The KRA Clearance Certificate holds significant importance in Kenya, typically issued to taxpayers upon the successful completion of filing KRA Returns and payment of any outstanding taxes to the Kenya Revenue Authority (KRA). This document serves as confirmation that the taxpayer, whose details are reflected on the KRA Clearance Certificate is compliant, having fulfilled all obligations by filing KRA Returns and settling tax liabilities as mandated by the law.

In Kenya, the KRA Clearance Certificate plays a crucial role, particularly in job applications. While it serves various purposes, its primary utility lies in employment contexts, where many employers require job seekers to include it in their application submissions. It is part of the 6 key documents that employers in Kenya require from job applicants in the various job opportunities that they may have.

To apply for a KRA Clearance Certificate on iTax, two essential requirements must be met. These prerequisites include possessing a KRA PIN Number and a KRA Password (iTax Password). These credentials are integral for logging into iTax and initiating the online application process for the Tax Compliance Certificate in Kenya. You need to take note that you will be issued with a KRA Clearance Certificate only when you have filed all KRA Returns and paid any tax due to KRA.

READ ALSO: How To Reprint KRA PIN Certificate On iTax

Requirements Needed In Applying For KRA Clearance Certificate On iTax

To be able to successfully apply for KRA Clearance Certificate on iTax, there are two important requirements that you need to ensure you have with you. This includes; KRA PIN Number and KRA Password (iTax Password). Below is a brief description of what each of these requirements entails in relation to the process of How To Apply For KRA Clearance Certificate On iTax.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you when you want to login to iTax. If by any chance you have forgotten or you don’t remember your KRA PIN Number, you can submit KRA PIN Retrieval request online here at CYBER.CO.KE and our support team will be able to assist with the retrieval of your lost or forgotten KRA PIN Number.

At the same time, if you are looking for a new KRA PIN Number, you can get it here in less than 3 minutes by submitting your KRA PIN Registration request at CYBER.CO.KE. Your new KRA PIN Number and KRA PIN Certificate will be sent to your Email Address once the request for KRA PIN Registration has been done and processed by our support team.

-

KRA Password (iTax Password)

The next requirement that you need to have with you in the process of applying for Tax Compliance Certificate on iTax is KRA Password (iTax Password). You will need the KRA Password to access your KRA Portal account. If you don’t know or have forgotten your KRA Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for KRA Password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used on iTax is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at CYBER.CO.KE and have your Email Address changed so as to enable your Reset KRA Password.

Did you know that you can easily apply and get your KRA PIN Number and KRA PIN Certificate online in less than 5 minutes by using CYBER.CO.KE today. Get it via email address or even WhatsApp upon submission.

Here at, CYBER.CO.KE, we offer unmatched KRA PIN Registration, KRA PIN Retrieval, KRA PIN Update and KRA PIN Change of Email Address services to Kenyans daily. Fill and submit your request online today.

