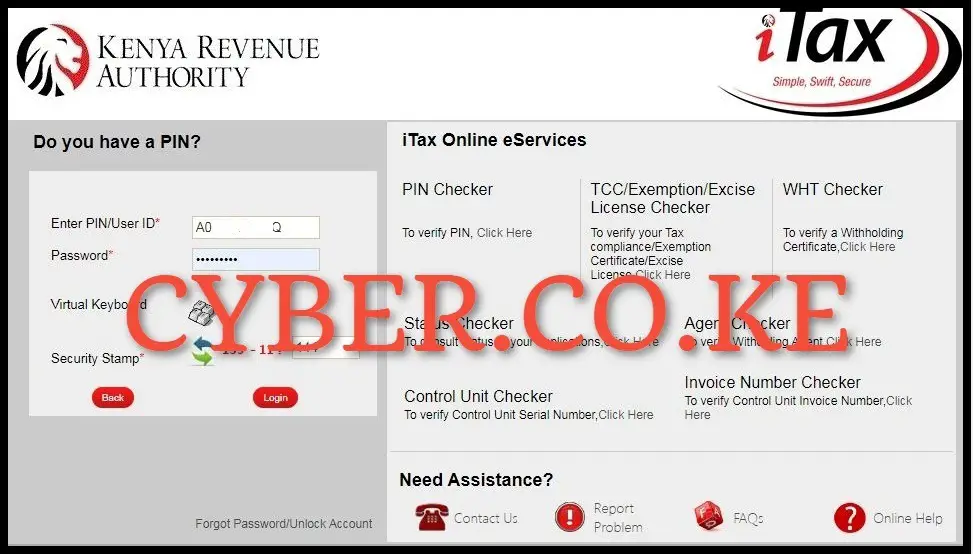

Step 2: Login Into iTax (KRA Portal)

In this step, you need to login into iTax (KRA Portal) account by entering your KRA PIN Number, KRA Password (iTax Password), solve the arithmetic question (security stamp) and then click on the “Login” button to access your account so as to begin the process of filing KRA Returns for Students.

Step 3: Click on Returns then File Nil Return

Next, after you have successfully logged into your iTax (KRA Portal) account, click on “Returns” menu then click on “File Nil Return” from the drop down menu list to begin the process of filing your KRA Nil Returns on iTax (KRA Portal).

Step 4: Select Tax Obligation

Selection of Tax Obligation is the next step where you have to select the KRA Tax Obligation that you want to file KRA Returns for Students under. Here, you need you need to select “Income Tax – Resident Individual” as the Tax Obligation then click on the “Next” button.

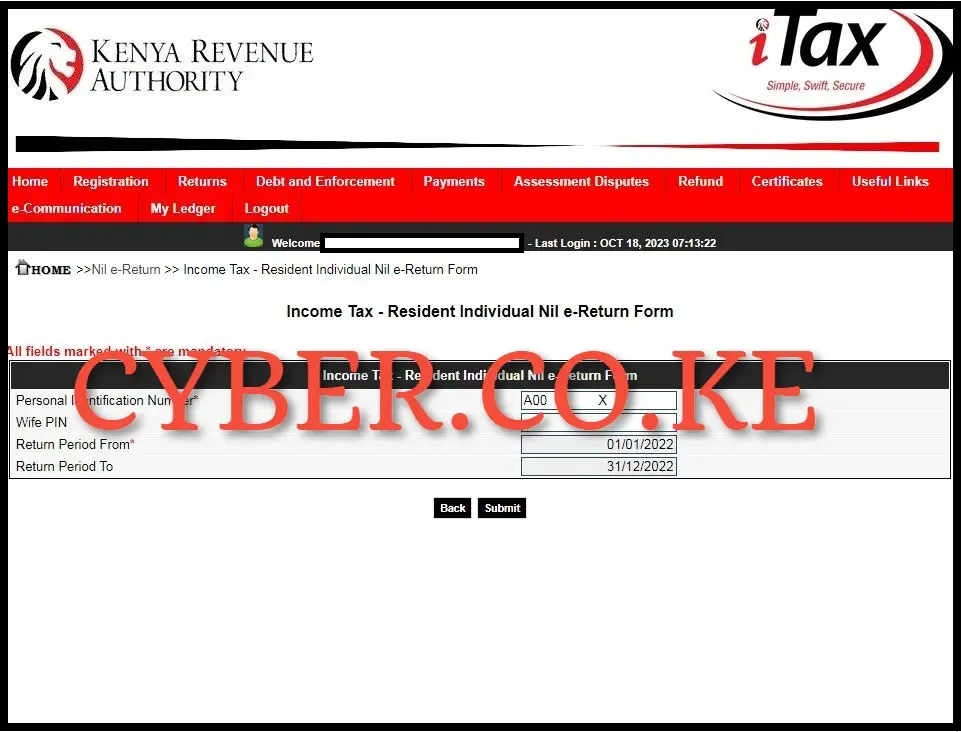

Step 5: Fill In The Income Tax Resident Individual Nil e-Return Form

In this step, you need to fill in the Income Tax Resident Individual Nil e-Return Form. On this KRA Nil e-Return Form, you are supposed to fill in is the “Return Period From” which will auto-fill the “Return Period To.” As an example, if you are filing KRA Returns for Students for the year 2023, the Return Period From will be 01/01/2023 and the Return Period To will be 31/12/2023. Once you have filled in the KRA Nil e-Return Form, click on the “Submit” button.

