Do you know that failure to file your KRA Returns on time before the elapse of the set deadlines leads to an automatic penalty being imposed by Kenya Revenue Authority (KRA) for late filing or KRA Returns. KRA Penalties applies to all types of KRA Returns such as KRA Nil Returns, KRA Employment Returns, Turnover Tax Returns, Monthly Rental Income Returns, Pay As You Earn Returns and even Value Added Tax Returns amongst other returns types.

The KRA Penalty is normally imposed on the taxpayer for late filing of KRA Returns on iTax. The good thing is that iTax has a functionality that enables you to check if you have any KRA Penalties. For you to be able to check whether or not you have KRA Penalties, you need to ensure that you first have with you both the KRA PIN Number and KRA Password (iTax Password) which you need in the process of logging into iTax.

Part of the cycle of being tax compliant here in Kenya is through the filing of KRA Returns for the respective tax obligations(s) that a taxpayer is registered for on iTax and also paying any taxes that are due to Kenya Revenue Authority (KRA). In this blog post, I will share the main steps that you need to follow in order to check whether or not you have KRA Penalties on iTax by using the General Ledger Report.

READ ALSO: Step-by-Step Process of Downloading Self Help Group KRA PIN Certificate

How To Check KRA Penalties On iTax

The following are the 5 main steps involved in the process of How To Check KRA Penalties On iTax that you need to follow.

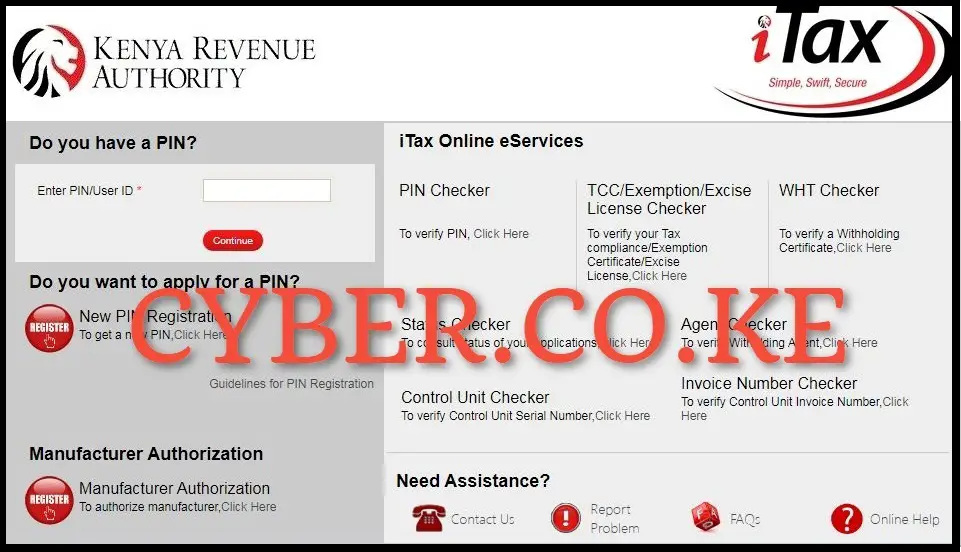

Step 1: Visit iTax

The first and foremost step in the process of checking KRA Penalties online is to visit iTax by using https://itax.kra.go.ke/KRA-Portal/

