CYBER.CO.KE is an independent Cyber Services website and is not affiliated with any government agency, including Kenya Revenue Authority (KRA). A service fee is charged for the assistance provided to customers in Kenya.

Explore the simple process of checking and confirming the KRA Tax Obligation that you are registered for on iTax by using the KRA PIN Checker functionality. Find out how to efficiently verify your KRA Tax Obligations online today.

The most important aspect of the KRA PIN Number for either Individuals or Non-Individuals is the KRA Tax Obligations that the taxpayer is registered for on KRA iTax Portal. When you apply for either KRA PIN for Individuals, KRA PIN for Companies or KRA PIN for Self Help Groups at Cyber.co.ke Portal, we normally assign the recommended KRA Tax Obligation by Kenya Revenue Authority (KRA).

In this article, I am going to share with you the step by step guide on How To Check KRA Tax Obligation On KRA iTax Portal. By the end of this article, you will have learnt and known the KRA Tax Obligation that you are registered for on iTax Portal. Having the understanding of KRA Tax Obligations is important as it will guide you on the type of KRA Returns that you need to file on KRA iTax Portal.

READ ALSO: KRA Nil Returns Portal Login Step By Step Procedure In 2020

Having a thorough understanding of what KRA Tax Obligations is is quite important and each and every taxpayer ought to understand the Tax Obligation that he or she is registered for on iTax Portal. This article will seek to address the key terms and concepts relating to KRA Tax Obligations i.e. What Is KRA Tax Obligation, Types Of KRA Tax Obligations, Requirements Needed To Check KRA Tax Obligation On iTax and How To Check KRA Tax Obligation On KRA iTax Portal.

It is important that each Kenyan is registered for the right Tax Obligation on iTax Portal. Failure to register for the correct Tax Obligation can cause huge problems for the taxpayer. If the taxpayer is an individual, then the Income Tax Resident Obligation (Kenyans) and Income Tax Non Resident (Foreigners) should be used. If the taxpayer is a non-individual, the appropriate Tax Obligations should be used.

The good thing is that you can request for the KRA PIN Registration services here at Cyber.co.ke Portal. Our teams will work on your KRA PIN Registration orders ensuring that you are registered for the correct and right KRA Tax Obligation on the KRA Portal or iTax Portal. At the same time you will receive your KRA PIN Certificate registered with the correct Tax Obligation on iTax.

What Is KRA Tax Obligation?

When applying for the KRA PIN online at Cyber.co.ke Portal, you will be required to select a tax obligation that you want to be registered for. In most cases the default Tax Obligation for Resident Individuals is the Income Tax Resident KRA Tax Obligation while that for Non Residents is Income Tax Non Resident kra Tax Obligation.

From the above, the KRA Tax Obligation can simply be referred to as the Tax framework that a taxpayer is registered for on the KRA iTax Portal. The Tax Obligation form the basis of the type of KRA Returns that the taxpayer is supposed to file at the end of each year during the KRA Tax Returns Period that runs from 1st January to 30th June of each year.

It is important that you get registered for the right KRA Tax Obligation(s). That is why it is recommended that you normally apply for your KRA PIN using Cyber.co.ke Portal as we have a team of tax experts that will ensure that you are registered for the correct Tax Obligation as recommended by Kenya Revenue Authority (KRA). When you register for the wrong KRA Tax Obligations, this will have a detrimental impact on your KRA PIN Number on iTax.

You always need to ensure that if you need either Personal KRA PIN Number, Company KRA PIN Number or Self Help Group KRA PIN Number in Kenya, just submit your order online here at Cyber.co.ke Portal and have our support teams register for you the correct KRA Tax Obligations that you are supposed to have a taxpayer in Kenya.

Having looked at the types of KRA Tax Obligations above, we now need to shift gears a little bit and look at Types Of KRA Tax Obligations. This is because there exists KRA Tax Obligations for both Individuals and Non Individual taxpayers in Kenya. This is as illustrated and explained below.

Types Of KRA Tax Obligations

To be able to understand KRA Tax Obligations, you need to take note that the Tax Obligations by KRA are normally categorized into two groups i.e. Individuals and Non Individuals. Individuals simply comprises of humans (Kenyans) while Non Individuals comprises or both Companies and Self Help Groups.

