The ongoing KRA Amnesty allows all taxpayers in Kenya apply for Amnesty of Fines, Penalties and Interest incurred. If you only have penalties and interest up to the period ending 31st December 2022, you will be entitled to automatic waiver of the penalties and interest related to that period and will not be required to make an amnesty application on iTax. If you have not paid all the principal taxes accrued up to 31st December 2022, you will be required to apply for the KRA Amnesty and propose a payment plan for any outstanding principal taxes which should be paid not later than 30th June 2024.

You can check out the following two blog posts to get an understanding of the KRA Amnesty Program; The Complete Beginner’s Guide To KRA Tax Amnesty 2023 and How To Apply For KRA Tax Amnesty (In 5 Steps). Once the Amnesty has been applied for, Kenya Revenue Authority (KRA) will issue you with a KRA Amnesty Certificate that confirms that you have granted Amnesty of Fines, Penalties and Interest as provided under section 37E of the Tax Procedures Act 2015. The KRA Amnesty Certificate Details includes; Tax Obligation, Tax Period, Interest Amount, Penalty Amount, Fine Amount and the Total Amount.

Once you are issued with KRA Amnesty Certificate, you are encouraged to remain compliant for no waivers and write-offs will be granted by KRA for any new debt. So, if you had only Penalties and Interest, the Amnesty Certificate will be issued immediately once the system clears those penalties and interest for you. On the other hand, those with principal amount will have to apply for KRA Amnesty and make a payment plan to clear the principal amount on or before 30th June 2024, afterwards the penalties and interest will also removed and KRA Amnesty Certificate will be issued to them.

READ ALSO: How To Apply For Tax Compliance Certificate On iTax

To be able to download KRA Amnesty Certificate on iTax, there are two key requirements that you need to ensure you have with you. The requirements needed to enable download of KRA Amnesty Certificate includes KRA PIN Number and KRA Password (iTax Password). Once you have been granted Amnesty on Penalties and Interest by Kenya Revenue Authority (KRA), you will be issued with the KRA Amnesty Certificate which you can easily download from your iTax account by using the above listed requirements.

Requirements Needed In Downloading KRA Amnesty Certificate On iTax

To be able tod download KRA Amnesty Certificate on iTax, you need to login to your account using both the KRA PIN Number and KRA Password (iTax Password). This two form what is referred to as the iTax login credentials. Below is a brief description of what the two requirements of downloading KRA Amnesty Certificate entails in relation to the process of How To Download KRA Amnesty Certificate on iTax.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you when you want to login to iTax. If by any chance you have forgotten or you don’t remember your KRA PIN Number, you can submit KRA PIN Retrieval request online here at CYBER.CO.KE and our support team will be able to assist with the retrieval of your lost or forgotten KRA PIN Number.

At the same time, if you are looking for a new KRA PIN Number, you can get it here in less than 3 minutes by submitting your KRA PIN Registration request at CYBER.CO.KE. Your new KRA PIN Number and KRA PIN Certificate will be sent to your Email Address once the request for KRA PIN Registration has been done and processed by our support team.

-

KRA Password (iTax Password)

The next requirement that you need to have with you in the process of downloading KRA Amnesty Certificate on iTax is KRA Password (iTax Password). You will need the KRA Password to access your KRA Portal account. If you don’t know or have forgotten your KRA Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for KRA Password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used on iTax is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at CYBER.CO.KE and have your Email Address changed so as to enable your Reset KRA Password.

Did you know that you can easily apply and get your KRA PIN Number and KRA PIN Certificate online in less than 5 minutes by using CYBER.CO.KE today. Get it via email address or even WhatsApp upon submission.

Here at, CYBER.CO.KE, we offer unmatched KRA PIN Registration, KRA PIN Retrieval, KRA PIN Update and KRA PIN Change of Email Address services to Kenyans daily. Fill and submit your request online today.

How To Download KRA Amnesty Certificate On iTax

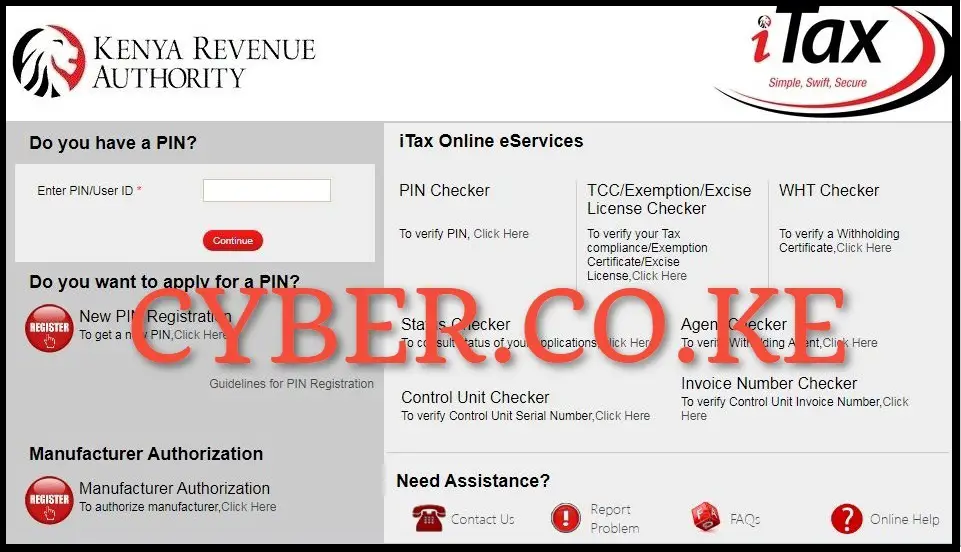

Step 1: Visit iTax

The first step in the process of downloading KRA Amnesty Certificate on iTax is to visit iTax by using https://itax.kra.go.ke/KRA-Portal/

