Do you need to check and confirm your KRA PIN Number on iTax Portal? Learn How To Check Your KRA PIN Using iTax PIN Checker functionality.

Having a KRA PIN Number does not necessarily mean that it is valid and active. Knowing how to check your KRA PIN Number using iTax PIN Checker is quite essential so as to know whether your KRA PIN is Valid and Active on KRA iTax Portal.

In this article today, I am going to share with you the steps that you should follow if you need to check your KRA PIN on iTax Portal. Having a KRA PIN is one thing, knowing if it is Valid and Active is another thing. By the end of this article, you will have known how to check your KRA PIN using iTax PIN Checker functionality.

READ ALSO: How To Use KRA Portal Print PIN Certificate Functionality

Many taxpayers normally confuse the digits in their KRA PIN Numbers and when they are asked to write the PIN Number either on a form or an online application, they end up writing the wrong KRA PIN Number. That’s where the iTax PIN Checker comes into play, so as to enable the taxpayer confirm if the PIN Number they are using is valid and Active.

The iTax PIN Checker plays a very important role on the KRA Portal. We all know that having a KRA PIN is one thing, but sometimes, you also need to check and check whether the KRA PIN that you have is valid or not, and that has been simplified by the iTax PIN Checker functionality on the KRA Portal or simply iTax Portal.

If by any chance you have forgotten your KRA PIN Number, you can request for KRA PIN Retrieval using Cyber.co.ke Portal. Our team will work on your KRA PIN Retrieval request and send you the KRA PIN Number together with the KRA PIN Certificate to the email address that you prefer. That will surely make it easier for you to use the iTax PIN Checker with much ease and convenience.

What Is iTax PIN Checker?

iTax PIN Checker is a functionality on KRA iTax Portal that enables a taxpayer to confirm whether his or her KRA PIN Number is Valid and Active on iTax. The iTax PIN Checker allows you to confirm whether or not a particular KRA PIN Number is Genuine or what we refer to as Valid.

A Genuine KRA PIN Number is generated by the Kenya Revenue Authority (KRA) Domestic Taxes Department System (DTDS) and that is also applied and received using the KRA PIN Registration services at Cyber.co.ke Portal and is in Active status.

Now that we have addressed what we mean by the term iTax PIN Checker, we need to look at the results that are gotten from using the KRA PIN Checker on iTax Portal. This will then form a foundation of understanding the steps that you need to follow in checking your KRA PIN on iTax Portal.

iTax PIN Checker Results

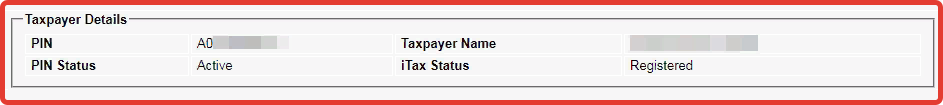

Since iTax PIN Checker is a functionality whose final results are the PIN Details of a taxpayer, we need to understand these sets of results that a taxpayer will get from using the KRA iTax PIN Checker Functionality. The results can be categorized into two i.e. Taxpayer Details and Obligation Details. Now let us analyze each one of these results below.

-

Taxpayer Details

The first part of the PIN Checker results outcome is the Taxpayer Details. Just as from the name, this is just the basic information about the taxpayer. The taxpayer details on the iTax PIN Checker Results is normally limited to only KRA PIN Number of the Taxpayer, Full Names of the Taxpayer, KRA PIN Status i.e Active or Dormant and KRA iTax Status i.e Registered or iPage Updated.

The KRA PIN Number is a 11 digit Personal Identification Number that is issued by Kenya Revenue Authority (KRA) and which you can apply and get at Cyber.co.ke Portal by using the KRA PIN Registration services request. The PIN Checker normally displays the KRA PIN Number of the taxpayer when the KRA PIN is Valid.

Full Names of the Taxpayer just as the name suggests simply mean the first, middle and last name of a taxpayer. These are the names that are also displayed on the National ID of a Kenyan. The way the names are displayed on the National ID is the same way that they will appear on your KRA PIN Certificate on iTax Portal.

