Do you need to file your KRA Employment Returns using the KRA Excel Sheet? Learn How To Download KRA Returns Excel Sheet On KRA iTax Portal.

It is that that time of the year whereby taxpayers are in a rush to file their KRA Returns before the 30th June Deadline, and to be able to file their KRA Employment Returns, you need to ensure that you download the KRA Returns Excel Sheet on iTax Portal.

In this article article today, I am going to share with you the steps that are involved in downloading the KRA Excel Sheet that is used to file Income Tax Returns for the taxpayers who are in Employment in Kenya. The KRA Returns Excel Sheet together with the P9 Form, form the key requirements that taxpayers who are employed need to have before filing their KRA Returns.

READ ALSO: How To Access KRA Web Portal Account Using Login Credentials

I won’t talk much about the P9 Form as there is a page here at Cyber.co.ke Portal that you need to check titled KRA P9 Form Download. The main focus of this article is to show taxpayers who are employed on the procedure they need to follow so as to download the KRA Returns Excel Sheet in their KRA Web Portal Account.

If you are employed and need to file your KRA Returns, you have two options that you can use. The first one being the use of the ITR for Employment functionality or the offline method using the KRA Excel Sheet or KRA Returns Form. To be able to use the KRA Excel Sheet to file your KRA Returns, you need to have with you your Tax Deduction Card or simply KRA P9 Form.

The KRA Returns Excel sheet can be downloaded from your iTax account after you have logged in using your KRA PIN Number and KRA Password. Normally, you will find the KRA Excel Sheet under the Returns menu tab in your iTax profile. One thing that you need to ensure is that you download the latest version of the KRA Returns Form or KRA Returns Excel Sheet so as to make filing of KRA Returns much easier.

What Is KRA Returns Excel Sheet?

The KRA Returns Excel Sheet is a Workbook that is used to fill in the Income Tax Details for a taxpayer during the process of Filing KRA Returns using the data and figures on the P9 Form. So, taxpayers who are employed use the KRA Excel Sheet to feed in the Income Tax Details for a particular period running from 1st January to 31 December.

The KRA Returns Excel Sheet is one of the two key requirements that a taxpayer needs before being able tof file his or Income Tax Returns on KRA iTax Portal. So, both the KRA Returns Excel Sheet and the P9 Form are needed in the process of filing Returns for a taxpayer.

The data that is displayed on an Employee’s KRA P9 Form is filled into the KRA Excel Sheet so as to compute the Tax Due or Refund Due to Kenya Revenue Authority (KRA) Domestic Taxes Department (DTD). For you to be able to open the the KRA Excel Sheet which is in a zipped folder, you need to ensure that your computer or laptop has the latest version Microsoft Office installed.

For the computers or Laptops that are using old Microsoft Office suite such as the Office 2007, once you download the KRA Excel Sheet, you need to ensure that you enable Macros so as to open and fill in the Income Tax Details. Higher versions of MS Office don’t have any problems with opening and using the KRA Returns Excel Sheet.

Now that we have looked at the definition of KRA Returns Excel Sheet, we need to look at the details/sections of the KRA Excel Sheet that taxpayers fill in the Income Tax details during the process of filing KRA Returns on iTax Portal.

Sections Of The KRA Returns Excel Sheet That Taxpayers Need To Fill When Filing KRA Returns

