Get to know the steps involved on How To Change KRA Email Address Using KRA iTax Portal. Change KRA iTax Email Address on your KRA PIN Certificate today.

If you have forgotten or no longer use the email address appearing on your KRA PIN Certificate, then it is high time that you change it for good. Going about the process of changing KRA Email Address is sometimes seemed a daunting task for many taxpayers in Kenya, but not anymore.

In this article, I am going to share with you the necessary steps that you need to follow in order to change the KRA Email Address appearing on your KRA PIN Certificate. Just as we have being discussing in all the previous articles, we need to lay down the foundation by defining what a KRA Email Address is.

READ ALSO: How To Confirm The Validity Of KRA PIN Using iTax PIN Checker

Normally, to be able to access your KRA Portal Account, you need to have with you the credentials that are needed i.e. KRA PIN Number and iTax Password. These tow form the basis of accessing iTax Account with ease. But in most cases, many Kenyans either have forgotten their KRA PIN Number or even the email that they used in KRA PIN Portal or KRA Portal (iTax Portal).

The good thing is that incase you have forgotten your KRA PIN Number or even iTax Password (KRA Password), here at Cyber.co.ke Portal we can gladly assist you with that. Incase you have forgotten your KRA PIN, then you can request for KRA PIN Retrieval and have both your KRA PIN Number and KRA PIN Certificate sent to you.

Incase you have forgotten your iTax Password, you can request for KRA PIN Change of Email Address so that you can be able to change your KRA Password. Normally to be able to change your KRA Email Address you need to access to your iTax Account. But the shortest and quickest way to change the KRA Email is by using our services.

What is KRA Email Address?

The KRA Email Address is a unique identifier for KRA iTax Accounts for Taxpayers in Kenya. Each Taxpayer has a unique Email Address that is not shared with any other person on iTax Portal. The KRA Email Address can either be Gmail, Yahoo or Outlook. And in some cases, company or organization email addresses can be used.

Without a KRA Email Address, then getting access to your KRA iTax Web Portal Account can be a daunting task. Now that we have defined what KRA Email Address is, we need to look at the core functions that Email Address play in KRA iTax Portal.

Functions of KRA Email Address

The Email Addresses in KRA iTax Portal play three crucial functions in line with the iTax Portal. This includes the following:

-

Receiving iTax First Time Login Credentials

The default function of all Email Addresses used on KRA iTax Portal is to receive the iTax First Time Login Password and KRA PIN Certificate document. When applying for KRA PIN Registration at Cyber.co.ke Portal, you default password together with a copy of your KRA PIN Certificate (PDF Format) will be sent to your KRA Email Address. In this case, you will need to log into your Email Address to access these two important items from Kenya Revenue Authority (KRA) Domestic Taxes Department (DTD).

-

Resetting KRA iTax Password

The other common function that KRA Email Addresses play is that they come in handy when a Taxpayer needs to change his or her iTax Password. This process is what sometimes being referred to as Reset iTax Password. When you have forgotten your KRA iTax Password, knowing the email address that you used while creating your KRA PIN is quite important. This is because the Reset Password will be sent to your Email Address. You can check out this article on How To Reset KRA iTax Portal.

