Are you looking to get a KRA Clearance Certificate on iTax Portal? Learn How To Apply For KRA Clearance Certificate Using iTax Portal.

One of the most important documents that is sought after by many taxpayers in Kenya is the KRA Clearance Certificate. The applications of this document are many but two are the most important i.e. Job Application Requirement and Tender Application Requirement. Know How To Apply For KRA Clearance Certificate is quite important to any Kenyan out there.

In this article, I am going to share with you the step by step guide on the process that you need to take when applying for KRA Clearance Certificate using the KRA iTax Portal. Getting to know how to apply for KRA Clearance Certificate is important as you will be issued with that important certificate that shows you have been compliant to Kenya Revenue Authority (KRA).

READ MORE: How To File KRA Returns Using KRA iTax Portal In 2020

At the end of this article, you will have known and learnt more about the Clearance Certificate by Kenya Revenue Authority (KRA) an how how you can easily get the Clearance Certificate by KRA by following our step by guide on How To Apply For KRA Clearance Certificate.

Just as I have mentioned above, knowing How To Apply For Clearance Certificate in Kenya by taxpayers is quite important. This article will seek to highlight on some important key aspects and terms pertaining to Clearance Certificate by KRA in Kenya.

We shall be covering terms such as: What Is KRA Clearance Certificate, Features Of KRA Clearance Certificate, Key Application Areas Of KRA Clearance Certificate, Reasons For Approval Of KRA Clearance Certificate, Reasons For Disapproval Of KRA Clearance Certificates, Requirements Needed For Application Of KRA Clearance Certificate and How To Apply For KRA Clearance Certificate Using iTax Portal.

What Is KRA Clearance Certificate?

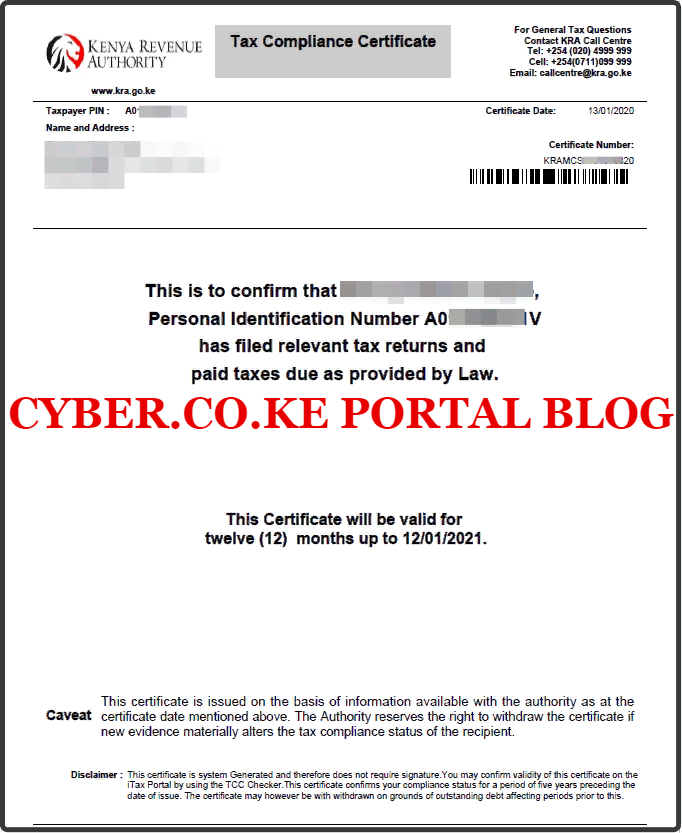

KRA Clearance Certificate is a document that is issued by Kenya Revenue Authority (KRA) to taxpayers who have complied to the set Income Tax Laws in Kenya by filing their Tax Returns and paying any taxes due to Kenya Revenue Authority (KRA) as provided and stipulated by the Law. The KRA Clearance Certificate is valid for a period of 12 months from the date it has been issued to a taxpayer. So after a period of the 12 months, you will need to apply for a new KRA Clearance Certificate using iTax Portal.

The Clearance Certificate is issued to taxpayers who have been compliant to the set Tax Lawas in Kenya. Being compliant means that you have no pending liabilities or pending returns with Kenya Revenue Authority (KRA). In simpler terms, compliant means you don’t owe KRA anything in terms of unpaid taxes. So, when you are compliant, something that Kenya Revenue Authority (KRA) wants all taxpayers to be, then applying for a Clearance Certificate will be a walk in the park for you. You will be able to get the TCC in less than 3 minutes of application.

