Get to know How To Download Income Tax Resident Individual Form On iTax. The steps involved in downloading KRA Returns Excel Form.

For you to be able to file your KRA Returns, you need to ensure that you have with you P9 Form and the Income Tax Resident Individual Form or Excel Sheet. You are going to need this during the Returns filing process, so this article is going to show you how to download the Income Tax Resident Individual Form.

Today, I am going to share with you the steps that are involved in downloading the KRA Returns Excel form оп iTax. The 2018 KRA Returns Period ended on 31st June 2019 and if you didn’t file your KRA Returns, then definitely you received a penalty for late filing.

READ ALSO: How To Confirm KRA PIN Using KRA PIN Checker on iTax

If you did not manage to file your KRA Returns for 2018, you can check our article on How to Apply for KRA Waiver on the penalty for late filing of returns. To be able to download your KRA Income Tax Resident Individual Form, you need to be logged in iTax using your KRA PIN Number and KRA Password.

Logging into KRA Portal or iTax is a process that requires you to have both your KRA PIN Number and iTax Password. To be able to access and view all the resources on iTax, you need to be logged into your iTax Account. The problem is that not that many Kenyans know the process that they need to follow.

The good thing is that incase you have forgotten your KRA PIN Number or even iTax Password (KRA Password), here at Cyber.co.ke Portal we can gladly assist you with that. Incase you have forgotten your KRA PIN, then you can request for KRA PIN Retrieval and have both your KRA PIN Number and KRA PIN Certificate sent to you. Incase you have forgotten your iTax Password, you can request for KRA PIN Change of Email Address so that you can be able to change your KRA Password.

Income Tax Resident Individual Form

Take into account that our main focus today is not on that issue but rather on the steps that are involved in downloading the Income Tax Resident Individual Form on iTax so as to enable filing of KRA Employment Returns.

This article will mainly benefit those who are in employment and have the KRA P9 Form so as to enable them file their Income Tax Returns using the Excel sheet. Previously, I had shared with you the procedures on How to File KRA Returns using P9 Form (for those employed) and also How to File KRA Nil Returns (for those unemployed). You can refer to those two articles on the steps involved in filing KRA Returns.

Back to our post, the KRA Income Tax Resident Individual Form can be downloaded on iTax if your KRA PIN is already updated on iTax. If your KRA PIN has net been updated on iTax, you can request for our KRA PIN Update Services here at Cyber.co.ke Portal.

If you have forgotten your KRA PIN, no worries, you can request for KRA PIN Retrieval Services also. For those who have forgotten their iTax Password, you can check our article on How To Reset KRA iTax Password. If you no longer use the current email and want it to be changed, you can request for our KRA Change of Email Address Services.

Now that you have that sorted, you can now begin the process of downloading the Income Tax Resident Individual Form on iTax. You need to take note that there are two KRA Returns forms on iTax. This includes:

-

Excel Return Form

-

ODS Return Form

The recommended and common is the Excel Return Form since majority of Kenyans know how to use the Microsoft Excel. An ODS file is a spreadsheet created by the Calc program included with the Apache OpenOffice suite. It stores data in cells that are organized into rows and columns.

So we are going tpo stick with the Excel Return Form. Now, let us dive into How To Download Income Tax Resident Individual Form On iTax.

How To Download Income Tax Resident Individual Form On iTax

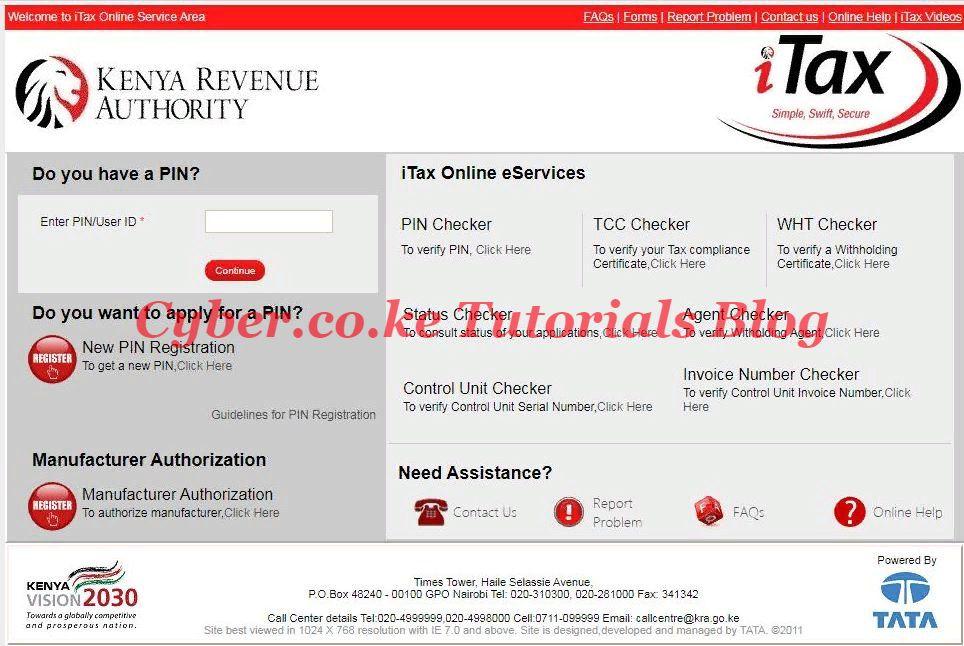

Step 1: Visit iTax Portal

First and foremost, we need to visit the KRA iTax Portal using the link provided in the above description.

