If you are employed in Kenya, you are required to file your KRA Returns on or before the elapse of the 30th June deadline. Failure to which a penalty will be imposed by Kenya Revenue Authority (KRA) for late filing of KRA Returns on iTax (KRA Portal).

Those who are in employment are supposed to file what is commonly referred to as KRA Returns for Employees or simply put it as Employment Returns. As the name suggests, this is the type of KRA Return that is filed by all employees in Kenya.

To be able to file KRA Returns for Employees (Employment Returns), you need to ensure that you have with you the P9 Form for the previous year. For example, in 2024 we are filing KRA Returns for 2023 so you need to have with you the P9 Form for the year 2023 so as to be able to successfully file KRA Returns online quickly and easily today.

READ ALSO: Step-by-Step Process of Filing KRA Returns for the First Time

How To File KRA Returns Using P9 Form

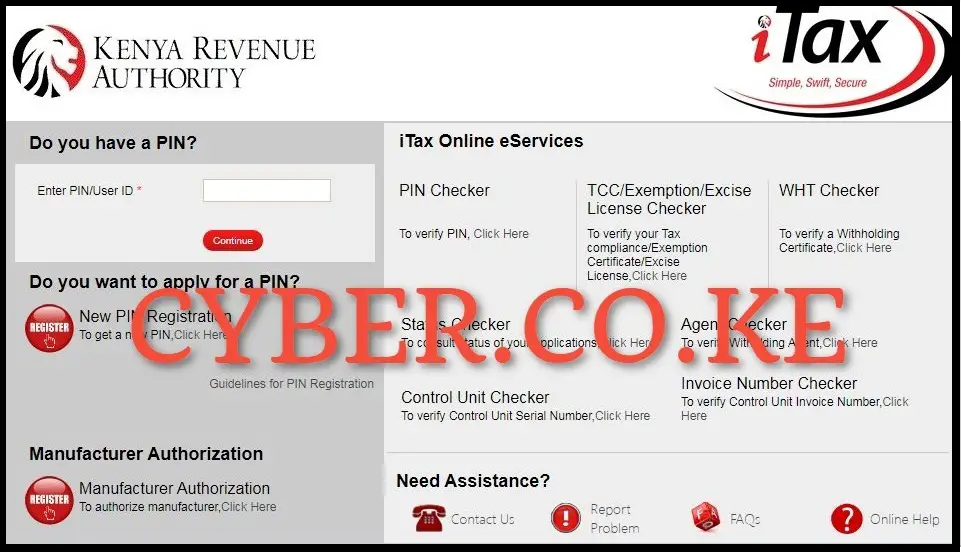

Step 1: Visit iTax (KRA Portal)

The first step in the process of filing KRA Returns using P9 Form is to visit iTax (KRA Portal) by using https://itax.kra.go.ke/KRA-Portal/

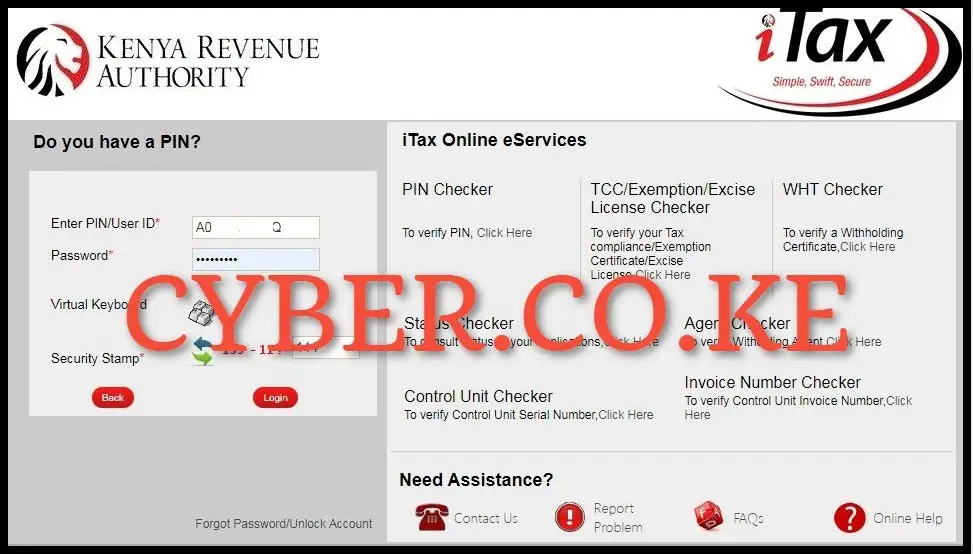

Step 2: Login Into iTax (KRA Portal)