KRA PIN Status simply shows whether the KRA PIN is Active or Dormant. If the PIN is Active, then the taxpayer can easily use the PIN by simply logging into his or her KRA Web Portal Account. On the other hand, if the KRA PIN Number is Dormant, the taxpayer will have to apply for KRA PIN Activation at his or her KRA Tax Station.

The last part under the Taxpayer details id the KRA iTax Status. There are normally only two types of iTax Status i.e. Registered or iPage Updated. If the KRA iTax Status shows Registered, then it simply means that the KRA PIN Number was applied on KRA iTax Portal using Cyber.co.ke Portal KRA PIN Registration services. On the other hand, iPage Updated means that the KRA PIN was migrated to iTax using the KRA PIN Update services at Cyber.co.ke Portal.

-

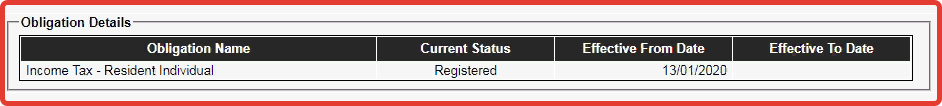

Obligation Details

The second and last section of the iTax PIN Checker Results is the Obligation Details. This normally comprises of Obligation Name, Current Status, Effective From Date and Effective Date To. I am going to highlight on each one below.

The first part i.e. Obligation Name simply shows the type of KRA Tax Obligation that a taxpayer is currently Registered under on iTax Portal. For most individual taxpayers in Kenya the Tax Obligation Registered is Income Tax Resident. For most companies the obligation registered can either be Income Tax Company, Value Added Tax (VAT) or Pay As You Earn.

Current Status simply shows the registration status on iTax Portal. The iTax Status for all KRA PIN Numbers on iTax Portal is Registered. When you apply for a KRA PIN Number on iTax, the status automatically becomes Registered.

The two last parts i.e. Effective Dates can be combined into one. Effective From Date shows that date that the KRA PIN was Registered on iTax Portal. On the other hand Effective To Date is not that important.

Now that we have looked at the iTax PIN Checker Results in detail above, we now need to know what requirement we need to have inorder to use the iTax PIN Checker to confirm a KRA PIN on iTax Portal. You are only going to need the KRA PIN Number for you to use the iTax PIN Checker functionality.

Requirement Needed For Use Of iTax PIN Checker

Since the iTax PIN Checker is used to confirm whether a KRA PIN Number is Genuine and Active, the only requirement that is going to be needed in this process is the KRA PIN Number of the taxpayer. This is as illustrated below.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

Now that we have with us the key requirement needed in this process, we can now look at the steps that we need to follow in the process of How To Check Your KRA PIN Using iTax PIN Checker.

