Do you need to know how to Login to your iTax Account? Learn How To Access KRA Web Portal Account Using KRA Login Credentials i.e Login ID and Password.

After successfully registering for a new KRA PIN online at Cyber.co.ke Portal, the next thing to do as a new taxpayer in Kenya is to login to your KRA Web Portal Account using the Login Credentials that were sent to your iTax Registered email address by Kenya Revenue Authority (KRA).

In this article, I am going to share with you the steps and procedure that you need to follow so as to access your KRA Web Portal Account quickly and easily. We are going to use the iTax Login ID and Password that were sent to the email address that we registered the KRA PIN with here at Cyber.co.ke Portal.

READ ALSO: How To File KRA Nil Returns Using KRA iTax Portal

But, we get deeper into that, we need to highlight some key definition of terms in relation to KRA Web Portal Account. This will enable you understand what this article is about and hence making the process of accessing the iTax Web Portal Account a walk in the park.

Logging into KRA Portal or iTax is a process that requires you to have both your KRA PIN Number Number and iTax Password. To be able to access and view all the resources on iTax, you need to be logged into your iTax Account. The problem is that not that many Kenyans know the process that they need to follow.

The good thing is that incase you have forgotten your KRA PIN Number or even iTax Password (KRA Password), here at Cyber.co.ke Portal we can gladly assist you with that. Incase you have forgotten your KRA PIN, then you can request for KRA PIN Retrieval and have both your KRA PIN Number and KRA PIN Certificate sent to you. Incase you have forgotten your iTax Password, you can request for KRA PIN Change of Email Address so that you can be able to change your KRA Password.

What Is KRA Web Portal Account?

KRA Web Portal Account in an online taxpayer account on the KRA iTax System that enables a taxpayer perform a variety of tax related operations, enquiries and tasks that are forwarded to Kenya Revenue Authority for processing and approval. Each KRA PIN Number is assigned an iTax Account for that taxpayer.

To be able to access your KRA Web Portal Account, you need to ensure that you have with you the KRA Login Credentials that are normally sent to the iTax Registered Email Address. These KRA Credentials includes the Login ID which is just the KRA PIN Number and the iTax Password.

After applying for a KRA PIN here at Cyber.co.ke Portal through our KRA PIN Registration services, once the order has been done, KRA creates a Web Portal Account and send the login credentials i.e login ID and password to the email address that you had written on the order form. You will need these login credentials so as to be able to access and use your KRA Web Portal Account.

Key Functions That A Taxpayer Can Perform In His/Her KRA Web Portal Account

This Web Portal Account is also sometimes referred to as iTax Account or iTax Web Portal Account. There a variety of operations or tasks that a taxpayer can perform using his or her iTax Web Portal Account. Since they are quite many, I am only going to highlight the key ones. These includes the following:

-

Registration Tasks and Operations

In the KRA Web Portal Account, you can perform the following under Registration functions: Amend PIN Details; Other Registration such as – (Excise Licence, Tax Relief Scheme, Excise Services, Application for Destruction of Excisable Goods, Remission of Excise Duty on Denatured Spirit, Import Certificate, Tax Agent Registration, Tax Agent Cancellation, Management of Sub Agent); Consult of Taxpayer Register; Reprint PIN Certificate; Excise Licence Cancellation; Excise Services Cancellation; Transfer Excise Licence; Withholding VAT Amendment; Withholding VAT Cancellation; Tenant Withholding Agent Amendment; e-Reactivation; e-Dormance; e-Cancellation; Opted Out Landlord Registration and Tenant Withholding Agent Cancellation.

-

Returns Tasks and Operations

In the KRA Web Portal Account, you can perform the following under Returns functions: File Return; File Amended Return; View Filed Return; File Nil Return and ITR For Employment Income Only. These operations come into play especially during the KRA Returns filing season that runs from 1st January to 30th June of each year.

-

Debt and Enforcement Operations

With this KRA Web Portal Account function, you can perform one key task or operation that is Request for Waiver of Penalties and Interests. So, when you fail to file your KRA Returns on time, you are automatically slapped with a tax penalty. You have the option to apply for KRA Waiver using iTax Portal Account.

-

Payments Tasks and Functions

This encompasses the following iTax operations: Payment Registration; Apply for Payment Plan; Consult Payments and finally Consult CGT Return. The CGT simply stands for Capital Gains Tax. This comes into play when you want to generate KRA Payment Slips for various tax payments using your iTax Account.