Next, login into iTax (KRA Portal) by using your KRA PIN Number, KRA Password (iTax Password), solve the arithmetic question (security stamp) and click on the “Login” button.

Step 3: Click on Returns then File Return

Once you are logged into iTax account (KRA Portal account), on the top menu, click on the “Returns” module followed by “File Return” from the drop-down list.

Step 4: Select Tax Obligation

In this step, you need to select the tax obligation as “Income Tax – Resident Individual” then click on the “Next” button to proceed to the next step.

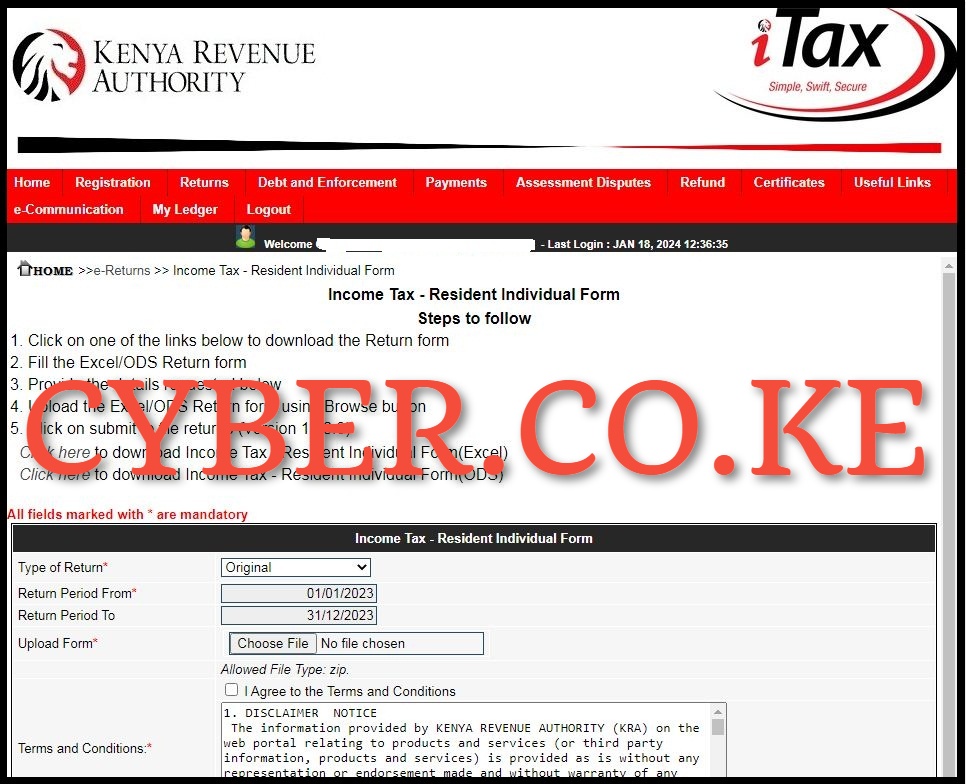

Step 5: Download Income Tax – Resident Individual Form (KRA Returns Excel Sheet version 18.0.9)

Next, download the Income Tax – Resident Individual Form version 18.0.9 from iTax (KRA Portal). This is basically the KRA Excel Sheet that you need to use when you want to file your KRA Returns online using P9 Form. To download the Income Tax – Resident Individual Form, just click on the text link titled “Click here to download Income Tax – Resident Individual Form(Excel)” This will in turn download and save the KRA Returns Excel Sheet to your device. You can also download the latest KRA Returns Excel Sheet here using – KRA Returns Excel Sheet version 18.0.9 for filing 2023 KRA Returns on iTax (KRA Portal).