If you are tax compliant, then KRA will issue you with a Clearance Certificate immediately you have finished applying for it on iTax. If you are not compliant, then KRA will give you the details of the pending returns and pending liabilities i.e. the years that you did not submit your KRA Returns and the years you have not paid for the liabilities accrued. You will have to settle all liabilities that you have with KRA before you can be issued with the KRA Clearance Certificate.

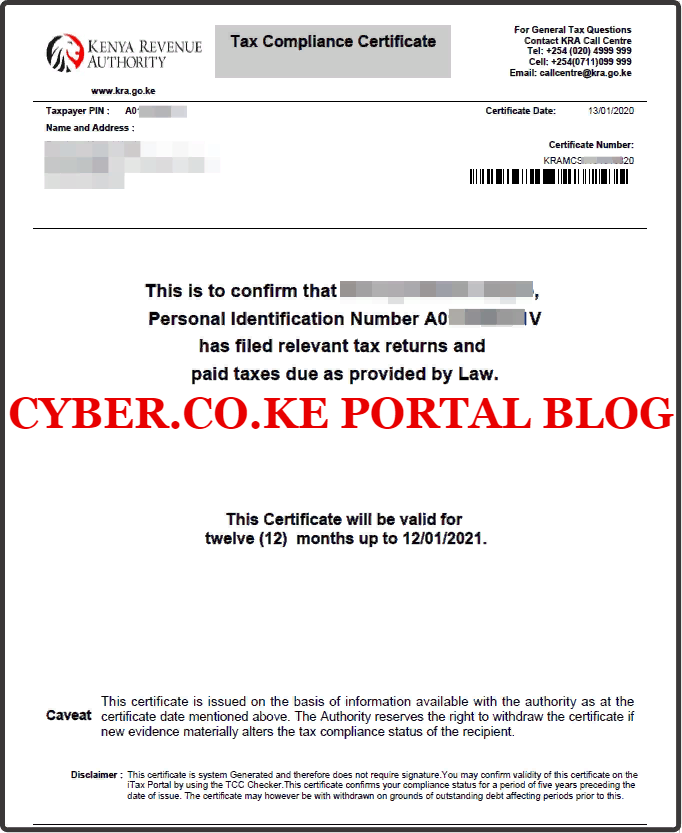

Having looked at what we mean by KRA Clearance Certificate above, we now need to look at Features Of KRA Clearance Certificate. When I talk about features of the Clearance Certificate, I simply mean the parts that form or make up the Clearance Certificate by KRA.

Features Of KRA Clearance Certificate

Just like any other document that is issued by Kenya Revenue Authority (KRA) such as KRA PIN Certificate for Individuals, KRA PIN Certificate for Companies, KRA PIN Certificates for Self Help Groups e.t.c, all these documents have unique features associated with them. The same applies to the KRA Clearance Certificate. The Clearance Certificate by KRA has some important features that every taxpayer needs to know just as outlined below.

From the above illustration, you will note that the Clearance Certificate by KRA is made up of Title of Document i.e. KRA Clearance Certificate or Tax Compliance Certificate (TCC); Header Section that is comprised of the Taxpayer PIN, Name and Address, Certificate Date and Certificate Number; Middle Section i.e. Information of the Clearance Certificate i.e. Name of the Taxpayer, Personal Identification Number (PIN) and Clearance Certificate Validity Period; and last section is the Footer that is made up of basically the Caveat and Disclaimer as you have noticed above.

Having looked at the main features or sections (parts) that make up the Clearance Certificate by KRA above, we now need to look at the Key Application Areas Of KRA Clearance Certificate. We need to basically understand where this Clearance Certificate is needed the most in Kenya.

Key Application Areas Of KRA Clearance Certificate

Normally, there exists two key applications areas of the KRA Clearance Certificate. These are Job Application Requirement and Tender Application Requirement. This is as outlined below.

-

Job Application Requirement

One of the main requirement for job applications in Kenya is the KRA Clearance Certificate. Nearly all employers in Kenya require that all applicants attach their Clearance Certificates together with their Job Application Resume and Documents. Some use the Clearance Certificate as an added advantage while others use it as atie breaker. This is because most employer want to employ job seekers who are compliant and have no pending penalties or liabilities. So, you need to get the Clearance Certificate if you want to increase your chances of securing that job in Kenya.