How To Apply For KRA Clearance Certificate On iTax

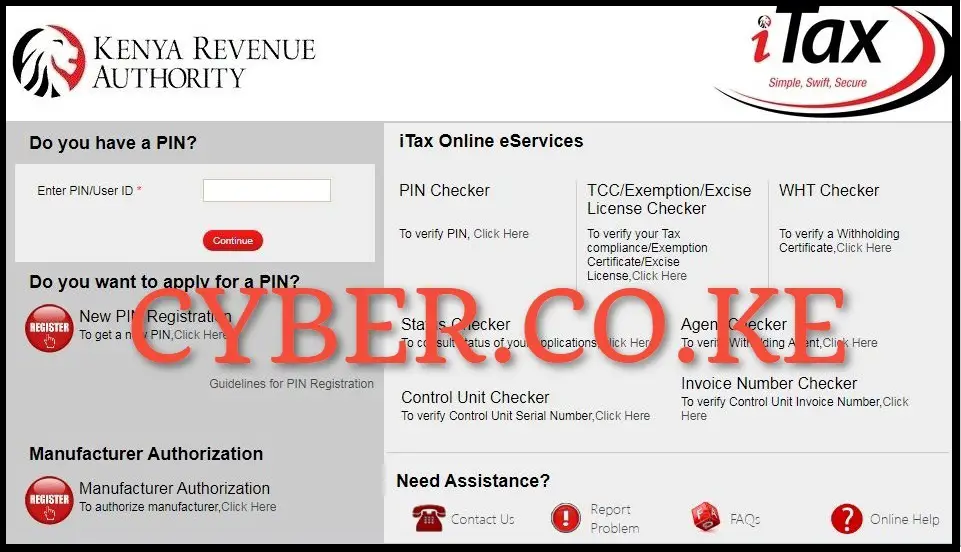

Step 1: Visit iTax

The first step in the process of applying for KRA Clearance Certificate is to visit iTax by using https://itax.kra.go.ke/KRA-Portal/

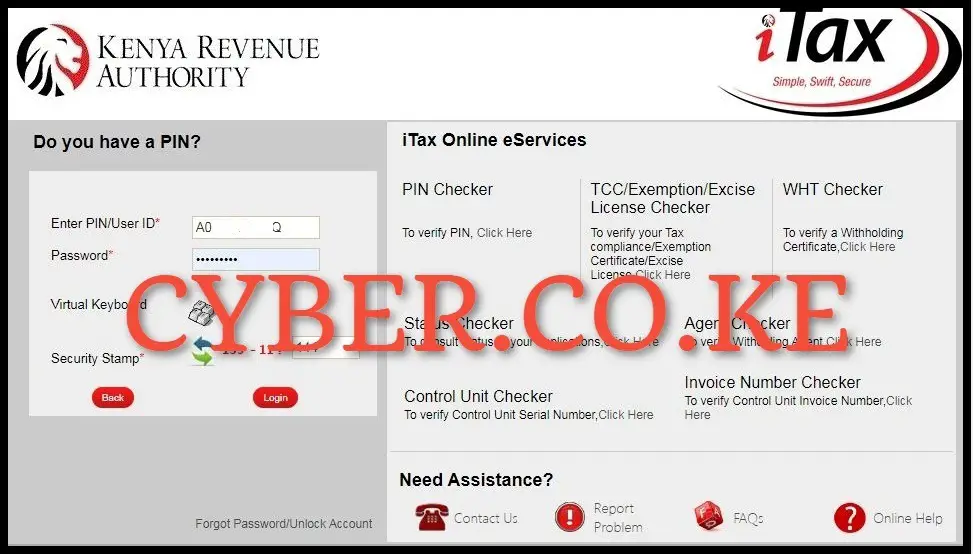

Step 2: Login To iTax

In this step, using both your KRA PIN Number and KRA Password (iTax Password), solve the arithmetic question (security stamp) and click on the “Login” button.

Step 3: Click on the Certificates On The Top Menu Tab

Next, once you have logged into iTax successfully, on the top right hand side menu click on “Certificates” module and then click on “Apply for KRA Clearance Certificate” from the drop down menu list. A pop up message “Please be informed that you are entitled for the KRA Clearance Certificate without any workflow. Please click ‘OK’ to continue” will appear, you are to click on “OK” to proceed to the next step.