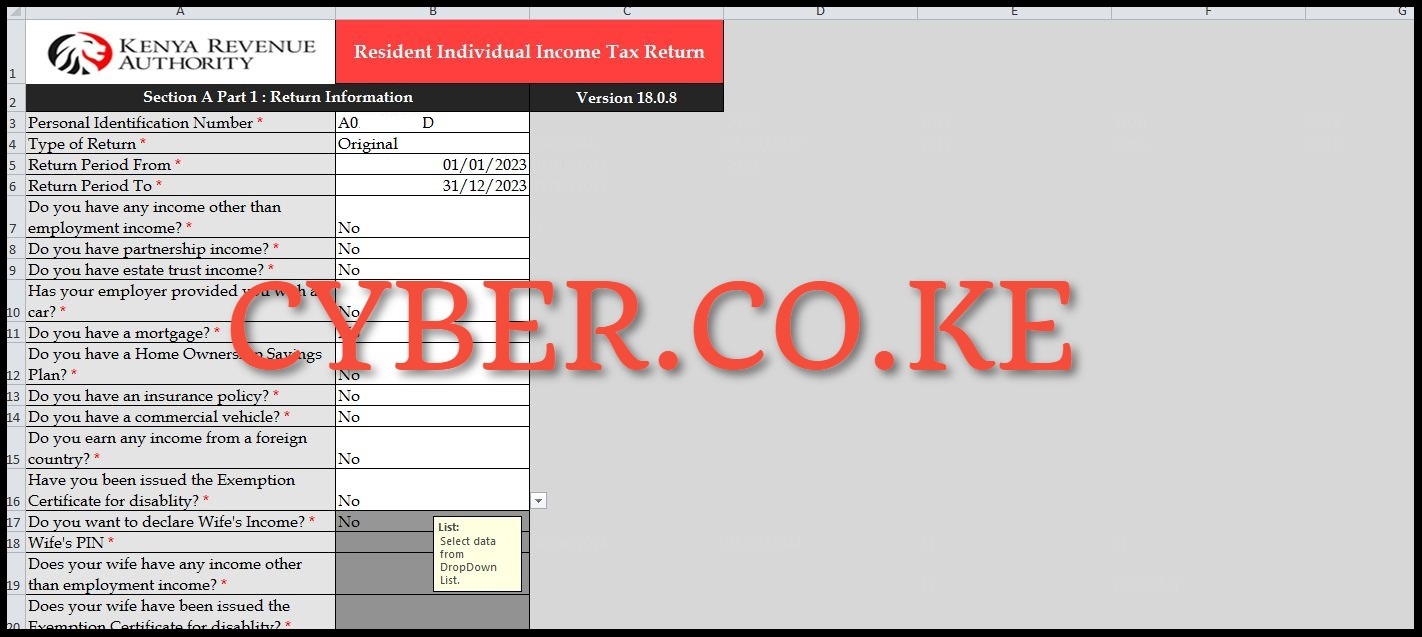

Step 6: Fill in the Income Tax – Resident Individual Returns Form

This is the most important step in the process of How To File KRA Returns using P9 Form. In this step, you need to fill in the KRA Excel Returns Sheet that you have downloaded on iTax (KRA Portal) by capturing the details that are contained on the P9 Form (Tax Deduction Card/KRA P9 Form). The KRA Returns Excel Sheet (Income Tax Resident Returns Form) has 4 main sections that you need to fill in using the details contained on your P9 Form. You need to ensure that you have with you the P9 Form for the year that you are filing the KRA Returns for.

a. Section A: Part 1 – Return Information

In this section, you need to type your KRA PIN Number, Type of Return (Original) and then type in the Return Period From and Return Period To on the KRA Returns Excel Sheet. Once you have captured these details, click on the “Next” button.

