Get to know How To Download KRA Income Tax Returns Form (Excel Sheet) from KRA iTax Portal today. Download the KRA Returns Excel Form (Excel Sheet) quickly and easily.

It is that period in a New Year whereby taxpayers are in the process of preparing to file their KRA Returns for the year 2019. Whether you are employed or unemployed, as long as you have an active KRA PIN, you need to file your KRA Returns.

In this article, I am going to share with you the steps that you need to follow in order to download the KRA Income Tax Returns Form also known as the Excel Sheet in your KRA iTax Account and use it to file your KRA Income Tax Returns. The KRA Income Tax Returns Form is very important when it comes to filing KRA Returns on iTax using P9 Form.

READ ALSO: 3 Important KRA Returns Requirements That You Need To Have With You

For those who are employed, they file the Income Tax Returns using the KRA Excel Sheet and their P9 Form, while those who are not employed file the KRA Nil Returns. You need to take that you need to file your KRA Returns for 2019 between 1st January 2020 to 30th June 2020.

The main focus of this article won’t be on Filing Returns but rather on How to Download the KRA Income Tax Returns Form (Excel Sheet). This form is also commonly what is referred to as the Income Tax Resident Individual Form (Excel) in KRA iTax Portal.

We are going to focus on those who are employed and will be filing their returns using the KRA Returns Form (KRA Excel Sheet) and their P9 Form. But first, before we proceed any further, we need to lay down the foundation by defining what we mean by KRA Income Tax Returns Form (Excel Sheet).

What Is Income Tax Returns Form?

The KRA Income Tax Returns Form (Excel Sheet) is an Excel Form in which the taxpayers file information about his or her income earned and tax applicable to Kenya Revenue Authority Domestic Taxes Department (DTD). The Returns Form is also know as the Income Tax Resident Individual Form (Excel) that is downloaded from the KRA iTax Portal by a taxpayer and is filled according to the date from the P9 Form.

The KRA Returns Form comprises of different sections that are to be filled using the date shown on the p9 Form. The main sections on the KRA Returns Excel Form that you will be required to fill on the KRA Excel Sheet includes the following:

1. Basic Information Section

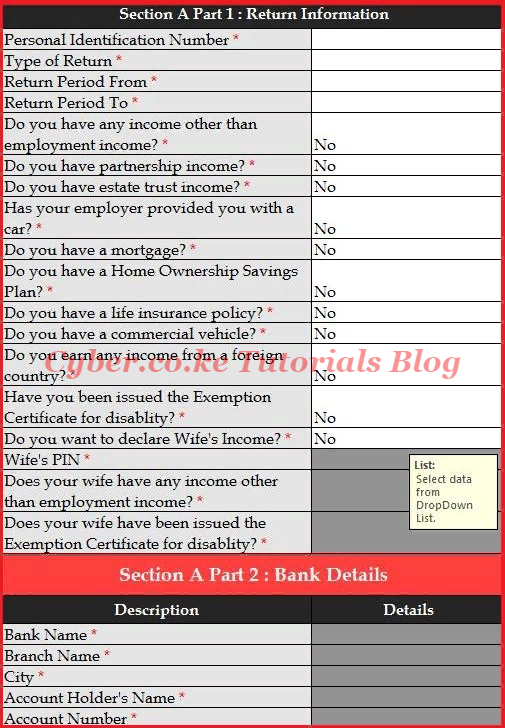

This comprises of Section A Part 1 (Return Information) and Section A Part 2 (Bank Details). You will only fill the Part 2 if you find that you were overtaxed and are due for a Refund from Kenya Revenue Authority (KRA).

