Do you have a Sole Proprietorship Business in Kenya that is eligible for Turnover Tax (TOT)? Get to know How To Add Sole Proprietorship Business On KRA iTax Portal.

Do you own and operate a Sole Proprietorship business in Kenya? If the answer to this question is Yes, then this article will come in handy for you. By now you maybe aware that Kenya Revenue Authority (KRA) has made it public that any business whose Gross Sales is less than Kshs. 5,000,000.00 per year need to be filing and paying the monthly Turnover Tax (TOT) and the yearly Presumptive Tax.

Adding your Sole Proprietorship Business on iTax is not that hard but it requires you to follow a line of steps and procedures to follow. This will entail amending the Source of Income on your KRA iTax Account to include Business as a Source of Income.

READ ALSO: The Complete Beginner’s Guide To KRA Turnover Tax (TOT) In Kenya

So, if you have an active KRA PIN Number on KRA iTax Portal, by now you should be starting the process of Adding the Sole Proprietorship Business in your iTax Account. As a small business owner, starting this year 2020, you need to Amend your Source of Income and add your Business Details on KRA iTax Portal to enable you be able to file and pay both Turnover Tax (TOT) and Presumptive Tax.

In this article, I am going to share with you the steps involved in Amending your Source of Income on KRA iTax Portal. As part of our heritage here at Cyber.co.ke Portal Blog, we need to look briefly at the key terms and requirements that we are going to need in the Process of Adding a Sole Proprietorship Business in KRA iTax Portal. To be able to register your business on iTax, you need to have your KRA PIN Number and iTax Password needed fo login purposes. But in most cases, many Kenyans either have forgotten their KRA PIN Number or even the email that they used in KRA PIN Portal or KRA Portal (iTax Portal).

The good thing is that incase you have forgotten your KRA PIN Number or even iTax Password (KRA Password), here at Cyber.co.ke Portal we can gladly assist you with that. Incase you have forgotten your KRA PIN, then you can request for KRA PIN Retrieval and have both your KRA PIN Number and KRA PIN Certificate sent to you. Incase you have forgotten your iTax Password, you can request for KRA PIN Change of Email Address so that you can be able to change your KRA Password.

What Is A Sole Proprietorship Business?

A Sole Proprietorship Business is not a legal entity and simply refers to a person who owns the business and is personally responsible for its debts. A Sole Proprietorship Business can operate under the name of its owner or it can do business under a Registered Business Name.

Also you can define it as a Business owned by one person who is entitles to all profits as well as losses of the business enterprise. You can get your Business Name Registered today at eCitizen and get a Business Registration Certificate that will be needed when you need to add that Business as a Source of Income in your KRA PIN on iTax Portal.

It takes you atleast a week to Register a Sole Proprietorship Business in Kenya and get the Business Registration Certificate also from the Business Registration Service in Kenya. Most Kenyans own and run small businesses which have been registered but they have not added Business as a Source of Income on their KRA PIN. This article will hep you know how to amend your PIN Details under the Source of Income and add that Business there.

Now that we know what we mean by the term Sole Proprietorship Business in Kenya, we need to look at the requirements that we need to have so as to add that business on your KRA PIN on iTax Portal. From long time, Sole Proprietorship businesses in Kenya did not require to Register for a KRA PIN Number ast they were using and are still using the KRA PIN of the Proprietor. I get asked most of the times by Kenyans; can I register a KRA PIN for my Business? Well, no you can’t. Your business will be using your KRA PIN for all transactions in Kenya.

Requirements Needed For Adding Sole Proprietorship Business on KRA iTax Portal

The requirements needed can basically be categorized into 3 key requirements. These are; Certificate of Registration for the Business, KRA PIN Number and KRA iTax Password. Now let us look at what each one entails.

-

Certificate of Registration for the Business

You can apply and get Business Registration Certificate on eCitizen quickly within a week. For you to add Business as a Source of Income on iTax, you will be needing this important Certificate. If you don’t have and have a business that is eligible to pay Turnover Tax (TOT) and Presumptive my free advice to you is have your business registered immediately. Getting this Certificate of Registration is very cheap and it will only cost you a total of Kshs. 1,000.00 only. You will use Kshs. 150.00 for Business Name Search and Reservation plus another Kshs. 850.00 for Business Name Registration and Issuance of the Certificate of Registration for your Business.