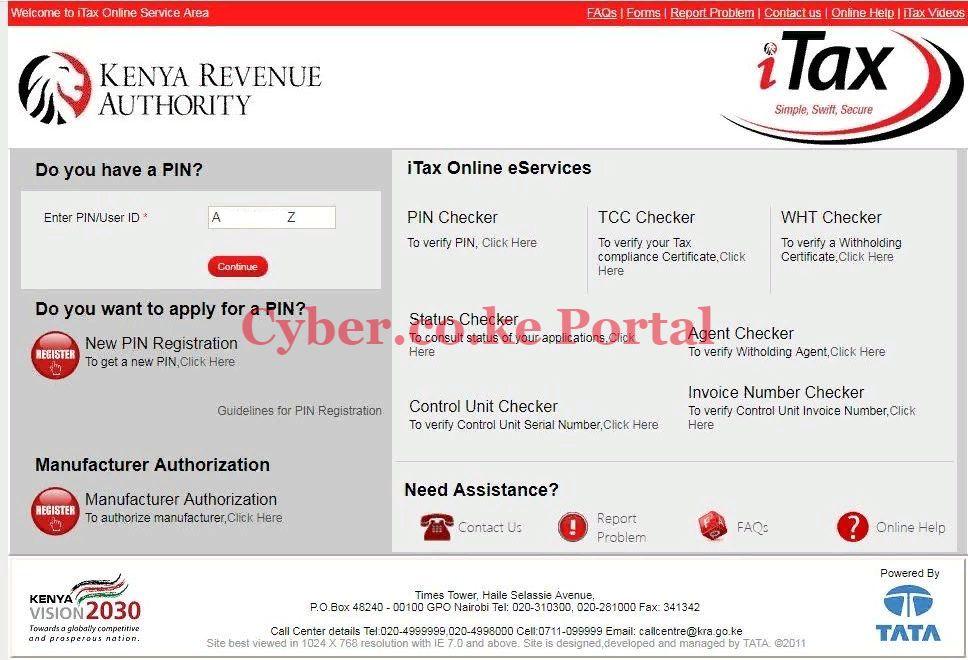

Step 2: Enter your KRA Number

Next, you will need to enter your KRA PIN Number. If you have forgotten it, you can place retrieval order here. Once you have entered your KRA PIN number click on the “Continue” button to proceed.

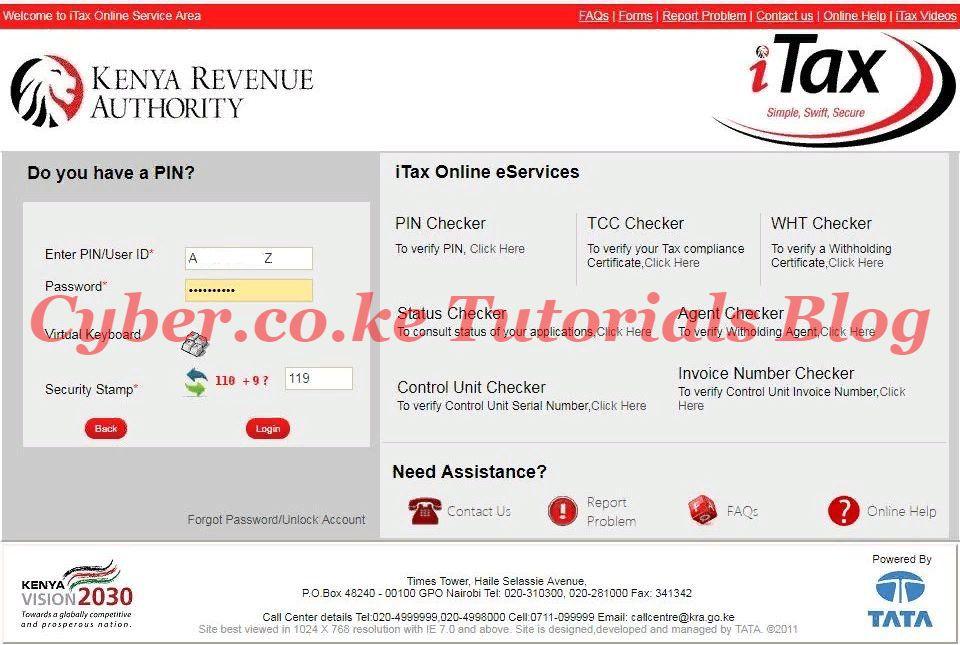

Step 3: Enter your KRA iTax Password and Security Stamp

In this step, you will be required to enter your KRA iTax Password. If you don’t remember your password, you can reset it by following our password reset guide. Once you have entered your password, click on the “Login” button.