-

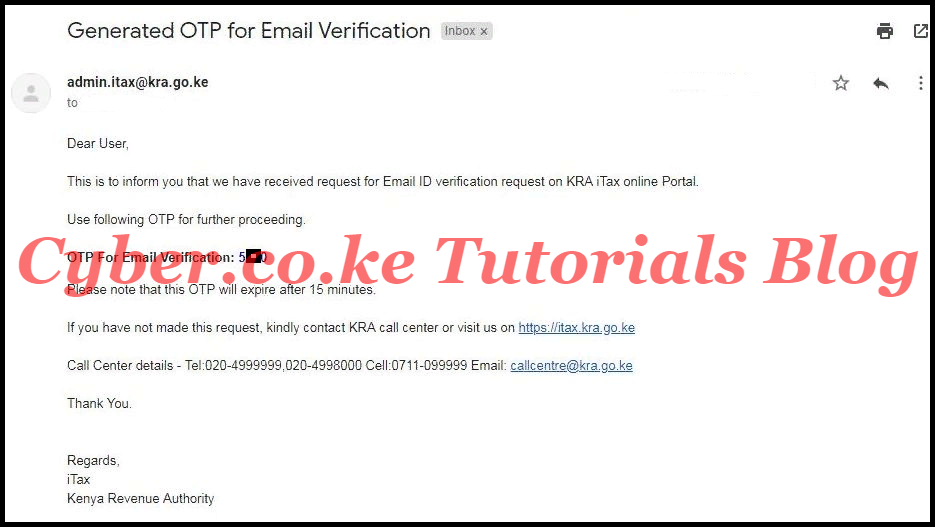

Receiving KRA OTP Codes

The other function that KRA Email Addresses plays is that they come in handy when you need to receive the KRA OTP Codes (KRA One Time Password). The KRA OTP is just a four digit code that is used to verify a Taxpayer Email Address on iTax Portal. These Codes are normally important when you are registering for a KRA PIN at Cyber.co.ke Portal and also when you need to change an existing Email Address in KRA iTax Account. Your can check out our page about KRA OTP Codes.

I think you now have an understanding of what KRA Email Address is and also the three main functions that the Email Addresses plays in KRA iTax Portal. Now, we need to look at the requirements needed for Changing the KRA Email Address on iTax Portal.

Requirements Needed for Changing KRA Email Address on iTax Portal

There are two main requirements that you need fulfill or have with you before you begin the process of Changing KRA Email Address. These includes the following:

-

KRA PIN Number

This is the first item that you need to have with you before beginning the process of KRA Email Change. If you don’t know or have forgotten your KRA PIN Number, you can request for KRA PIN Retrieval Service here at Cyber.co.ke Portal. Just place and submit your order for KRA PIN Retrieval and our Support Team will gladly assist you in retrieving your lost or forgotten KRA PIN Number.

-

KRA iTax Password

The next item that you need to have with your is your KRA iTax Password. If you have forgotten your KRA Password, you can check out our article on How To Reset KRA iTax Password. You need to note that the Change of iTax Password will only be successful if you know your current email address as your reset password will be sent to that email. If you need to know the Email Address that you used in iTax, you can check our article on How To Find The KRA Email Address Used On KRA iTax Portal.

If you no longer have access or no longer use that email address, you can submit your order online for KRA PIN Change of Email Address at Cyber.co.ke Portal and our Support Team will glady assist you on that. The same applies in case you also forgot your KRA PIN Number, retrieve here at Cyber.co.ke Portal today quickly and easily.

Now that you know of the requirements that you need in the process of Changing KRA Email Address, we can now look at the steps on How To Change KRA Email Address on iTax Portal.