-

KRA PIN Number

The next important requirement that you need to have with you is your KRA PIN Number. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request. If you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal.

-

KRA iTax Password

The next item that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable your Reset KRA iTax Password.

Once you are set to go with the above requirements i.e Certificate of Registration for the Business, KRA PIN Number and KRA iTax Password, we can now proceed to the process of amending your KRA PIN Details under Source of Income and adding that Business in your KRA iTax Account by linking it to your KRA PIN Number.

How To Add Sole Proprietorship Business On KRA iTax Portal

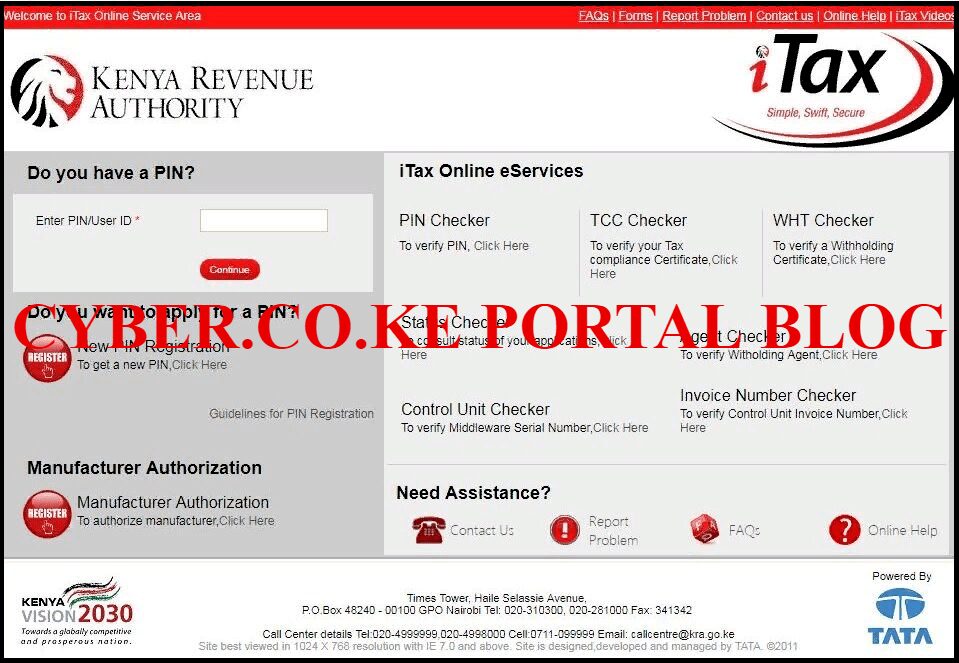

Step 1: Visit KRA Portal

The first step that you need to take is to ensure that you visit the KRA iTax Portal using the link provided above in the title.

