Have you applied for Company KRA PIN Registration and got the Company KRA PIN Number and now want to apply for Company Tax Compliance Certificate (TCC)? Well, you can easily apply for Company Tax Compliance Certificate (TCC) by using iTax (KRA Portal) and get the same Tax Compliance Certificate (TCC) immediately provided the company is compliant in matters KRA Returns and Tax Payments to Kenya Revenue Authority (KRA).

The Company Tax Compliance Certificate (TCC) is quite important especially in scenarios whereby the company is applying for tenders in Kenya and the TCC is one of the documents needed. To be able ato apply for Company Tax Compliance Certificate (TCC) using iTax (KRA Portal), you need to have with you both the Company KRA PIN Number and KRA Password (iTax Password).

These two requirements are quite important as they serve as the iTax login credentials that taxpayers use to access the iTax (KRA Portal) account with ease. In this blog post, I am going to share with you the main steps that are involved in the whole process of How To Apply for Company Tax Compliance Certificate (TCC) online using iTax (KRA Portal).

READ ALSO: Step-by-Step Process of Downloading Company KRA PIN Certificate

How To Apply for Company Tax Compliance Certificate (TCC)

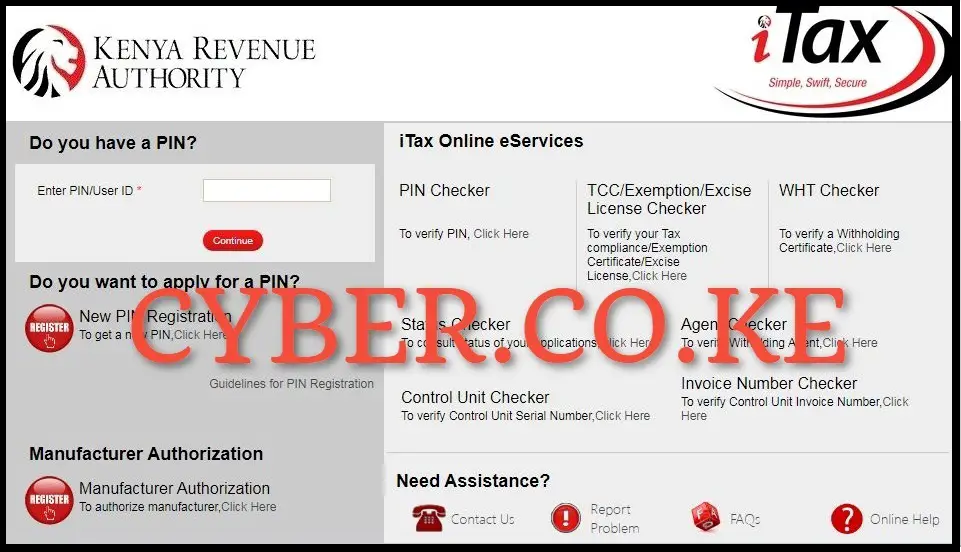

Step 1: Visit iTax (KRA Portal)

To be able to apply for Company Tax Compliance Certificate (TCC), you first need to visit iTax (KRA Portal) by using https://itax.kra.go.ke/KRA-Portal/

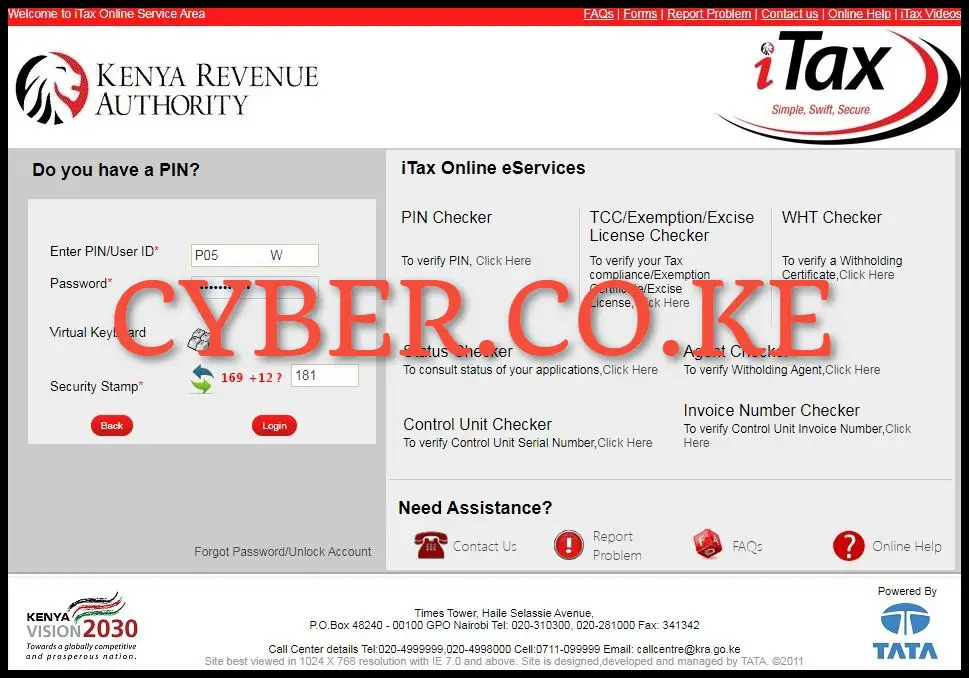

Step 2: Login Into iTax (KRA Portal)

In this step, you need to enter the Company KRA PIN Number, KRA Password (iTax Password), solve the arithmetic question (security stamp) and then click on the “Login” button so as to access your iTax (KRA Portal) account and begin the process of applying for Company Tax Compliance Certificate (TCC).

