Get to know How To Apply For KRA Waiver Using iTax online today. Follow our step by step guide in applying for KRA Waiver.

In this article, I am going to share with you the step by step guide involved in the process of applying for Waiver of penalties in your iTax account. You might be forced to apply for Waiver when you have penalties on your iTax account.

The KRA Penalties normally arise as a result of you failing to file your returns on time i.e filing returns after the lapse of the return period that runs from 1st January to 30th June. So, by any chance you file your KRA Returns past this returns period window, then you will be penalized automatically by KRA for late filing.

READ ALSO: How To Write KRA Waiver Letter

So, always remember that filing of your returns whether employed or unemployed in crucial. Don’t take it for granted. Now, our main focus on this article will be in the process of applying for KRA Waiving using iTax portal.

What Is KRA Waiver?

A waiver application is a request made by a taxpayer for consideration on penalties and interest to be remitted where they fail to pay their taxes or file returns by stipulated due dates to Commissioner Domestic Taxes. This provision covers only penalty and interest. The principal tax has to be settled in full.

Requirements for KRA Waiver Application

Before you start the waiver application process, there are three items that you need to have with you so as to make the process flow smoothly without any hitches. This is as outlined below:

- Your KRA PIN Number

- Your iTax Password

- KRA Waiver Letter

Your KRA PIN Number

This is the most important item in your list for the process of KRA Waiver application. If you have forgotten your KRA PIN Number, you can always request it here on our KRA PIN Retrieval section at Cyber.co.ke Portal.

Your iTax Password

Next, you need your iTax password. The password will enable you log into your iTax portal account. If you have forgotten your iTax password, you can read our guide on How to Reset KRA iTax Password. If you have forgotten the email address address you used during KRA PIN Application, you can request for KRA Change of Email Address here at Cyber.co.ke Portal.

KRA Waiver Letter

The last item on your Waiver application is the KRA Waiver Letter. Basically this is a letter giving out the reasons why you require the penalties to be waived. You can check our article on How to Write KRA Waiver Letter. You can even download and use our KRA Waiver Letter samples both MS Doc and PDF versions.

Now that you have the above items with you, we can proceed and look at the steps that are involved in the process of applying for KRA Waiver on iTax.

How To Apply For KRA Waiver Using iTax

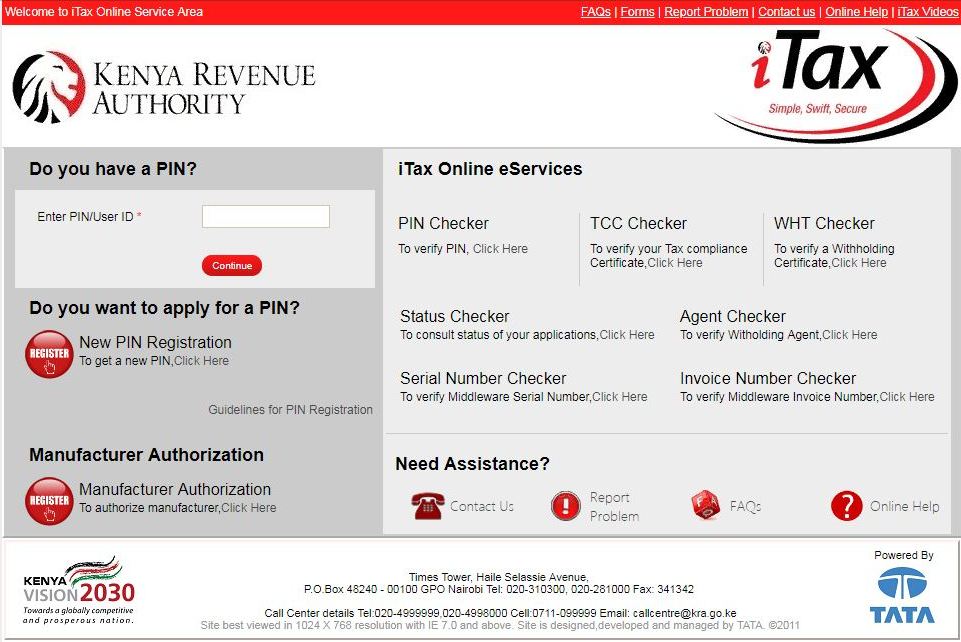

Step 1: Visit iTax Portal

First, you need to access the KRA iTax Portal using the link provided above. Below is a screenshot of the same.

