CYBER.CO.KE is an independent Cyber Services website and is not affiliated with any government agency, including Kenya Revenue Authority (KRA). A service fee is charged for the assistance provided to customers in Kenya.

The KRA Payment Slip is a very important document that is normally generated on iTax (KRA Portal) for the sole purpose of paying for a given amount of tax that is due on various KRA Tax Obligations. In normal scenarios, when you want to make payments to Kenya Revenue Authority (KRA) for a given Tax Obligation, you have to first generate a KRA Payment Slip for the tax obligation that you want to pay for.

The KRA Payment Slip contains important details such as the amount of tax to pay and the mode of payment either using KRA Paybill Number 222222 or any of the KRA Partner banks listed on the payment slip. To be able to generate KRA Payment Slip on iTax (KRA Portal), you need to first ensure that you have with you both KRA PIN Number and KRA Password (iTax Password).

You are going to need these two important credentials for the sole purpose of logging into iTax (KRA Portal) so as to generate KRA Payment Slip online. In this blog post, I will share the main steps in the process of How To Generate KRA Payment Slip that all taxpayers need to follow in order to generate and get their KRA Payment Slip online quickly and easily today.

READ ALSO: Step-by-Step Process of Getting KRA PIN Certificate

How To Generate KRA Payment Slip

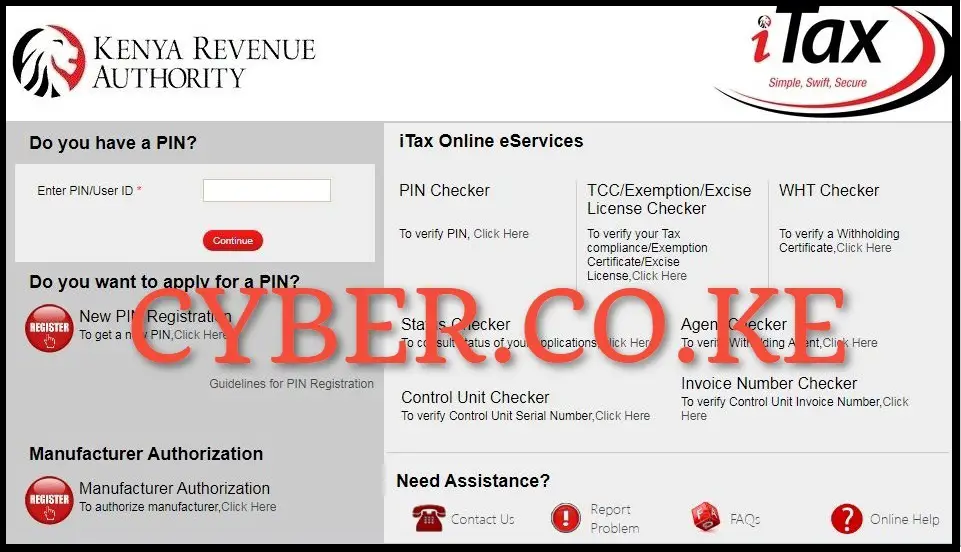

Step 1: Visit iTax (KRA Portal)

The first step step in the process of generating KRA Payment Slip online is to visit iTax (KRA Portal) by using https://itax.kra.go.ke/KRA-Portal/

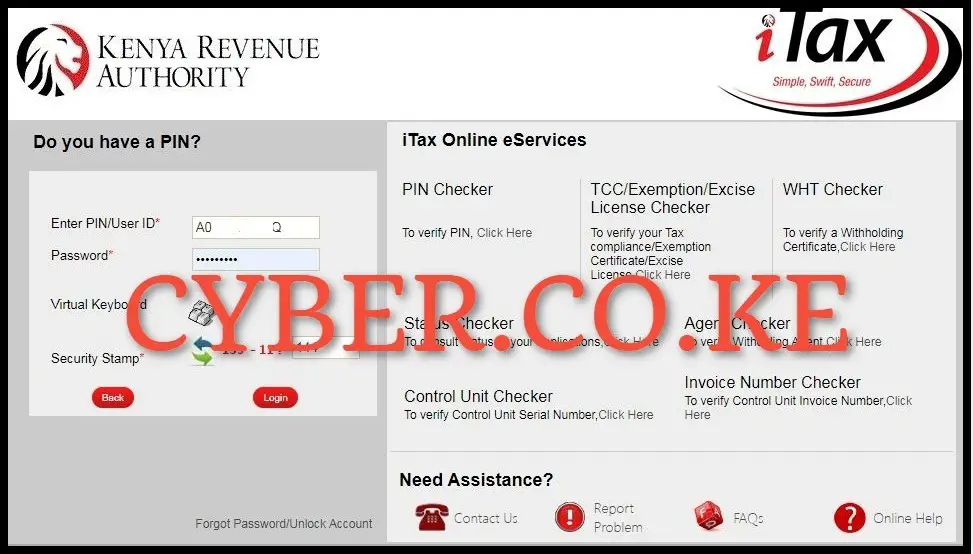

Step 2: Login Into iTax (KRA Portal)

In this step, you need to enter your KRA PIN Number, KRA Password (iTax Password), solve the arithmetic question (security stamp) and then proceed to click on the “Login” button so as to login into your iTax (KRA Portal) account.