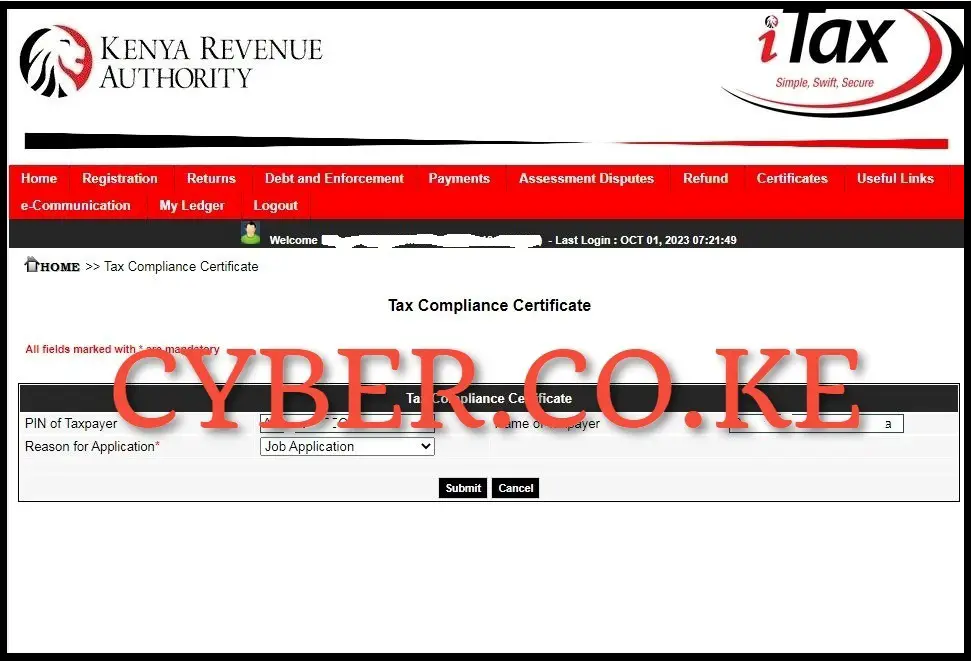

Step 4: Provide Reason for Application of KRA Clearance Certificate

In this step, you are to provide the reason why you are applying for KRA Clearance Certificate. There are many reasons why you might be applying for KRA Clearance Certificate, you can select the most commons reasons as listed on iTax such as Job Application, Government Tender, Renewal of Work Permit, Clearing and Forwarding Agents, Seeking Liquor Licences, Confirmation of Compliance Status or other Regulatory Requirements. Choose one that suits your needs and click on “Submit” button.

Step 5: Download KRA Clearance Certificate

The last step involves downloading the generated KRA Clearance Certificate on iTax. To download the KRA Clearance Certificate click on the text link to download the Clearance Certificate online. The message “Approval Receipt for KRA Clearance Certificate Generated Successfully” means that the process of application for KRA Clearance Certificate on iTax is complete and it has been auto approved by the system.

READ ALSO: How To Download KRA Payment Slip On iTax

The above 5 steps sums up the process that one needs to follow when applying for KRA Clearance Certificate on iTax. Take note that you will only be issued with KRA Clearance Certificate when you don’t have any pending KRA Returns or pending Tax Liabilities. Also, you will be issued with the KRA Clearance Certificate immediately if you are compliant in matters KRA Returns and KRA Tax Payments. So, next time you want to apply for KRA Clearance Certificate on iTax, you need to follow the above 5 key steps involved in that process.

Matthews Ohotto is an Article Writer at CYBER.CO.KE and a Video Creator at Video Tutorials Kenya (YouTube). He specializes in crafting insightful Blog Posts and Video Tutorials that empower Kenyans with practical digital skills. He is a holder of Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT).

KRA INDIVIDUAL SERVICES

SUBMIT SERVICE REQUEST

KRA PIN REGISTRATION

Are you looking for KRA PIN Registration services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN RETRIEVAL

Are you looking for KRA PIN Retrieval services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN UPDATE

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN CHANGE OF EMAIL ADDRESS

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA RETURNS SERVICES

SUBMIT SERVICE REQUEST

KRA NIL RETURNS

Are you looking for KRA Nil Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA EMPLOYMENT RETURNS

Are you looking for KRA Employment Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA AMENDED RETURNS

Are you looking for KRA Amended Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA WITHHOLDING TAX RETURNS

Are you looking for KRA Withholding Tax Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.