Get to know How To Confirm KRA PIN Using KRA PIN Checker on iTax Portal. Learn the process of confirming KRA PIN using PIN Checker on iTax.

Need to confirm your KRA PIN Number on iTax Portal? Follow the steps and procedures that are outlined in this article so as to be able to confirm your KRA PIN Number and KRA PIN Certificate using the KRA PIN Checker functionality on iTax Portal.

In this article I am going to share with you the steps involved in verifying KRA PINs online using the KRA PIN Checker functionality on iTax. Get to know the steps to follow when you need to confirm the KRA PIN on iTax Portal. So, if you have a KRA PIN and need to check its validity, then the KRA PIN Checker on iTax Portal will come in handy.

READ ALSO: How To Verify KRA Tax Compliance Certificate Using iTax TCC Checker

Before we continue, you need to ensure that you have with you the KRA PIN Number, if you dont have a KRA PIN, you can place order online for KRA PIN Registration here at Cyber.co.ke Portal. If in any case you don’t know or have forgotten your KRA PIN, your can also place order online here at Cyber.co.ke Portal for KRA PIN Retrieval.

The good thing is that incase you have forgotten your KRA PIN Number or even iTax Password (KRA Password), here at Cyber.co.ke Portal we can gladly assist you with that. Incase you have forgotten your KRA PIN, then you can request for KRA PIN Retrieval and have both your KRA PIN Number and KRA PIN Certificate sent to you.

Incase you have forgotten your iTax Password, you can request for KRA PIN Change of Email Address so that you can be able to change your KRA Password. Having outlined that above, now we can look at what KRA PIN Checker is and we can check KRA PIN using KRA PIN Checker on iTax Portal.

What Is KRA PIN Checker?

The KRA PIN Checker functionality on iTax allows you to confirm whether or not a KRA PIN is genuine or not. The information provided by the KRA PIN Checker is limited to only the basic information about the taxpayer.

The KRA PIN Checker results are the final step in this process. The results of the PIN Checker basically simply display the PIN Details of the taxpayer from Kenya Revenue Authority (KRA). The basic information that will be displayed on the PIN Checker Results includes the following:

- Taxpayer Details

- Address Details

- Obligation Details

Once you have with you the KRA PIN Number that you want to check and confirm using the PIN Checker on KRA Website, the you are good to go. Now that you have the KRA PIN with you, we can begin the process of confirming the number using the PIN Checker on iTax.

How To Confirm KRA PIN Using KRA PIN Checker on iTax

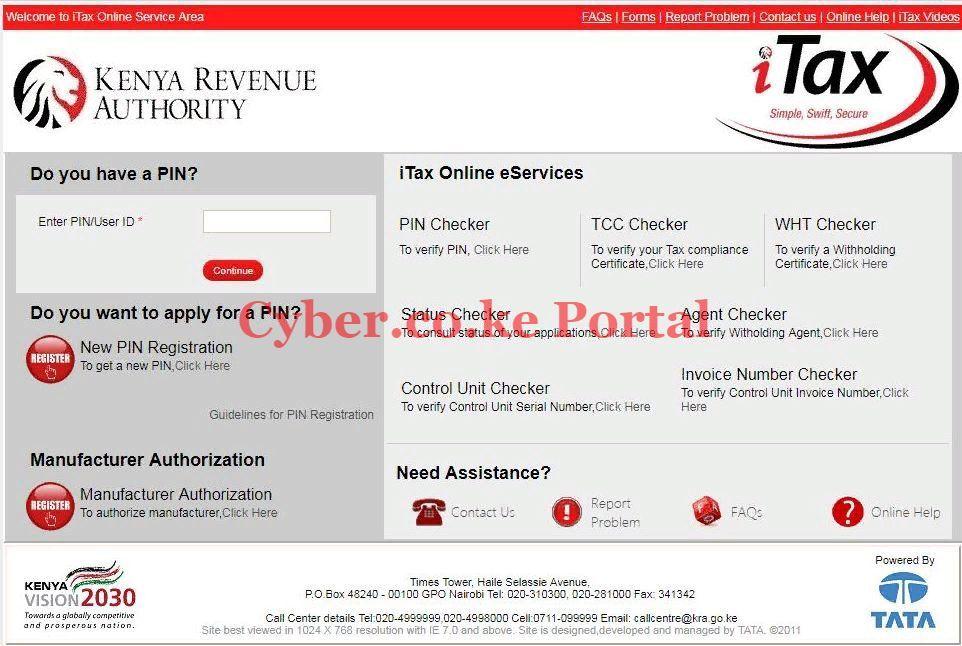

Step 1: Visit iTax Portal

The first step in this process involves visiting the KRA iTax Portal using the link provided in the above description.

