Get to know about the KRA Presumptive Tax online today. Learn about Presumptive Tax in Kenya and the group of taxpayers who are supposed to pay this tax.

Do you own a business that is eligible to pay Presumptive Tax to Kenya Revenue Authority (KRA)? If your business gross sales for a given year is less than Kshs. 5,000,000.00 then your business is eligible to be paying the yearly KRA Presumptive Tax.

Today, I am going to share with you about something that has been trending for a while since the year began. This is the KRA Presumptive tax. In this article I am going to share with you; What is Presumptive Tax, Who Should Pay Presumptive Tax, Who Is Exempted From Payment of Presumptive Tax, What Is The Rate for Presumptive Tax, When Is Presumptive Tax Due, How Do I Pay Presumptive Tax and What Is The Penalty For Late Payment of Presumptive Tax.

READ ALSO: How To Change KRA PIN Email Address Using iTax Portal

According to a Public Notice issued by the Kenya Revenue Authority (KRA) dated 06/01/2020, the Presumptive Tax has come into effect and KRA is requesting all eligible taxpayers are to pay for the Presumptive Tax at the time of payment for business permit fee or trade licence.

The Presumptive Tax is paid by a person when acquiring or renewing a Business Permit or a Trade Licence at the County Government. The applicable rate of the KRA Presumptive Tax is 15% of the business permit fee or licence payable.

The KRA Presumptive Tax is an advance tax that shall be deducted from the Turnover Tax payable in the subsequent month(s) and therefore there is no double taxation. Kindly take note as from May 2020, the Kenya Revenue Authority (KRA) removed Presumptive Tax for businesses in Kenya. This was prior to us writing this article.

What is Presumptive Tax?

The KRA Presumptive Tax is an advance tax that is payable by small businesses (SMEs) whose gross sales does not exceed or is expected not to exceed Kshs. 5,000,000.00 per year. This is in accordance with Finance Act, 2018. Presumptive Tax applies where the turnover from business is less than shillings five million (5,000,000.00) per annum.

Gross sales in this context refers to the grand total of all sale transactions reported in a given period, without any deductions included within the figure. If the total Gross Sales of your business for a period of one year is less than the stipulated amount above, then you are supposed to pay Presumptive Tax.

In this context, let’s say if the annual/yearly Gross Sales of your business does not exceed the Kshs. 5,000,000.00 then you are eligible to start paying the KRA Presumptive Tax. Note that this figure is the total sales that your business is able to generate in a period of 12 months.

Who Should Pay Presumptive Tax

So, who then is supposed to pay this Presumptive Tax in Kenya. Well the group of taxpayers or persons who are liable to pay the KRA Presumptive Tax includes the following:

- Residents / taxpayer whose gross turnover from business does not exceed Kshs. 5 million during a year of income. So, if you own a business whose total sales for a period of 12 months does not exceed Kshs. 5,000,000.00 then you are supposed to pay Presumptive Tax.

- Residents / taxpayers who are issued or are liable to be issued with a Business Permit or Trade License by a County Government. In whichever of the 47 Counties that you run your business from, as long as you apply for a Permit for the Current year, then you are also supposed to pay Presumptive Tax.

Who Is Exempted From Payment of Presumptive Tax

The Presumptive Tax by KRA also comes with its own exemptions. Not all taxpayers in Kenya are supposed to pay this tax. In this case, a group of taxpayers is also exempted from paying this tax to the Kenya Revenue Authority (KRA). The KRA Presumptive Tax does not apply to the following group of taxpayers:

- A person whose income is exempt from tax under the First Schedule of Income Tax Act and has a valid exemption certificate.

- A person who would otherwise pay tax under this regime but elects by notice in writing to the Commissioner not to be subjected to the Presumptive Tax.

- A resident person whose Gross Turnover from business exceeds Kshs. 5,000,000.00 in a year of income.

- Any income derived from the following:

- Management and Professional services.

- Rental Business.

- Incorporated Companies.

Now that we have looked at the group of taxpayers who are exempted from paying this tax, we need to look at the rate of the KRA Presumptive Tax.

What Is The Rate for Presumptive Tax?

Just like any other tax in Kenya, the Presumptive Tax also has its own tax rate that is quite different from the other tax rates in Kenya that we currently have. The rate of Presumptive Tax shall be amount equal to 15% of the amount payable for a Business Permit or trade License issued by a County Government.