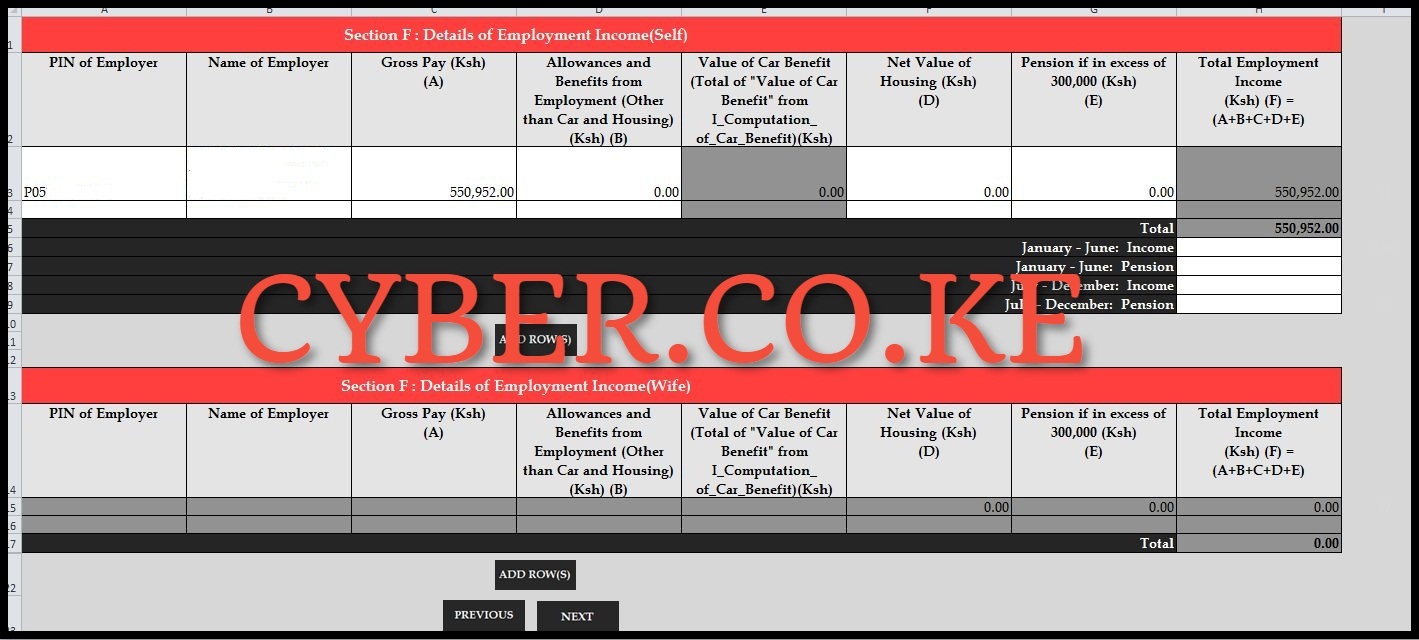

b. Section F: Details of Employment Income (Self)

In this section, you need to type in the PIN of Employer, Name of Employer and the Gross Pay as shown on your P9 Form. Once you have captured these details, click on the “Next” button.