How To Check and Confirm Your KRA PIN Using iTax PIN Checker

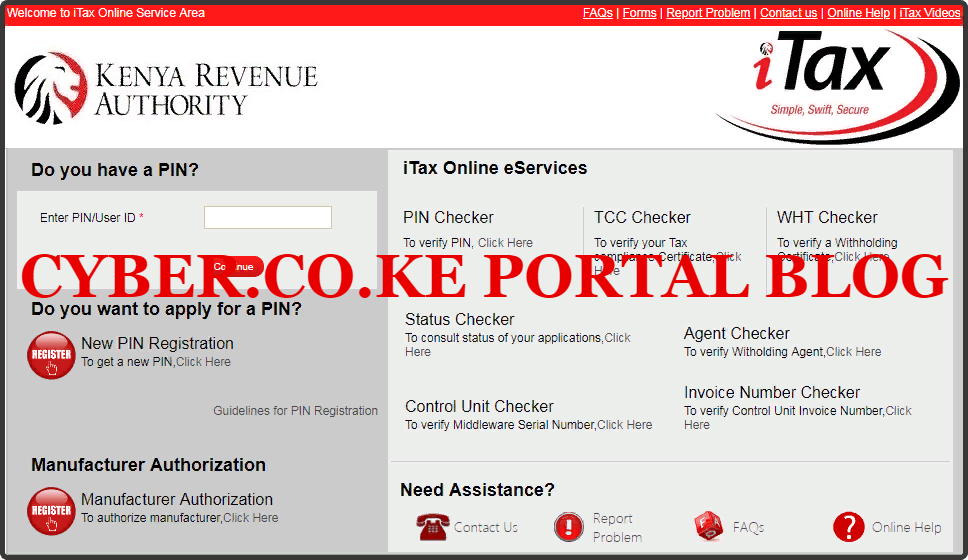

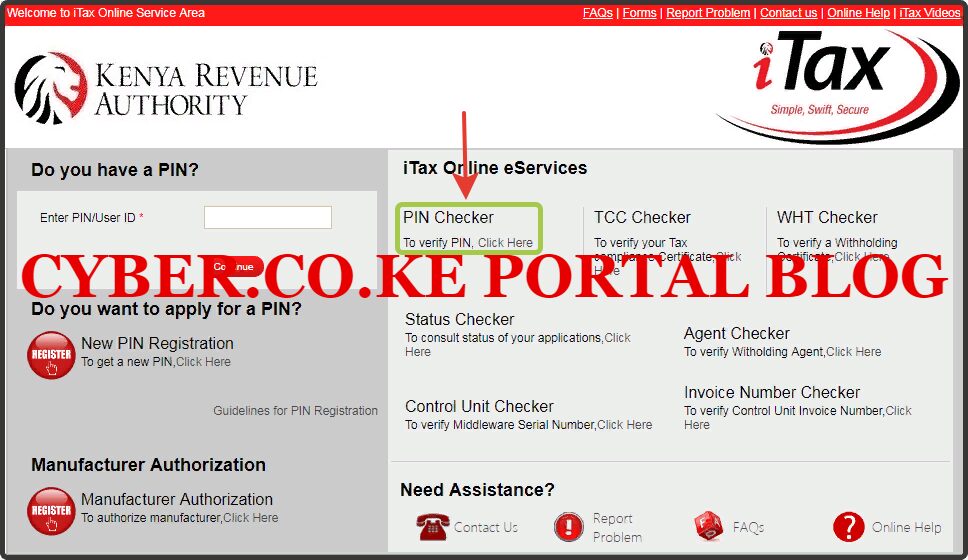

Step 1: Visit KRA Portal

The first step that you need to take is to ensure that you visit the KRA iTax Web Portal using the link provided above in the above description. Note, the above is an external link that will take you to the KRA iTax Portal.

Step 2: Click On The iTax PIN Checker Link

Next, you will need to click on the iTax PIN Checker link. This is as illustrated in the screenshot image below.

