Filing KRA Returns is a crucial and important task for individuals holding active KRA PIN Numbers here in Kenya, as mandated by the law. The deadline for filing KRA Returns, set by the Kenya Revenue Authority (KRA), is on or before June 30th each year. Failure to meet this deadline results in a penalty of Kshs. 2,000 per year for late filing of KRA Returns on iTax (KRA Portal).

For those who have recently acquired their new KRA PIN Number and are seeking to file their KRA Returns for the first time, this blog post provides a comprehensive overview of the necessary steps that you need to take in order to successfully file KRA Returns for the first time. The process for first time filing of KRA Returns on iTax (KRA Portal) is designed to assist new taxpayers in successfully completing their KRA Returns. If it’s your initial attempt at filing KRA Returns on iTax (KRA Portal), rest assured that the procedure is straightforward and easy to follow.

To initiate your first time filing on iTax (KRA Portal), ensure you have two essential requirements: your KRA PIN Number and the KRA Password (iTax Password). These credentials are integral to the iTax login process, allowing you to access your iTax account and efficiently file your KRA Returns for the first time with much ease and convenience.

READ ALSO: How To Check KRA PIN Using KRA PIN Checker On iTax

Filing KRA Returns for the First Time involves the following; Visit iTax (KRA Portal), Login Into iTax, Click on Returns then File KRA Nil Returns, Select KRA Tax Obligation, Fill In The Income Tax – Resident Individual Nil e-Return Form and finally Download e-Return Acknowledgement Receipt. Below is an in depth step-by-step process that you need to follow.

How To File KRA Returns For The First Time

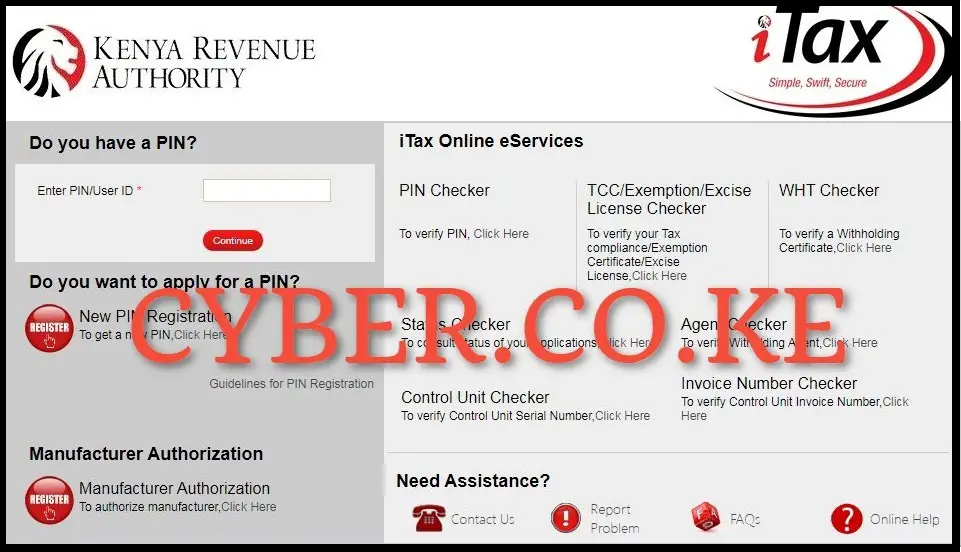

Step 1: Visit iTax (KRA Portal)

To be able to file KRA Returns for the first time, the first step is to visit iTax (KRA Portal) by using https://itax.kra.go.ke/KRA-Portal/