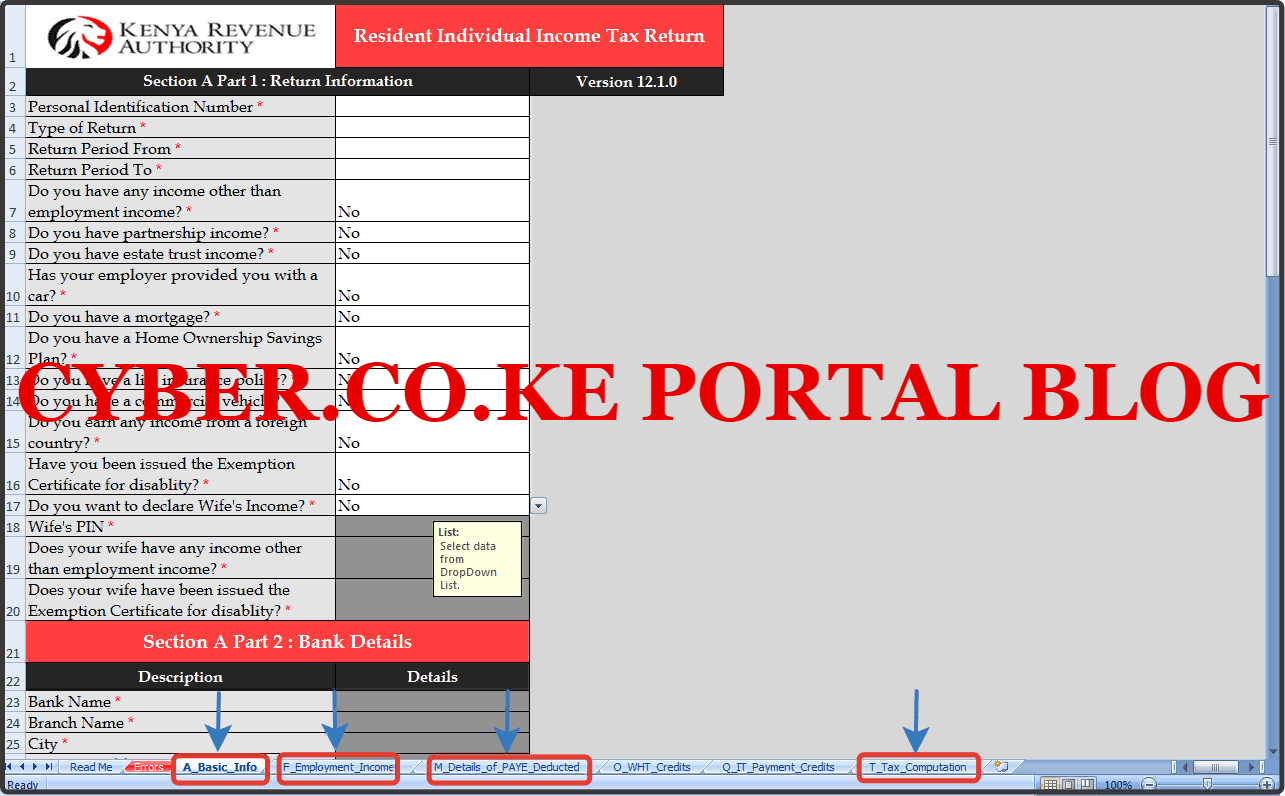

The KRA Excel Sheet comprises of different sections that are filled during the process of filing KRA Returns using P9 Form. This includes the following sections on the KRA Excel Sheet document:

- Basic Info

- Employment Income

- Details of PAYE Deducted

- Tax Computation

I am going to briefly discuss the above 4 sections of the KRA Returns Excel Sheet that the taxpayer need to concern himself/herself with. These are the only sections that are important on the KRA Excel Sheet.

-

Basic Information Section (A_Basic_Info)

This is sometimes referred to as Basic Information tab on the Excel Sheet. You need to take note that the Basic Information part of the KRA Excel Sheet comprises of Part 1 to Part 6 i.e. Return Information (Part 1); Bank Details (Part 2); Details of Auditor (Part 3); Landlord Details – Self (Part 4) and Landlord Details – Wife (Part 4); Tenant Details Self (Part 5) and Tenant Details – Wife (Part 5); Details of Exemption Certificate for Disability – Self (Part 6) and Details of Exemption Certificate for Disability – Wife (Part 6).

I know you might be thinking those are so many sections on the Excel Sheet Basic Information part, don’t worry only Part 1 (Return Information) and Part 2 (Bank Details) are important under the Basic Information section.

Part 2 (Bank Details) will come in handy in cases you get a negative figure i.e Kshs. -2,450.00 on the Tax Computation section as this simply means that you were overtaxed and are due for a Refund from KRA in which case you will need to fill the Bank Details on Part 2 of the Excel Sheet.

