The KRA Payment Slip is a very important document that is generated online on the KRA Portal (iTax Portal) by a taxpayer after filing the returns for a specific tax obligation and he or she wants to make payment of the tax due to Kenya Revenue Authority (KRA). The KRA Returns process normally encompasses filing of KRA tax returns and payment of any tax due. To be able to make payments, the KRA Payment Slip is required as it contains the important details pertaining to tax payment to KRA. The KRA Payment Slip serves as an official tax receipt that is generated and issued to a taxpayer for purposes of making tax payments.

The KRA Payment Slip download is a process that involves accessing your iTax account and downloading this document online in your account. KRA Payment Slip contains very important details pertaining to the payment that a taxpayer wants to make to Kenya Revenue Authority (KRA). The details contained in the KRA Payment Slip includes: Taxpayer KRA PIN Number, Taxpayer Names, Payment Registration Date, Payment Registration Number (PRN) and the Payment Details (KRA Partner Banks and M-Payment). When you want to make a payment to KRA, you are supposed to use the downloaded KRA Payment Slip from your KRA Portal (iTax Portal) account since it serves as an official receipt for purposes of tax payments in Kenya.

For you to be able to download the KRA Payment Slip online using KRA Portal (iTax Portal), you need to have with you a set of two important requirements i.e. KRA PIN Number and KRA Password (iTax Password). The KRA Payment Slip download process normally involves using your iTax login credentials (details) to access your KRA Portal account so as to be able to download the payment slip online in Kenya. This process is only possible when you have both your KRA PIN Number and KRA Password (iTax Password). There is no way to generate or even download the payment slip without a taxpayer first initiating the process online in their iTax account.

READ ALSO: How To Reset KRA Password Online (In 7 Steps)

Requirements Needed In Downloading KRA Payment Slip Online

Downloading of KRA Payment Slip as mentioned above requires a taxpayer to login to their KRA Portal (iTax Portal) account and follow the outlined steps of KRA Payment Slip Download. To be able to download KRA Payment Slip, use both your KRA PIN Number and KRA Password (iTax Password) to first login to your account and initiate the download process of the payment slip for the tax obligation that you want to make payment for.

-

KRA PIN Number

The KRA PIN Number is the most important requirement that you need to have with you when you want to login to KRA Portal (iTax Portal) so as to be able to download your KRA Payment Slip. If by any chance you have forgotten or you don’t remember your KRA PIN Number, you can submit KRA PIN Retrieval request online here at CYBER.CO.KE and our support team will be able to assist with the retrieval of your lost or forgotten KRA PIN Number.

At the same time, if you are looking for a new KRA PIN Number, you can get it here in less than 3 minutes by submitting your KRA PIN Registration request at CYBER.CO.KE. Your new KRA PIN Number and KRA PIN Certificate will be sent to your Email Address once the request for KRA PIN Registration has been done and processed by our support team.

-

KRA Password (iTax Password)

The next requirement that you need to have with you in the process of KRA Payment Slip download on iTax Portal (KRA Portal) is your KRA Password (iTax Password), which you will need to access your KRA Portal account. If you don’t know or have forgotten your KRA Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for KRA Password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at CYBER.CO.KE and have your Email Address changed so as to enable your Reset KRA Password.

Did you know that you can easily apply and get your KRA PIN Number and KRA PIN Certificate online in less than 5 minutes by using CYBER.CO.KE today. Get it via email address or even WhatsApp upon submission.

Here at, CYBER.CO.KE, we offer unmatched KRA PIN Registration, KRA PIN Retrieval, KRA PIN Update and KRA PIN Change of Email Address services to Kenyans daily. Fill and submit your request online today.

How To Download KRA Payment Slip Online (In 5 Steps)