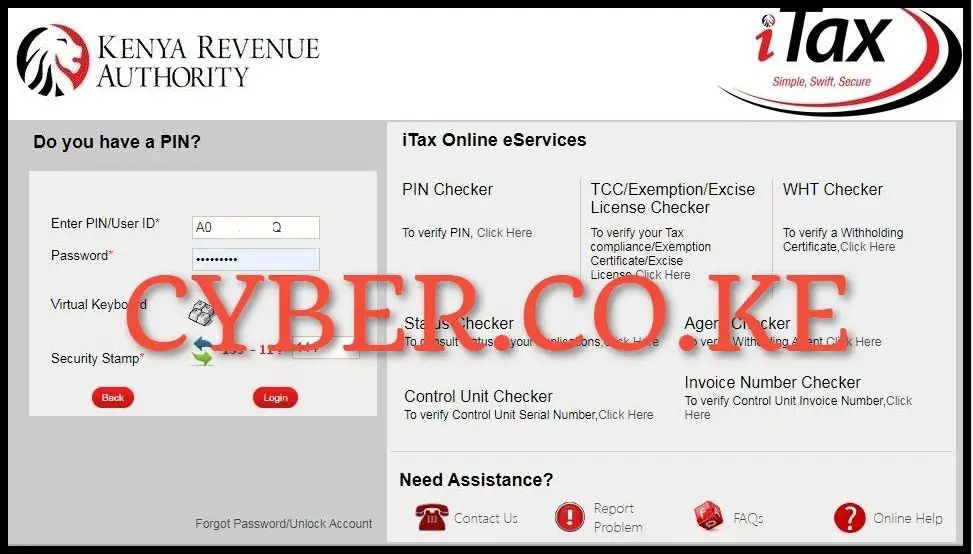

Step 2: Login Into iTax (KRA Portal)

In this step, you need to enter your KRA PIN Number, iTax Password (KRA Password), solve the arithmetic question (security stamp) and click on the “Login” button.

Step 3: Click on Returns then File KRA Nil Returns

Upon successfully logging into iTax (KRA Portal) account, click on the “Returns” module and then click on “File Nil Return” to begin the process of filing KRA Returns for the first time.

Step 4: Select KRA Tax Obligation

In this step, you need to select the KRA Tax Obligation that you are filing the KRA Returns for. Since we are filing KRA Returns for the first time, select “Income Tax – Resident Individual” then click on the “Next” button.

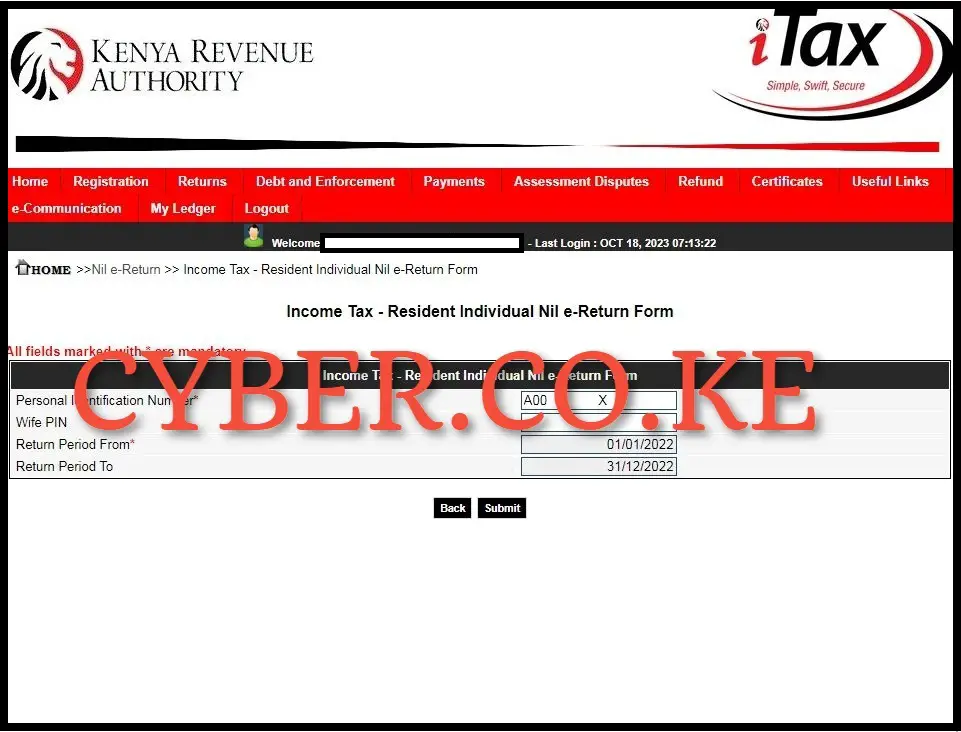

Step 5: Fill In The Income Tax – Resident Individual Nil e-Return Form

Next, you need to fill in the Income Tax Resident Individual Nil e-Return Form. In this case, since you are filing KRA Returns for the first time, as an example we choose 01/01/2023 as the return period from and the return period to will auto fill as 31/12/2023, then click on the “Submit” button to submit your KRA Returns online.