2. Employment Income Section

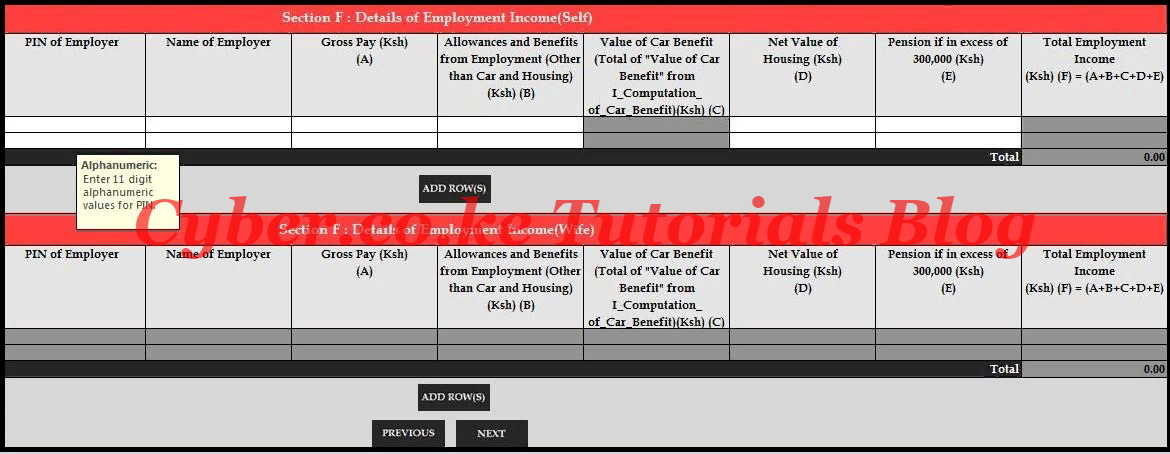

The Employment Income Section comprises of Section F (Details of Employment Income) for Self. The other section for Wife is not a must to fill so we shall ignore that section.

3. Details of PAYE Deducted Section

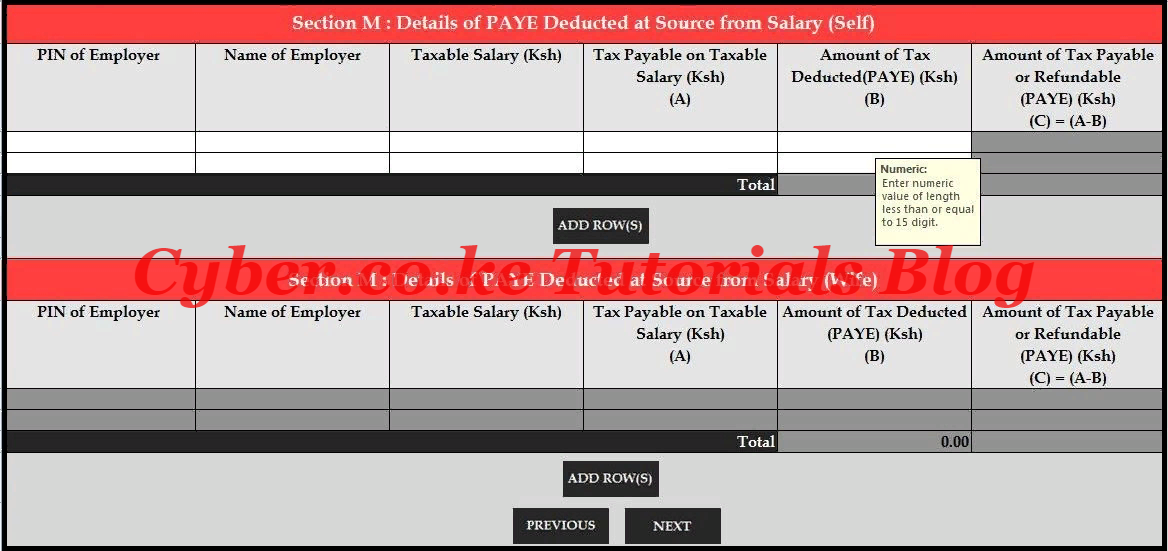

This part comprises of Section M (Details of PAYE Deducted at Source from Salary) for self. The other section for wife is not a must and can be ignored.