-

Employment Income Section (F_Employment_Income)

The other important section of the KRA Excel Sheet is the Employment Income Section. This comprises of two parts i.e. Details of Employment Income – Self and Details of Employment Income – Wife. You do need to fill in the Wife Income Details part.

Now under this section is whereby your KRA P9 Form comes into play. This is because you need to fill in your Income Details in the KRA Excel Sheet i.e your employment income for the period of the last 12 months for the year ending 31st December.

-

Details of PAYE Deducted (M_Details_of_PAYE_Deducted)

This is the most important part where you fill in the details of PAYE that was deducted on your salary for a period of 12 months. It also comprises of two parts i.e. Details of PAYE Deducted at Source from Salary – Self and Details of PAYE Deducted at Source from Salary – Wife. The wife part is not important and does not require filling.

The PAYE is basically the amount of Pay As You Earn that was deducted from your salary in the period of the last 12 months for the year ending 31st December. Since PAYE is normally deducted on the monthly salary, you will need to fill in the total PAYE that was deducted during the period of 12 months.

-

Tax Computation (T_Tax_Computation)

Last but definitely not the least section of the KRA Returns Excel Sheet is the Tax Computation Section. This is an important section of the KRA Excel Sheet as we shall be computing the Tax or Refund Due from Kenya Revenue Authority (KRA).

In this part of the KRA Excel Sheet, once you have ensured that you have filled in the required figures, you need to click on the “Validate” option so as to validate the entire KRA Returns Excel Sheet before uploading the generated zipped Returns document on your KRA Web Portal Account and submitting the Return to KRA, and that will signify the end of filing process.

Now that we have looked at the 4 most important sections of the KRA Returns Excel Sheet, we need to look at the requirements that we are going to need in the process of downloading the KRA Excel Sheet that is needed during the Returns filing process. You are already familiar with these 2 key requirements that are needed i.e. KRA PIN Number and KRA iTax Password. I am going to highlight on each one below.

Requirements Needed To Download KRA Returns Excel Sheet On iTax Portal

For you to be able to download the KRA Returns Excel Sheet from your KRA Web Portal Account, you are going to need to have with you KRA PIN Number and KRA iTax Password. This is as highlighted below:

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable your Reset KRA iTax Password.

Now that you have with you these 2 key requirements that are needed in this process of downloading KRA Excel Sheet, we can look at the steps that you need to follow on How To Download KRA Returns Excel Sheet On iTax Portal.

How To Download KRA Returns Excel Sheet On iTax Portal

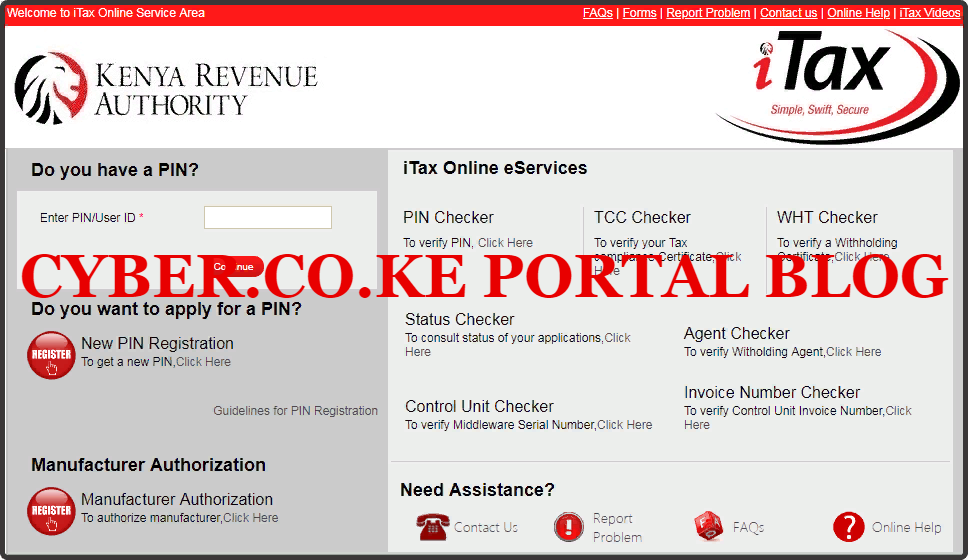

Step 1: Visit KRA Portal

The first step that you need to take is to ensure that you visit the KRA iTax Web Portal using the link provided above in the above description. Note, the above is an external link that will take you to the KRA iTax Portal.

