Are you looking to check and confirm your KRA Penalties on iTax Portal? Learn How To Check KRA Penalties Using KRA iTax Portal.

Did you know that having an active KRA PIN Number and failing to file KRA Returns attracts a penalty for each year not filed. Many taxpayers in Kenya have KRA PINs and some have never even filed any Returns on iTax since they got their KRA PIN. One thing that they don’t know is that a KRA Penalty has or will be imposed the moment they file all their pending KRA Returns.

In this article, I am going to share with you the step by step guide on How To Check KRA Penalties Using KRA iTax Portal. By the end of this article, you will have known How To Check KRA Penalties on iTax Portal. You will learn the process that you need to check to view and confirm whether or not you have any KRA Penalties that have been imposed on your KRA PIN.

READ ALSO: How To Verify KRA Withholding Certificate Using WHT Checker

Not that many people know of KRA Penalties and their has been scarcity of information pertaining to KRA Penalties. We are going to cover some key areas pertaining to KRA Penalties on the iTax Portal including: What Is KRA Penalties, Reasons For KRA Penalties, Impact Of KRA Penalties On A Taxpayer, Requirements Needed To Check KRA Penalties on iTax Portal and How To Check KRA Penalties Using KRA iTax Portal.

Most taxpayer who have KRA PIN Numbers but no source of income i.e. the unemployed tend to have this old school notion that since they are unemployed, then there is no need for them to file KRA Returns. Well, this notion is quite wrong and failure to file KRA Returns will lead to KRA Penalties. Kenya Revenue Authority (KRA) has made it simpler for taxpayers who dod not have any source of income i.e. unemployed, they just need to file what we call KRA Nil Returns and they are good to go.

Filing of KRA Nil Returns for taxpayers who don’t have any source of income will save them from the KRA Penalties if they fail to file returns for a specific year. So my advise to you if you fall into this category is File your KRA Returns. It is now even much easier thanks to Cyber.co.ke Portal‘s KRA Nil Returns Filing that enables taxpayers to submit their KRA Nil Returns Filing orders online and our support team will assist in filing the KRA Returns hence saving you from the hefty KRA Penalties that looms around the corner for non filers when the 30th June deadline elapses.

What Is KRA Penalties?

KRA Penalties simply refers to a penalty that is imposed on a taxpayer for failing to file his or her KRA Returns for a specified period or year. When a taxpayer fails to file his or her KRA Returns either KRA Nil Returns or KRA Employment Returns, then a penalty will be imposed on the taxpayer for what we call late filing of KRA Returns on iTax Portal.

Late filing in this context refers to filing your KRA Returns way past the 30th June deadline. Normally a taxpayer has a window period of 6 months that runs between 1st January to 30th June of each year to file the KRA Returns for the previous year. KRA Penalties have a great impact in terms of future applications that a taxpayer might need to make on the KRA iTax Portal. To be able to understand this, let us look at an example below.

Assuming we have a taxpayer who got his or her KRA PIN Number using Cyber.co.ke Portal‘s KRA PIN Registration services in February 2019 (last year). This taxpayer will need to file his or her KRA Returns for the 2019, this year 2020. So, the taxpayer has between 1st January to 30th June to file his or her KRA Returns. If he or she fails to file the Returns within this period, then KRA will automatically impose a penalty for late filing. The same applies to taxpayers who have KRA PIN Numbers and have never filed returns on iTax from 2015 to 2018, they automatically receive the Defaulter Notices thus KRA Penalties.

So what is this KRA Penalty? Well the KRA Penalties for failure to file KRA Returns is Kshs. 2.000/= only. Remember this used to be Kshs. 20,000/= (in the past when you did not file any Returns, the KRA Penalties used to be Kshs. 20,000.00) and it was revised down to Kshs. 2,000/= in the Income Tax Act of 2018. It seems KRA had some leniency since a huge number of taxpayers who are normally penalized with KRA Penalties are those who are unemployed and they are the majority in Kenya and have active KRA PIN Numbers. So, if you fail to file KRA Returns, then prepare yourself for a hefty KRA Penalty of Kshs. 2,000/= for each year that you did not file your KRA Returns.

Now that we have laid down the foundation to KRA Penalties, we now need to look at the Reasons For KRA Penalties. What are those reasons if any behind KRA Penalties on the KRA iTax Portal.

Reasons For KRA Penalties

Why does the Kenya Revenue Authority (KRA) impose what we refer to as the KRA Penalties on a taxpayer? Well the answer is quite simple. The Kenya Revenue Authority (KRA) puts the KRA Penalties to the categories of the taxpayers whom they categorize as “Non Filers”. So, if you have a KRA PIN and you don’t file any of the KRA Returns for a particular year, then you belong to the category of Non Filers. And being a Non Filer simply means that you already have pending KRA Returns which inturn leads to what we call the KRA Penalties.