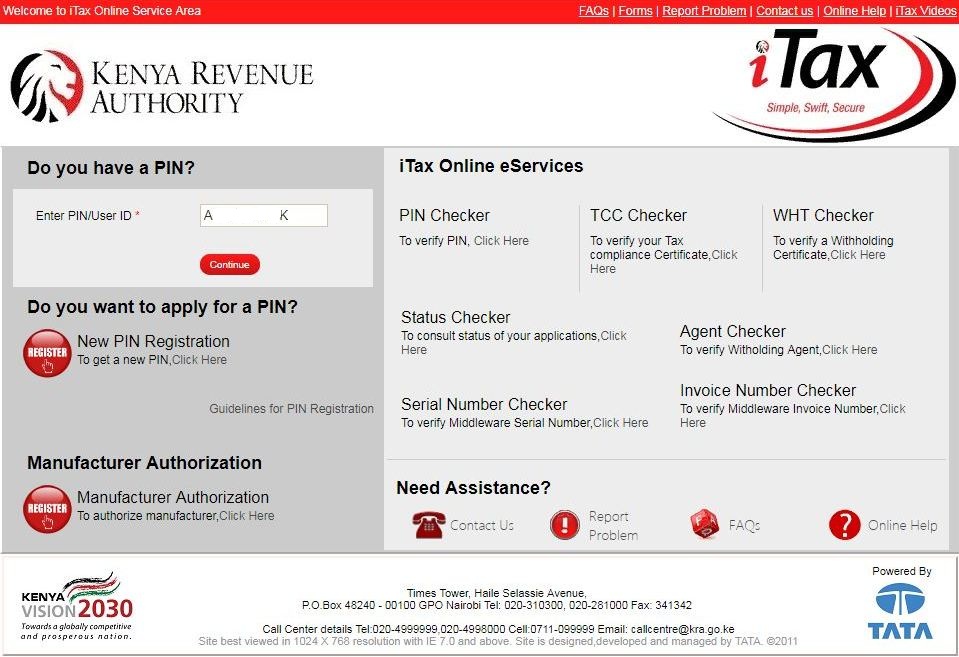

Step 2: Enter your KRA PIN Number

Next, you will be required to enter your KRA PIN Number. Once you have entered your KRA PIN Number, click on the Continue button to proceed to the next step.

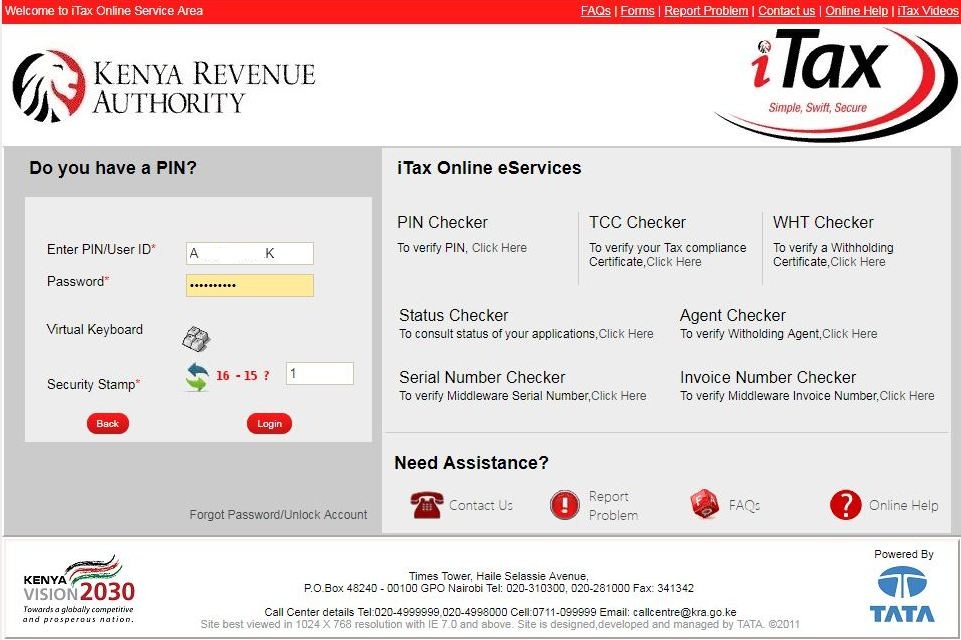

Step 3: Enter your iTax Password

In this step, you will be required to enter your KRA iTax Password and at the same time solve the arithmetic question (security stamp). Once you have done this, you can proceed and click on the login button.

