The e-Return Acknowledgement Receipt is an important document that is issued to taxpayers upon successful filing of their KRA Returns either KRA Nil Returns, KRA Employment Returns, Turnover Tax (TOT) Returns, Monthly Rental Income (MRI) Returns, Pay As You Earn (PAYE) Returns or even Value Added Tax (VAT) Returns online using iTax (KRA Portal).

The e-Return Acknowledgement Receipt contains details such as the Personal Information and Return Filing Details together with the Return Summary. So, if you fail to get a copy of the KRA e-Return Acknowledgement Return after filing any KRA Returns online, you can easily download a copy of the e-Return Receipt on iTax (KRA Portal).

To be able to download the e-Return Acknowledgement Receipt online using iTax (KRA Portal), you need to ensure that you have with you both your KRA PIN Number and KRA Password (iTax Password) which you are going to need in the process of logging into your iTax (KRA Portal) account.

READ ALSO: Step-by-Step Process of Filing KRA Returns: For Pensioners

In this blog post, I will cover the main steps that all taxpayers in Kenya need to follow in order to easily download their KRA e-Returns Acknowledgement Receipts online using iTax (KRA Portal) after filing any of the KRA Returns.

How To Download e-Return Acknowledgement Receipt

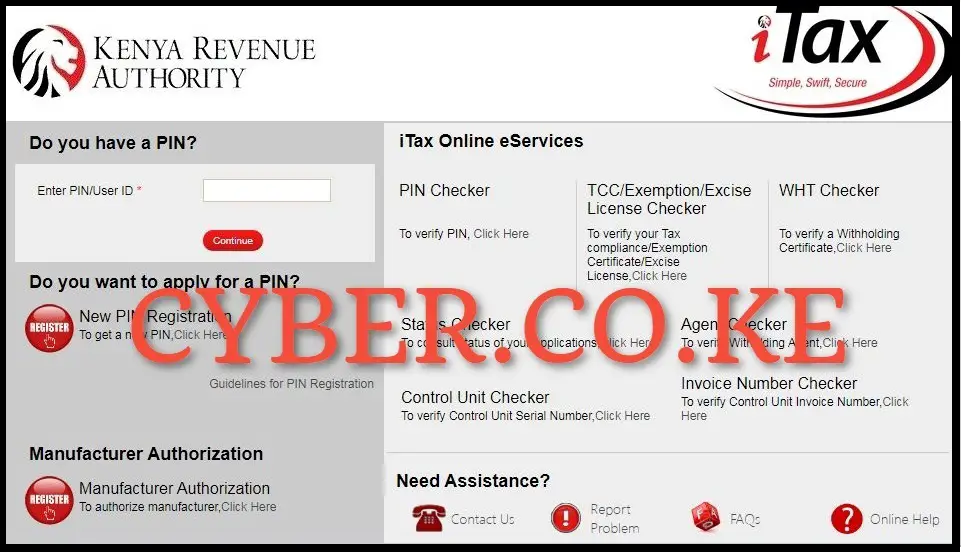

Step 1: Visit iTax (KRA Portal)

To be able to download your KRA e-Return Acknowledgement Receipt online, you first need to visit iTax (KRA Portal) using https://itax.kra.go.ke/KRA-Portal/