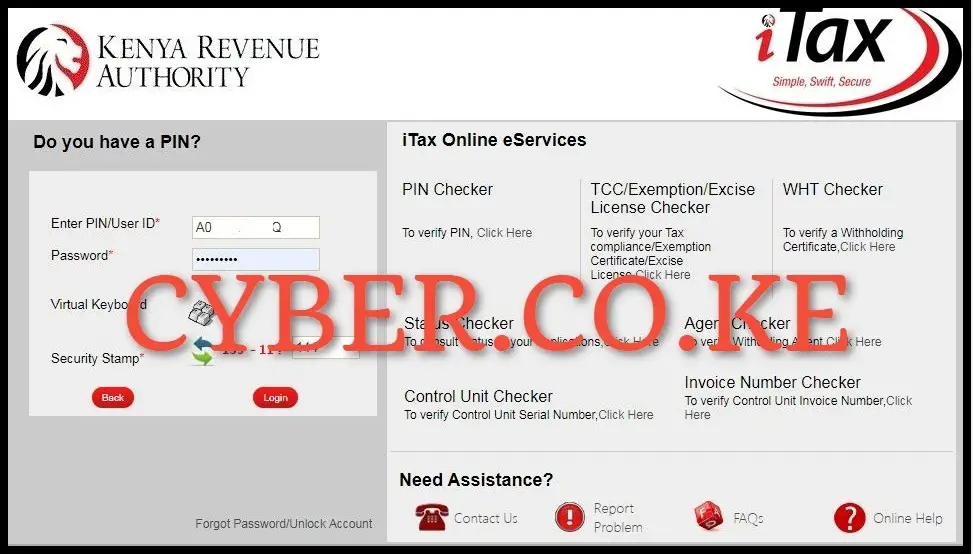

Step 2: Login Into iTax

Next, you need to enter your KRA PIN Number, KRA Password (iTax Password), solve the arithmetic question (security stamp) and click on the “Login” button to access your iTax account and begin the process of checking if you have KRA Penalties.

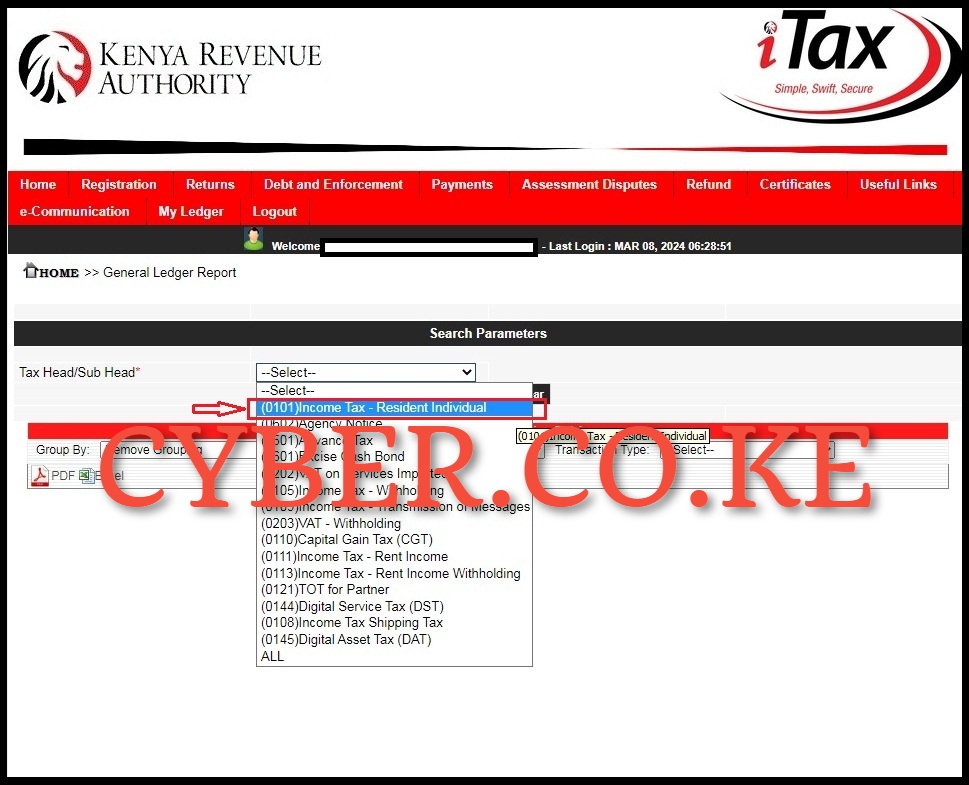

Step 3: Click on My Ledger followed by General Ledger Report

Once you have successfully logged into iTax account, on the top menu in the iTax account dashboard, click on “My Ledger” then click on “General Ledger Report” from the drop down menu items list that will appear.

