Disclaimer

CYBER.CO.KE is a Cyber Services Business and is not affiliated with any government agency, including Kenya Revenue Authority (KRA). This is a Cyber Services Business and Customers Pay for Services requested.

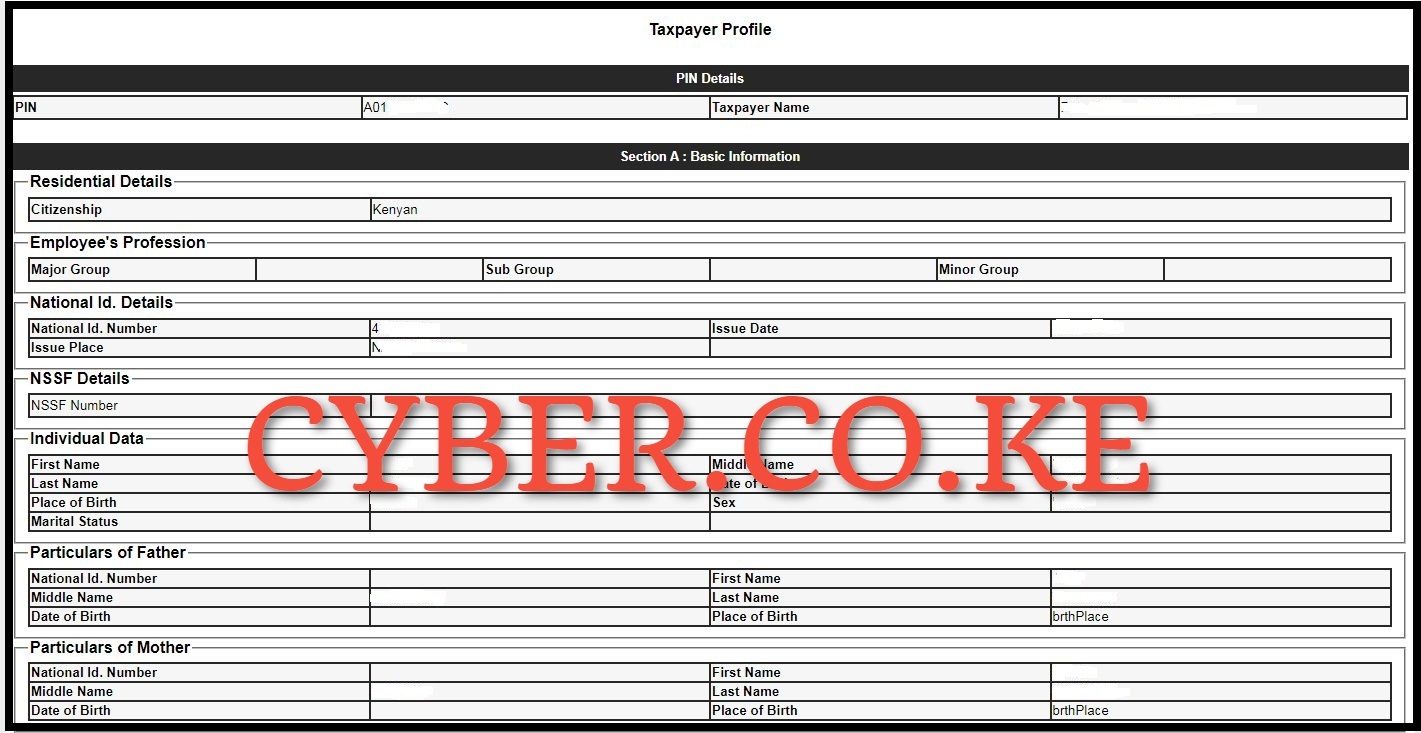

The KRA Taxpayer Profile is a feature on the KRA Portal (iTax Portal) that allows taxpayers to view their profile as captured in the KRA Systems. This is what is normally referred to as Tax Payer Profile or simply KRA Taxpayer Profile. With every new KRA PIN Registration request, the details are normally stored in a taxpayer’s profile on iTax under what is commonly referred to as Tax Payer Register. Just as the name suggests, it contains the details/records of the taxpayer in Kenya and can easily be accessed once you are logged into your iTax Portal (KRA Portal) account.

