In this blog post, I am going to show you How To File KRA Nil Returns On iTax (KRA Portal) in 2024 online today quickly and easily with a full illustration on the steps. Take note that the deadline for filing KRA Returns in 2025 is on 30th June 2025 as set out by Kenya Revenue Authority (KRA). So, you have between 1st January 2025 to 30th June 2025 to file your KRA Nil Returns in 2025. It is a good habit for taxpayers in Kenya to be filing their KRA Nil Returns as early as possible so as to avoid the last minute rush that comes with the filing of KRA Returns on iTax especially this year 2025.

Do you have an active KRA PIN and you don’t have have a source of income (student/unemployed)? Check out our article on How To File KRA Nil Returns using iTax (KRA Portal) quickly and easily today. Filing of KRA Nil Returns is allowed for taxpayers who do not have any source of income. When I talk of source of income, it means that the taxpayer does not have Business Income, Rental Income or Employment Income, thus the need to file KRA Nil Returns on iTax (KRA Portal). You should prepare to file your KRA Nil Returns in 2025 as early as possible and you have between 01/01/2025 to 30/06/2025 to file KRA Nil Returns 2025.

You will learn the step-by-step process of filing KRA Nil Returns in 2025 that you need to follow in order to file your KRA Nil Returns successfully using iTax (KRA Portal). By the end of this blog post, you will have learnt How To File KRA Nil Returns in 2024 if you you have a KRA PIN and not in employment (student/unemployed). Avoid the last minute rush and penalties by filing your Nil Returns before the 30th June 2025 deadline. The deadline for filing KRA Returns for the year 2024 is on 30th June 2025. Meaning in the year 2025, we shall be filing KRA Nil Returns for the year 2024 for the return period of 01/01/2024 to 31/12/2024.

READ ALSO: How To File KRA Nil Returns Using KRA iTax Portal

Don’t wait for the last minute rush, file your KRA Nil Returns quickly and easily today if you don’t have any source of income. In this article, I am going to share with your the process of Filing Nil Returns on KRA iTax Portal in 2025. But before we go any further we need to understand what we mean by the term KRA Nil Returns.

You need to take note and understand that any Kenyan with a KRA PIN is supposed to file his or her iTax Returns on or before the deadline. So, whether you are employed or unemployed, as long as you have a KRA PIN Number, filing KRA Returns is a must and failure to do so means that you will receive a penalty from Kenya Revenue Authority (KRA).

Any person who has an active KRA PIN Number and does not have any income is supposed to file his or her KRA Nil Returns between 1st January and 30th June of each year. So, you need to forget about the old notion that KRA Returns is for those who are employed, but rather any Kenyan with an active KRA PIN is supposed to be filing KRA Returns each year.

What Is KRA Nil Returns?

KRA Nil Returns applies to those who do not have a source of income sometimes referred to as the unemployed. Source of income in sense that the taxpayer does not have income from Rental, Business or Employment. Kindly take note that every Kenyan, who has a valid KRA PIN Number is required by Law to declare their annual income every year before 30th June of the following year. This year 2025, taxpayers will be filing the KRA Nil Returns for 2024 thus we refer to this as KRA Nil Returns 2025.

So, if you had no income in the year 2024, then you will need to file KRA Nil Returns this year 2025. If not employed (student/unemployed) and do not have an alternative source of income i.e Rental, Business or Employment income you file what we refer to as KRA Nil Returns 2025 on or before the deadline of 30th June 2025. If you have a KRA PIN Number, the law states that you should file KRA Returns. If you have no income, you are supposed to be filing a Nil KRA Return. Failure to do so as indicated in the Tax Procedures Act leads to penalties.

Please be informed that the penalty is now Kshs. 2,000 for late filing of individual KRA Returns i.e. both KRA Nil Returns and KRA Employment Returns. This is stipulated in the 2018 Finance Act. If you are in employment, you need to file KRA Employment Returns using your P9 Form. You can read the step by step guide on How To File KRA Returns If Employed Using KRA P9 Form. We also do offer KRA Returns services whereby our support team can assist you to file either KRA Nil Returns in 2025 or even KRA Employment Returns in 2025.