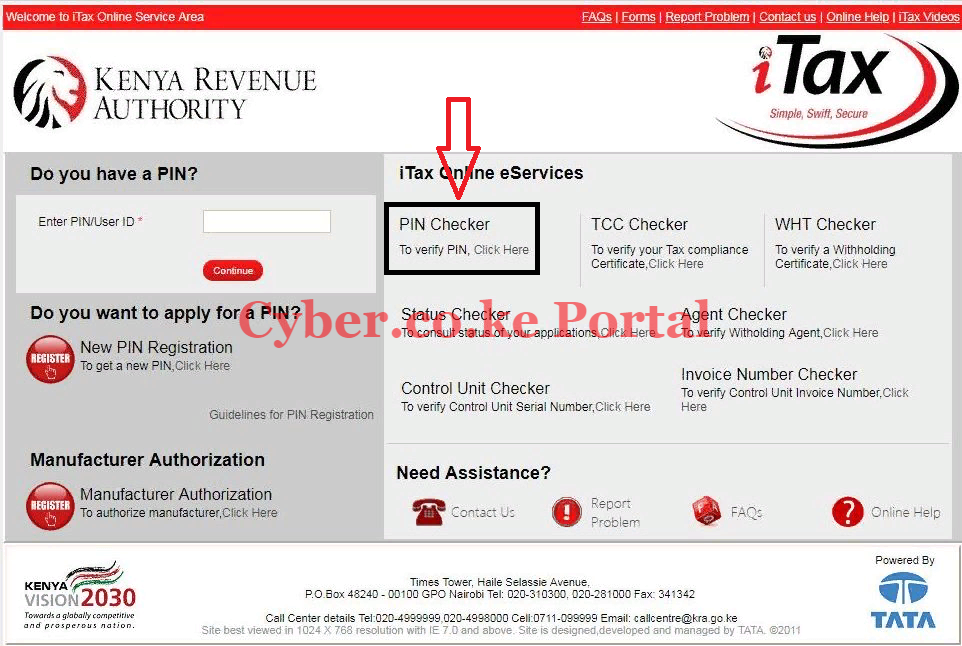

Step 2: Click on the PIN Checker section

Next, you will click on the PIN Checker section on the iTax Portal homepage. This is as shown in the screenshot below.

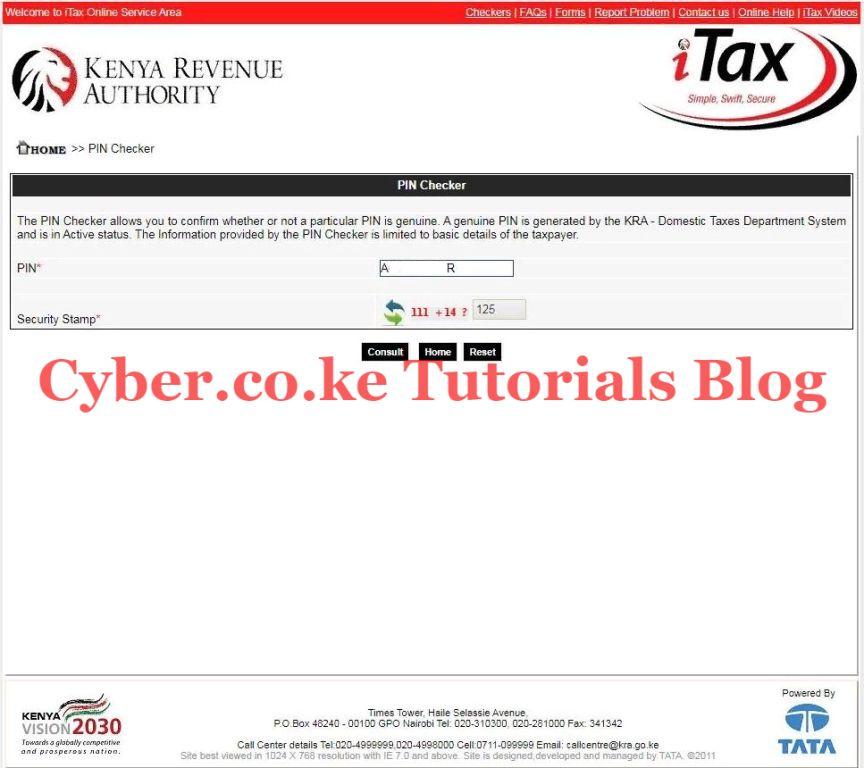

Step 3: Enter KRA PIN Number and Security Stamp (solve arithmetic question)

In this step, you will enter your KRA PIN Number and also solve the arithmetic question (security stamp). Once you have done that, click on the “Consult” button.