Step 4: General Ledger Report Search Parameters

In this step, you need to select the Tax Head/Sub Head that you want to check if you have KRA Penalties for. In this example, the Tax Head is “(0101) Income Tax – Resident Individual.” Once you have selected the Tax Head/Sub Head, click on the “Show Ledger” button.

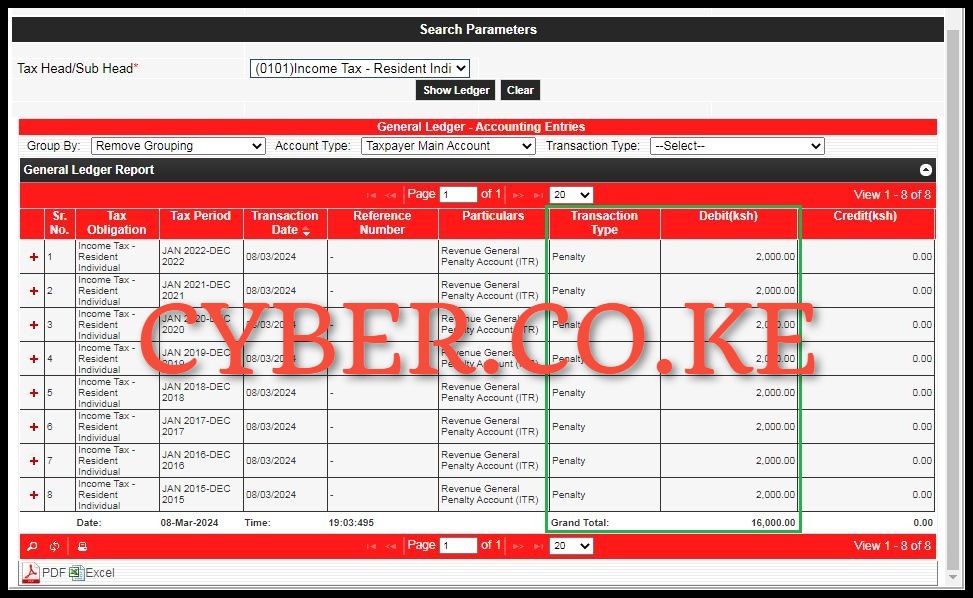

Step 5: General Ledger Report

In this last step, you will be able to see the General Ledger Report for the tax head that you are checking KRA Penalties for on iTax. The column of interest is the one titled “Transaction Type” that shows the Penalty and the Debit column that shows the amount of KRA Penalty. Clicking on the “+” sign you will see the following message – “Being penalty amounting 2,000.00 Ksh imposed under section 83 – Tax Procedure Act 2015 for Late filing Penalty for the Return Period 01/01/2022 to 31/12/2022 for the Head Office.”

The good news is that there is an ongoing KRA Tax Amnesty that runs up to 30th June 2024, where all the penalties that you see in you General Ledger Report will be automatically removed. This is a great initiative by Kenya Revenue Authority (KRA) that gives all taxpayers who had penalties and interest a fresh start by removing all the penalties upto 30th December 2022. Taxpayers are encouraged to take advantage of this KRA Tax Amnesty. If you only have penalties, all of it will be removed automatically by KRA.

READ ALSO: Step-by-Step Process of Unlocking KRA Portal Account

The above 5 steps sums up the process that you need to follow so as to check KRA Penalties on iTax. As a general reminder, KRA Penalties are normally imposed on taxpayers who file their KRA Returns past the set deadline dates. Also, for you to check KRA Penalties on iTax, you need to have both the KRA PIN Number and KRA Password (iTax Password). You you have with you these two requirements, you can follow the above outlined steps that are involved in How To Check KRA Penalties online using iTax.

TRENDING BLOG POSTS IN KENYA

CYBER.CO.KE

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

CLICK HERE TO REGISTER KRA PIN NUMBER

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

CLICK HERE TO RETRIEVE KRA PIN CERTIFICATE

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

CLICK HERE TO UPDATE KRA PIN NUMBER

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

CLICK HERE TO CHANGE KRA PIN EMAIL ADDRESS