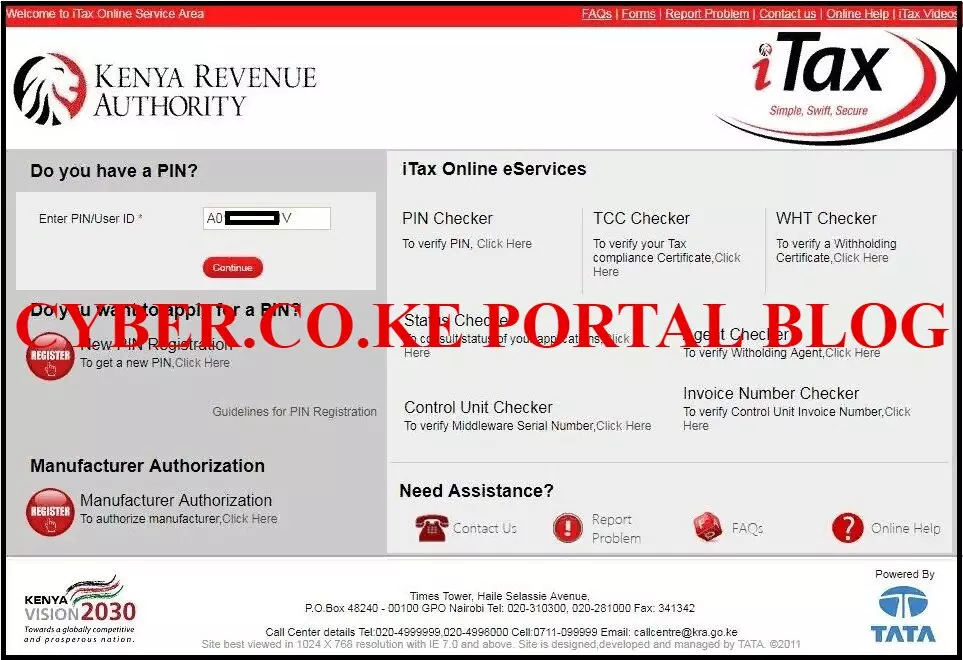

Step 2: Enter Your KRA PIN Number

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

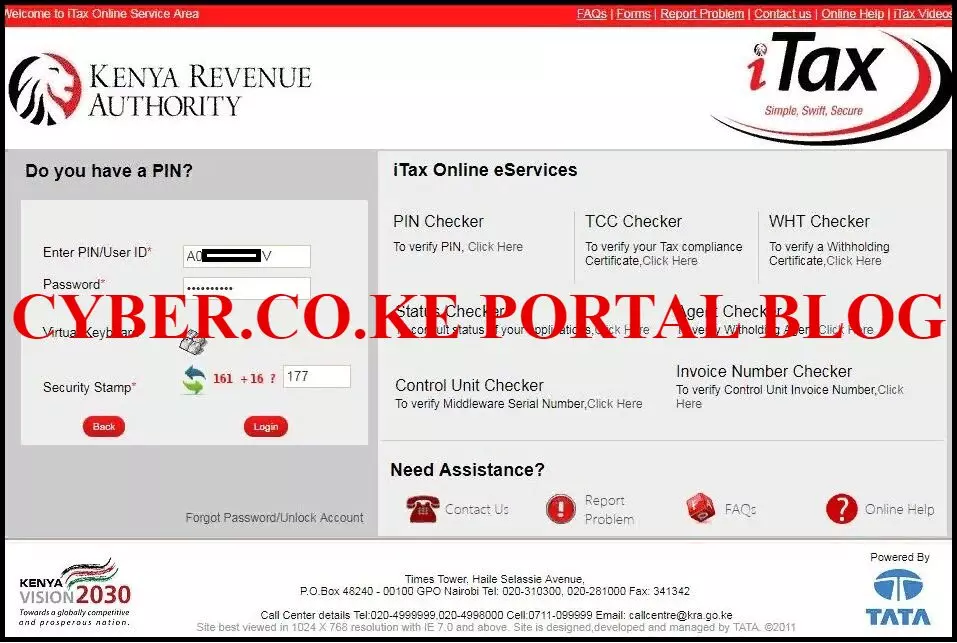

Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: iTax Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be able to see and access your iTax Account Dashboard. This is as illustrated in the screenshot below.

Step 5: Click On The Registration Menu Tab Followed By Amend PIN Details

In this step, you will need toc click on the “Registration” menu tab and from the dropdown list of the menu list items, click on “Amend PIN Details.”