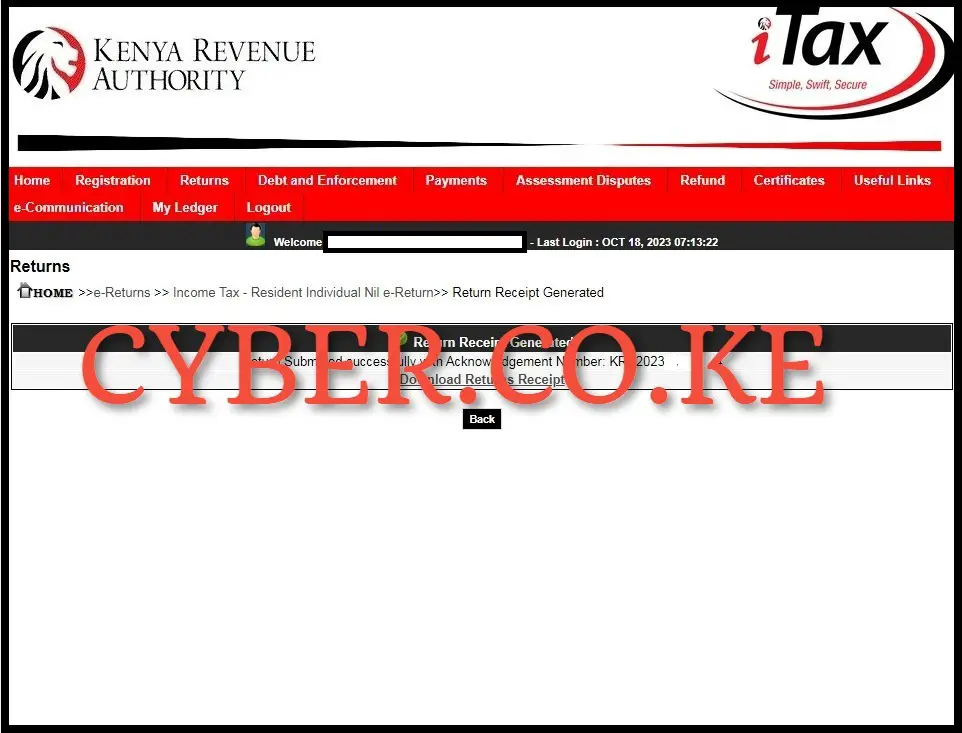

Step 6: Download e-Return Acknowledgement Receipt

Once you have successfully filed KRA Returns for the first time, you now need to download the e-Return Acknowledgement Receipt. This marks the final and last step in the process of filing KRA Returns for the first time. To download the e-Return Acknowledgement Receipt, just click on the “Download KRA Returns Receipt” link to download and save the KRA Returns Receipt on your device.

READ ALSO: How To File KRA Nil Returns For Students On iTax

The above 6 steps sums up the process that you need to follow in order to file KRA Returns for the first time on iTax (KRA Portal). As a reminder, you need to ensure that you have with you the two most important requirements that are needed in this process i.e. KRA PIN Number and iTax Password (KRA Password). Once you have both of these requirements with you, you can follow the above outlined 6 steps so as to be able to successfully file KRA Returns for the first time.

DON’T MISS OUT. CHECK OUT OUR TRENDING POPULAR BLOG POSTS IN KENYA.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

REGISTER KRA PIN NUMBER

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

RETRIEVE KRA PIN CERTIFICATE

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

UPDATE KRA PIN NUMBER

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

CHANGE EMAIL ADDRESS

Stay Tax Compliant in Kenya

Contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.

Our dedicated team is ready to assist you immediately you fill and submit your service request online. Whether you need help with Registering KRA PIN Number, Retrieving KRA PIN Certificate, Updating KRA PIN Number or Changing KRA PIN Email Address, we are here to assist you.

Get in touch with us today and experience professional online customer support.