-

Tender Application Requirement

So you own a company and want to be prequalified for any given tender in Kenya, well you need to ensure that you have a KRA Clearance Certificate. You will need to submit the Clearance Certificate together with your tender application documents. This is because the Clearance Certificate by KRA is one of those documents that play an important role in the prequalification process of any given tender in Kenya. So you need to get that important document if you need to even get a small chance of getting prequalified.

Having looked at the main key areas where the Clearance Certificate is needed the most in Kenya, we need now to shift gears and look at Reasons For Approval Of KRA Clearance Certificate and Reasons For Disapproval Of KRA Clearance Certificates.

Reasons For Approval Of KRA Clearance Certificates

What are the main reasons why KRA Clearance Certificate Application is Approved? Well, the answer is quite simple: It is approved because you don’t have any pending returns or pending liabilities. So, if you fit into this criteria, then your application for KRA Clearance Certificate will normally get approved immediately upon application. This is because the process of Approval of Clearance Certificate starting this year 2020 has been changed by KRA and you will no longer have to wait for days in order to get your Clearance Certificate by KRA anymore, you get it immediately upon application.

Reasons For Disapproval Of KRA Clearance Certificates

What are the main reasons why KRA Clearance Certificate Application is Disapproved or Declined? Well, the answers is basically: you have pending un-filed returns on iTax for a given year and also you have pending unpaid taxes or liabilities. So, the application for Clearance Certificate is normally declined because of the two main reasons above. You will need to ensure that you file all pending returns and pay all pending liabilities before you can be issued with the Clearance Certificate. Once you have sorted all this out, then you can go ahead and apply for the KRA Clearance Certificate.

Now that we know the main reasons for Approval and Disapproval of KRA Compliance Certificates, we need to look at the Requirements Needed For Application Of KRA Clearance Certificate. Basically these are the requirements that you need to have with you before you apply for KRA Clearance Certificate on iTax.

Requirements Needed For Application Of KRA Clearance Certificate

To be able to apply for KRA Clearance Certificate on iTax, you need to ensure that you have with you KRA PIN Number and KRA iTax Password. These are basically the most important requirements for the process of Clearance Certificate Application on iTax. This is as described and illustrated below.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable your Reset KRA iTax Password.

Now that we have looked at the key requirements that are needed in the process of applying for KRA Clearance Certificate, we can now go ahead and look at the step by step process of How To Apply For KRA Clearance Certificate Using iTax Portal.

How To Apply For KRA Clearance Certificate Using iTax Portal

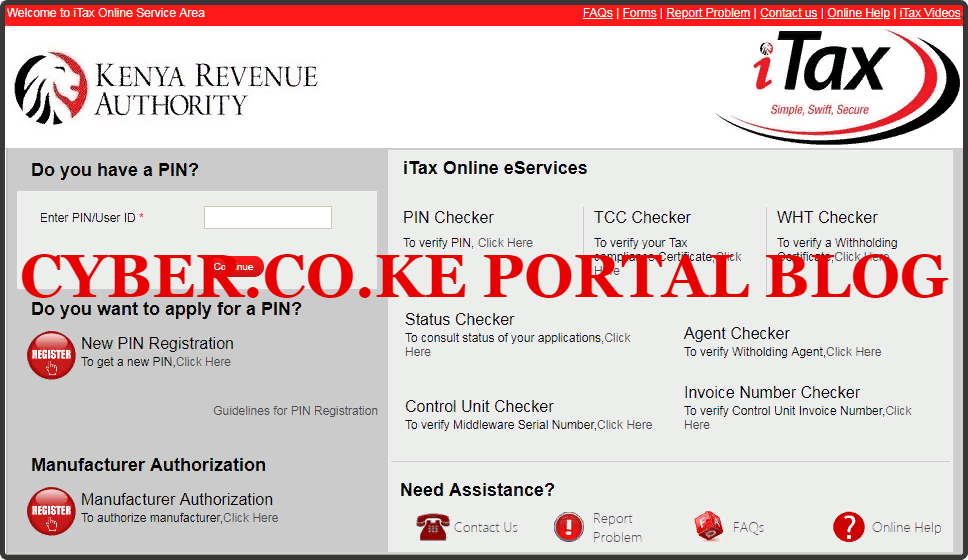

Step 1: Visit KRA Portal

The first step that you need to take in the process of Applying for KRA Clearance Certificate on iTax is to visit the KRA iTax Portal by clicking on the link provided in the above description.