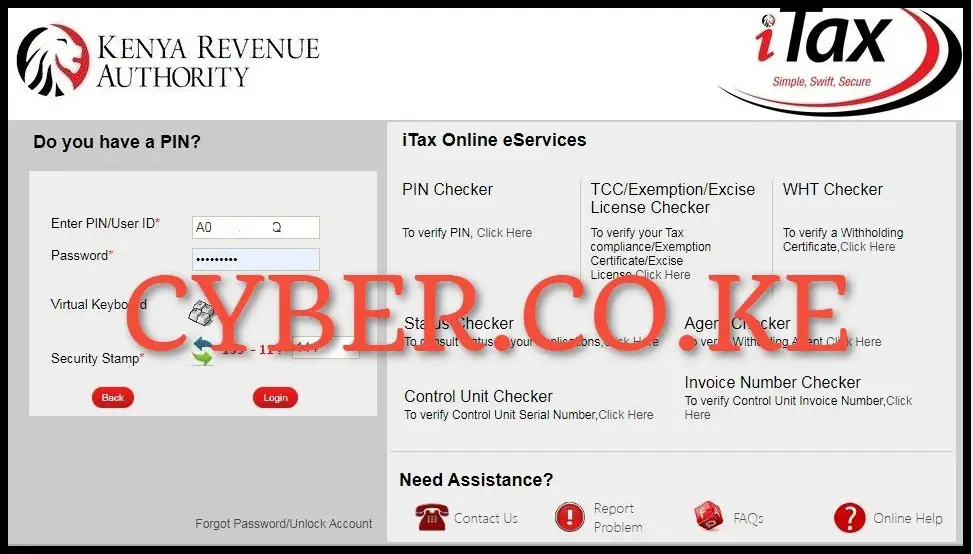

Step 2: Login Into iTax (KRA Portal)

Next, enter your KRA PIN Number, KRA Password (iTax Password), solve the arithmetic question (security stamp) and then click on the “Login” button to access your iTax (KRA Portal) so as to begin the process of downloading e-Return Acknowledgement Receipt.

Step 3: Click on Useful Links then Consult and Reprint Acknowledgement Receipt and Certificates

Upon successful login into iTax (KRA Portal) account, on the top menu click on “Useful Links” then click on “Reprint Acknowledgement Receipt and Certificates” from the drop down sub-menu items list.

Step 4: Fill the Consult and Reprint Acknowledgement Receipt Form

In this step, you need to fill in the following important fields on the Consult and Reprint Acknowledgement Receipt form; Business Process – Taxpayer Return Processing; Business Sub Process – Original Return Filing; Obligation Name – Income Tax Resident Individual; Tax Period From; 01/01/2023 and Tax Period To: 31/12/2023 (choose the tax return period that you want the e-Return Acknowledgement Receipt for). Once you have filled in those details, click on the “Consult” button to load the KRA e-Return Acknowledgement Receipt. Take note, on the pop up window “Do you want to consult with given details?” click on “OK” button.

Step 5: Download e-Return Acknowledgement Receipt

In this last step, you now need to download the generated e-Return Acknowledgement Receipt on iTax (KRA Portal). To download the KRA e-Return Acknowledgement Receipt on iTax (KRA Portal), on the output section of the consult criteria form just under the “Acknowledgement Number” column, click on the acknowledgement serial number i.e KRA2023***********7, which will in turn initiate the download of the e-Return Acknowledgement Receipt.

READ ALSO: Step-by-Step Process of Filing KRA Returns: For Retirees

The above 5 steps sums up the process of How To Download e-Return Acknowledgement Receipt online using iTax (KRA Portal). Just as a reminder, downloading of the KRA e-Return Acknowledgement Receipt requires one to have already filed his or her KRA Returns online and now want to download a copy of the KRA Returns Receipt. You need to ensure that you have with you KRA PIN Number and KRA Password (iTax Password) which are needed in accessing iTax (KRA Portal). Once you have all these with you, you can follow the above outlined steps so as to download your KRA e-Return Acknowledgement Receipt.

Matthews Ohotto is an Article Writer at CYBER.CO.KE and a Video Creator at Step-by-Step Tutorials Kenya (YouTube). He specializes in crafting insightful Blog Posts and Video Tutorials that empower Kenyans with practical digital skills. He is a holder of Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT).

KRA INDIVIDUAL SERVICES

SUBMIT SERVICE REQUEST

KRA PIN REGISTRATION

Are you looking for KRA PIN Registration services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN RETRIEVAL

Are you looking for KRA PIN Retrieval services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN UPDATE

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN CHANGE OF EMAIL ADDRESS

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA RETURNS SERVICES

SUBMIT SERVICE REQUEST

KRA NIL RETURNS

Are you looking for KRA Nil Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA EMPLOYMENT RETURNS

Are you looking for KRA Employment Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA AMENDED RETURNS

Are you looking for KRA Amended Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA WITHHOLDING TAX RETURNS

Are you looking for KRA Withholding Tax Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.