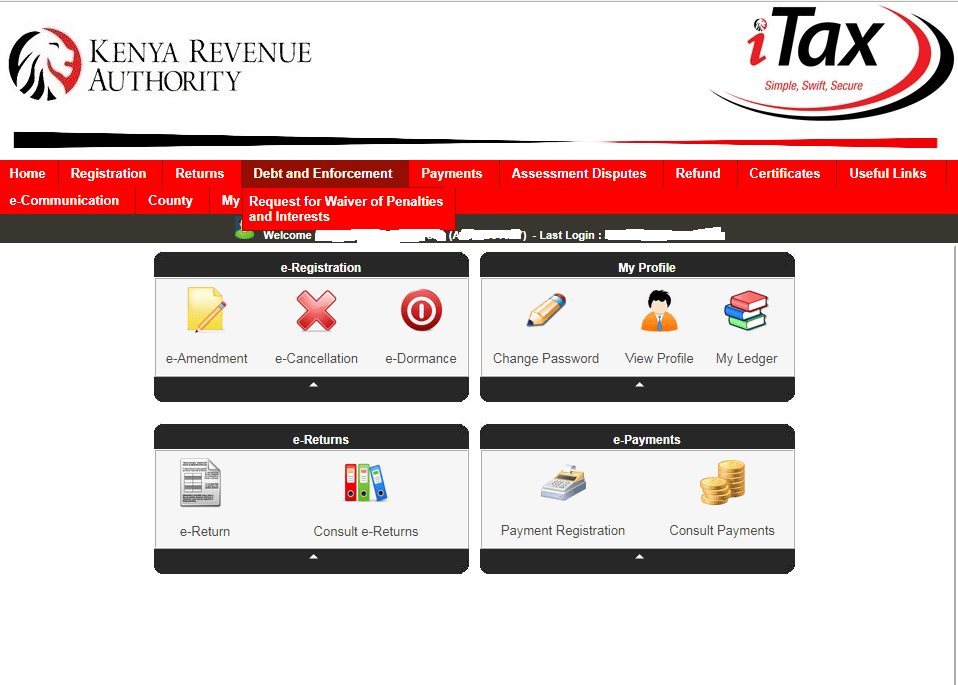

Step 4: iTax Account iPage

Once you have successfully entered your KRA PIN Number and iTax Password, you will be taken to your iTax iPage account (KRA Web Portal Account). The screenshot is as shown below.

Step 5: Click on Debt and Enforcement tab then Request for Waiver of Penalties and Interest sub menu tab

In this step, you are required to click on the Debt and Enforcement tab. Just underneath it there will be a drop down sub-menu tab written Request for Waiver of Penalties and Interests. This is what you click on so as to proceed to the next step.

Step 6: Application Form for Waiver

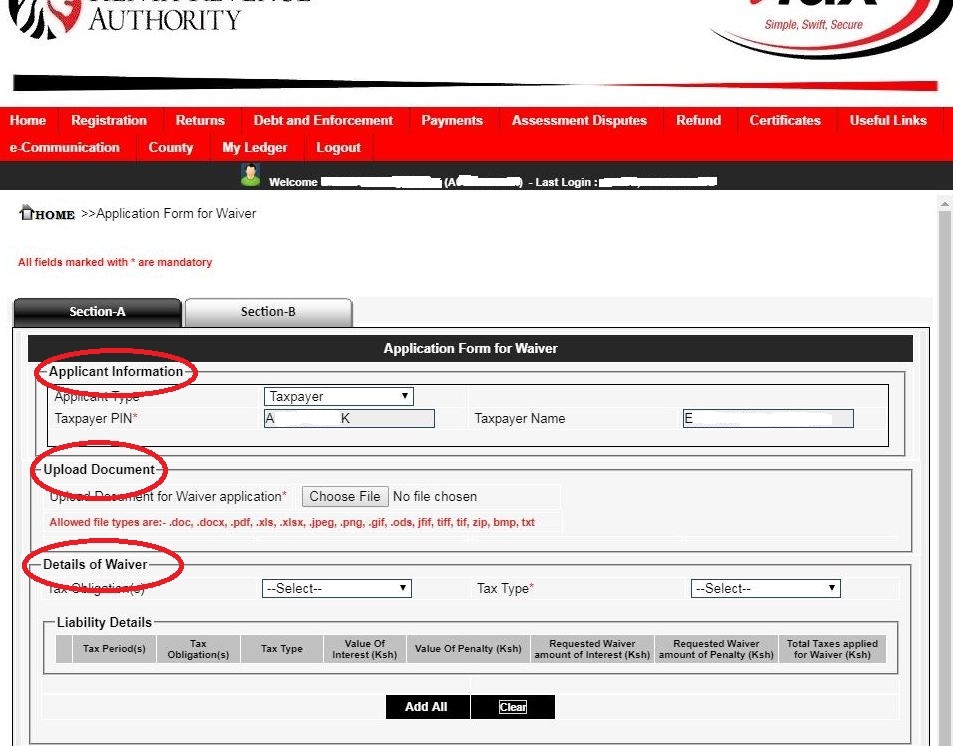

This is the most important step in the process of Waiver Application. Basically the KRA Waiver Application Form contains the following fields:

- Section A

- Section B

- Applicant Information (Applicant Type, Taxpayer PIN and Taxpayer Name)

- Upload Document (Upload Document for Waiver Application i.e KRA Waiver Letter)

- Details of Waiver (Tax Obligation and Tax Type)

The screenshot below outlines all the above fields in details.