Step 3: Click on Certificates

Upon successful iTax (KRA Portal) account login, on the top right side of the account dashboard, click on “Certificate” then click on “Apply for Tax Compliance Certificate” from the drop down menu list. A pop up message “Please be informed that you are entitled for the Tax Compliance Certificate (TCC) without any workflow. Please click ‘OK’ to continue” will appear, you are to click on “OK” to proceed to the next step.

Step 4: Provide Reason for Application of Company Tax Compliance Certificate (TCC)

Next, you need to provide or give a reason of applying for Company Tax Compliance Certificate (TCC) based on the most common reasons for application of Tax Compliance Certificate (TCC) on iTax (KRA Portal) including; Job Application, Government Tender, Renewal of Work Permit, Clearing and Forwarding Agents, Seeking Liquor Licences, Confirmation of Compliance Status or other Regulatory Requirements. Choose one that suits your needs and then click on the “Submit” button.

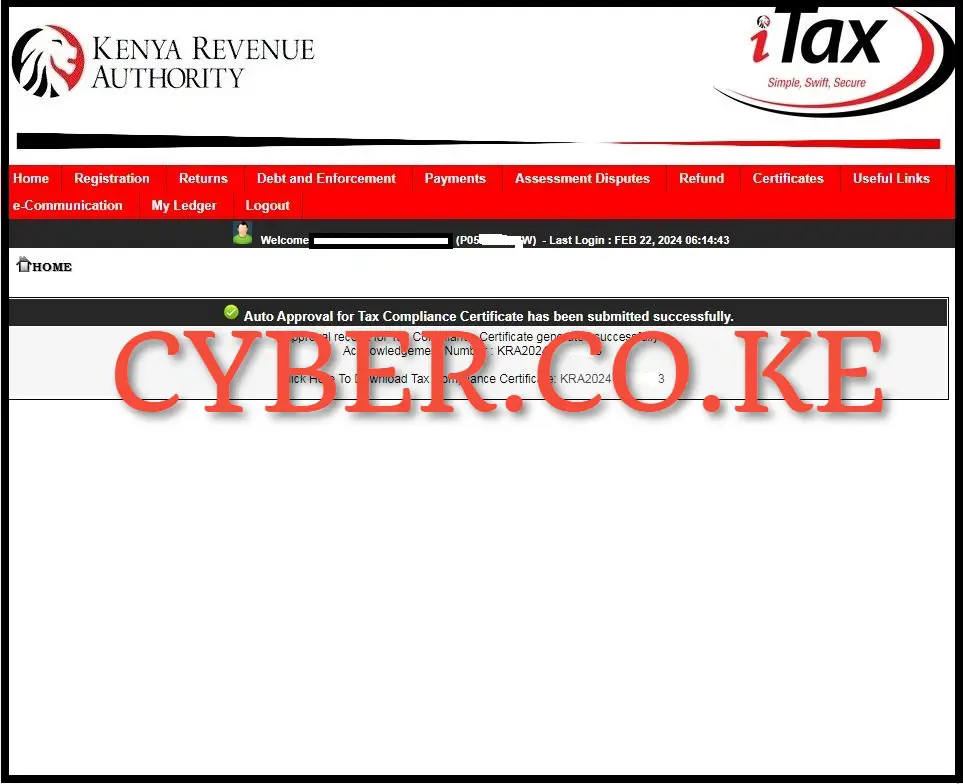

Step 5: Download Company Tax Compliance Certificate (TCC)

The final step in the process of applying for Company Tax Compliance Certificate (TCC) is the downloading of the generated Tax Compliance Certificate (TCC) on iTax (KRA Portal). The notification “Approval Receipt for Tax Compliance Certificate Generated Successfully” means that the application for Company Tax Compliance Certificate (TCC) on iTax (KRA Portal) is complete and it has been auto approved by the system, so you just need to download the Company Tax Compliance Certificate (TCC). To download the Tax Compliance Certificate (TCC) for Company, click on the text link labeled “Click Here To Download Tax Compliance Certificate: KRA2024*******3” which will inturn save the Tax Compliance Certificate (TCC) to the device that you are using.

READ ALSO: Step-by-Step Process of Downloading Group Tax Compliance Certificate

The process of applying for Company Tax Compliance Certificate (TCC) is quite easy provided the company is compliant in terms of KRA Returns filing and Tax Payments to KRA. Also, you need to ensure that you have with you both the Company KRA PIN Number and KRA Password (iTax Password) which you are going to use so as to login into iTax (KRA Portal) account. Once you have all these with you, you can follow the above 5 main steps that are involved in the process of How To Apply for Company Tax Compliance Certificate (TCC) online using iTax (KRA Portal).

Matthews Ohotto is an Article Writer at CYBER.CO.KE and a Video Creator at Video Tutorials Kenya (YouTube). He specializes in crafting insightful Blog Posts and Video Tutorials that empower Kenyans with practical digital skills. He is a holder of Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT).

KRA INDIVIDUAL SERVICES

SUBMIT SERVICE REQUEST

KRA PIN REGISTRATION

Are you looking for KRA PIN Registration services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN RETRIEVAL

Are you looking for KRA PIN Retrieval services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN UPDATE

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN CHANGE OF EMAIL ADDRESS

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA RETURNS SERVICES

SUBMIT SERVICE REQUEST

KRA NIL RETURNS

Are you looking for KRA Nil Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA EMPLOYMENT RETURNS

Are you looking for KRA Employment Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA AMENDED RETURNS

Are you looking for KRA Amended Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA WITHHOLDING TAX RETURNS

Are you looking for KRA Withholding Tax Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.