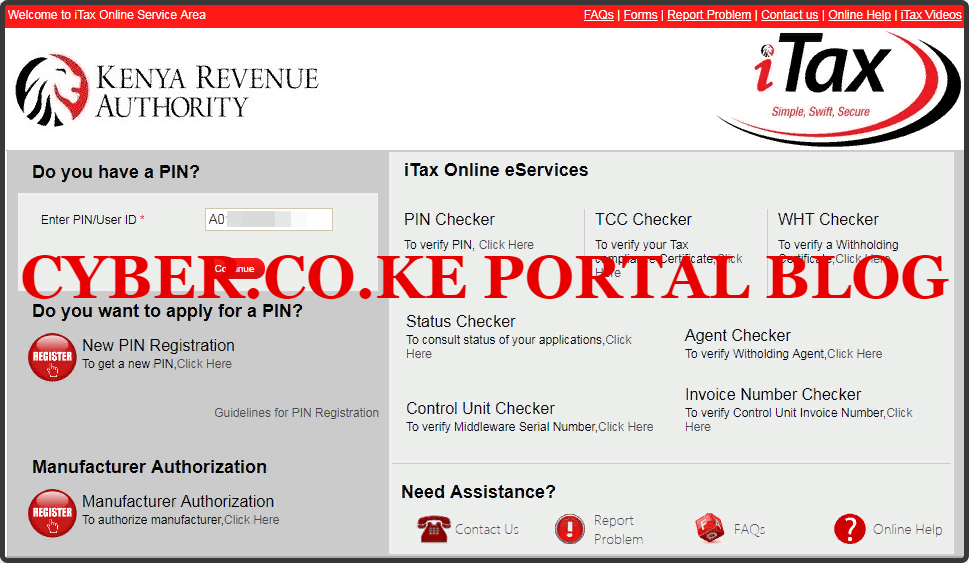

Step 2: Enter Your KRA PIN Number In the PIN/User ID Section

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

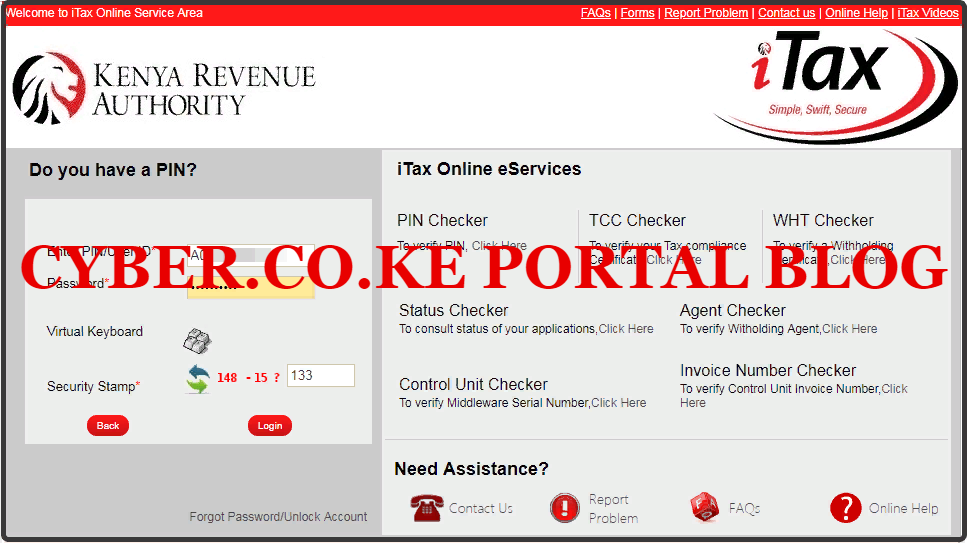

Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: KRA iTax Web Portal Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA iTax Web Portal Account Dashboard. Here upon successful login process, you are able to view a wide range of iTax Portal functionalities. Since we need to download the KRA Returns Excel Sheet, we proceed to step 5 below.

