CYBER.CO.KE is an independent online Cyber Services website and is not affiliated with any government agency, including Kenya Revenue Authority (KRA). We charge a Cyber Services fee for the professional assistance provided to customers in Kenya.

In this step-by-step tutorial, you are going to learn and get to know How To Check If You Have Filed KRA Returns.

Get KRA PIN Certificate via Email Address and WhatsApp

Submit Service Request

Get KRA PIN Number via SMS

Follow These Steps

How To Check If You Have Filed KRA Returns

The following are the 4 main steps involved in the process of How To Check If You Have Filed KRA Returns that you need to follow.

-

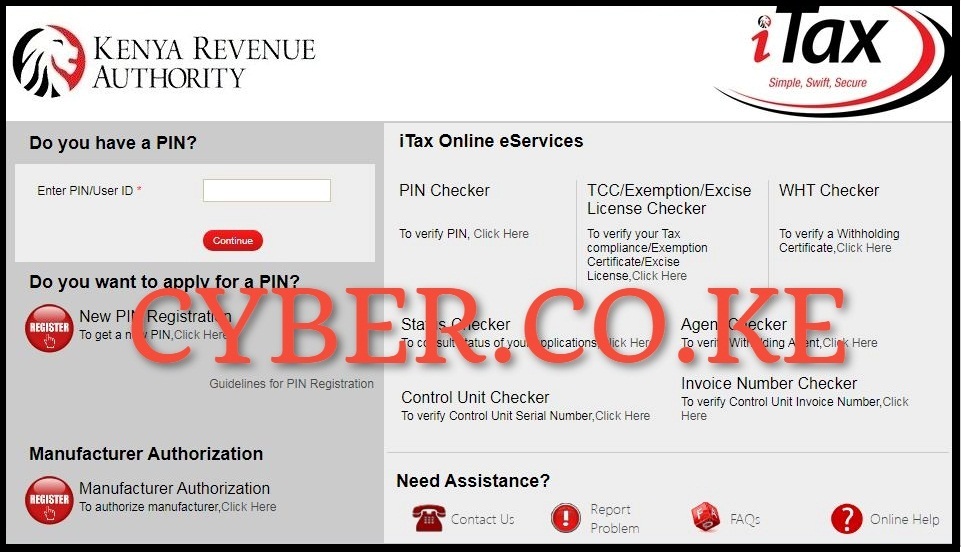

Step 1: Visit iTax (KRA Portal)

The first step in checking if you have filed your KRA Returns is by vising the KRA Portal (iTax Portal) using https://itax.kra.go.ke/KRA-Portal/ link.

-

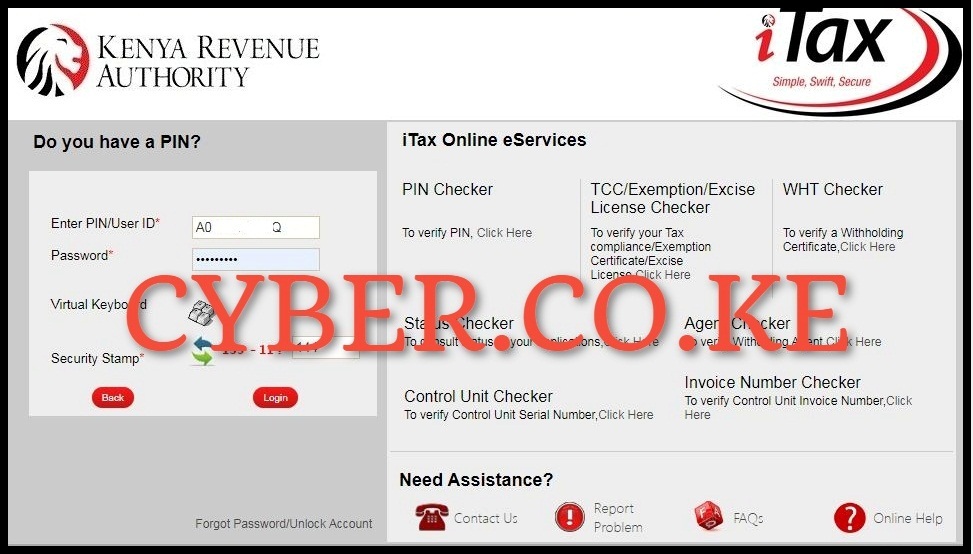

Step 2: Login Into iTax (KRA Portal)

Next, login to KRA Portal using both your KRA PIN Number and KRA Password, solve the arithmetic question (security stamp) and click on the “Login” button.

