It is always important to be in the know how of the status of your KRA PIN Number on KRA Portal or iTax Portal. A KRA PIN Number can normally be in tow states i.e. Active or Inactive(sometimes referred to as dormant). Understanding the process and steps that are involved in How To Check KRA PIN Number Status is very crucial.

As it is a norm here in Kenya, many KRA PIN Numbers are registered on a day to day basis and majority are registered to serve only one purpose after which the taxpayer tends to forget that he or she has a KRA PIN Number and also does not know the status of his or her KRA PIN Number on iTax Portal or KRA Portal.

To check the status of your KRA PIN Number, you need to use the KRA PIN Checker functionality on KRA Portal (iTax Portal). The KRA PIN Checking functionality enables taxpayers in Kenya whether or not the KRA PIN Number(s) is valid and active in the KRA system. Also it enables one to check the tax obligation that the KRA PIN is registered for on KRA Portal (iTax Portal).

READ ALSO: How To Apply For Tax Compliance Certificate (In 5 Steps)

For one to be able to check the status of KRA PIN Number online using KRA Portal, you basically need to have with you your KRA PIN Number itself. Since you want to check the status of the KRA PIN on iTax, then you definitely need to have with you that KRA PIN Number.

This is the main requirement that is need in the whole process of checking the status of your KRA PIN Number using the KRA Portal. Checking the status of your KRA PIN is done through the use of the KRA PIN Checker functionality that is on the KRA Portal.

Requirement Needed In Checking KRA PIN Number Status

You need to have with you the KRA PIN Number that you want to check it’s status on KRA Portal through the KRA PIN Checker functionality.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you when you want to login to KRA Portal. If by any chance you have forgotten or you don’t remember your KRA PIN Number, you can submit KRA PIN Retrieval request online here at CYBER.CO.KE and our support team will be able to assist with the retrieval of your lost or forgotten KRA PIN Number.

At the same time, if you are looking for a new KRA PIN Number, you can get it here in less than 3 minutes by submitting your KRA PIN Registration request at CYBER.CO.KE. Your new KRA PIN Number and KRA PIN Certificate will be sent to your Email Address once the request for KRA PIN Registration has been done and processed by our support team.

Did you know that you can easily apply and get your KRA PIN Number and KRA PIN Certificate online in less than 5 minutes by using CYBER.CO.KE today. Get it via email address or even WhatsApp upon submission.

Here at, CYBER.CO.KE, we offer unmatched KRA PIN Registration, KRA PIN Retrieval, KRA PIN Update and KRA PIN Change of Email Address services to Kenyans daily. Fill and submit your request online today.

How To Check KRA PIN Number Status (In 4 Steps)

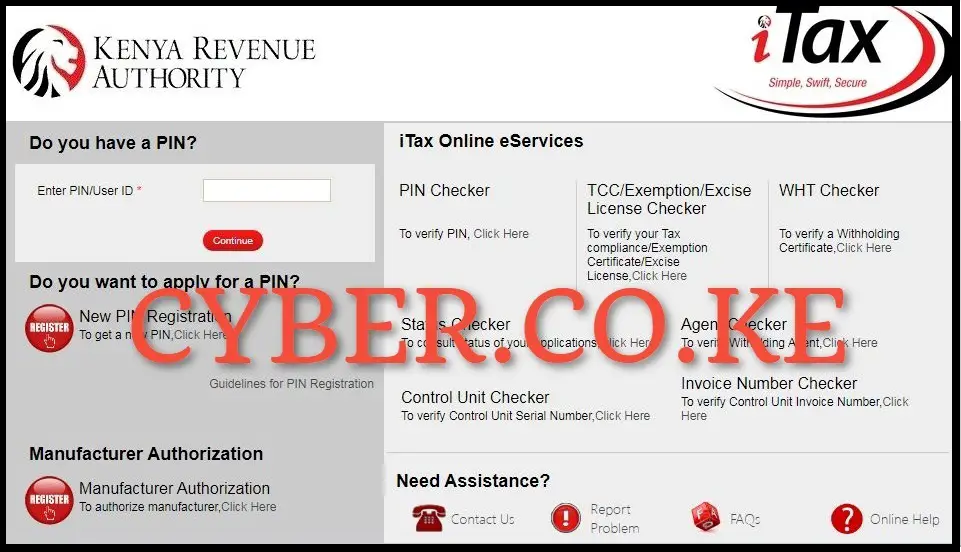

Step 1: Visit KRA Portal

The first step in the process of checking KRA PIN Number Status, is to visit the KRA Portal using https://itax.kra.go.ke/KRA-Portal/