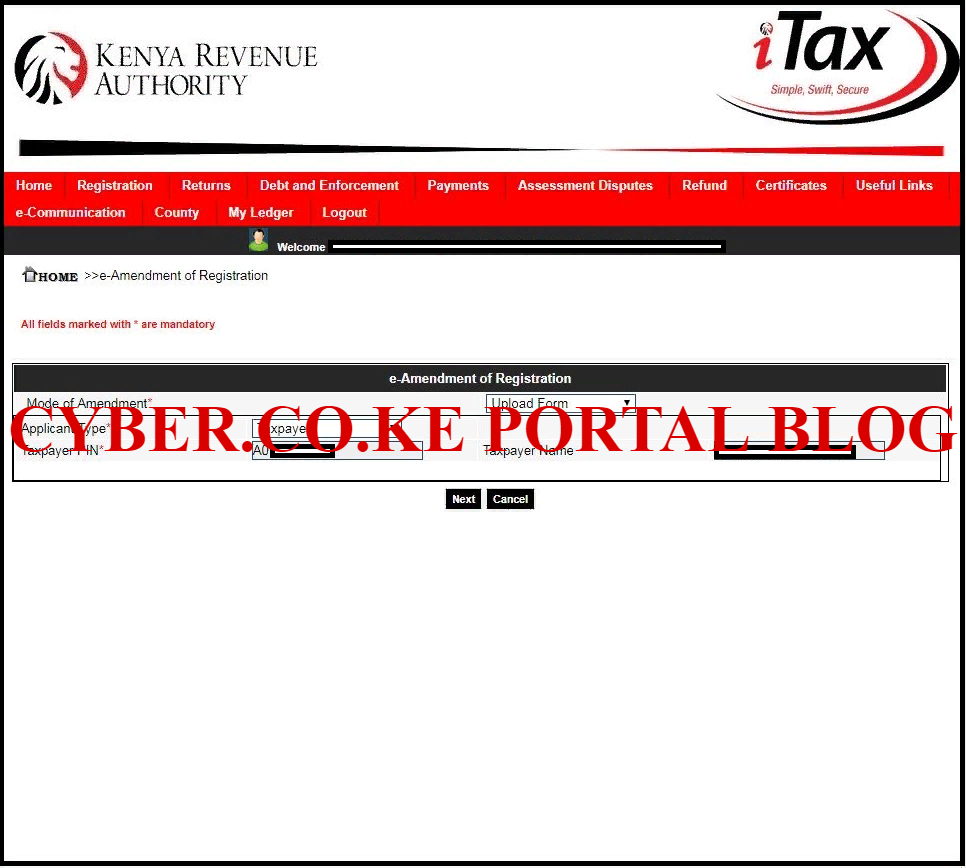

Step 6: Select The Mode of Amendment in the e-Amendment of Registration Form

In this step, you will need to select the mode of Amendment. In our case, we shall select the Online Form mode. You can also choose to use the Upload Form mode of amendment but we prefer that you use the Online Form mode of amendment. The other fields on the e-Amendment of Registration Form such as the Applicant Type, Taxpayer Name and Taxpayer Name are automatically pre-filled by the system. Once you have selected the mode of amendment, click on the “Next” button.