Step 5: Click On Returns Menu Then File Returns

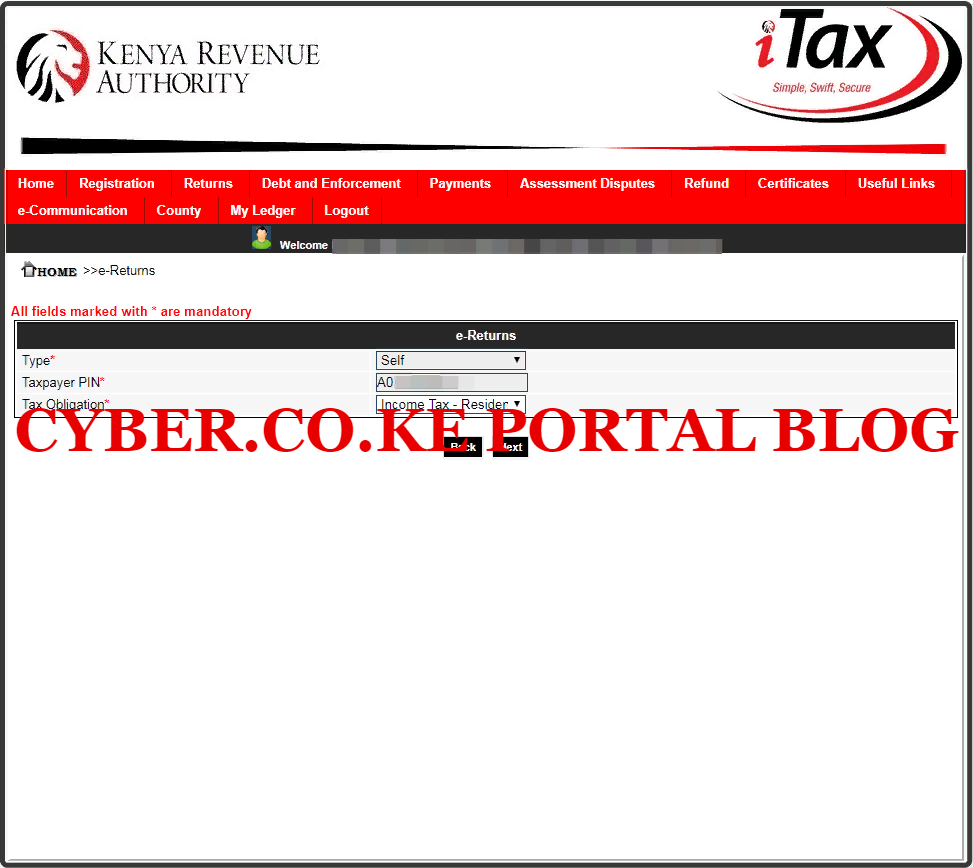

In this step, you will need to click on the “Returns” menu and from the drop down menu selection list, click on “File Returns.” This is as illustrated in the screenshot below:

Step 6: Select Tax Obligation As Income Tax Resident Individual

In this step, you will need to select the tax obligation as Income Tax Resident Individual. The Type and Taxpayer PIN are automatically pre-filled. Once you have selected the Tax Obligation, click on the “Next” button.