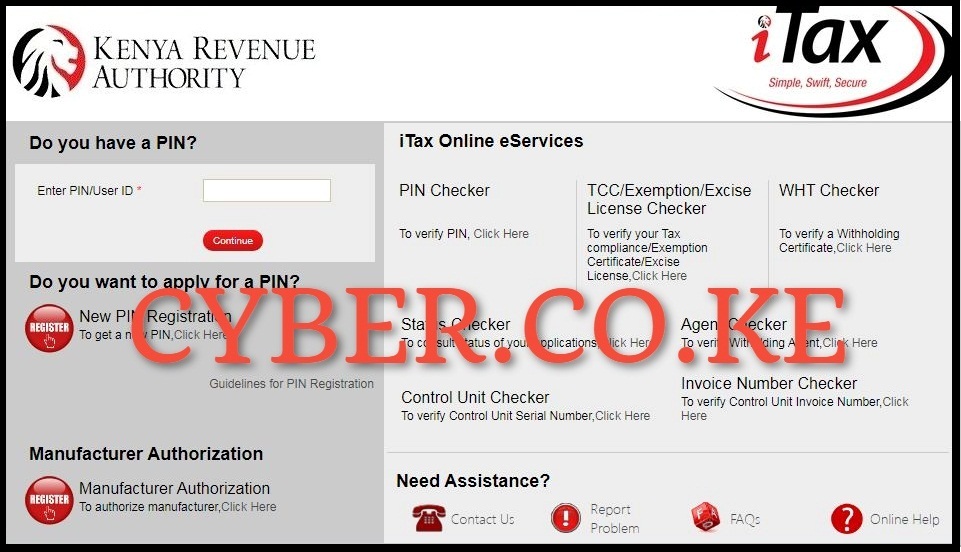

Step 1: Visit KRA Portal

The first step in downloading KRA Payment Slip online is by visiting KRA Portal using the link https://itax.kra.go.ke/KRA-Portal/

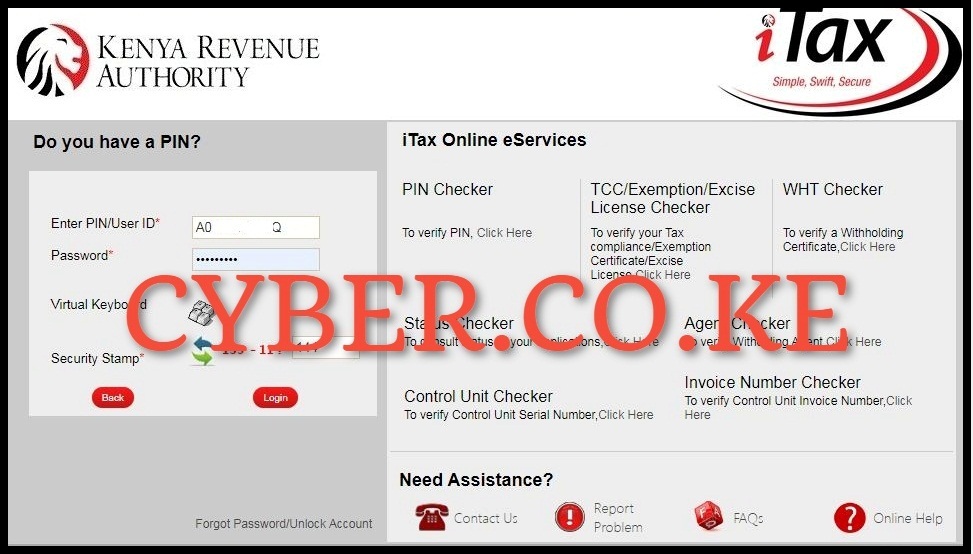

Step 2: Login to KRA Portal

Next, login to your account by entering your KRA PIN Number and KRA Password (iTax Password) and solving the arithmetic question (security stamp). Once you have entered these details on the login page, click on the “Login” button.

Step 3: Click on Useful Links then Consult and Reprint Acknowledgement Receipt and Certificates

In this step, at the right hand side of your iTax account dashboard, click on “Useful Links” then scroll down to “Consult and Reprint Acknowledgement Receipt and Certificates” section. All the KRA Payment Slips are normally located under this section and that’s where you will be able to download the payment slip or any other tax payment slip for different tax obligations.