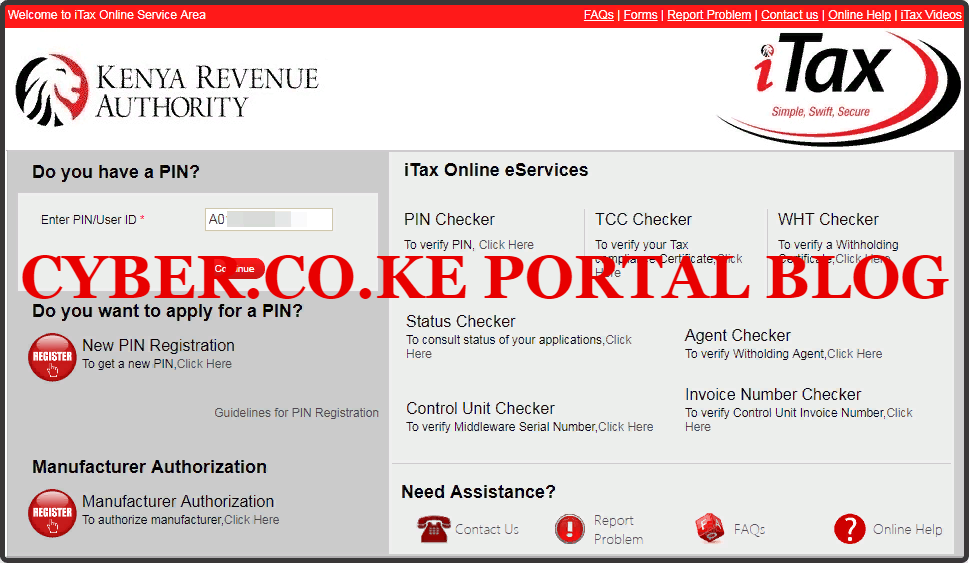

Step 2: Enter Your KRA PIN Number In the PIN/User ID Section

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

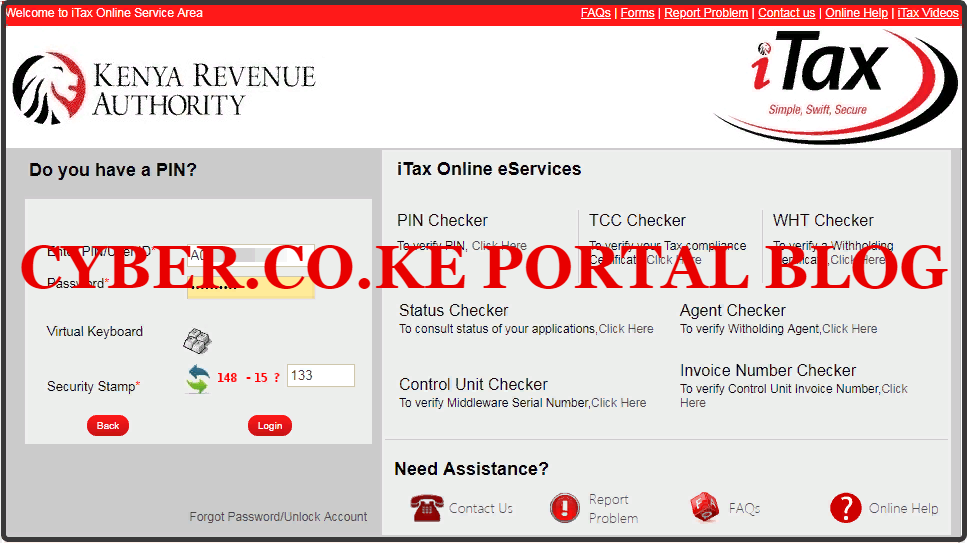

Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: KRA iTax Portal Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA iTax Web Portal Account Dashboard. Here upon successful login process, you are able to view a wide range of iTax Portal functionalities. Since in this article we are learning about How To Apply For KRA Clearance Certificate, we proceed to Step 5.

Step 5: Click On Certificate Followed By Apply For KRA Clearance Certificate (TCC)

In this step, you will need to click on the Certificate menu tab then from the drop down menu list click on Apply for Tax Compliance Certificate (TCC). This is as outlined in the screenshot below.