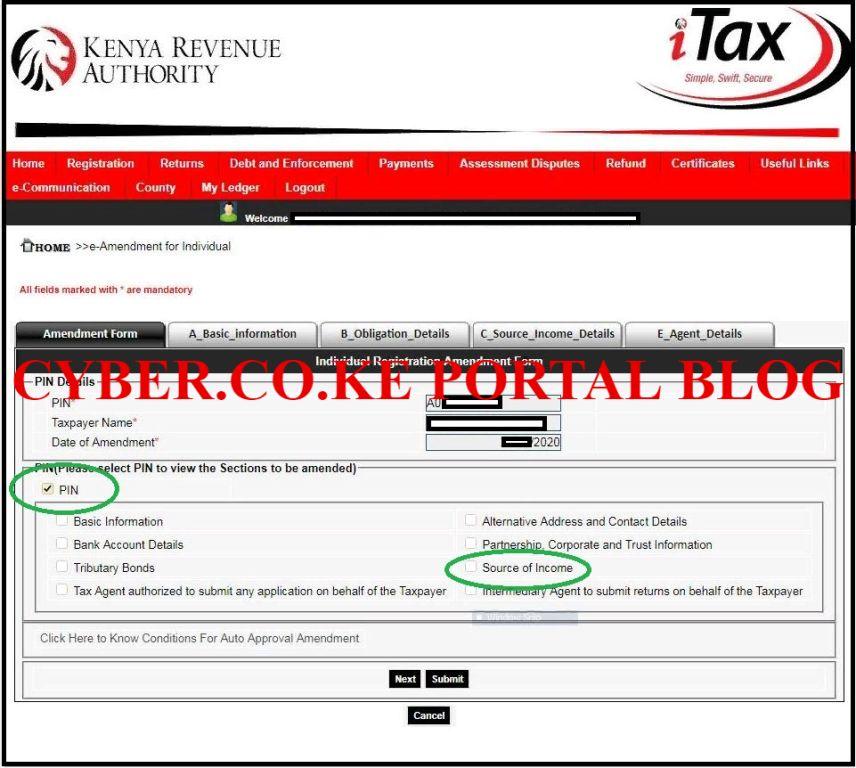

Step 7: Fill In The Individual Registration Amendment Form

In this step, you will need to fill in the Individual Registration Amendment form by selecting PIN and Source of Income tabs. This is because Because Business option is located under Source of Income section of the KRA PIN Amendment Form. Once you have selected the two fields. This is as illustrated below.

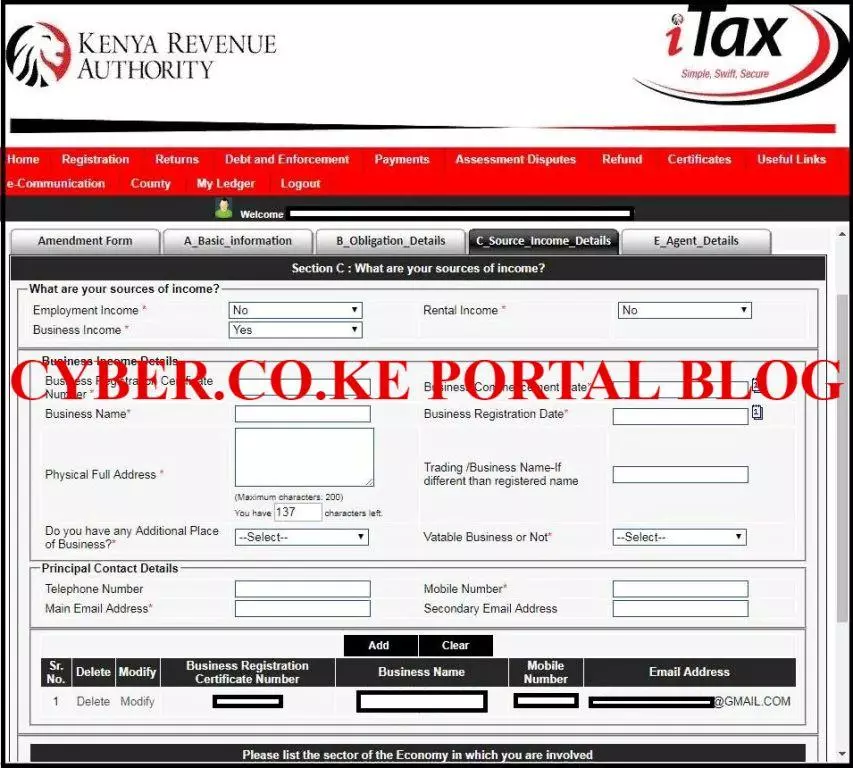

Step 8: Click On Source of Income Details Tab (C_Source_Income_Details)

In this section, you will need to specify what your Source of Income is. Since we adding Sole Proprietorship Business in this section, you will need to select “YES” under the Business Income Tab. The Business Income Details that you will need to fill in this section includes; Business Registration Certificate Number, Business Commence Date, Business Name, Business Registration Date, Physical Full Address, Do you have any Additional Place of Business, Vatable Business or Not. In the Principal Contact Details of the Sole Proprietorship Business, you will need to enter Mobile Number and Main Email Address. Once you have filled in all the Business Details above, click on the “Add” button. Next you will proceed to the Economy in which your Business is involved in. In this section, you need to select your Business Section, Group, Description and Type. Click on the “Add” button once you have done that. Once you added your business details, click on the “Submit” button.