4. Tax Computation Section

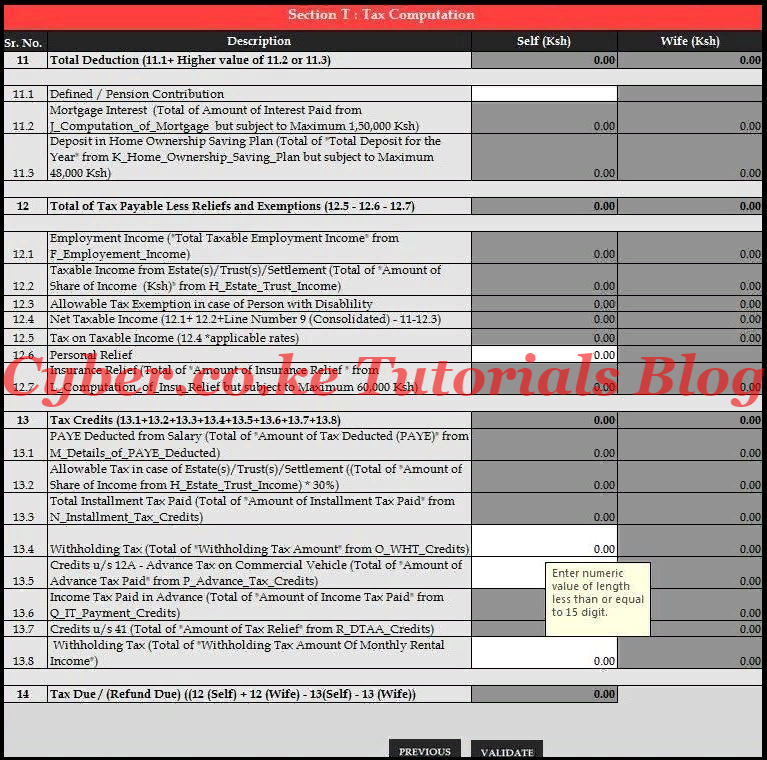

The last of the Income Tax Returns Form is Section T (Tax Computation). This is where the tax computation is done after inputting the Personal Relief for the year so as to get the Tax Due or Refund Due.

Note: If you have Withholding Tax (WHT) Credits, then you will need to declare the same on the excel sheet. In our case, we do not have any WHT.

Now that we have looked at what the KRA Returns Form is and the sections that it has, we need to know How To Download KRA Income Tax Returns Form (Excel Sheet).

How To Download KRA Income Tax Returns Form (Excel Sheet)

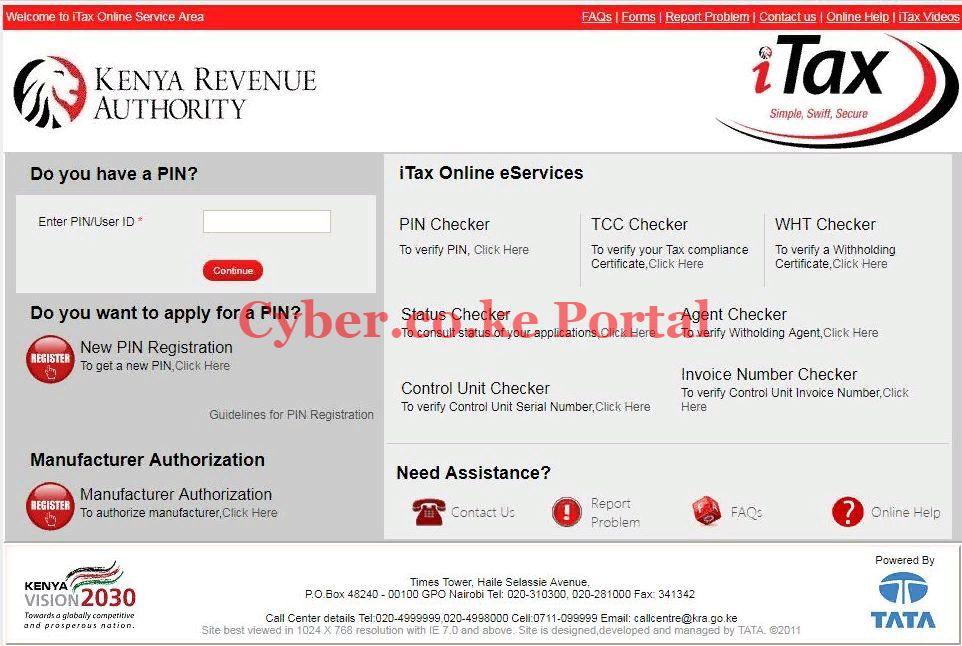

Step 1: Visit KRA Portal

The first thing that you need to do is to access the KRA iTax Portal using the ling provided in the description above.