-

KRA Tax Obligations For Individuals

The first category of KRA Tax Obligation is Tax Obligations for Individuals. Just as from the name suggests, this is simply the humans or Kenyans. Being the majority, you need to take note the different types of Tax Obligations under this category. Individuals is made up of: Kenyan, Non Kenyan Resident and Non Kenyan Non Resident.

There are five KRA Tax Obligations under the Individuals categories. This includes: Income Tax Resident, Income Tax Non Resident, Income Tax PAYE (for Employers only), Turnover Tax (ToT) and Value Added Tax (VAT). The default Tax Obligation for Kenyans is the Income Tax Resident and this obligation is the one that most taxpayers are registered for in Kenya.

-

KRA Tax Obligations For Non Individuals

The other category of KRA Tax Obligation is Tax Obligations for Non Individuals. Non Individuals normally comprises of Companies and Self Help Groups. If you need KRA PIN for Companies or KRA PIN for Self Help Groups, there are different types of Tax Obligations that the KRA PIN Number can be used to register the KRA PINs for Non Individuals.

There are five KRA Tax Obligations under the Individuals categories. This includes: Income Tax Company, Income Tax Partnership, Income Tax PAYE (for Employers only) and Value Added Tax (VAT). The most commonly used Tax Obligation is Income Tax Company and Income Tax PAYE (for Employers only).

Now that we know the two types of KRA Tax Obligations as explained above, we now need to look at the Requirements Needed To Check KRA Tax Obligation On iTax. The most important requirement that you need to ensure that you have with you is the KRA PIN Number. This is as explained below.

Requirements Needed To Check KRA Tax Obligation On iTax Portal

To be able toc check and confirm the type of KRA Tax Obligation(s) that you are registered for on iTax, you need to have with you your KRA PIN Number. This can either be your Personal KRA PIN Number, Company KRA PIN Number or Self Help Group KRA PIN Number.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

Now that we have the main requirement that is needed in the process of checking and confirming the type of KRA Tax Obligation that a taxpayer is registered for on iTax, we can now proceed ahead and look at the step by step guide of How To Check KRA Tax Obligation On KRA iTax Portal.

How To Check KRA Tax Obligation On KRA iTax Portal

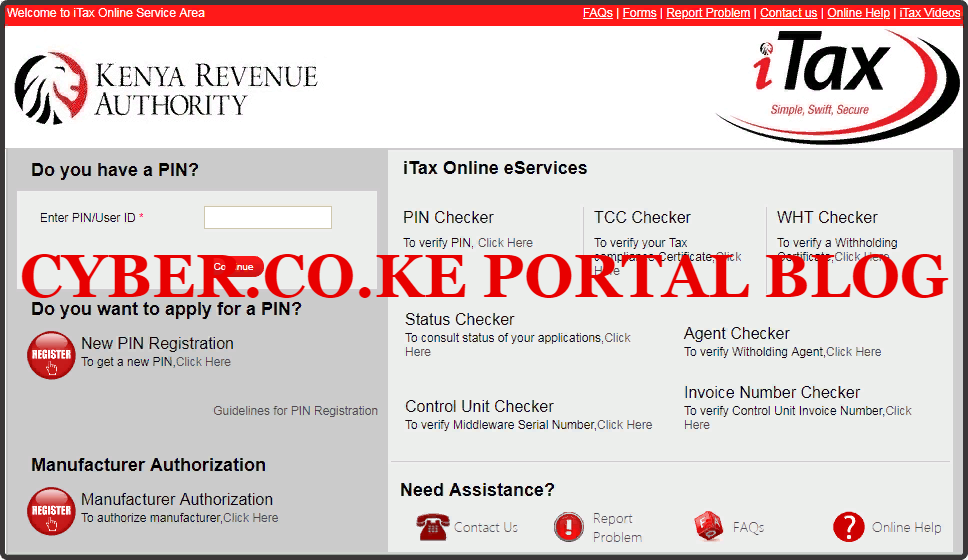

Step 1: Visit iTax Portal

The first step that you need to take in the process of checking and confirming the KRA Tax Obligation that you are registered for on iTax is to visit the KRA iTax Portal by clicking on the link provided in the above description.