-

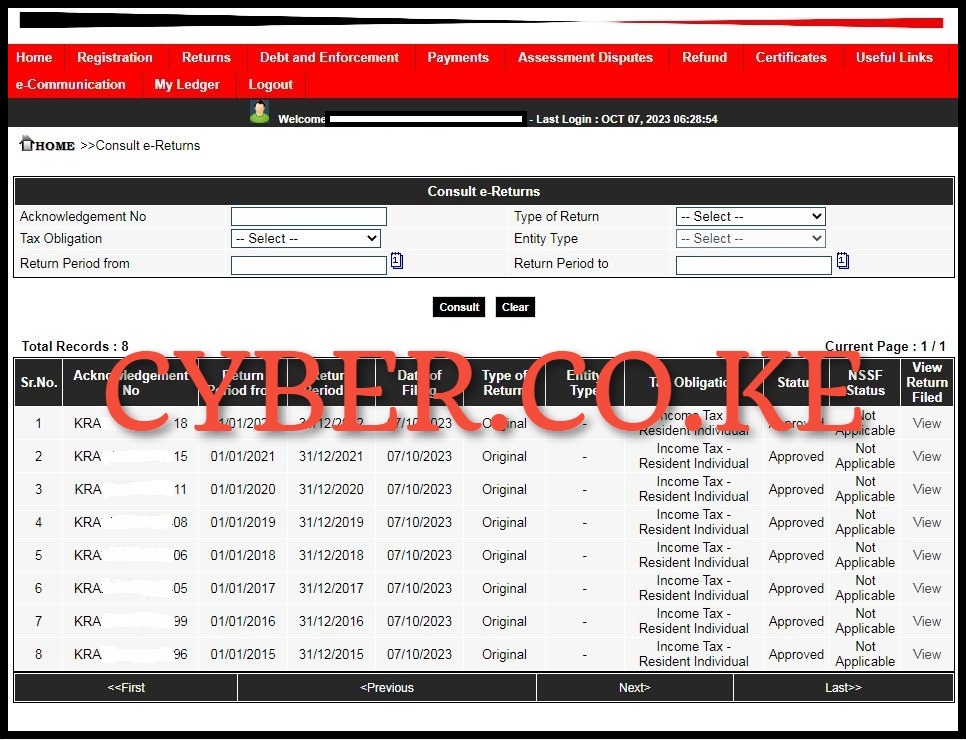

Step 3: Click on Returns menu then View Filed Return

In this step, on the top menu bar, click on “Returns” and from the drop-down menu list, click on “View Filed Return“.

-

Step 4: Consult e-Returns

Next, in the consult e-Returns form that will load, you will notice the following form fields; Acknowledgement Number, Type of Return, Tax Obligation, Entity Type, Return Period From and Return Period To. These fields are not mandatory to fill, but if you want you can always narrow down your search to a specific type or KRA Returns and KRA Tax Obligation.

Normally, there is no need to fill in those form fields since you are checking if you have filed any KRA Returns online. Click on the “Consult” button to view if you have filed KRA Returns on iTax Portal. The form will be populated with the details of all the KRA Returns that you have filed on KRA Portal. If you have never filed any KRA Returns, you will get a message telling you “No Records Found“.

On the other hand, if you have been filing your KRA Returns, then all the returns filed will be listed down and you can always check and confirm. The above 4 steps sums up the process involved in How To Check If You Have Filed KRA Returns. It is important that as taxpayer, you file your KRA Returns on or before the elapse of the 30th June deadline set by Kenya Revenue Authority (KRA).

Matthews Ohotto is a Writer at CYBER.CO.KE where he specializes in writing helpful and informative Step-by-Step Tutorials that empower Kenyans with practical skills and knowledge. He holds a Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT). Get KRA Individual Services and KRA Returns Services in Kenya.