Learn about the KRA OTP Verification Codes on iTax Portal today. The ultimate beginner’s guide to OTP KRA (One Time Password) Codes on iTax Portal.

In today’s article, I am going to share with you the complete beginner’s guide to KRA One Time Password (KRA OTP). We are to look at the basic definitions, history and even some terms pertaining to KRA OTP Codes. So, if you are beginner, then this article is definitely a must read today.

KRA One Time Password or KRA OTP is a new email verification mechanism that ensures the email that a taxpayer want to associates his or KRA PIN Number on iTax is a valid and working email. The days of using fictitious emails on iTax Portal are long gone.

READ ALSO: KRA PIN Number Download Procedure On KRA iTax Portal

It’s quite impossible to use the KRA iTax without having to go through KRA OTP Verification process. When applying for KRA PIN using Cyber.co.ke Portal, our support team have to verify your email address by requesting KRA OTP Code.

As a verification method on iTax Portal, you just have to learn to live with it as it is part of our day to day procedures. So, before we go any deeper in this article, we need to look at some basic definitions of terms that we are going to use in most parts of this article.

Sometimes, we can refer this process of receiving KRA OTP codes in email addresses as the KRA OTP Verification of Email Address on iTax Portal. When you get the KRA OTP codes, you will need to input the same on KRA iTax Portal. We now need to look at the main reasons that Kenya Revenue Authority (KRA) introduced the OTP Verification method on KRA iTax Portal.

What Is KRA OTP?

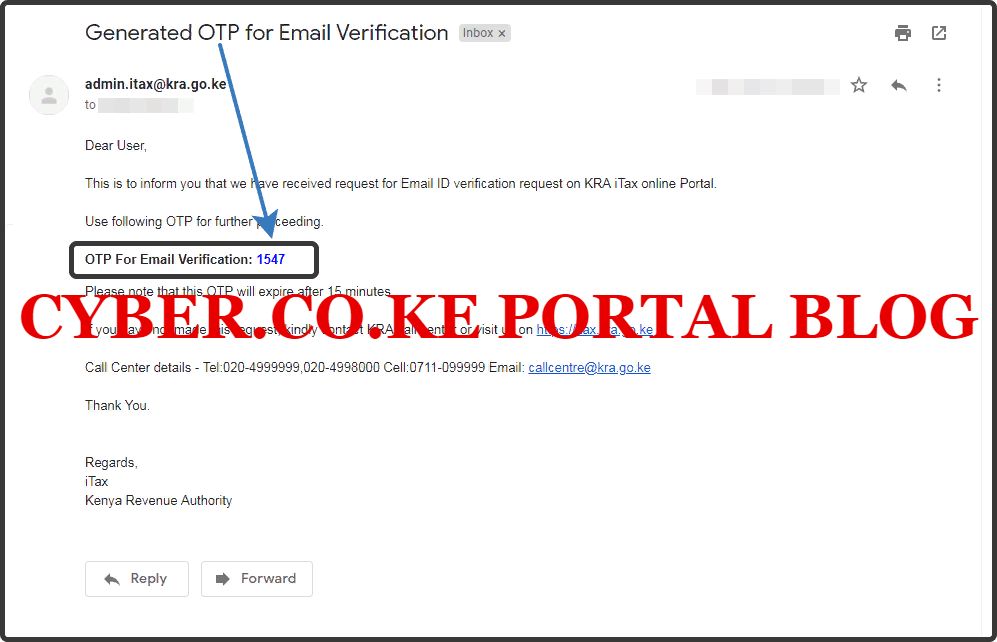

KRA OTP (KRA One Time Password) is a 4 digit code that is sent to a taxpayer’s email address by Kenya Revenue Authority (KRA) during the process of KRA PIN Registration, First Time Login to iTax Portal and process of Changing KRA iTax Email Address, for the sole purpose of verifying the email address on the KRA iTax Portal.

The OTP Code that is requested and sent to a taxpayer’s email address (Generated OTP for Email Verification) is used as a verification method of the taxpayer’s email address on iTax Portal. So, before any email is accepted on iTax, it has to be verified though the process called KRA OTP Verification of Email Address.

Whether you call it KRA OTP, OTP KRA, KRA iTax OTP or iTax OTP, they all mean one and the same thing. So, from the above definition of OTP KRA Codes, we can simply put it that KRA OTP is a code whose sole purpose is to verify the email address that a taxpayer is going to use or is using on KRA Web Portal Account.

Reasons Why Kenya Revenue Authority (KRA) Introduced KRA OTP Verification Method

Back in mid 2018, KRA introduced the OTP Verification method as a solution that seeked to validate and update taxpayers’ email address details on KRA Taxpayer’s database as part of the ongoing data cleaning initiatives that Kenya Revenue Authority (KRA) was undertaking.