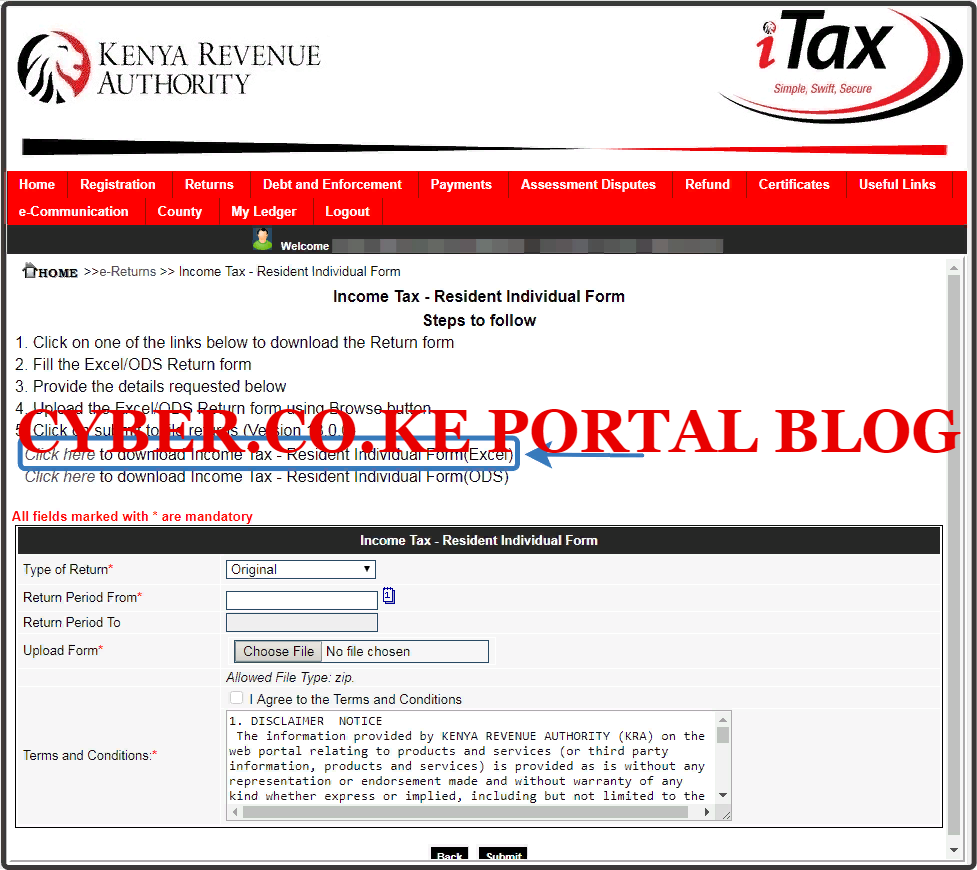

Step 7: Download KRA Returns Excel Sheet (Income Tax Resident Individual Form Excel)

In this last step, you will need to download the KRA Returns Excel Sheet that is referred to as the Income Tax Resident Individual Form – Excel form the iTax Web Portal Account. As I mentioned in the beginning of this article, this is a zipped file and you need to ensure that your laptop or computer has MS Office suite that has the MS Excel installed.

DOWNLOAD THE LATEST KRA RETURNS TEMPLATE (LATEST TEMPLATE FOR KRA RETURNS FILING IN 2022) – VERSION 18.0.6

Once you have followed the steps above on downloading the KRA Excel Sheet, you can now officially start filing your KRA Returns using both the KRA P9 Form and the KRA Returns Excel Sheet on iTax Portal. Once you have the downloaded KRA Returns Excel Sheet above, you can check our article on How To File KRA Returns Using P9 Form and KRA Excel Sheet.

READ ALSO: How To File KRA Nil Returns Using KRA iTax Portal

As a quick tip, always download latest version of the KRA Income Tax Resident Resident Individual Excel Sheet from your KRA Web Portal Account. This will ensure that you are able to fill the KRA Excel Sheet smoothly without any hitches as you will have downloaded the latest version of the KRA Returns Excel Sheet on iTax Portal.

DON’T MISS OUT. CHECK OUT OUR TRENDING POPULAR BLOG POSTS IN KENYA.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

KRA PIN REGISTRATION

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

KRA PIN RETRIEVAL

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

KRA PIN UPDATE

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

KRA PIN CHANGE OF EMAIL ADDRESS

Stay Tax Compliant in Kenya

Contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.