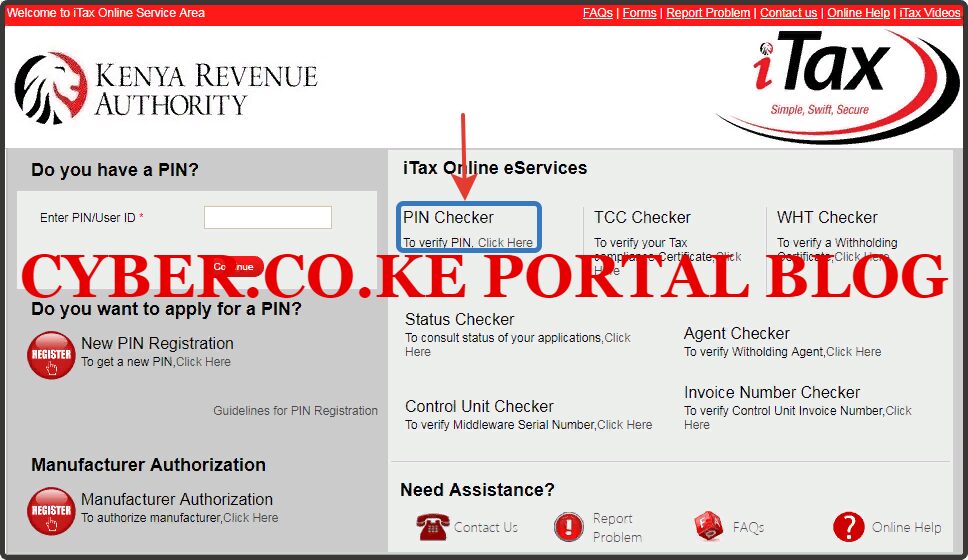

Step 2: Click On PIN Checker

The process of checking and confirming the type of KRA Tax Obligations that a taxpayer is registered for involves the use of the KRA PIN Checker Functionality that is found on iTax. On the iTax homepage, you need to click on the “PIN Checker” option as illustrated in the screenshot below.

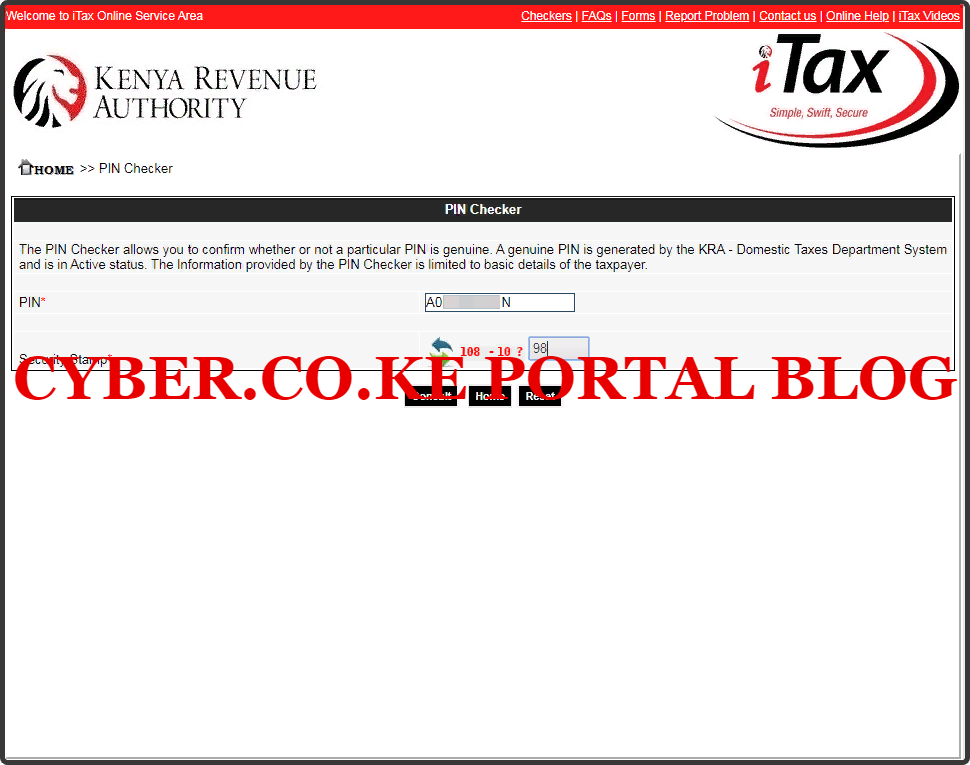

Step 3: Enter KRA PIN Number And Solve Arithmetic Question (Security Stamp)