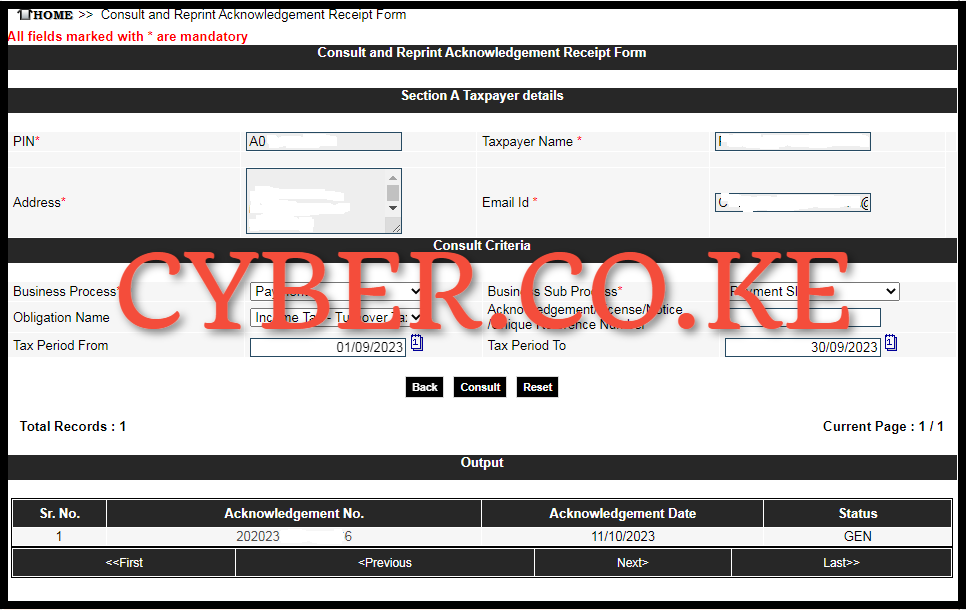

Step 4: Fill the Consult and Reprint Acknowledgement Receipt Form Online

The “Consult and Reprint Acknowledgement Receipt Form” on KRA Portal is quite important. As mentioned above, you can download any KRA Tax Payment Slip (KRA Payment Slip) using this form with much ease. The most important form fields that you need to fill includes: Business Process (Payment), Business Sub Process (Payment Slip), Obligation Name (i.e PAYE, MRI, TOT, VAT e.t.c), Tax Period From and Tax Period To. Depending of the tax obligation that you want to download the KRA Payment Slip for, same process applies. Once you have filled in the above fields on the form, click on “Consult” to download the KRA Payment Slip online.

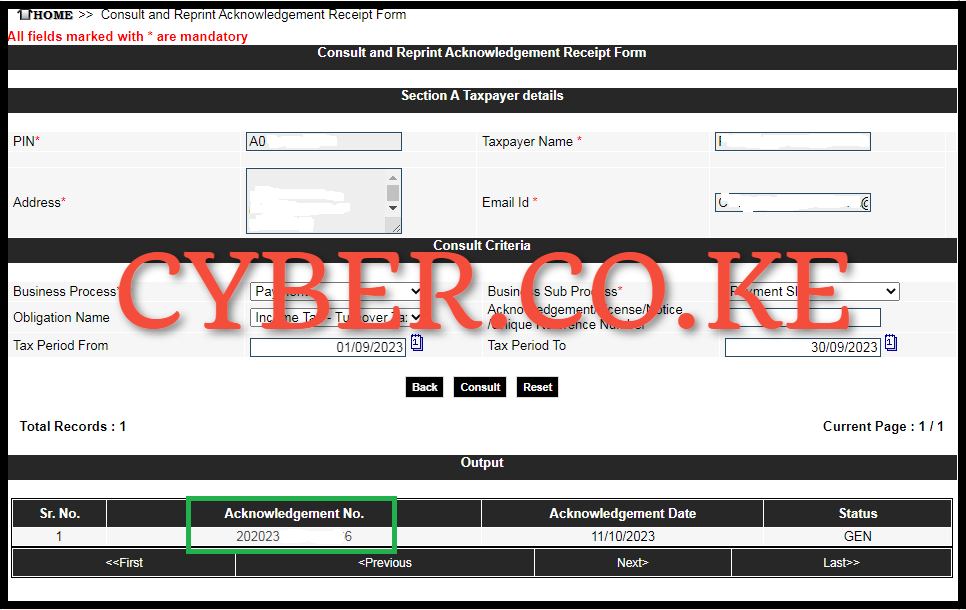

Step 5: Download KRA Payment Slip

In the last step, you can now download KRA Payment Slip by clicking on the Acknowledgement Number taxt link. This will automatically download the KRA Payment Slip to your device and from there you can choose to save, print or share. But since you want to make a tax payment, it is advisable to download the payment slip and print (if you are going to make payment via bank).

READ ALSO: How To Download KRA PIN Certificate PDF (In 5 Steps)

If you are going to make an M-Payment, then you can save the save softcopy and use the KRA Paybill Number 572572 to make payment of the tax due to Kenya Revenue Authority (KRA). Having downloaded the payment slip online for your tax obligation, it always important to have a tax records of the same. So, next time you have filed your KRA Returns and want to make payments, remember to download your KRA Payment Slip online by accessing iTax account and following the above step by step procedure involved in KRA Payment Slip download.

Matthews Ohotto is a Tutorials Writer at CYBER.CO.KE where he specializes in writing helpful and informative Step-by-Step Tutorials that empower Kenyans with practical skills and knowledge. He holds a Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT). Need help? Send an email to: [email protected] today.