If you are not in employment, then you can proceed to file KRA Nil Returns as outlined in the step by step guide in this blog post. This year 2025, we are filing the KRA Nil Returns for the year 2024 as mentioned in the introduction above. So the Return From and Return To Date will be 01/01/2024 – 31/12/2024 (KRA Nil Returns 2025). Also, you need to take note that the deadline for filing KRA Returns (KRA Nil Returns 2025) is on or before 30th June 2025. So, the earlier you file your Nil Returns using iTax (KRA Portal) the better for you. Don’t wait for the hectic last minute rush, whn you can file your KRA Nil Returns 2025 as early as today.

Filing of KRA Nil Returns In 2025

It is important that if you have an active KRA PIN Number on iTax (KRA Portal), you should ensure that you file your KRA Returns each and every year between 1st January to 30th June. This dates are very important to note down is you want to part of the tax compliant Kenyans. The deadline this year for file KRA Nil Returns is 30th June 2025.

The Tax Procedures Act states that if a return is not submitted by the respective due date a penalty will be imposed. Avoid getting penalties from Kenya Revenue Authority (KRA) and file your KRA Nil Returns online today with ease and convenience. The earlier you file your KRA Nil Returns in 2025, the better.

Requirements Needed For Filing KRA Nil Returns In 2025

To be able to file your KRA Nil Returns on iTax, you need to ensure that you have with you KRA PIN Number and KRA iTax Password. Before we get started on the various steps, you need to ensure that you have the following two items with you:

- Your KRA PIN Number

- Your KRA Password (iTax Password)

For you to able to file your KRA Nil Returns 2025 on iTax (KRA Portal), you need to ensure that you have with you two key requirements i.e KRA PIN Number and KRA Password (iTax Password). We are going to look at each of these KRA Nil Returns 2025 requirements in brief details below.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA Password (iTax Password)

The next requirement that you need to have with you is your KRA Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable your Reset KRA iTax Password.

If you know your KRA PIN number but you don’t know your iTax password you can request for password reset on the iTax portal. A new password will be sent to your registered email address (unless you dont know you email address: Gmail, Yahoo or Outlook). You can check out our articles on How To Reset KRA Password on iTax Portal.

Now that you have ensured that you have everything ready with you we can start the process of filing KRA Nil Returns 2025. These are the returns for the year ended 31st December 2024. Assuming that now you have everything with you i.e your KRA PIN number and KRA Password (iTax Password), we can start the process of How To File KRA Nil Returns 2024 on iTax (KRA Portal).

How To File KRA Nil Returns

The following are the 7 main steps involved in the process of How To File KRA Nil Returns that you need to follow.

Step 1: Visit iTax (KRA Portal)