Step 7: Fill in Application Form for Waiver and Upload KRA Waiver Letter

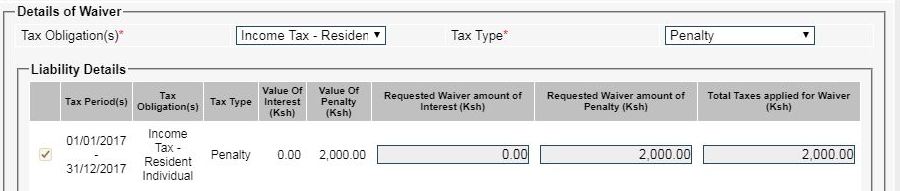

In this step, you will need to upload the KRA Waiver Letter and add the details of waiver i.e liability details. Take note that the Applicant Information part is auto-populated so you main focus here will be to upload the KRA Waiver Letter and the Fill the Details of Waiver. You need to select the tax obligation (Income Tax Resident Individual) and then select the tax type (Penalty). Once you select the tax tax, all the liabilities (KRA Penalties) will auto-populate.

Once you have filled in the details of the waiver, ensure that you have uploaded your KRA Waiver Letter under the upload section.

Once you have filled in the Waiver form correctly and uploaded the Waiver letter, click on the submit button.

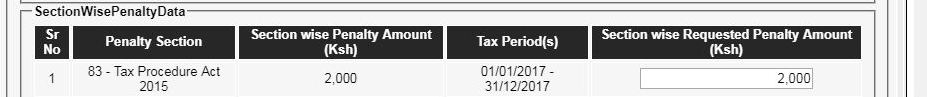

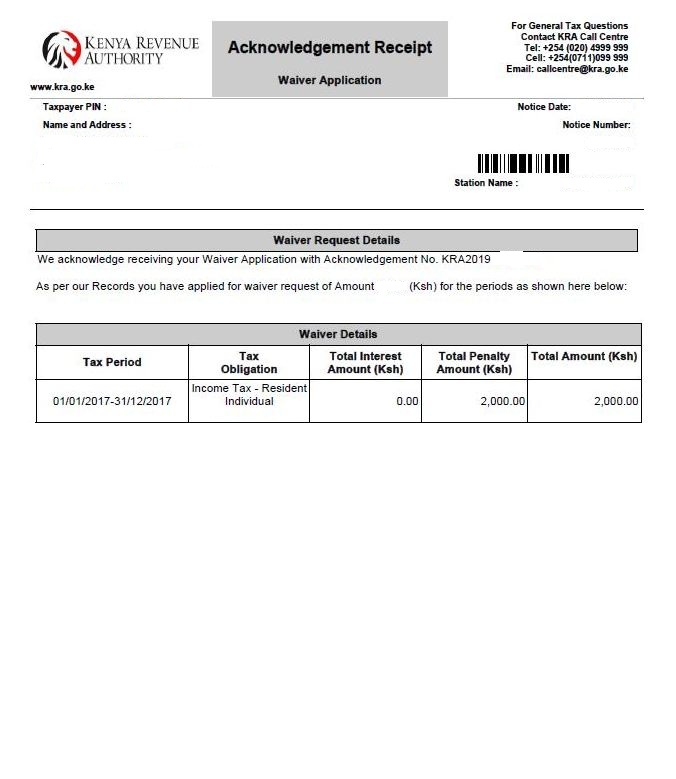

Step 8: Download Acknowledgement Receipt for KRA Waiver Application

The last step after submitting your KRA Waiver Application request on iTax is to download the acknowledgement receipt for KRA Waiver application.

Click on the Download link to download the KRA Waiver receipt. This is a final confirmation that you have applied for KRA Waiver on Penalties in your iTax account. Also you can use the Waiver receipt to track the status of you KRA Waiver Application.

To sum everything up, the above steps are the ones you need to follow when applying for your KRA Waiver in iTax portal. Feel free to share this article online with those who are looking for the process of How to Apply for KRA Waiver using iTax portal.

Kindly note that your reasons for not filing the returns on time is what will determine whether the KRA Waiver Application will be approved or not.

DON’T MISS OUT. CHECK OUT OUR TRENDING POPULAR BLOG POSTS IN KENYA.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

KRA PIN REGISTRATION

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

KRA PIN RETRIEVAL

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

KRA PIN UPDATE

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

KRA PIN CHANGE OF EMAIL ADDRESS

Stay Tax Compliant in Kenya

Contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.