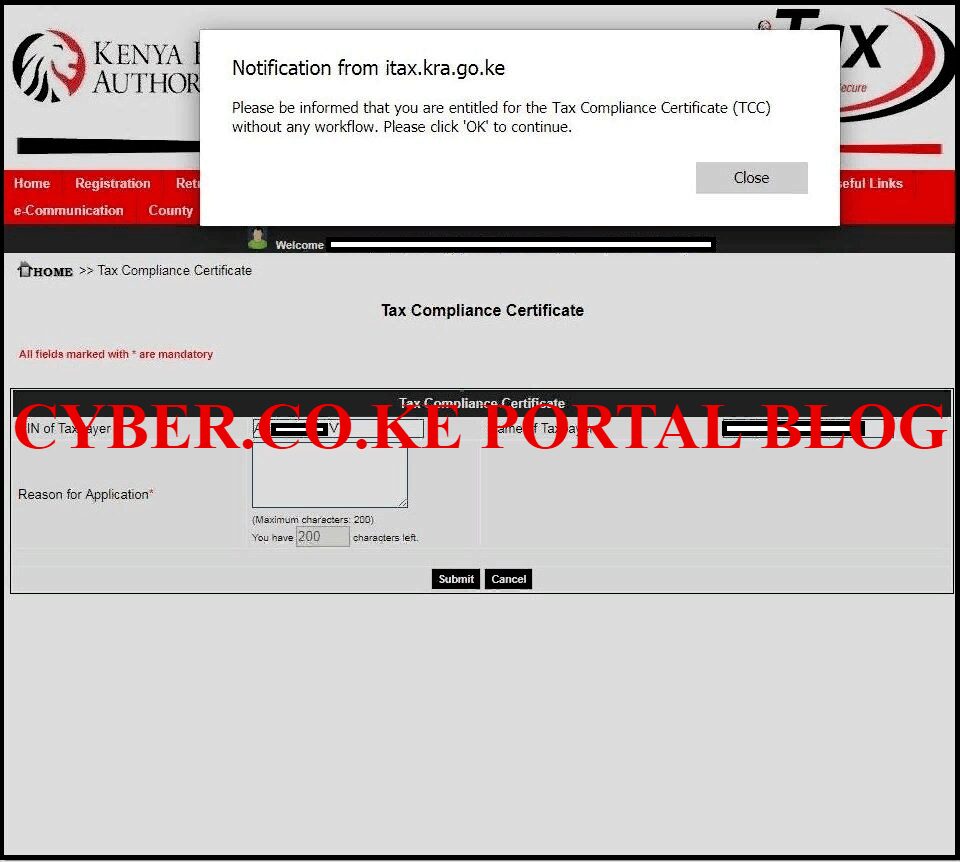

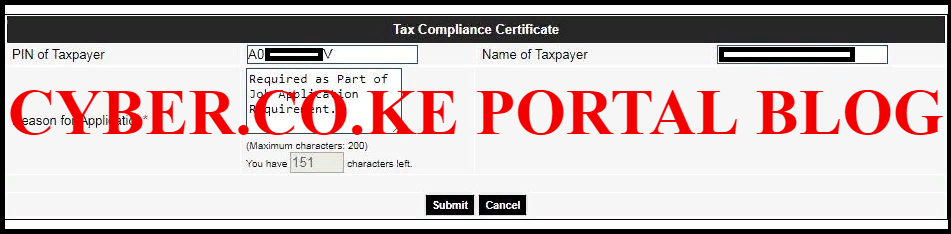

Step 6: Fill In The KRA Clearance Certificate Form

In this step, you will have to fill in the reason for your application for Clearance Certificate by KRA. This can either be Job Application Requirement or even Tender Application Requirement. The reason you give here here depend on what you need the Clearance Certificate for.

Normally, there are two pop up notifications from itax.kra.go.ke that you will get when applying for the Clearance Certificates by KRA. You will take note that with this new enhancement, a popup window will be display as shown in the image above saying: “Please be informed that you are entitled for the Tax Compliance Certificate (TCC) without any workflow. Please click OK to continue.” What the above message simply means is that when you choose to apply for the KRA Clearance Certificate on iTax, it will be issued to you immediately upon application.

The other message that you will get for those who have pending un filed returns and liabilities at KRA when applying for Clearance Certificate is: “Please note that you cannot apply for TCC as you have pending return/payment to be filed or liability to be paid. Please click OK to view the details of pending returns.” What this message is that you will not get issued with the Clearance Certificate until you file all pending returns and pay all pending liabilities on iTax.

For those who get the first message, you can go ahead and fill in the reasons for application for your Clearance Certificate by KRA. This is as illustrated in the screenshot below.

Once you have filled in the reason for Clearance Certificate application, click on the “Submit” button to submit the application request to Kenya Revenue Authority (KRA).