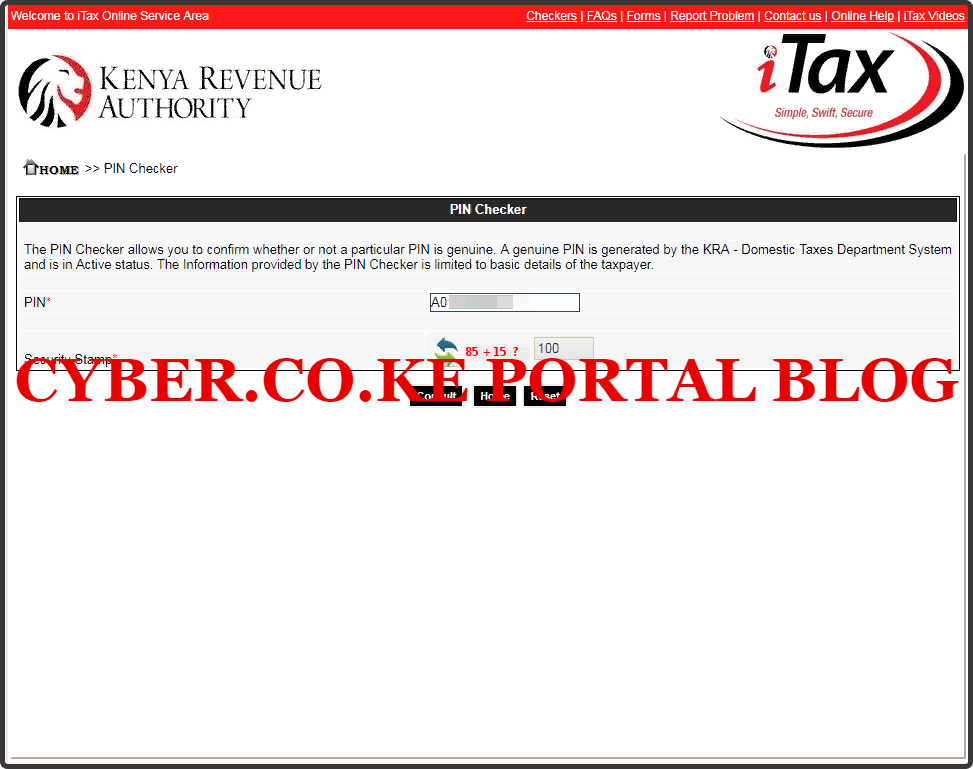

Step 3: Enter Your KRA PIN Number And Solve Arithmetic Question

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN above, you will also need to solve the arithmetic question (security stamp). Once you have entered the KRA PIN Number and solved the arithmetic question, click on the “Submit” button. This is as illustrated below.

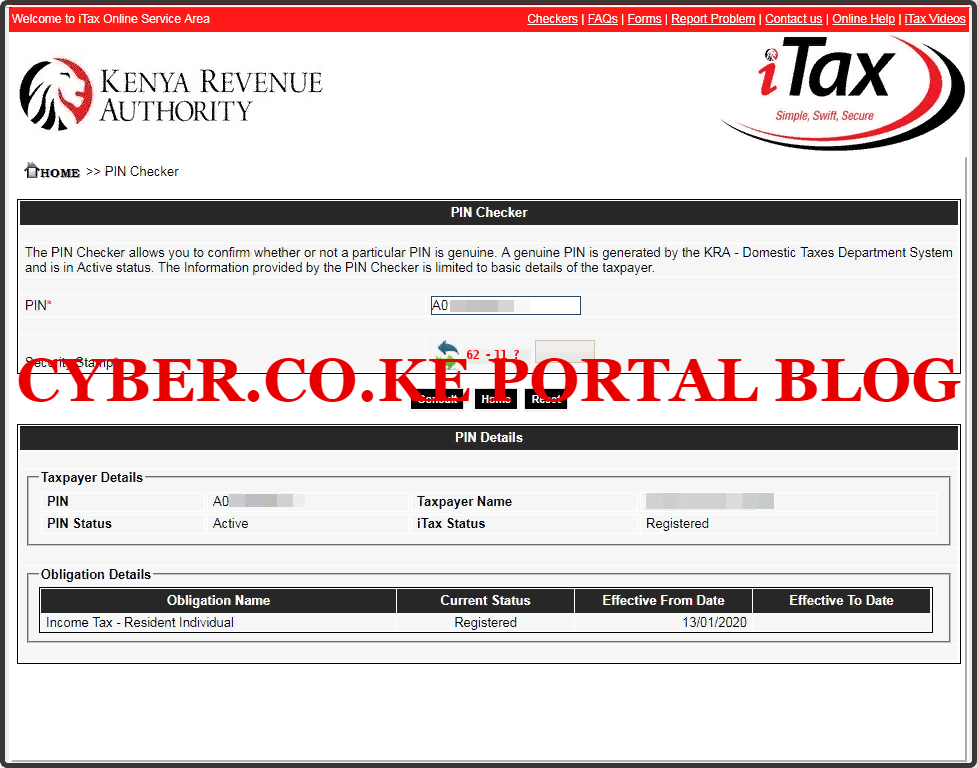

Step 4: iTax PIN Checker Results

The last step in the process of checking your KRA PIN Number using iTax PIN Checker is the results of the PIN Checker. Just as I had explained above, the iTax PIN Checker results comprises of two key parts i.e. Taxpayer Details and Obligation Details as illustrated in the screenshot below.

READ ALSO: How To Reprint KRA Clearance Certificate On iTax Portal

What you need to take note of the iTax PIN Checker results is that a Valid KRA PIN Number will display both the taxpayer details and the obligation details. If the KRA PIN is not genuine, then no results will be displayed. So, next time you need to check and confirm your KRA PIN using iTax PIN Checker, just follow the above steps that will enable you to check and confirm if the KRA PIN that you are currently using is valid and active on KRA iTax Portal.

Matthews Ohotto is a Tutorials Writer at CYBER.CO.KE where he specializes in writing helpful and informative Step-by-Step Tutorials that empower Kenyans with practical skills and knowledge. He holds a Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT). Need help? Send an email to: [email protected] today.