With this, the KRA OTP Verification method was introduced as a feature on the KRA iTax Web Portal. Before any email was accepted on iTax, the taxpayer had to verify that email address by entering the 4 digit OTP Verification Code that was sent to their emails.

So, the sole reason of the KRA OTP Codes on iTax is for verification purposes. This is used to verify that the email that a person wants to use and it be linked to his or her KRA PIN Number and iTax Password is valid and active. So, the days of taxpayers using wrong emails is long gone. You will have to ensure that you either use a valid Gmail, Yahoo or Outlook email addressed.

Purpose of KRA OTP Verification Codes Method on iTax Portal

- Verify Taxpayer Email During KRA PIN Registration Process: The main reason for KRA OTP, is to verify the email address of a taxpayer during the KRA PIN Registration Process on iTax Web Portal. So, before your KRA PIN Registration request is complete on iTax, your email address needs to verified by entering the 4 digit KRA OTP Code that was sent to that email address.

- Verify Taxpayer Email Address During First Time Login on KRA iTax Portal: For any person who has not logged into his or her iTax Account since mid 2018, the first thing you will see is a box asking you to verify the email address on that iTax account by sending an OTP Code to that email and entering it to confirm the email address. You will also see the pop up asking you to Update iTax Profession. You can refer to the article we wrote on How To Update Your Profession in iTax.

- Verify Taxpayer Email Address During Contact Details Amendment on iTax Portal: Incase you are trying to amend the contact details on iTax i.e change the email on iTax, you need to enter the KRA OTP Verification code that was sent to the email address that you want to use as your new email on iTax Web Portal Account.

Now that we addressed the definition, reasons and purpose above, we need to look at the major challenges that most taxpayers face with KRA OTP Verification Codes on iTax Portal. This is what many people refer to as KRA OTP Problems is simple terms.

Major KRA OTP Challenges On KRA iTax Portal

This is sometimes referred to as the KRA OTP Problems. I don’t think there exist many challenges in relation to KRA OTP on iTax. Infact two challenge stands out as the one most taxpayers face and have to cope with on iTax Portal. This includes and comprises of KRA OTP Delay(s) and Expired KRA OTP Codes.

-

KRA OTP Delay(s)

It’s common nature that any web based system can sometimes experience a system or server downtime affecting its core functionalities. The same applies to KRA iTax Portal. Sometimes there are system downtimes which in turn lead to a delay in KRA relaying the KRA OTP Verification Codes to taxpayers email addresses. It’s funny when user’s rush to complain that: “KRA Won’t Send OTP” or “KRA Not Sending OTP” For your information, it is not KRA that is sending the OTP Codes but rather the KRA iTax System.

The good thing is that when KRA iTax has some server or connectivity issues, the KRA Technical Teams are always on stand by to ensure that issue is resolved within the shortest time possible and the iTax System starts relaying the OTP Verification Codes to taxpayers email addresses.

From my research, I have found out that the KRA OTP Codes work well with Gmail Accounts unlike the other Email Accounts such as Yahoo, which I wonder who still uses in this modern time. When trying to receive the OTP Codes in Yahoo, you might experience a total delay adn only for the Codes to end up in Yahoo Spam.

-

Expired KRA OTP Codes

If there is a system downtime affecting KRA iTax Portal, this sometimes leads to the KRA OTP Delay above and subsequently a taxpayer ends up receiving an Expired OTP Code. This is because the KRA OTP code sent to the email is only valid for 15 minutes after which it expires. In case it does you are required to send the verification code again and a new code will be sent to your email.

When you request for KRA OTP Code on iTax, you only have 15 minutes after which the OTP Code becomes useless. This in turn means you have to request another OTP Verification Code. So, you have to mind time here when working with the KRA OTP Codes, as a 15 minute OTP Lifespan is quite small for the slow users.

How To Get KRA OTP Verification Codes

The KRA OTP Code is browser sensitive. But it works fine with Google Chrome or Mozilla Firefox. If you are unable to verify your Email Address on iTax Portal, you can always contact our support team and we will gladly assist you with the KRA OTP Verification service request. So, you don’t have to worry about the KRA OTP Delays and Expired OTP Codes.

READ ALSO: Frequently Asked Questions About KRA Returns By Taxpayers

Let our KRA PIN Registration support team assist you in getting the KRA OTP Verification Codes quickly and easily and have your KRA PIN Certificate sent to your iTax Email Address without much fuss and hussle for you. That sums up our beginner’s guide to KRA OTP in relation to iTax Portal. Now you know as much as you need to know about the KRA OTP Verification of Email Addresses on KRA iTax Portal.

DON’T MISS OUT. CHECK OUT OUR TRENDING POPULAR BLOG POSTS IN KENYA.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

KRA PIN REGISTRATION

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

KRA PIN RETRIEVAL

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

KRA PIN UPDATE

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

KRA PIN CHANGE OF EMAIL ADDRESS

Stay Tax Compliant in Kenya

Contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.