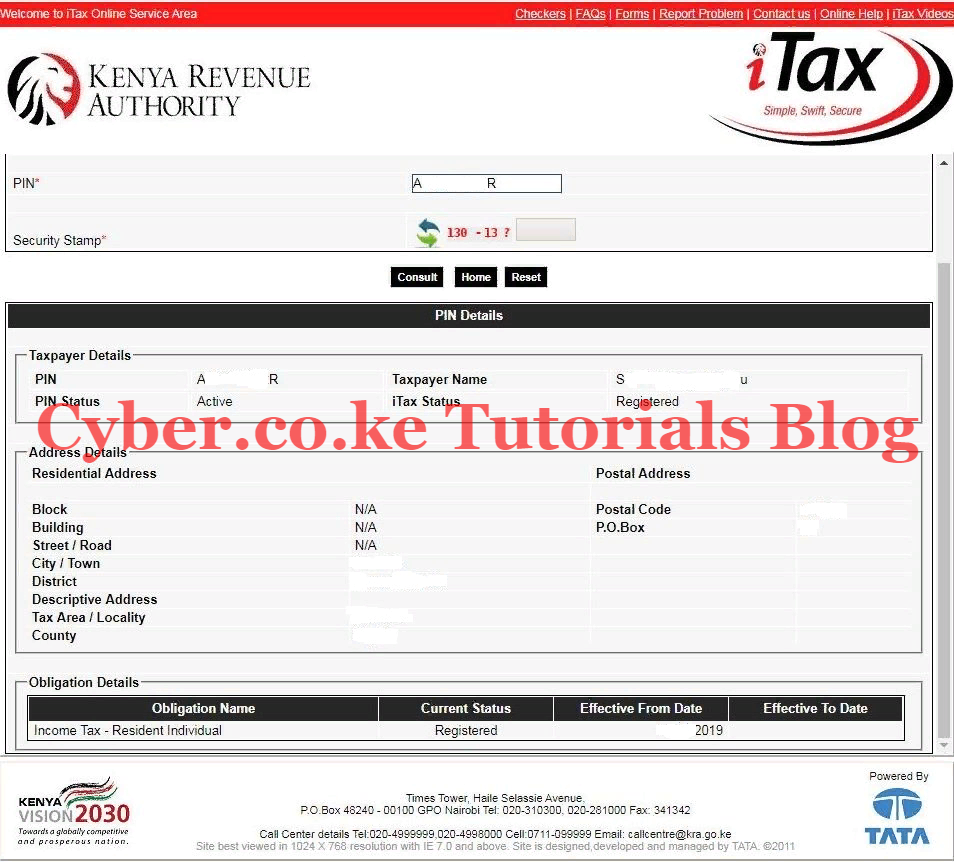

Step 4: KRA PIN Details Results

This is the last and final step whereby the taxpayer PIN details will be displayed confirming that the KRA PIN is genuine and at the same time active. This is illustrated in the screenshot below.

If the KRA PIN is genuine, then the PIN details will contain: Taxpayer Details, Address Details and Obligation Details. Not that this not a PIN Certificate since it just displays the taxpayer PIN details. You can get your KRA PIN Certificate using our KRA PIN Retrieval services here at Cyber.co.ke Portal.

On the PIN Details results that will be displayed on the KRA iTax Website Portal by the KRA PIN Checker you will need to note the following:

-

Taxpayer Details Section

In the taxpayer details on the KRA PIN Checker results, you will see: PIN (the KRA PIN number), Taxpayer Name, PIN Status (Active), iTax Status (Registered).

-

Address Details Section

In this section, you will see the following: Residential Address (block, building, street/road, city/town, district, descriptive address, tax area/locality and county. In the Postal Address part: (p.o.box and postal code).

-

Obligation Details Section

READ ALSO: How To Login Into iTax Portal

This is the last section of the PIN Details results from the KRA PIN Checker. Here, you will see: obligation name, current status, effective from date and effective to date). And those are the steps involved in verifying if a KRA PIN is genuine or not using the iTax functionality on iTax Portal.

TRENDING BLOG POSTS IN KENYA

CYBER.CO.KE

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

CLICK HERE TO REGISTER KRA PIN NUMBER

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

CLICK HERE TO RETRIEVE KRA PIN CERTIFICATE

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

CLICK HERE TO UPDATE KRA PIN NUMBER

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

CLICK HERE TO CHANGE KRA PIN EMAIL ADDRESS