Step 4: iTax Account iPage Dashboard

Once you have logged in successfully, you will be able to see your iTax Account iPage dashboard. This is as illustrated in the screenshot below.

Step 5: Click on the Returns Tab then Click on File Returns

Next, you will click on the “Returns” tab followed by the “File Returns ” tab. This is as shown below.

Step 6: e-Returns

In this section, fill in the tax obligation that you are filing the return for. In our case, it is Income Tax Resident Individual. Click on the “Next” button to proceed.

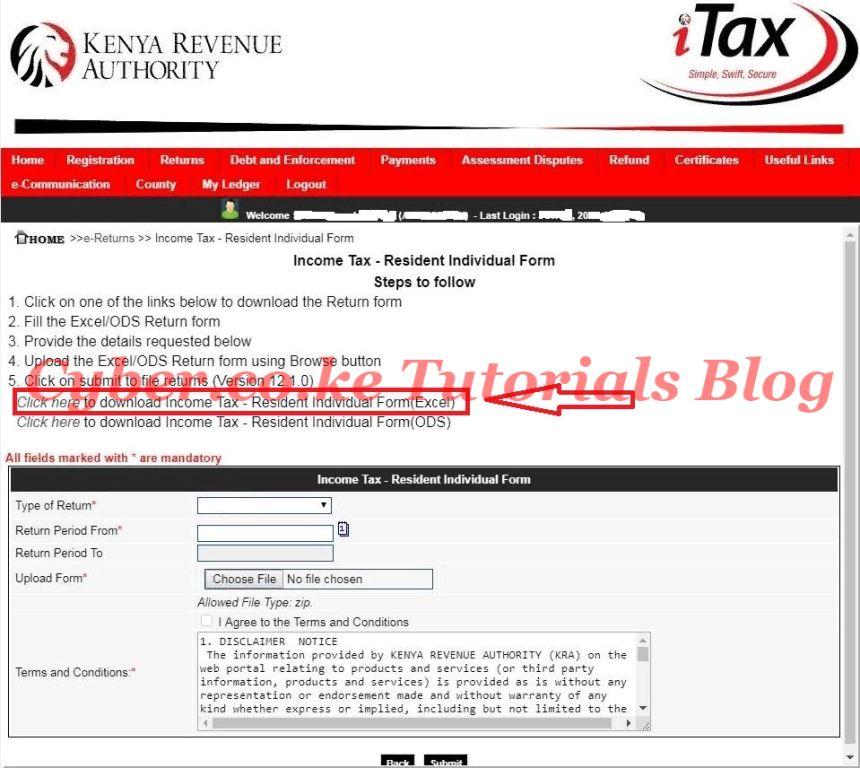

Step 7: Download KRA Income Tax Resident Individual Return Form (Excel)

This is the last step whereby you will need to download the Income Tax Resident Individual Form. You need to download the Excel Form.

You will obviously need Microsoft Office installed on you computer so as to open the Excel file. By default Macros on the Excel sheet in Microsoft Excel 2007 is disabled, so you will need to enable Macros on the Excel sheet. If you are using a higher version of Microsoft Office Suite such as Office 2010, Office 2013, Office 2016 or Office 2019 and above, it should open easily without asking you anything about enabling Macros.

Another issue that you may experience with the KRA Income Tax Resident Individual Form (Excel) if you are using Microsoft Office 2007 (most commonly used in Kenya), you might be required to download an addon to enable the KRA Excel Sheet open.

Download 2007 Microsoft Office Suite Service Pack 2 (SP2)

Download Income Tax Resident Individual Form (Excel)

Download Income Tax Resident Individual Form (ODS)

READ ALSO: How To Verify KRA Tax Compliance Certificate Using iTax TCC Checker

And that is How To Download Income Tax Resident Individual Form On iTax. You need to ensure that you download the latest KRA Returns form from your iTax Account when you are filing your KRA Returns.

DON’T MISS OUT. CHECK OUT OUR TRENDING POPULAR BLOG POSTS IN KENYA.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

REGISTER KRA PIN NUMBER

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

RETRIEVE KRA PIN CERTIFICATE

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

UPDATE KRA PIN NUMBER

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

CHANGE EMAIL ADDRESS

Stay Tax Compliant in Kenya

Contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.

Our dedicated team is ready to assist you immediately you fill and submit your service request online. Whether you need help with Registering KRA PIN Number, Retrieving KRA PIN Certificate, Updating KRA PIN Number or Changing KRA PIN Email Address, we are here to assist you.

Get in touch with us today and experience professional online customer support.