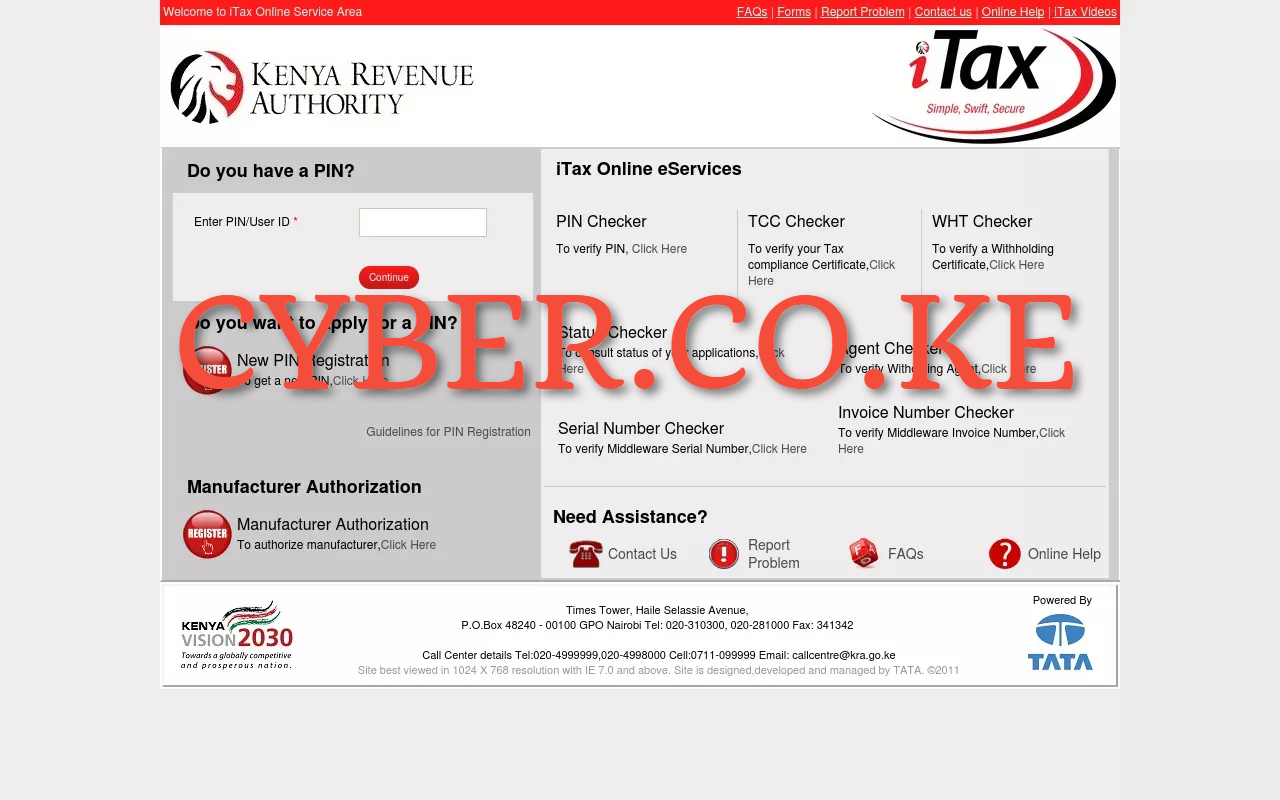

The first step in the process of Filing KRA Nil Returns in 2025 is to first visit KRA Portal (iTax) using https://itax.kra.go.ke/KRA-Portal/. Once there, enter your KRA PIN Number, KRA Password (iTax Password), solve the arithmetic question (security stamp) and click on the “Login” button.

Step 2: KRA Portal (iTax) Dashboard

Once you have successfully logged into your iTax account (KRA Portal account) you should see the following as shown above. In you iTax account you can do a variety of tasks online. Our main focus for this blog post will be on filing KRA Nil Returns 2024, so we proceed to step 3 below.

Step 3: Click On Returns then File KRA Nil Returns

On your iTax account top panel menu, Click on “Returns” and then File KRA Nil Returns option from the drop down menu list to start the process of filing KRA Nil Returns 2024 on iTax (KRA Portal).

Step 4: Select The KRA Tax Obligation

In this step, you need to select the KRA Tax Obligation that you are filing the KRA Nil Returns 2024 for. In this example, we select Income Tax – Resident and click on the “Next” button to proceed with filing of KRA Nil Returns 2024.

Step 5: Fill The Income Tax – Resident Individual Nil e-Return Form

In this step, you select the return period. Since we are filing KRA Nil Returns 2024 for the previous year 2023, our return period will start from 01/01/2024 to 31/12/2024. The return period to automatically auto-fills by itself. Click on the submit button to proceed.