How To Change KRA Email Address Using KRA iTax Portal

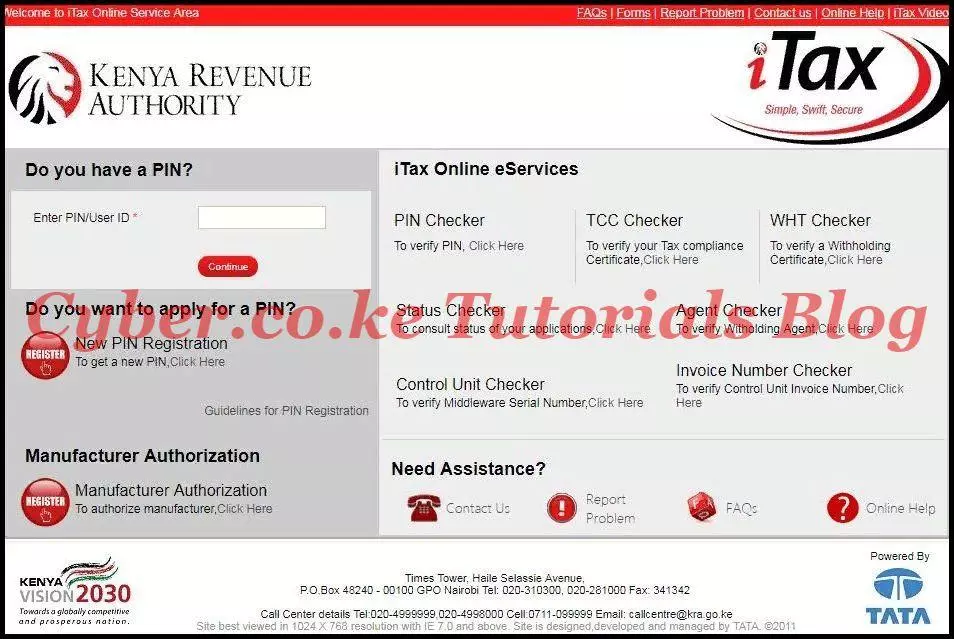

Step 1: Visit iTax Portal

The first step in this process involves visiting the KRA iTax Portal using the link provided in the above description.

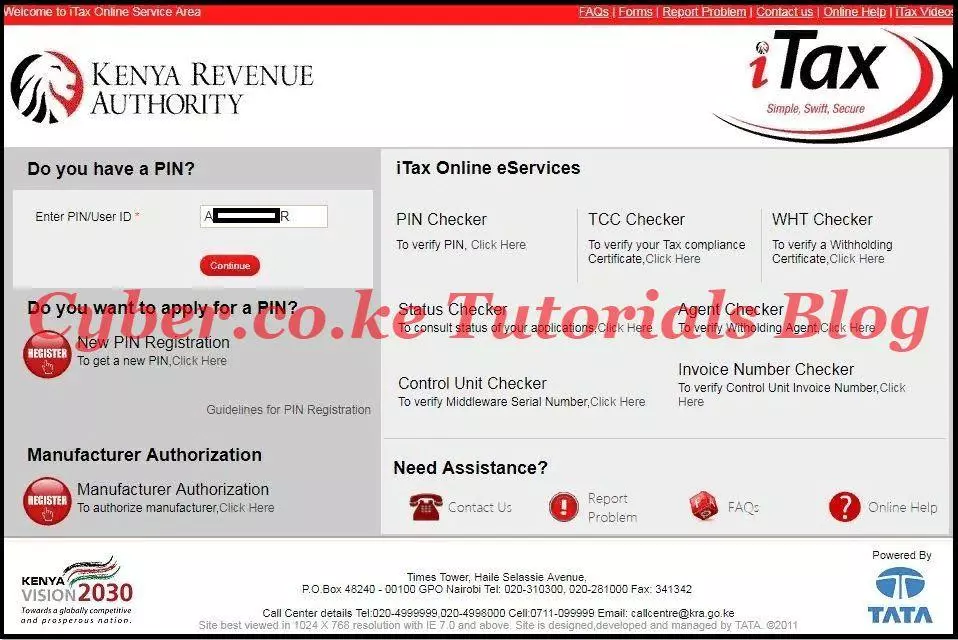

Step 2: Enter Your KRA PIN Number

In this step, you will required to enter your 11 digits KRA PIN Number. If you dont know or have forgotten your KRA PIN Number, submit order online for KRA PIN Retrieval here at Cyber.co.ke Portal. Once you have entered your KRA PIN Number, click on the “Continue” button to proceed to the next step.