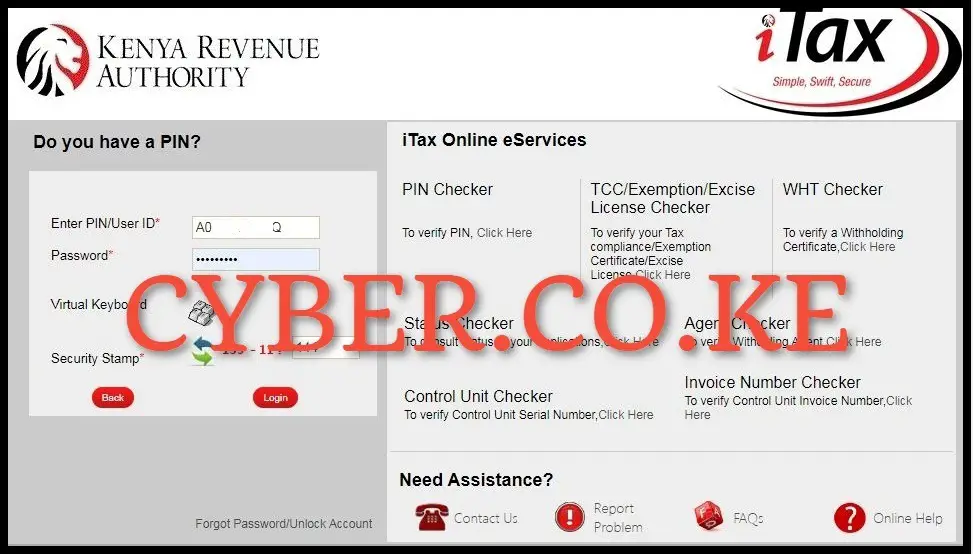

Step 2: Login To iTax

Next, using both your KRA PIN Number and KRA Password (iTax Password), solve the arithmetic question (security stamp) and click on the “Login” button to access your iTax account.

Step 3: Click on Useful Links then Consult and Reprint Acknowledgement Receipt and Certificates

Once you are logged into iTax, on the top right hand side menu, click on “Useful Links” and click on “Reprint Acknowledgement Receipt and Certificates” so as to begin the process of downloading KRA Amnesty Certificate online.

Step 4: Fill the Consult and Reprint Acknowledgement Receipt and Certificates Form

The most important step in the process of downloading KRA Amnesty Certificate on iTax is filling the “Consult and Reprint Acknowledgement Receipt and Certificates Form” online. You need to fill in the “Consult Criteria” part of the form as the “Taxpayer Details” part is already pre-filled with your details. The following fields are the one you are to select and fill; i. Business Process – Debt and Enforcement; Business Sub Process -Amnesty Certificate; Obligation Name – Income Tax Resident Individual (choose the obligation that you want the Amnesty Certificate for); Tax Period From – 01/01/2021 and finally Tax Period To – 31/12/2021. Once you have filled in those fields accordingly, click on the “Consult” button to generate your KRA Amnesty Certificate. Take note that the system will at times populate all the KRA Amnesty Certificates for all periods that had penalties and interests.

Step 5: Download KRA Amnesty Certificate

The last step involves downloading the KRA Amnesty Certificate that has been generated by the system. To download your KRA Amnesty Certificate, in the “Output” section of the form, just under the “Acknowledgement Number” column, click on the acknowledgement serial number i.e KRA2023***********8, which will in turn initiate the download of KRA Amnesty Certificate on the iTax. At this point you can choose to save the downloaded KRA Amnesty Certificate and even make a print out of the same Amnesty Certificate. As a general reminder once again, once you are issued with KRA Amnesty Certificate, you are encouraged to remain compliant for no waivers and write-offs will be granted by Kenya Revenue Authority (KRA) for any new debt.

READ ALSO: How To Download PIN Certificate On KRA Portal (In 5 Steps)

The above 5 steps sums up the whole process of downloading KRA Amnesty Certificate on iTax Portal. You need to ensure that you are able to login to your iTax account using KRA PIN Number and KRA Password (iTax Password). Also if you had principal tax, you are supposed to clear it before the penalties and interest can be removed and be issued with Amnesty Certificate. For those who have only Penalties and Interest, the KRA Amnesty Certificate is issued immediately once the system clears the penalties and interest for you. So, next time you are looking for Amnesty Certificate, just follow the above 5 steps so as to download your KRA Amnesty Certificate quickly and easily.

Matthews Ohotto is an Article Writer at CYBER.CO.KE and a Video Creator at Video Tutorials Kenya (YouTube). He specializes in crafting insightful Blog Posts and Video Tutorials that empower Kenyans with practical digital skills. He is a holder of Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT).

KRA INDIVIDUAL SERVICES

SUBMIT SERVICE REQUEST

KRA PIN REGISTRATION

Are you looking for KRA PIN Registration services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN RETRIEVAL

Are you looking for KRA PIN Retrieval services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN UPDATE

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN CHANGE OF EMAIL ADDRESS

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA RETURNS SERVICES

SUBMIT SERVICE REQUEST

KRA NIL RETURNS

Are you looking for KRA Nil Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA EMPLOYMENT RETURNS

Are you looking for KRA Employment Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA AMENDED RETURNS

Are you looking for KRA Amended Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA WITHHOLDING TAX RETURNS

Are you looking for KRA Withholding Tax Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.