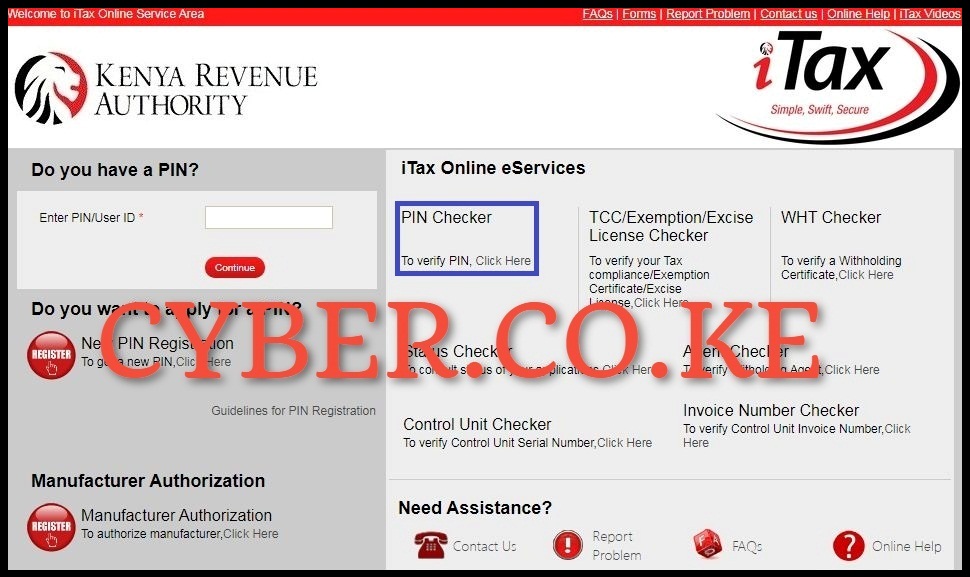

Step 2: Click On KRA PIN Checker Functionality

Next, you will need to click on the KRA PIN Checker functionality or feature that is located on the homepage of the KRA Portal. It’s sometimes referred to as simply PIN Checker.

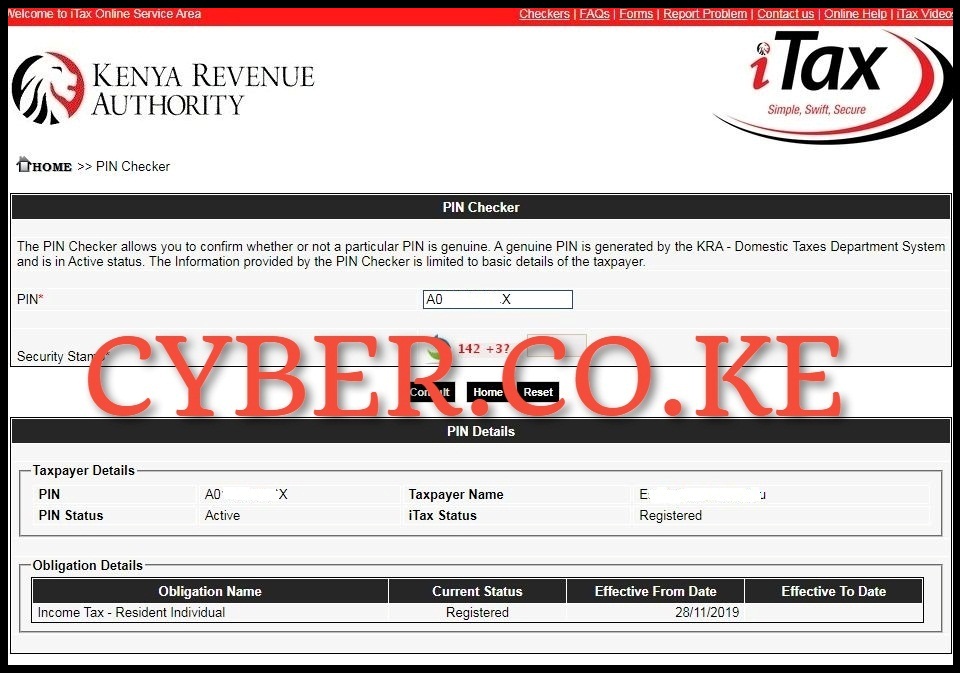

Step 3: Enter KRA PIN Number and Solve Arithmetic Question

In this step, you will enter/input your KRA PIN Number and at the same time solve the arithmetic question or simply the security stamp. Afterwards, click on the “Consult” button. Take note that the KRA PIN Checker functionality allows you to confirm whether or not a particular KRA PIN is genuine. A genuine KRA PIN Number is generated by the KRA – Domestic Taxes Department System and is in “Active” status. The Information provided by the KRA PIN Checker is limited to basic details of the taxpayer.

Step 4: KRA PIN Number Status

In this last step, the results of the status of the KRA PIN Number will be displayed. This is grouped into two sections: taxpayer details and obligation details. The taxpayer details comprises of the following fields; PIN, Taxpayer Name, PIN Status and iTax Status. The obligation details comprises of; Obligation Name, Current Status, Effective From Date and Effective To Date.

READ ALSO: How To Check KRA Payment Status Using KRA Status Checker

Since we want to confirm the status of the KRA PIN Number on KRA Portal, the field of interest is the PIN Status. You need to ensure that the KRA PIN status is in “Active” state. This means that you can use your KRA PIN easily by accessing your iTax account and performing various transactions where the KRA PIN Number might be required.

DON’T MISS OUT. CHECK OUT OUR TRENDING BLOG POSTS IN KENYA NOW.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

CLICK HERE TO REGISTER KRA PIN NUMBER

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

CLICK HERE TO RETRIEVE KRA PIN CERTIFICATE

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

CLICK HERE TO UPDATE KRA PIN NUMBER

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

CLICK HERE TO CHANGE KRA PIN EMAIL ADDRESS

Stay tax compliant in Kenya - contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.