The KRA Taxpayer Profile is normally comprised of 5 sections i.e. KRA PIN Details, Basic Information, Taxpayer Obligation, Taxpayer Sources of Income and Additional Place of Business. The Taxpayer Profile normally comes in handy when you are applying for Birth Certificates or even the Kenyan Passport, as you can use the KRA Taxpayer Profile to verify certain details for the taxpayer including but not limited to Basic Information such as Parents Details, which are normally required in the process of Birth and Passport Applications.

To be able to view, check, download and even print your Taxpayer Profile on KRA Portal (iTax Portal), you need to have with you the two main requirements that are needed in accessing your iTax account. This includes your KRA PIN Number and KRA Password (iTax Password). These two are quite important as it’s the only way that a taxpayer can login to his or her account nd download the KRA Taxpayer Profile online.

READ ALSO: How To Check The Validity of Tax Compliance Certificate

Requirements Needed In Downloading KRA Taxpayer Profile

As mentioned above, to be able to check and download your KRA Taxpayer Profile online, you need to login to your KRA Portal account by using both your KRA PIN Number and KRA Password (iTax Password). This is as described below.

-

KRA PIN Number

The KRA PIN Number is the most important requirement that you need to have with you when you want to login to KRA Portal (iTax Portal) so as to be able to check and download Taxpayer Profile online. If by any chance you have forgotten or you don’t remember your KRA PIN Number, you can submit KRA PIN Retrieval request online here at CYBER.CO.KE and our support team will be able to assist with the retrieval of your lost or forgotten KRA PIN Number.

At the same time, if you are looking for a new KRA PIN Number, you can get it here in less than 3 minutes by submitting your KRA PIN Registration request at CYBER.CO.KE. Your new KRA PIN Number and KRA PIN Certificate will be sent to your Email Address once the request for KRA PIN Registration has been done and processed by our support team.

-

KRA Password (iTax Password)

The next requirement that you need to have with you in the process of downloading KRA Taxpayer Profile on iTax Portal (KRA Portal) is your KRA Password (iTax Password), which you will need to access your KRA Portal account. If you don’t know or have forgotten your KRA Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for KRA Password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at CYBER.CO.KE and have your Email Address changed so as to enable your Reset KRA Password.

Did you know that you can easily apply and get your KRA PIN Number and KRA PIN Certificate online in less than 5 minutes by using CYBER.CO.KE today. Get it via email address or even WhatsApp upon submission.

Here at, CYBER.CO.KE, we offer unmatched KRA PIN Registration, KRA PIN Retrieval, KRA PIN Update and KRA PIN Change of Email Address services to Kenyans daily. Fill and submit your request online today.

How To Download KRA Taxpayer Profile Online (In 5 Steps)

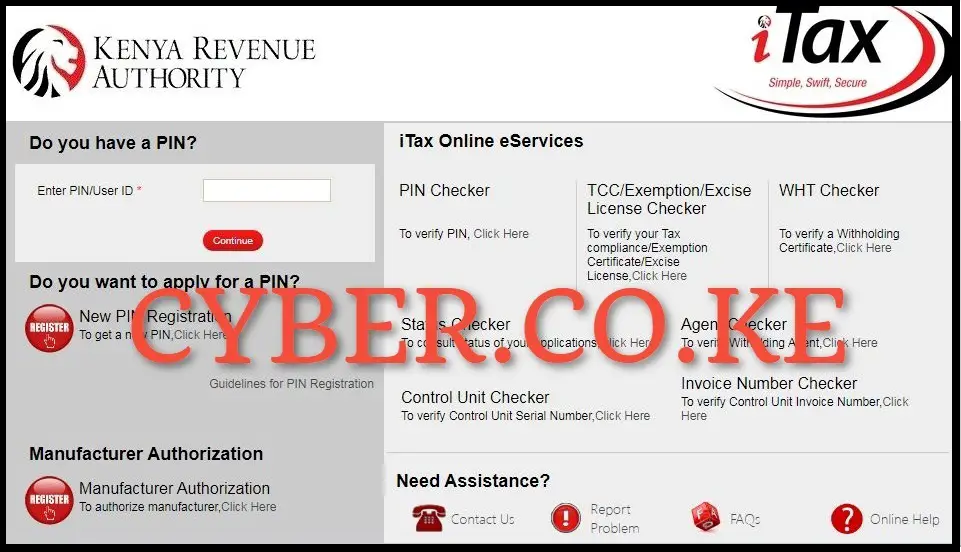

Step 1: Visit KRA Portal

The first step involved in Taxpayer Profile download is visiting the KRA Portal by using the link https://itax.kra.go.ke/KRA-Portal/