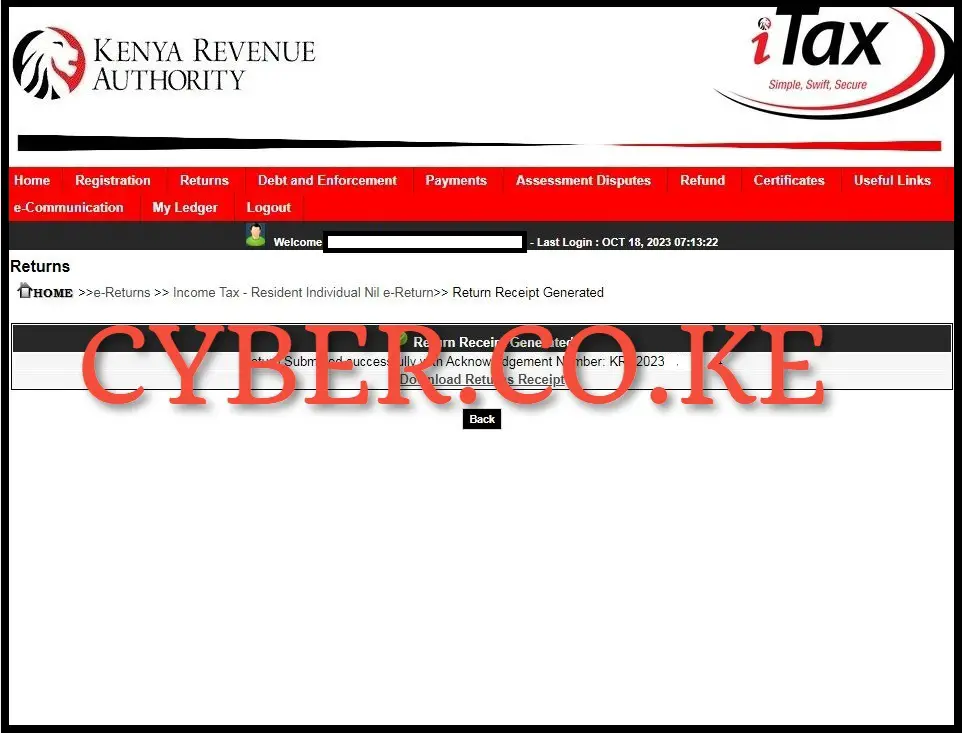

Step 6: Download e-Return Acknowledgement Receipt

In this last step, all you need to do is download the KRA e-Return Acknowledgement Receipt that has been generated by iTax (KRA Portal) after the submission of your KRA Returns for Students. To download the KRA Returns Receipt, click on the link that is titled “Download Returns Receipt” to download and save the e-Return Acknowledgement Receipt.

READ ALSO: Step-by-Step Process of Downloading KRA Payment Slip

Filing of KRA Returns for Students on iTax (KRA Portal) is quite simple but you need to note some important things. Students who don’t have any source of income are required to file KRA Nil Returns on iTax. Also, you need to ensure that you have with you both your KRA PIN Number and KRA Password (iTax Password) which are required in the process of logging into iTax (KRA Portal) account. Once you have with all these, you can follow the outlined 6 steps so as to successfully file KRA Returns for Students online using iTax (KRA Portal) before the elapse of the 30th June KRA Returns deadline.

Matthews Ohotto is an Article Writer at CYBER.CO.KE and a Video Creator at Video Tutorials Kenya (YouTube). He specializes in crafting insightful Blog Posts and Video Tutorials that empower Kenyans with practical digital skills. He is a holder of Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT).

KRA INDIVIDUAL SERVICES

SUBMIT SERVICE REQUEST

KRA PIN REGISTRATION

Are you looking for KRA PIN Registration services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN RETRIEVAL

Are you looking for KRA PIN Retrieval services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN UPDATE

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN CHANGE OF EMAIL ADDRESS

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA RETURNS SERVICES

SUBMIT SERVICE REQUEST

KRA NIL RETURNS

Are you looking for KRA Nil Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA EMPLOYMENT RETURNS

Are you looking for KRA Employment Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA AMENDED RETURNS

Are you looking for KRA Amended Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA WITHHOLDING TAX RETURNS

Are you looking for KRA Withholding Tax Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.