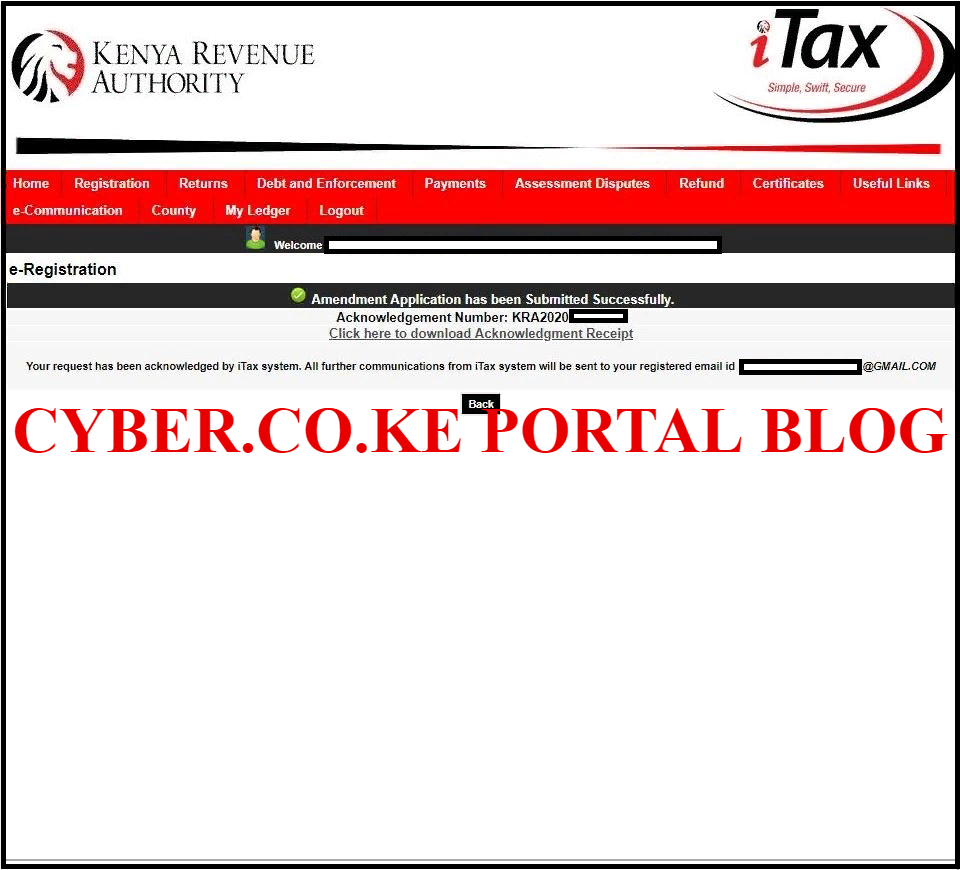

Step 9: Download Amendment Acknowledgement Receipt

The last step in the process of adding Business as a Source of Income on your KRA PIN in iTax Portal will involve downloading the Acknowledgement Receipt that has been successfully generated by the KRA iTax Portal. At this point you will need to take note that since adding Business as a Source of Income, a task will be generated and forwarded to the relevant task manager for Approval of the addition of Business on your KRA PIN.

Take note that your application for amendment in registration details i.e amending your source of income on iTax Portal has been been sent successfully to Kenya Revenue Authority (KRA). The document in the last step is just an acknowledgement receipt and not a PIN Certificate.

The application of adding Sole Proprietorship Business to KRA PIN on KRA iTax has been forwarded to the concerned area officer for further processing. Please follow the instructions given in the email and produce necessary documents.

READ ALSO: The Complete Beginner’s Guide To KRA Presumptive Tax In Kenya

Kindly note that the Approval of the Amendment can take upto 2 business days. If you haven’t received any Approval Email from KRA, then you can forward your Business Registration Certificate to [email protected] for a quick follow up. Also an email will be sent to your iTax Registered Email Address when the Application has been approved.

DON’T MISS OUT. CHECK OUT OUR TRENDING POPULAR BLOG POSTS IN KENYA.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

KRA PIN REGISTRATION

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

KRA PIN RETRIEVAL

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

KRA PIN UPDATE

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

KRA PIN CHANGE OF EMAIL ADDRESS

Stay Tax Compliant in Kenya

Contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.