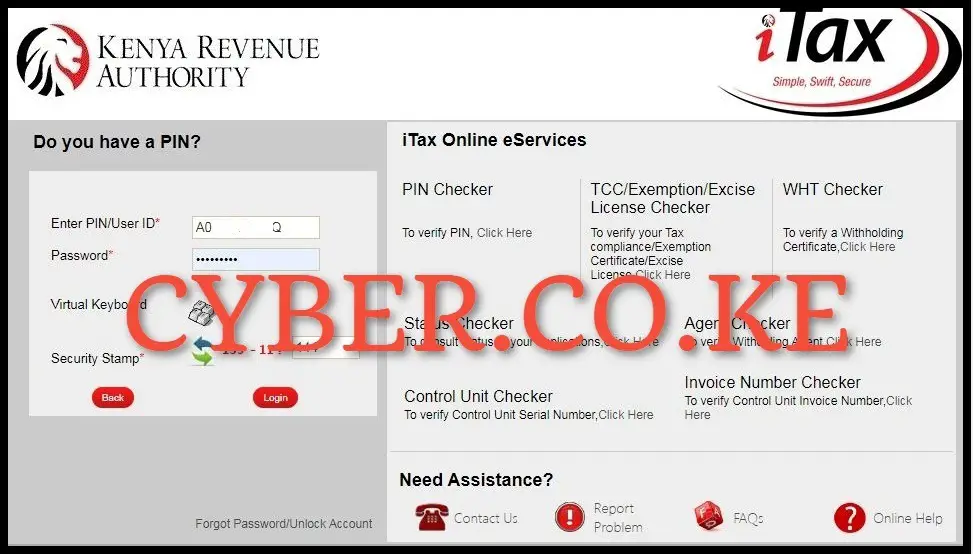

Step 2: Login to KRA Portal

Next, login to KRA Portal by using both your KRA PIN Number and KRA Password (iTax Password), solve the arithmetic question (security stamp) and proceed to click on the “Login” button.

Step 3: Click on Registration menu then Consult Taxpayer Register

In this step, once you are logged in, click on the “Registration” and from the drop-down menu list, click on “Consult Taxpayer Register” to proceed to the next step.

Step 4: Select Applicant Type for the Taxpayer Profile

Next, on the Taxpayer Profile selection form, on the applicant type select Taxpayer which will load the Taxpayer KRA PIN Number and Taxpayer Names. Click on the “Submit” button to submit the request for Taxpayer Profile download on KRA Portal. A pop up will appear asking you; “Do you want to submit the Data” click on “OK” button.

Step 5: Download KRA Taxpayer Profile

The last step in the process of downloading Taxpayer Profile using KRA Portal, involves the actual downloading the Taxpayer Profile in PDF format. You can download the Taxpayer Profile by clicking on Ctrl+P which is the Print shortcut. This will give you 2 options; Print Taxpayer Profile or Save Taxpayer Profile PDF version. The choice is all yours at this point.

READ ALSO: How To Download KRA Payment Slip Online (In 5 Steps)

The KRA Taxpayer Profile is very important as it enables a taxpayer to get their details from the KRA Taxpayer Register that the Taxpayer Profile is located in. The process of Taxpayer Profile download is important to understand as this Taxpayer Profile will come in hand when you are looking for certain basic details, which you can get from your profile and use the same details in the various applications that the KRA Taxpayer Profile might come in handy for you in Kenya.

Matthews Ohotto is a Writer at CYBER.CO.KE where he specializes in writing helpful and informative Step-by-Step Tutorials that empower Kenyans with practical skills and knowledge. He holds a Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT). Get KRA Individual Services and KRA Returns Services in Kenya.