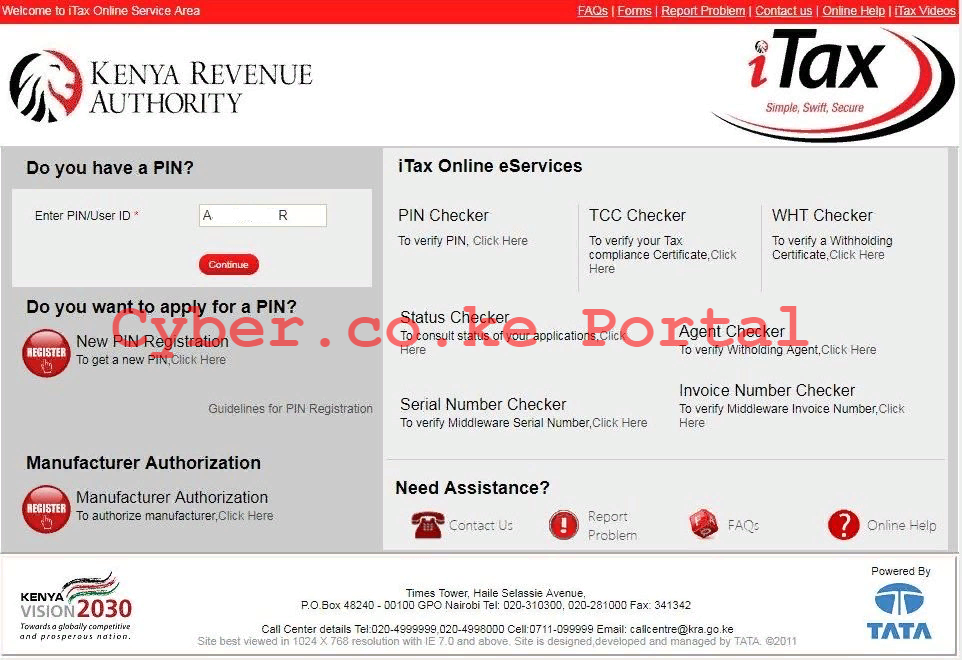

Step 2: Enter your KRA PIN Number

Next, you will need to enter your KRA PIN Number. If you dont remember your KRA PIN, you can request for KRA PIN Retrieval at Cyber.co.ke Portal. Once you have entered your KRA PIN Number, click on the “Continue” button.

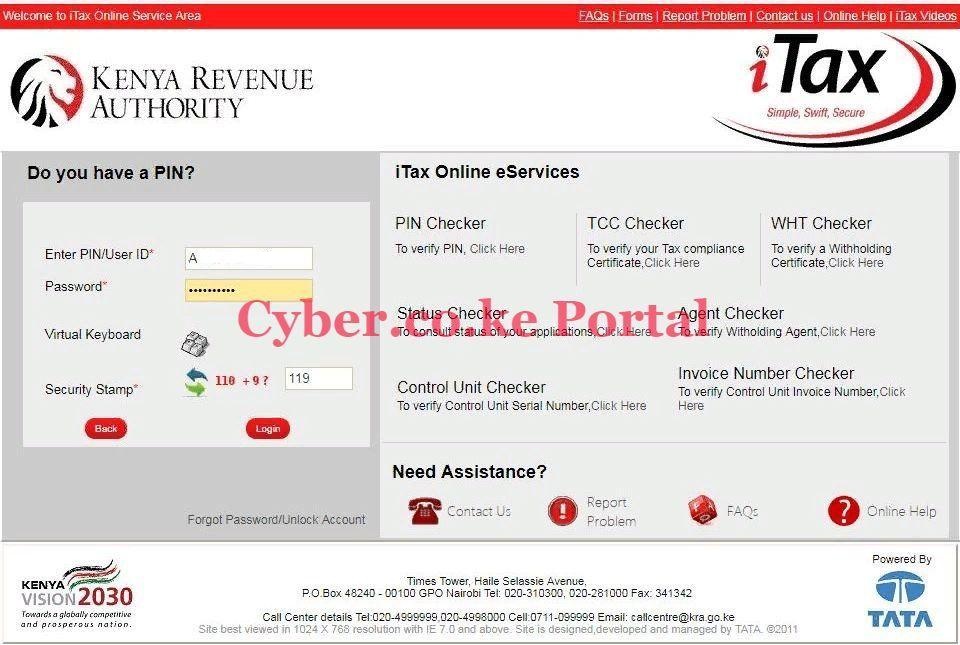

Step 3: Enter your iTax Password and Security Stamp

In this step, you will be required to enter your KRA iTax Password and solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can follow the procedures outlined in How To Reset KRA iTax Password. Your password reset will be sent to your email address and your can use it to change to a new iTax Password.