From the above, the main reason for KRA Penalties is basically due to the fact that a taxpayer is a Non Filer i.e. has never filed KRA Returns for a particular particular period or year. For example, you might have gotten your KRA PIN back in 2013, during this time the KRA iTax Portal was not yet launched. This was the era of the defunct Mapato System (Legacy), you updated your KRA PIN on iTax through the KRA PIN Update services at Cyber.co.ke Portal in 2019. At this point you will need to file all pending Returns on iTax Portal from 2015 – 2018.

Filing those pending Returns will automatically generate Defaulter Notices that will be sent to your iTax Registered Email Address and in turn KRA Penalties for each year that you did not file the returns will be imposed. So, you will have penalties for 2015, 2016, 2017 and 2018, the sole reason being that the iTax System flagged you a s Non Filer as the KRA Penalties were imposed on you due to what we refer to as Late Filing of KRA Returns on iTax.

Now that we have looked at the main reasons for KRA Penalties on iTax, we now need to look at the impact that the KRA Penalties have on the taxpayer in Kenya.

Impact Of KRA Penalties On A Taxpayer

KRA Penalties have a detrimental impact on a taxpayer. If you have any pending returns that you have not yet filed on KRA iTax Portal, then you definitely have a KRA Penalty. This can have a great impact when you try to apply for the KRA Tax Compliance Certificate which is an important document especially for job seekers. During the process of apply for a Tax Compliance Certificate, you will definitely not be issued with the Tax Compliance Certificate.

This is because the system shows that you have pending liabilities i.e. pending returns and KRA Penalties on iTax. This will mean that you will have to file all those pending KRA Returns on iTax Portal, and apply for KRA Waiver using the iTax Portal. And “if” your waiver application is Approved, then you can re-apply for the KRA Tax Compliance Certificate. Most of the time the Waiver applications are not approved especially when you do not provide sufficient evidence to support your waiver application) and you have to pay up all the KRA Penalties

So, now you see the main impact the KRA Penalties can have on taxpayer is huge and should not be taken lightly. Maybe you forgot to file your KRA Returns due to one reason or the other, the main thing is that once the Tax Defaulter Notices have been generated, then your ship has sailed to the deep waters and the only way to get to the harbour is by filing all pending KRA Returns and paying up the accrues KRA Penalties for the years that you did not file your KRA Returns. The only way to avoid KRA Penalties is to ensure that as long as you have an active KRA PIN, you file your Returns each year between 1st January and 30th June.

Having looked at the impact that the KRA Penalties have on a taxpayer, now we need to look at the main requirements that are needed in the process of How To Check KRA Penalties Using KRA iTax Portal . These requirements includes: KRA PIN Number and KRA iTax Password. I am going to briefly highlight on each one of the requirements below.

Requirements Needed To Check KRA Penalties on iTax Portal

To be able to check and view KRA Penalties on iTax Portal, you need to ensure that you have with you the iTax Login Credentials that comprises of the KRA PIN Number and KRA iTax Password.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same as the one you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable you Reset KRA iTax Password.

Now that you have with you the requirements that are need to check KRA Penalties above, we can now change gears and look at the steps that you need to follow on How To Check KRA Penalties Using KRA iTax Portal.

How To Check KRA Penalties Using KRA iTax Portal

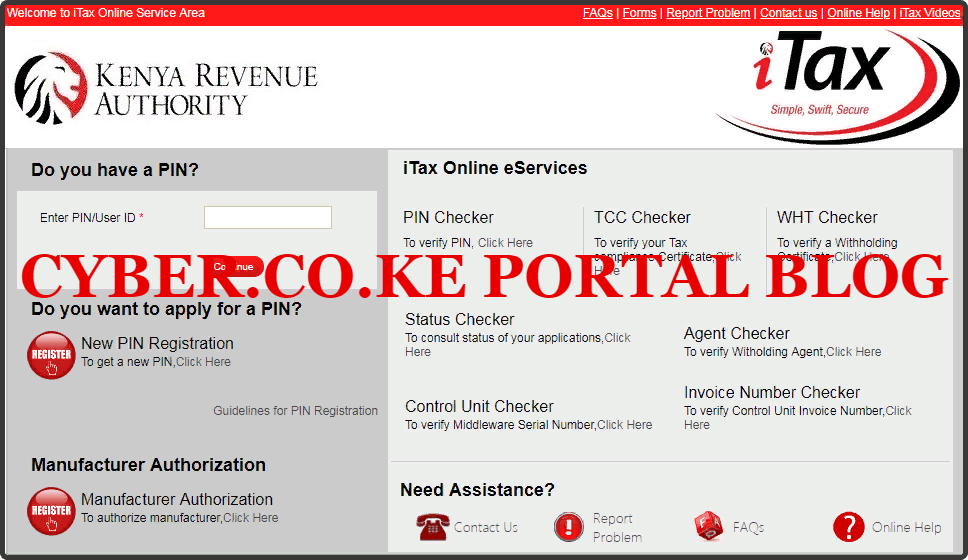

Step 1: Visit KRA Portal

The first step that you need to take in the process of How To Check KRA Penalties is to ensure that you visit the KRA iTax Web Portal using the link provided above in the description. Take note that the above is an external link that will take you to the KRA iTax Portal i.e. link will open in a new tab.