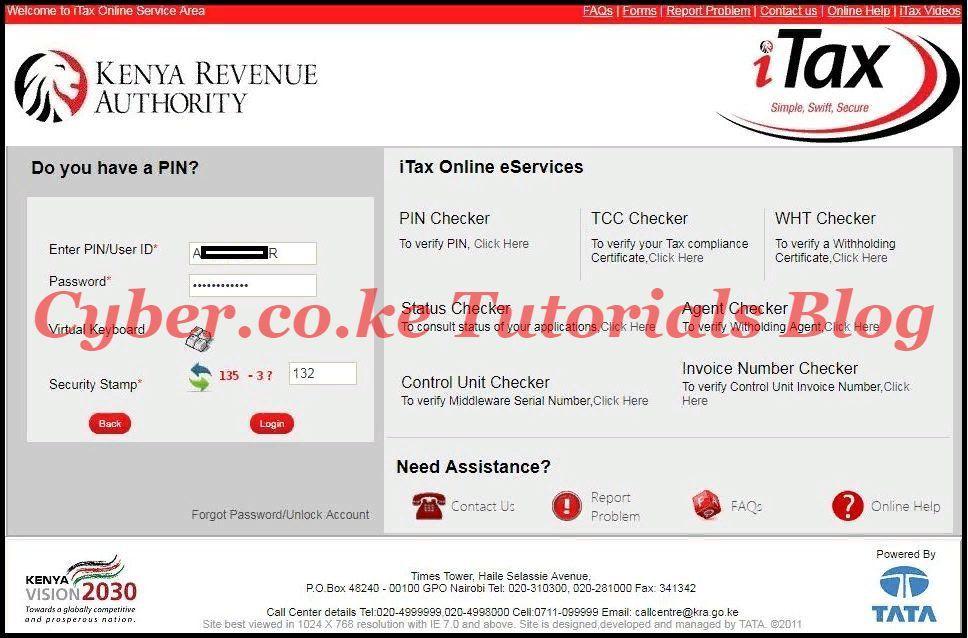

Step 3: Enter KRA iTax Password And Solve Arithmetic Question (Security Stamp)

Here, you will be required to enter your KRA iTax Password and solve the arithmetic question (security stamp). If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have entered your iTax Password and solved the arithmetic question, click on the “Login” button to proceed to the next step.

Step 4: KRA iTax Dashboard

Once you have successfully logged into your KRA iTax Account, you will be able to see your iTax iPage Dashboard. This is as illustrated below.