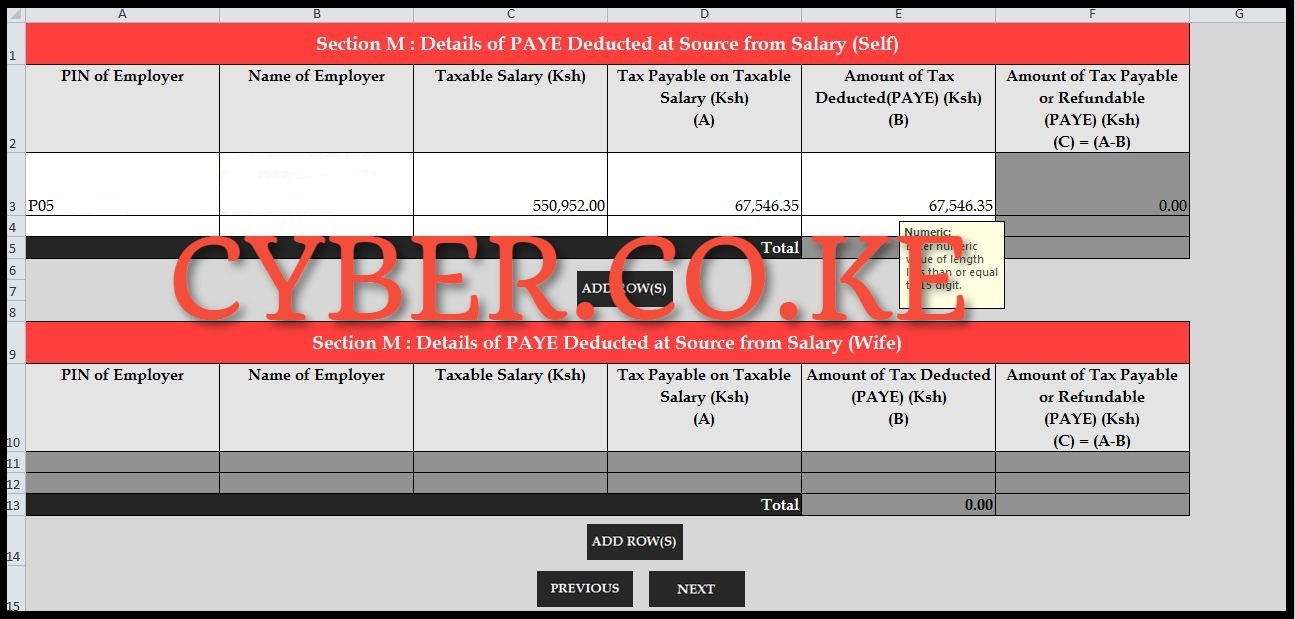

c. Section M: Details of PAYE Deducted at Source from Salary (Self)

In this section, you need to enter the PIN of Employer, Name of Employer, Taxable Salary, Tax Payable on Taxable Salary and Amount of Tax Deducted (PAYE). Once you have captured these details, click on the “Next” button.