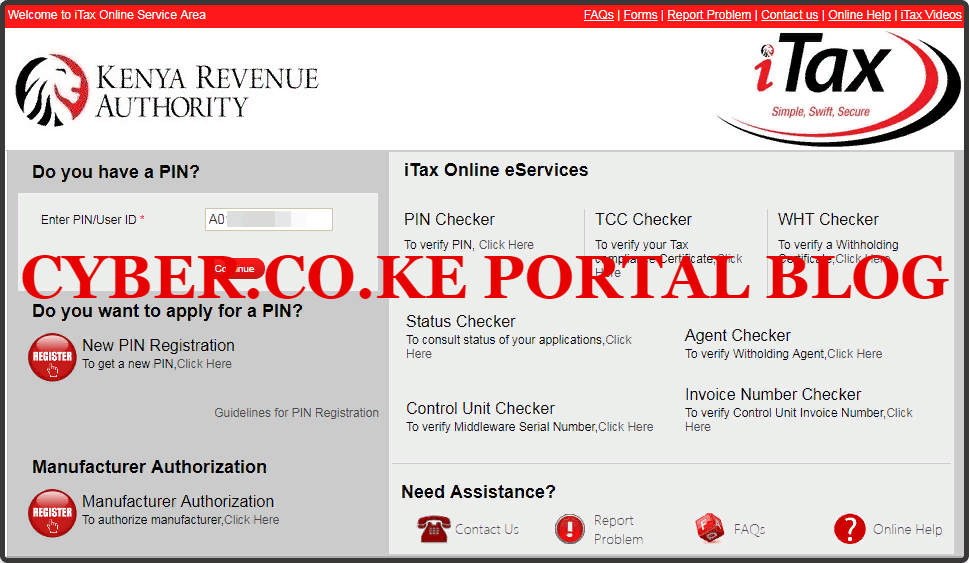

Step 2: Enter Your KRA PIN Number In the PIN/User ID Section

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

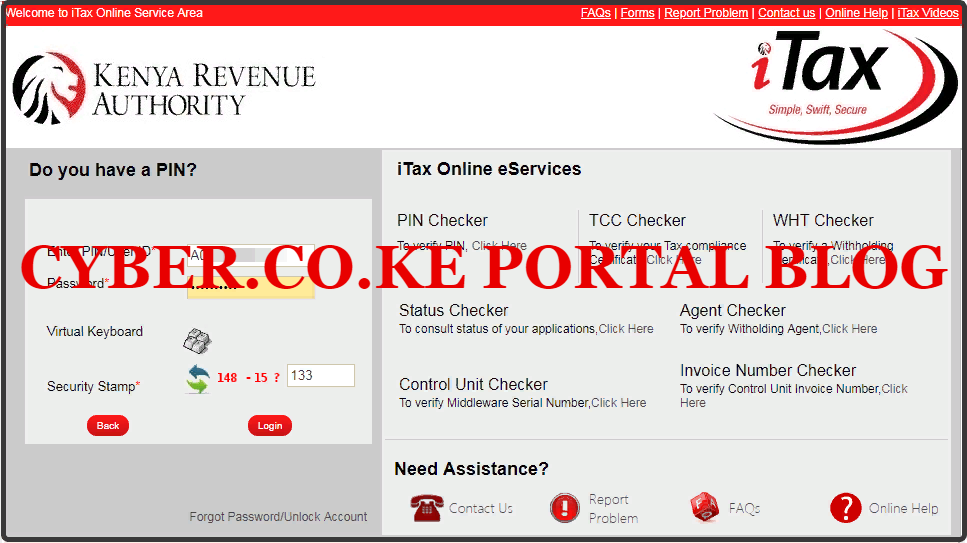

Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: KRA iTax Web Portal Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA iTax Web Portal Account Dashboard. Here upon successful login process, you are able to view a wide range of iTax Portal functionalities. Since we need to know How To Check KRA Penalties on iTax Portal, we proceed to Step 5 below.

Step 5: Click On Debt And Enforcement Menu Tab

For you to be able to check KRA Penalties on iTax Web Portal Account, you will need to click on the Debt and Enforcement menu followed by Request for Waiver of Penalties and Interests. This is the quickest way to check all KRA Penalties in your iTax Account. This is as illustrated below.