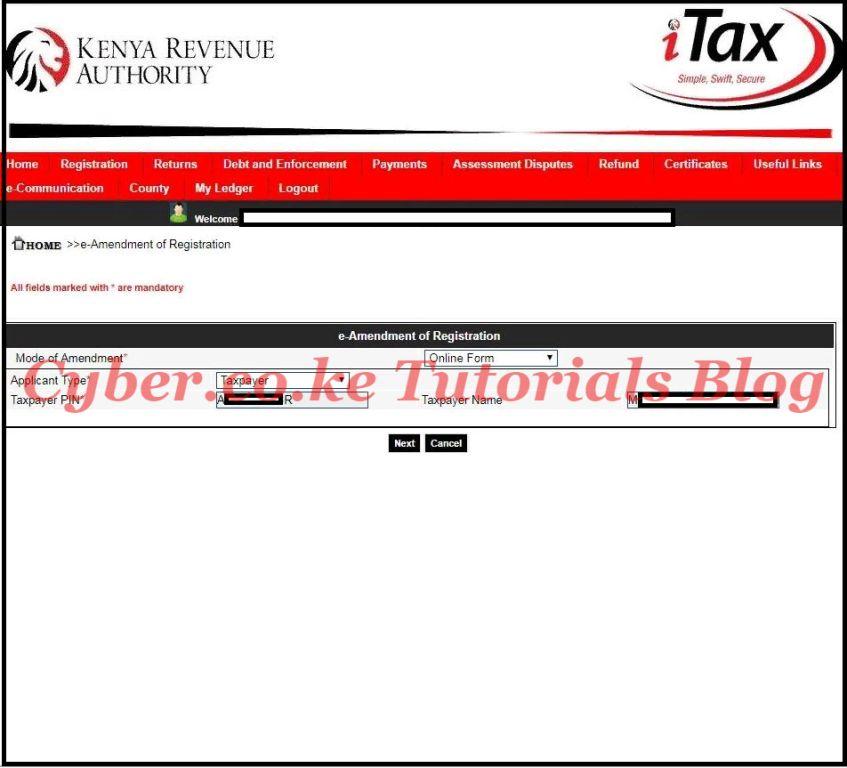

Step 5: Click on Registration Tab then Amend PIN Details

In this step, you need to click on Registration menu tab and from its dropdown menu list, click on Amend PIN Details. This will load the e-Amendment of Registration page where you need to select the Mode of Amendment i.e Online Form. The other fields such as Applicant Type, Taxpayer PIN and Taxpayer Name are automatically pre-selected by the system. Click on the “Next” button to proceed to next step.

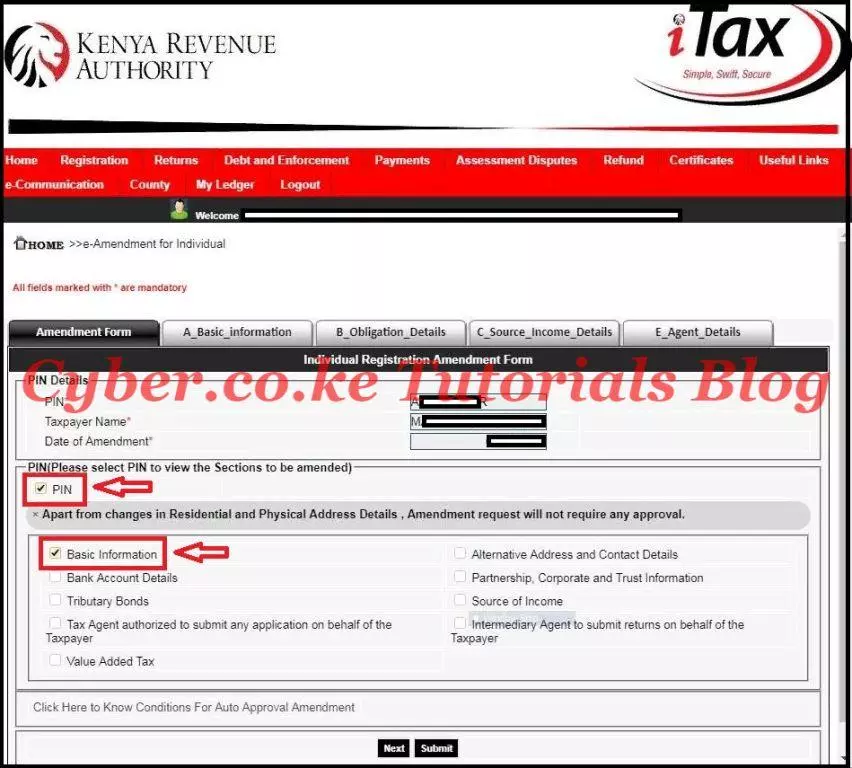

Step 6: e-Amendment Form for Individuals

In this step, since we are changing the KRA Email Address associated with iTax Account to a new one, this option falls under Basic Information Section A. Here you need to select PIN to view the Section to be amended. You then click on the Basic Information checkbox and click on the “Next” button.

You need to take note that since we are changing the KRA Email Address in iTax Portal, it falls under the Basic Information (Section A) tab.

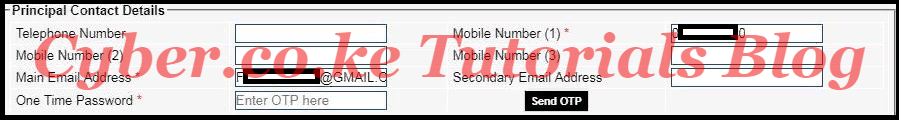

Step 7: Edit Principal Contact Details Main Email Address

In the Basic Information section, you need to scroll down to Principal Contact Details where KRA Email Address falls under the Main Email Address box. You will need to type in your new email address to replace the current email address address being displayed there.