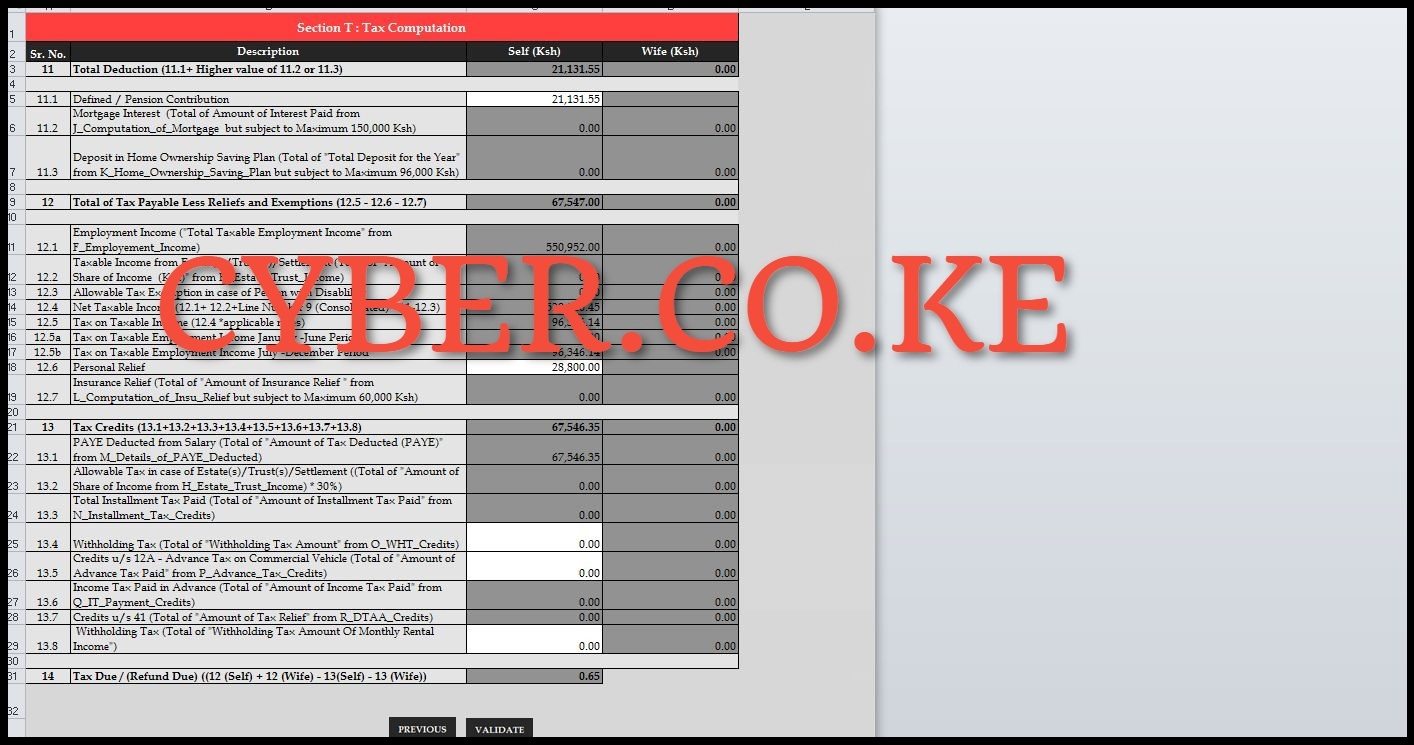

d. Section T: Tax Computation

In this last section, you need to type in Defined/Pension Contribution and then Personal Relief. Once you have typed in these two fields on the KRA Excel Sheet, click on the “Validate” button to validate the Income Tax Resident Individual Returns Form (KRA Returns Excel Sheet).

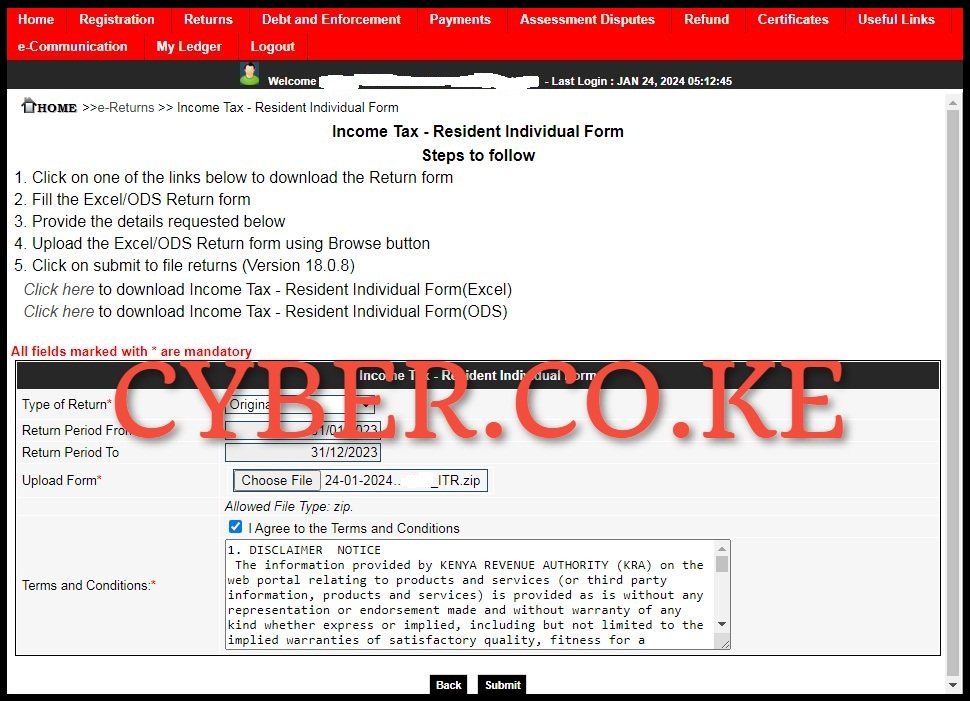

Step 7: Upload the Income Tax – Resident Individual Form (KRA Excel Sheet)

In this step, you need to upload the validated Income Tax – Resident Individual Form (KRA Excel Sheet) on iTax (KRA Portal). Ensure the Type of Return is Original, Return Period From i.e. 01/01/2023, Return Period To 31/12/2023, Upload the Validated KRA Returns Excel Sheet, Tick on the “I Agree to the Terms and Conditions” and then click on the “Submit” button. A pop up will appear asking “Do you want to upload the form?” click on the “OK” button.