-

Assessment Disputes Tasks and Operations

Under this in your iTax Web Portal Account, you are able to perform tasks such as: Objection Application; Notice of Intention to Appeal – (Appeal to the Local Committee/Tribunal, Appeal to the High Court and Appeal to the Court of Appeal); Objection Application WHT VAT; Notice of Intention to Appeal WHT VAT – (Appeal to the Local Committee/Tribunal, Appeal to the High Court and Appeal to the Court of Appeal);

-

Refund Task and Operations

The other function that you can perform using your KRA Web Portal Account is Refund operations and tasks such as: VAT; Income Tax; Excise; Stamp Duty; Land Rent; Inventory and FACredit Self Utilization. In cases whereby you were overtaxed by KRA, there is an option to apply for Tax Refund and this can be done easily on iTax Portal Account.

-

Certificates Tasks and Operations

This function on the KRA Web Portal entails the following tasks and operations: Reprint Withholding Certificate; Withholding VAT Certificate Cancellation; Rental Income Withholding Certificate Cancellation; Withholding Certificate Cancellation; Apply for Tax Compliance Certificate – TCC; Consult and Reprint TCC; Reprint VAT Withholding Certificate and Reprint Rental Income Withholding Certicate.

Those are but the most important iTax Functionalities in your KRA Web Portal Account that you will need to use one day. I could not highlight all of them since others perform the same task as the ones that I have already listed above.

Now that we have looked at the key functions that a taxpayer can perform in his or her KRA Web Portal Account, we need to look at the key requirements that are needed to login to KRA iTax Account. As I have always been mentioning in all my previous articles here, you are going to need KRA PIN Number (Login ID) and KRA iTax Password.

Requirements Needed To Login To KRA Web Portal Account

For one to be able to access his or her KRA Web Portal Account, you will need to have KRA PIN Number and KRA iTax Password. Let us look at these two key requirements in details below.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable your Reset KRA iTax Password.

Now that you have with the tow requirements that are needed in the process of accessing your KRA Web Portal Account, we can now look at the steps to follow on How To Access KRA Web Portal Account Using Login Credentials. As mentioned earlier on in this article, the KRA Login Credentials for the iTax Web Portal are simple the KRA PIN Number and iTax Password.

How To Access KRA Web Portal Account Using Login Credentials

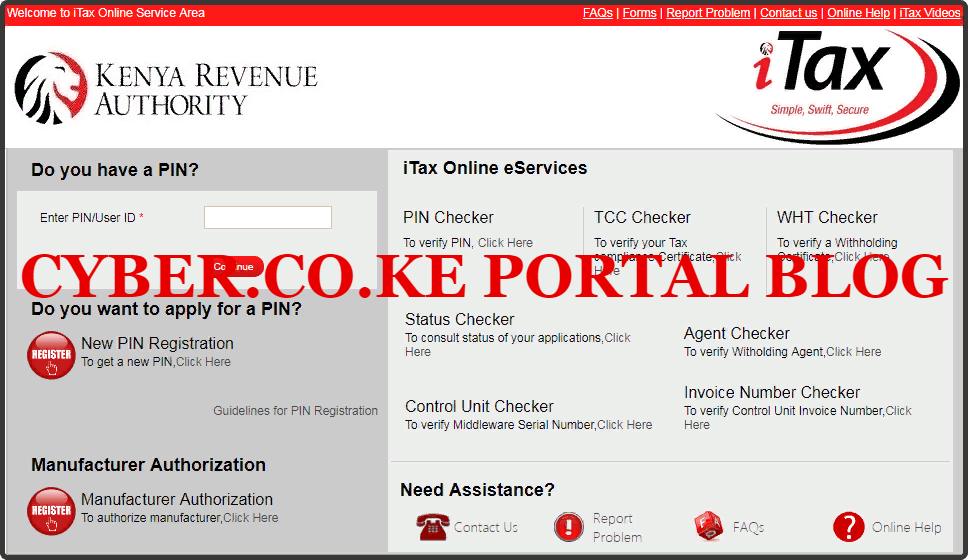

Step 1: Visit KRA Portal

The first step that you need to take is to ensure that you visit the KRA iTax Web Portal using the link provided above in the above description. Note, the above is an external link that will take you to the KRA iTax Portal.