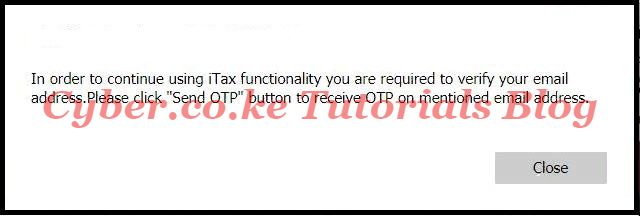

Step 8: Enter KRA OTP Code

In this step, to validate the new KRA Email Address on iTax Portal, you need to enter the KRA OTP Code that will be sent to your new email address.

The above pop will prompt you that you need to verify your email address on iTax by entering the four digit OTP code sent to that new email address. Note that the otp is only valid for 15 minutes after which it expires.

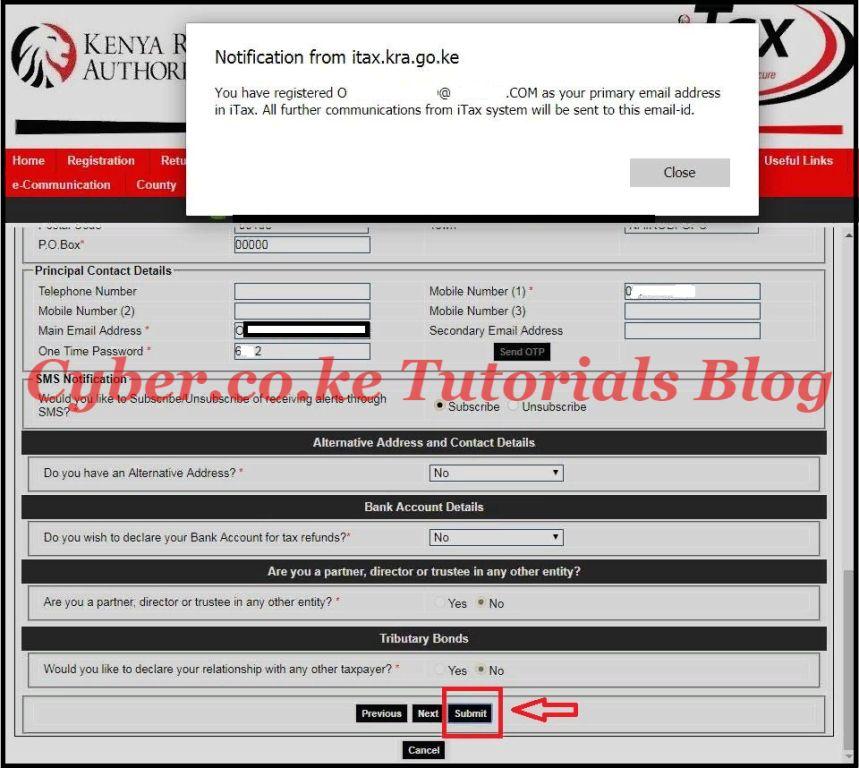

Step 9: Submit The Amendment Form

This step involves you submitting the Amendment Form online by clicking on the “Submit” button. You will get a pop up prompt asking you to confirm that you have registered a new Email Address on iTax Portal that will be associated with your iTax Account.