Step 3: Click on Payments then Payment Registration

Once you are logged into iTax (KRA Portal) account, click on the “Payments” menu then click on “Payment Registration” from the drop down menu items list.

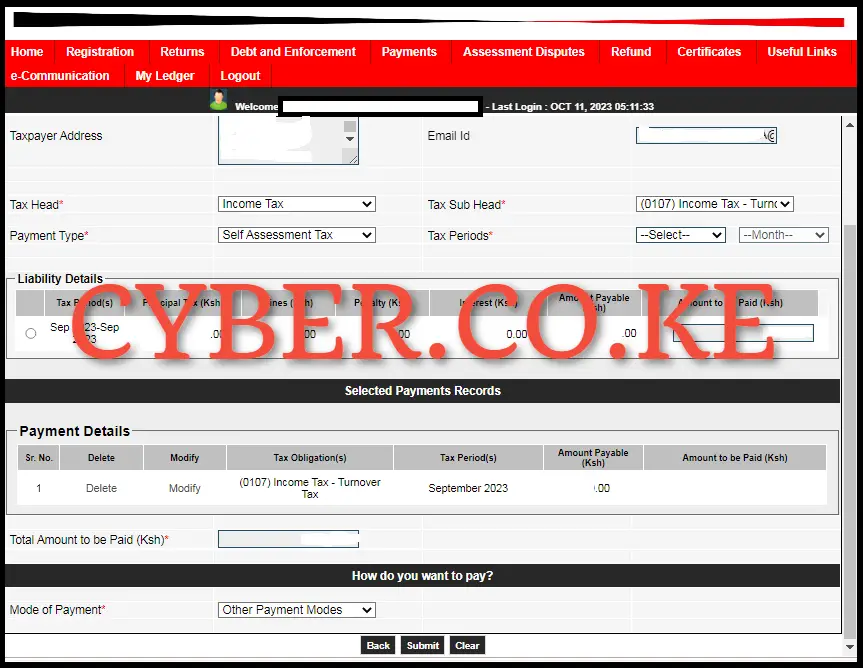

Step 4: Fill the e-Payment Form and e-Payment Registration Form

In this step, there are two main sections i.e. e-Payment Form and e-Payment Registration Form. The main one is the e-Payment Registration Form where details of the tax to be paid need to be captured.

The e-Payment Form contains details such as Applicant Type, Taxpayer PIN Number, and Taxpayer Names. Simply click the “Next” button to access and load the subsequent e-Payment Registration Form.

The most important form is the e-Payment Registration Form, which you are supposed to fill in some details. This form captures essential payment details, including payment information and preferred payment method. Key fields to complete include: Tax Head, Tax Sub Head, and Payment Type. Once you have added all the relevant details, click the “Add” button to incorporate this information into the payment records.

On matters payment, you can choose either RTGS, Bank Transfer or alternative methods such as M-PESA Paybill Number 222222. Please ensure that you send the exact amount specified on the KRA Payment Slip to successfully finalize the transaction. After selecting your payment method, click the “Submit” button.

Step 5: Download KRA Payment Slip

The last step involves downloading the generated KRA Payment Slip on iTax (KRA Portal). To download the KRA Payment Slip, you need to click the “Download KRA Payment Slip” link. This will initiate the downloading of the KRA Payment Slip to your device where you can choose to either print out a copy of the KRA Payment Slip or even save a soft copy of the KRA Payment Slip PDF version (format).

READ ALSO: Step-by-Step Process of Viewing Filed KRA Returns

The above 5 steps sums up the process that one needs to follow in order to generate KRA Payment Slip using iTax (KRA Portal). As a general reminder, to be able to generate KRA Payment Slip, you need to ensure that you are able to login into your iTax (KRA Portal) account using both your KRA PIN Number and KRA Password (iTax Password). Once you have these two credentials, you can follow the listed 5 steps above so as to be able to generate your KRA Payment Slip online using iTax (KRA Portal) and proceed to make payments either using M-PESA Paybill Number 222222 or using the listed KRA Partner Banks in Kenya.

Matthews Ohotto is a Writer at CYBER.CO.KE where he specializes in writing helpful and informative Step-by-Step Tutorials that empower Kenyans with practical skills and knowledge. He holds a Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT). Get KRA Individual Services and KRA Returns Services in Kenya.