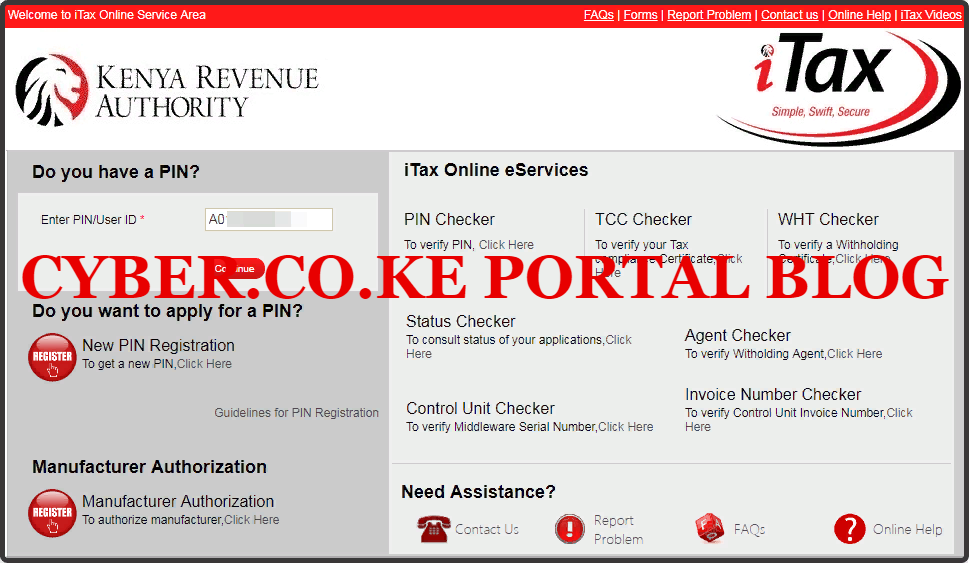

Step 2: Enter Your KRA PIN Number In the PIN/User ID Section

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

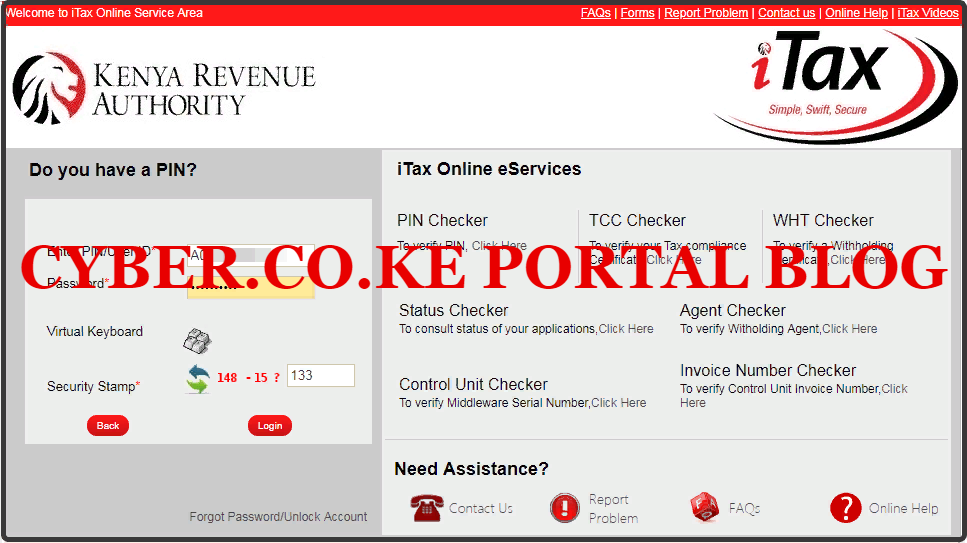

Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: KRA iTax Web Portal Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA iTax Web Portal Account Dashboard. Here upon successful login process, you are able to view a wide range of iTax Portal functionalities.

READ ALSO: How To Retrieve KRA PIN Certificate Using KRA iTax Web Portal

This step forms the last step in the processing logging into and accessing a taxpayer’s KRA Web Portal Account. From the Web Portal Account dashboard as illustrated above, you can see the various tasks and functionalities that I had earlier explained in the beginning of this article. So, next time you need to access your Web Portal Account, just follow the above 4 simple steps. The only thing that you need to ensure is that you have with you the KRA Login Credentials i.e KRA PIN Number and iTax Password.

Matthews Ohotto is an Article Writer at CYBER.CO.KE and a Video Creator at Video Tutorials Kenya (YouTube). He specializes in crafting insightful Blog Posts and Video Tutorials that empower Kenyans with practical digital skills. He is a holder of Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT).

KRA INDIVIDUAL SERVICES

SUBMIT SERVICE REQUEST

KRA PIN REGISTRATION

Are you looking for KRA PIN Registration services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN RETRIEVAL

Are you looking for KRA PIN Retrieval services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN UPDATE

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN CHANGE OF EMAIL ADDRESS

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA RETURNS SERVICES

SUBMIT SERVICE REQUEST

KRA NIL RETURNS

Are you looking for KRA Nil Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA EMPLOYMENT RETURNS

Are you looking for KRA Employment Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA AMENDED RETURNS

Are you looking for KRA Amended Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA WITHHOLDING TAX RETURNS

Are you looking for KRA Withholding Tax Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.