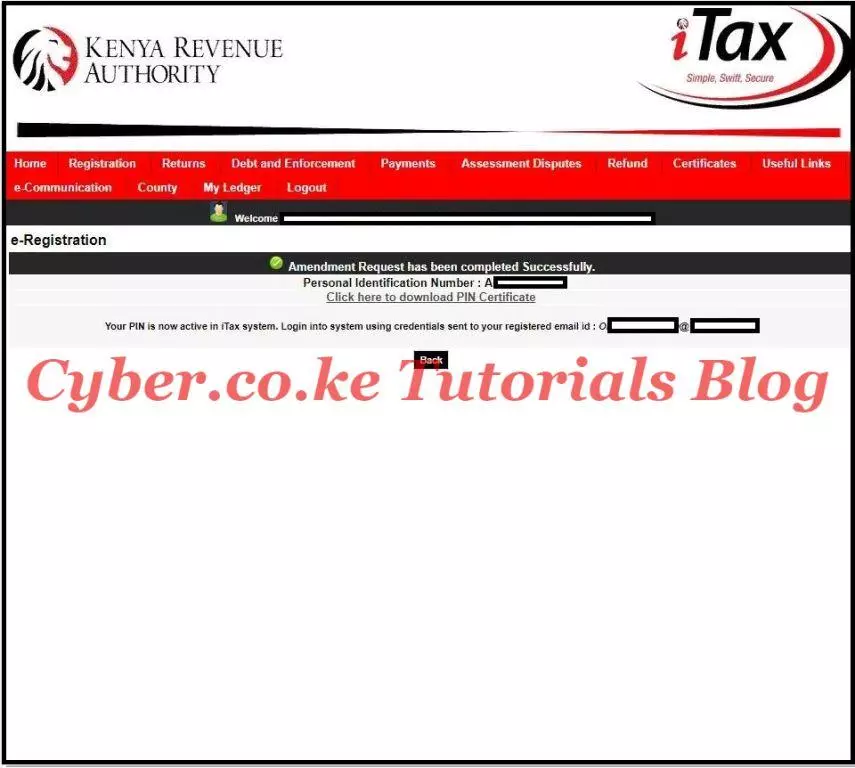

Step 10: Download The Amended KRA PIN Certificate

This is the last step in the process of Changing Email Address on a KRA PIN Certificate using KRA iTax Portal. This is the final confirmation that your KRA PIN is Active in the iTax System and that new login credentials have been sent to the newly registered email address.

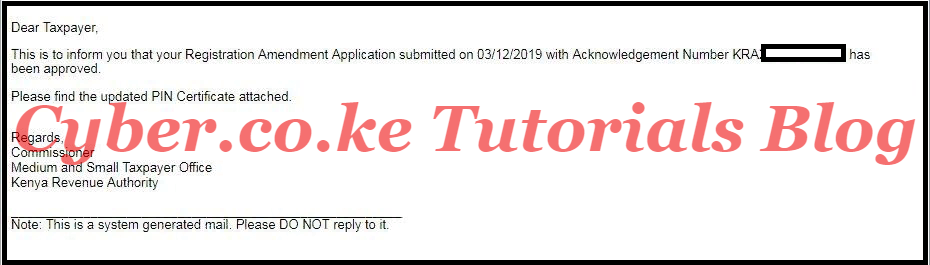

The other thing is that you will receive in your Email Address the Approval of Registration Amendment message from Kenya Revenue Authority (KRA). The sample of email amendment message from KRA is as illustrated below.

READ ALSO: How To Confirm The Validity Of KRA Tax Compliance Certificate

Just to sum up everything that we have discussed above, you need to take note of one important thing i.e for you to be able to Change KRA Email Address in iTax Portal, you need to have with your KRA PIN Number and iTax Password. So next time you are in need of changing the KRA PIN Email Address, just follow our proven 10 steps on How To Change KRA Email Address Using KRA iTax Portal.

DON’T MISS OUT. CHECK OUT OUR TRENDING POPULAR BLOG POSTS IN KENYA.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

KRA PIN REGISTRATION

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

KRA PIN RETRIEVAL

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

KRA PIN UPDATE

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

KRA PIN CHANGE OF EMAIL ADDRESS

Stay Tax Compliant in Kenya

Contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.