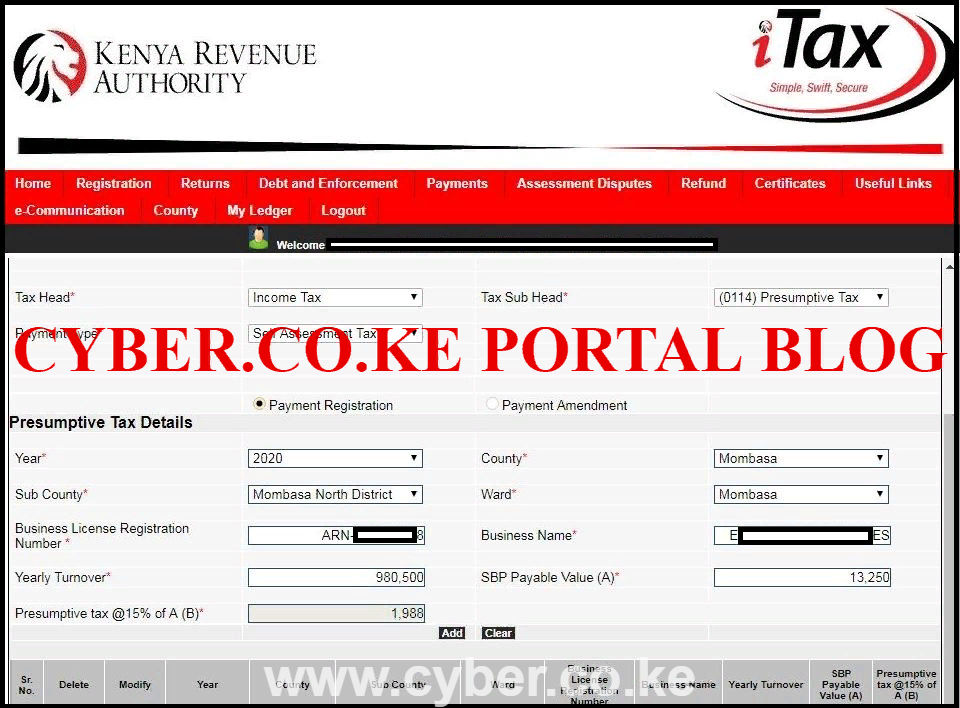

We need to look at an example. Let’s say for example you have and run a small business in Mombasa County i.e Medium Shop. The yearly permit charge by the County Government of Mombasa is Kshs. 13,250.00 inclusive of the Fire Fees.

Now, the amount of Presumptive Tax that will be payable to Kenya Revenue Authority (KRA) will be; 15% of Kshs. 13,250.00 = Kshs. 1,987.50 (Kshs. 1,988.00 :: rounded up figure). This is the amount of Presumptive Tax that you are supposed to pay KRA if you run such a Medium Shop in Mombasa County. Below is an illustration of the calculation on KRA iTax Portal.

Kindly note that the amount of the County Permit Fee varies across the different 47 Counties in Kenya. Permits in the different Counties in Kenya are charged differently. So depending in which County your Business operates from the 15% tax rate is constant.

When Is Presumptive Tax Due?

All KRA taxes have a due that that they are supposed to be paid on or before that date. This tax does not have a due date. Why? The due date for payment of the tax shall be at the time of payment for the Business Permit or Trade Licence or renewal of the same.

Why is this the case? Well most counties including Mombasa County have a grace period of renewing Business Permits between 1st January to 31st March. As for a new business, it can be opened during any time of the year and during the time that you apply and get your Permit, you are supposed to also pay the Presumptive Tax for that business.

How Do I Pay Presumptive Tax?

Eligible taxpayers will have to log onto KRA iTax to make payment for Presumptive Tax. The taxpayers shall be required to generate a Payment Registration Number (PRN) on iTax under Presumptive Tax Payment, after which they can pay through M-Pesa Pay Bill Number 572572 or any other partner bank.

PAYMENT SLIP: How To Generate Presumptive Tax Payment Slip Using iTax Portal

PAYMENT METHOD: How To Pay Presumptive Tax Using KRA Paybill Number 572572

What Is The Penalty For Late Payment of Presumptive Tax?

Is there a penalty if you are eligible to pay Presumptive Tax and fail to pay it? Well, the answer to this question is Yes, there is a penalty that will be imposed by Kenya Revenue Authority. This is 5% of the tax due and a late payment of interest 1% per month as outlined in the Tax Procedures Act, 2015.

You should also take note of the following in relation to KRA Presumptive Tax:

- Can a Taxpayer Choose Not To Be Subject To Presumptive Tax? A taxpayer can choose not to be subject to Presumptive Tax by applying to the Commissioner in writing in this case the taxpayer shall be expected to prepare accounts and file returns annually under the normal income tax regime.

- How To Register For Presumptive Tax? Taxpayers shall register online through KRA iTax Portal or through their mobile phones.

- Is Presumptive Tax Final Tax? The answer is Yes. Persons who declare and pay both the presumptive tax and turnover tax will not be required to file monthly VAT and the annual income tax returns.

- How To Pay For Presumptive Tax Through KRA iTax Portal? You will apply for KRA Presumptive Tax and pay once you have been issued by the County Permit for that year. You will need the County Permit Number when paying the Presumptive Tax.

READ ALSO: How To File KRA Returns Using KRA iTax Portal If Unemployed

So, those are the important things that you need to know about this Tax. Ensure that if you are running a business that is eligible to pay Presumptive Tax, then as a thumbs up rule, you should pay the tax. This is part of ensuring that we build Kenya by paying taxes as required by the Law.

DON’T MISS OUT. CHECK OUT OUR TRENDING POPULAR BLOG POSTS IN KENYA.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

KRA PIN REGISTRATION

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

KRA PIN RETRIEVAL

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

KRA PIN UPDATE

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

KRA PIN CHANGE OF EMAIL ADDRESS

Stay Tax Compliant in Kenya

Contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.