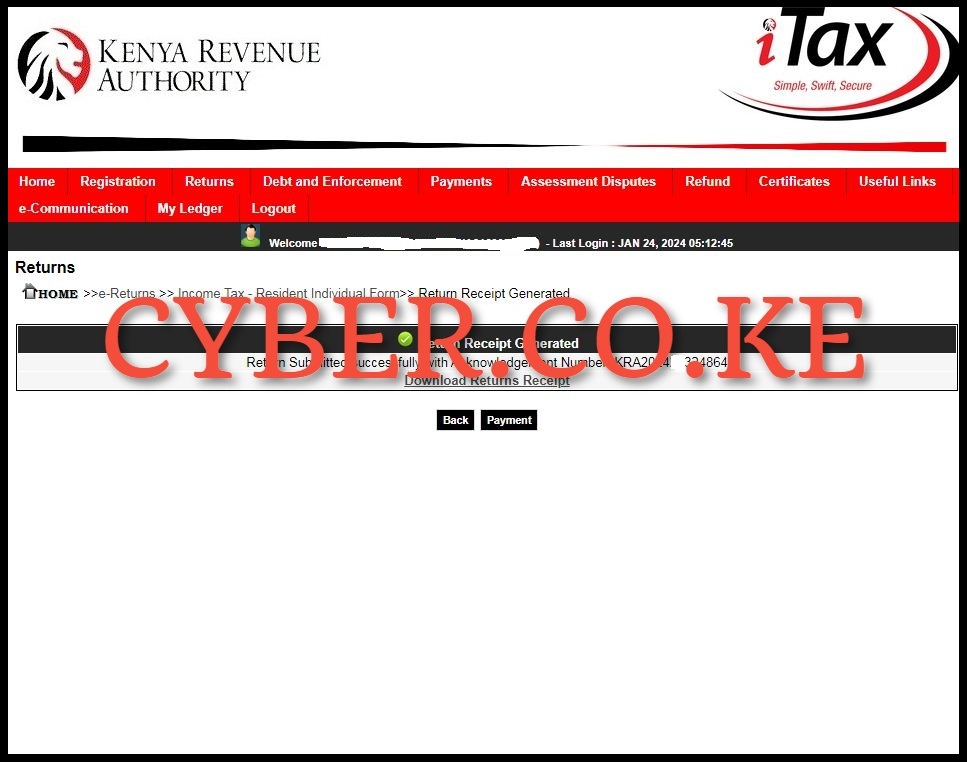

Step 8: Download KRA e-Returns Acknowledgement Receipt

The last step in the whole process of How To File KRA Returns using P9 Form on iTax (KRA Portal), is to download the generated e-Returns Acknowledgement Receipt. This KRA Returns Receipt serves as a confirmation that your KRA Return has been successfully filed, submitted and received by Kenya Revenue Authority (KRA).

READ ALSO: Step-by-Step Process of Downloading KRA Acknowledgement Receipt

The above steps sums up the whole process that is involved in How To File KRA Returns using P9 Form on iTax (KRA Portal). For you to file KRA Returns using P9 Form successfully, you need to ensure that you have with your KRA PIN Number, KRA Password (iTax Password) and P9 Form. Once you have these three requirements with you, you can follow the above outlined 8 main steps in the process of filing KRA Returns using P9 Form online on iTax (KRA Portal).

Matthews Ohotto is an Article Writer at CYBER.CO.KE and a Video Creator at Step-by-Step Tutorials Kenya (YouTube). He specializes in crafting insightful Blog Posts and Video Tutorials that empower Kenyans with practical digital skills. He is a holder of Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT).

KRA INDIVIDUAL SERVICES

SUBMIT SERVICE REQUEST

KRA PIN REGISTRATION

Are you looking for KRA PIN Registration services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN RETRIEVAL

Are you looking for KRA PIN Retrieval services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN UPDATE

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN CHANGE OF EMAIL ADDRESS

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA RETURNS SERVICES

SUBMIT SERVICE REQUEST

KRA NIL RETURNS

Are you looking for KRA Nil Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA EMPLOYMENT RETURNS

Are you looking for KRA Employment Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA AMENDED RETURNS

Are you looking for KRA Amended Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA WITHHOLDING TAX RETURNS

Are you looking for KRA Withholding Tax Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.