Step 4: iTax Portal Dashboard

Once you have successfully logged into iTax, you will be able to see your iTax Dashboard. This is as shown below.

Step 5: Click on Returns Tab Menu

Click on the Returns tab and then click File Return tab from the drop down menu appearing as shown below:

Step 6: Select KRA Tax Obligation

Here, you will be required to select the tax obligation. In this case, we select Income Tax – Resident Individual since we are filing KRA Returns for Kenyan resident with employment income.

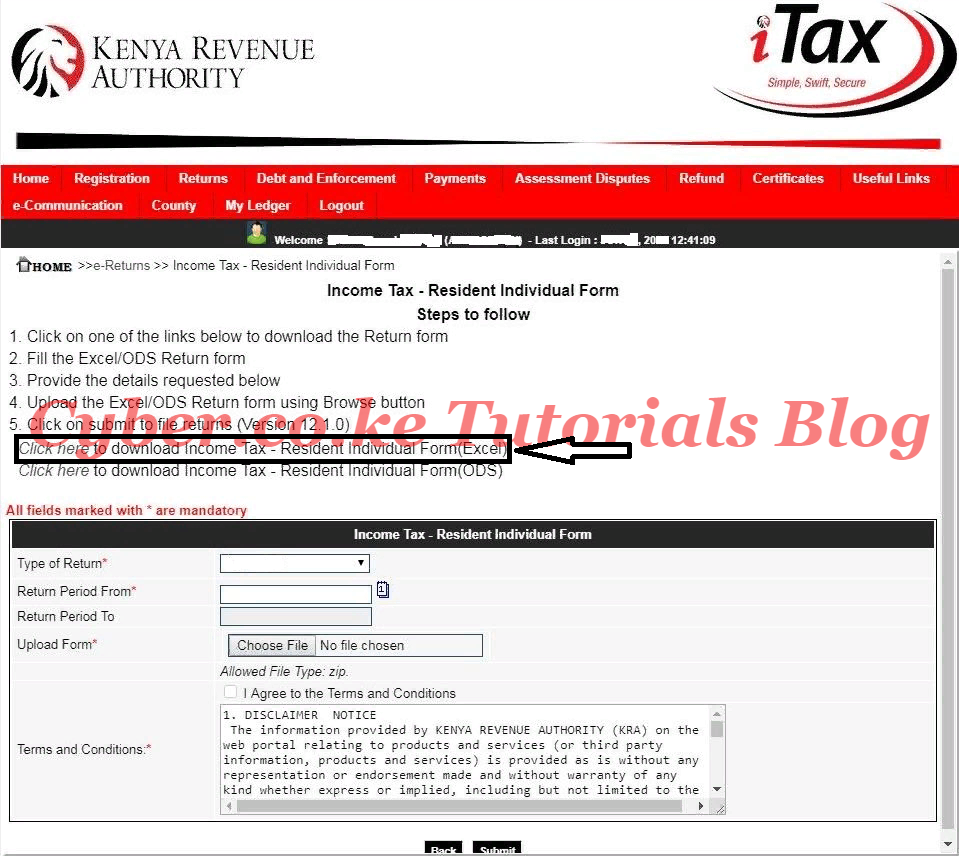

Step 7: Download Income Tax Resident Individual Form (Excel Sheet)

This is the last step where you will be required to download the Income Tax Returns Form (Excel Sheet). In KRA iTax Portal this is labeled as the Income Tax Resident – Individual Form (Excel).

READ ALSO: How To Change KRA Email Address Using KRA iTax Portal

The above are the steps that you need to follow when you need to download the KRA Excel Sheet from the KRA iTax Portal so as to file your KRA Income Tax Returns using your P9 Form. File your KRA Returns early so as to avoid the last minute rush.

DON’T MISS OUT. CHECK OUT OUR TRENDING POPULAR BLOG POSTS IN KENYA.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

KRA PIN REGISTRATION

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

KRA PIN RETRIEVAL

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

KRA PIN UPDATE

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

KRA PIN CHANGE OF EMAIL ADDRESS

Stay Tax Compliant in Kenya

Contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.