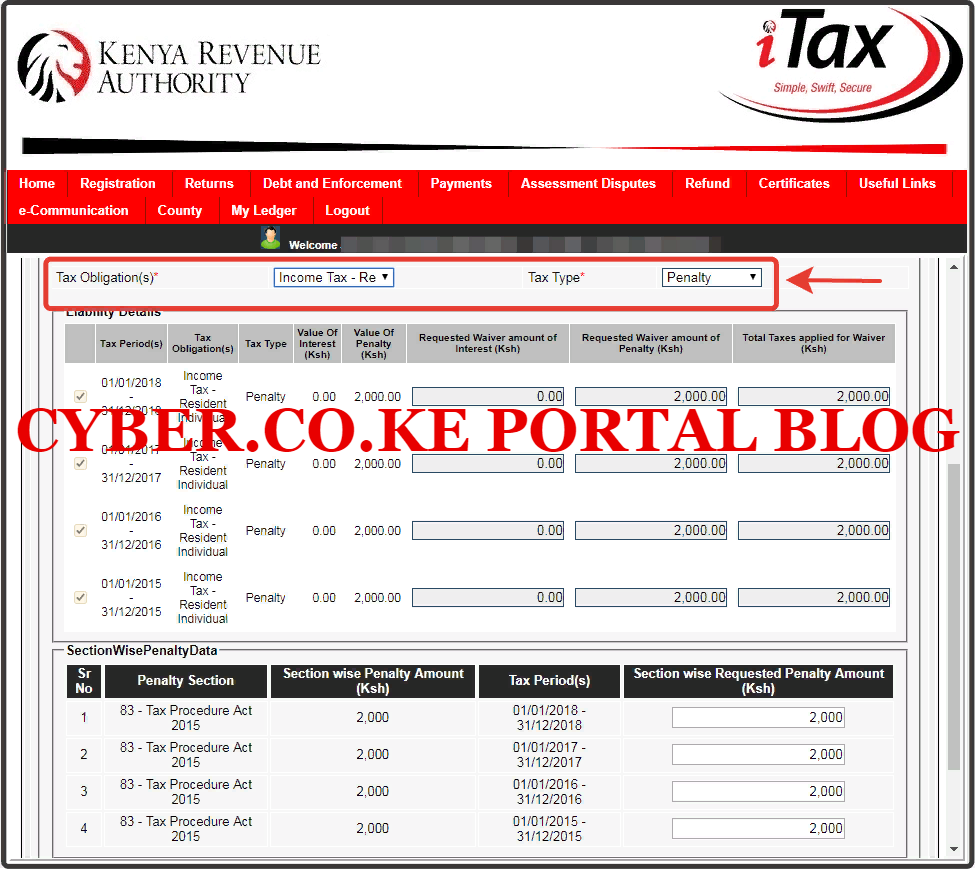

Step 6: Select The Tax Obligation And The Tax Type

In this step, you will need to select both the tax obligation and the tax type. In this case since want to know How To Check KRA Penalties, under the tax obligation we are going to select Income Tax Resident Individual while in the tax type section we shall select Penalty. This is because we are viewing the KRA Penalties that a taxpayer has on KRA iTax Portal. This is as illustrated in the screenshot below.

From the above screenshot, you can notice that the taxpayer has accrued a lot of KRA Penalties as a result of late KRA Returns Filing on iTax. Also note that the year starts from 2015. This is the default year for iTax. So if you have a KRA PIN that has not yet been updated on iTax Portal, then the penalties tend to start from 2015.

This taxpayer has two options, first he or she can choose to apply for KRA Waiver on the accrued KRA Penalties of he or she can choose to offset the liabilities of the KRA Penalties by paying those penalties using KRA M-Pesa Paybill Number or at the Bank. If you follow the above steps on How To Check KRA Penalties and see the same as above, then that simply means you have KRA Penalties. To sum up everything on the process of How To Check KRA Penalties using iTax Portal, you need to note one important thing.

READ ALSO: How To Check KRA PIN Certificate Email Address On iTax

That is always ensure that you file your KRA Returns especially if you have an active KRA PIN Number but still unemployed. This will save you a great deal from getting the KRA Penalties for being a Non Filer or Late Filing. The dates for filing KRA Returns is from 1st January to 30th June. If you want any help with your KRA Returns either KRA Nil Returns Filing or KRA Employment Returns Filing, just submit your order online at Cyber.co.ke Portal today. So, next time you want to confirm and check whether you have any KRA Penalties, just follow our guide on How To Check KRA Penalties.

DON’T MISS OUT. CHECK OUT OUR TRENDING POPULAR BLOG POSTS IN KENYA.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

KRA PIN REGISTRATION

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

KRA PIN RETRIEVAL

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

KRA PIN UPDATE

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

KRA PIN CHANGE OF EMAIL ADDRESS

Stay Tax Compliant in Kenya

Contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.