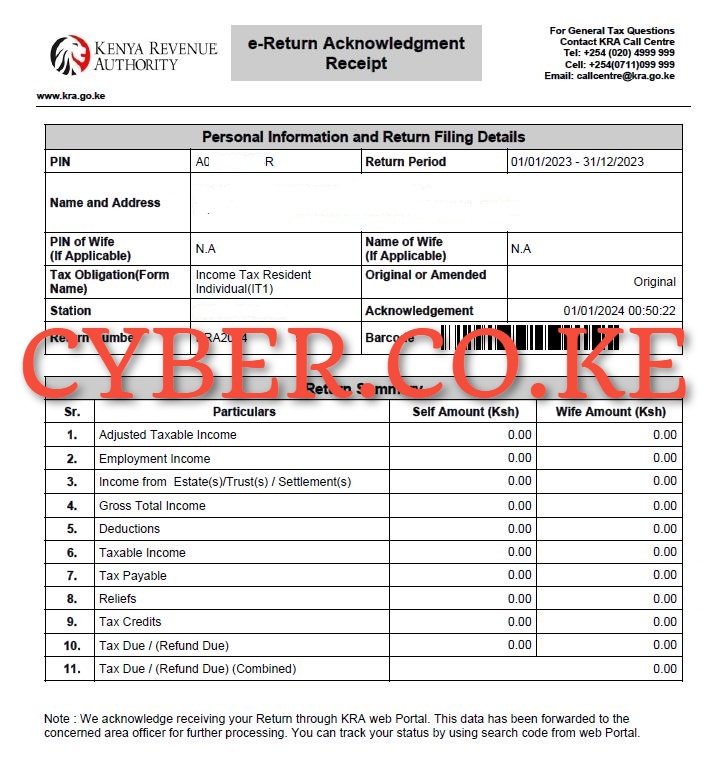

Step 6: Download KRA Nil Returns Acknowledgement Receipt

Upon successful submission and filing of your KRA Nil Returns 2024 on iTax (KRA Portal), a KRA Returns Receipt (e-Return Acknowledgement Receipt) will be generated with an acknowledgement number. Download the KRA Nil Returns Receipt and either save or print a copy of the same for reference purposes.

Step 7: Print or Save KRA e-Return Acknowledgement Receipt

The last and final step will involves printing or saving the downloaded KRA e-Return Acknowledgement Receipt that you downloaded. This is a final indication that you have successfully filed the KRA Nil Returns for the year 2024.

The above are the 7 mains steps that are involved in the process of How To File KRA Nil Returns In 2025 using iTax (KRA Portal). Share the same with all your family and friends. Tell a friend to tell a friend to file KRA Nil Returns 2024 early this year before 30th June 2025 as set out by Kenya Revenue Authority (KRA).

What You Need To Know About Filing KRA Nil Returns in 2025

-

Are you unemployed but have a KRA PIN Number?

If yes, remember all KRA PIN Number holders must file returns even when you have No source of income on or before the 30th June 2024 deadline.

-

Do you need to visit a KRA office once you file online?

No, you do not need to visit any offices or centres to file KRA Nil Returns 2024. All KRA Returns are filed online and once you file your returns you will receive an acknowledgement receipt in your email. You can download a copy from your iTax account.

-

Do you need to file your returns if you registered for a KRA PIN Number this year?

Your Individual Income Tax Returns are due immediately after the end of each year i.e. 31st December. If you got your KRA PIN this year 2025, you will start filing KRA Nil Returns from next year 2026. So, be sharp and spare a few minutes of your time in a day and file your KRA Nil Returns in 2025 today before the 30th June 2025 deadline.

READ ALSO: How To File KRA Returns Using P9 Form

Remember the earlier you start filing your KRA Nil Returns in 2025 the better for you. Avoid last minute rush that will lead to a penalty of Kshs. 2,000/= for late filing of your KRA Nil Returns 2025. There are no extensions for that period. Please be informed that the penalty is now Kshs. 2,000 for late filing of individual returns. This is stipulated in the 2018 Finance Act. So file your KRA Nil Returns in 2025 on or before the elapse of the deadline of 30th June 2025. Don’t wait for last minute rush, file your KRA Nil Returns online today.

TRENDING BLOG POSTS IN KENYA

CYBER.CO.KE

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

CLICK HERE TO REGISTER KRA PIN NUMBER

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

CLICK HERE TO RETRIEVE KRA PIN CERTIFICATE

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

CLICK HERE TO UPDATE KRA PIN NUMBER

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

CLICK HERE TO CHANGE KRA PIN EMAIL ADDRESS