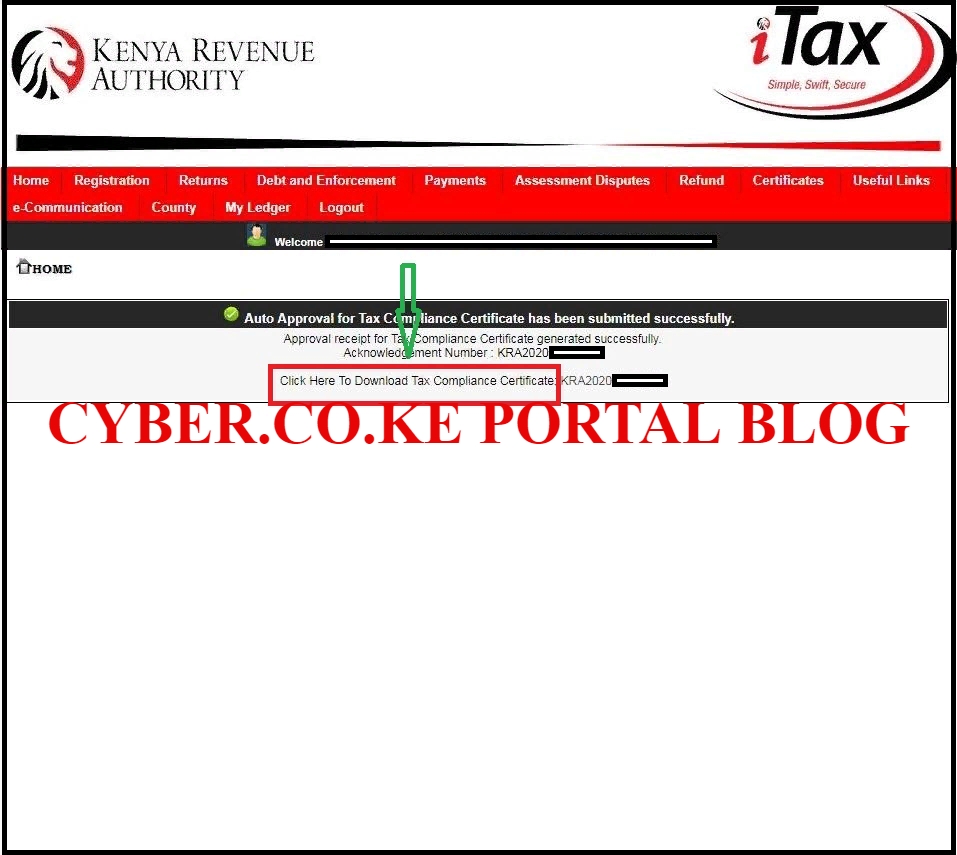

Step 7: Download KRA Clearance Certificate

This is the last step whereby you will need to download the Approved Clearance Certificate. You will also need to take note of the approval receipt for the KRA Clearance Certificate that also has an acknowledgement number associated with it. This is as shown below:

Once you have downloaded the KRA Clearance Certificate, you will be able to make copied for future uses when it will be needed. Also you need to take note that the Clearance Certificate is only valid for a period of 12 months from that date it was issued. Below is a screenshot of the KRA Clearance Certificate.

READ ALSO: KRA Announces New PAYE And VAT Rates In Response To COVID-19

The above steps form the process of applying for the KRA Clearance Certificate in Kenya. One thing that you need to take note is that you need to ensure that you have with you the KRA PIN Number and KRA iTax Password before you begin the process of applying for Clearance Certificate on iTax. So, next time you are in need of your KRA Clearance Certificate, just follow our step by step guide on How To Apply For KRA Clearance Certificate Using iTax Portal.

Matthews Ohotto is an Article Writer at CYBER.CO.KE and a Video Creator at Step-by-Step Tutorials Kenya (YouTube). He specializes in crafting insightful Blog Posts and Video Tutorials that empower Kenyans with practical digital skills. He is a holder of Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT).

KRA INDIVIDUAL SERVICES

SUBMIT SERVICE REQUEST

KRA PIN REGISTRATION

Are you looking for KRA PIN Registration services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN RETRIEVAL

Are you looking for KRA PIN Retrieval services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN UPDATE

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN CHANGE OF EMAIL ADDRESS

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA RETURNS SERVICES

SUBMIT SERVICE REQUEST

KRA NIL RETURNS

Are you looking for KRA Nil Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA EMPLOYMENT RETURNS

Are you looking for KRA Employment Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA AMENDED RETURNS

Are you looking for KRA Amended Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA WITHHOLDING TAX RETURNS

Are you looking for KRA Withholding Tax Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.