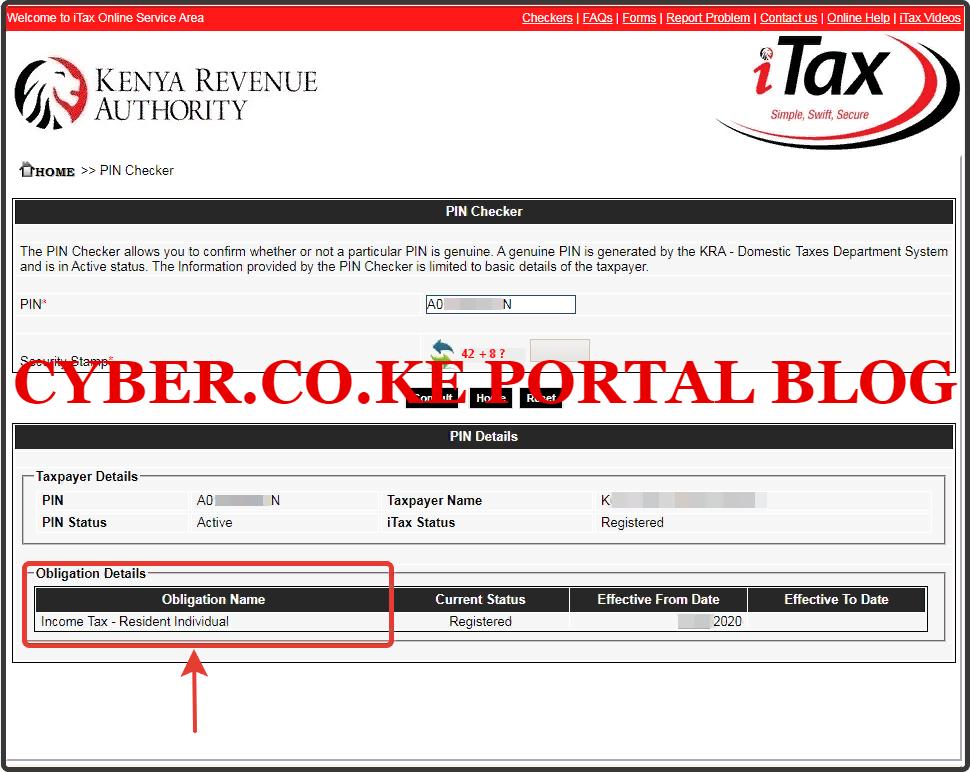

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, you need to solve the Arithmetic Question (Security Stamp) and once you have done so, click on the “Consult” button as illustrated below.

Step 4: KRA Tax Obligation Details

In the last step in the process of checking and confirming the KRA Tax Obligation that a taxpayer is registered for on iTax is the PIN Details Results form the PIN Checker functionality. Here you can view the Tax Obligation that the taxpayer is registered for on iTax. In our case, since we were checking for an Individual taxpayer, the KRA Tax Obligation in this case is Income Tax Resident Individual as illustrated below.

READ ALSO: How To Apply For KRA Clearance Certificate Using iTax Portal

You can use the process above to check and confirm the KRA Tax Obligation that a Company or Self Help Group is registered for on iTax. You will only require the KRA PIN of either the Company or Self Help Group to check and confirm the KRA Tax Obligations that the PIN is registered for on iTax. The above steps sums up the process that is involved in How To Check KRA Tax Obligation On KRA iTax Portal.

Matthews Ohotto is a Writer at CYBER.CO.KE where he specializes in writing helpful and informative Step-by-Step Tutorials that empower Kenyans with practical skills and knowledge. He holds a Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT). Get KRA Individual Services and KRA Returns Services in Kenya.