Learn How To File KRA Nil Returns using KRA iTax Portal today. Get to know how to file KRA Nil Returns quickly and easily using iTax Portal.

It is that time of the year whereby each Kenyan taxpayer is in a rush to file his or her KRA Returns on iTax Portal. So whether Employed or Unemployed, everyone is making sure that they file their Returns for the previous year before the 30th June Deadline.

So, In this article, I am going to share with you the steps that you need to take incase you need to file your KRA Nil Returns on iTax Portal. This article will be of great benefit to those who are unemployed or sometimes referred to as students. If you are in employment, you can check out How To File KRA Returns Using P9 Form.

READ ALSO: How To Retrieve KRA PIN Certificate Using KRA iTax Web Portal

Before we get deeper into looking at How To File KRA Nil Returns Using KRA iTax Portal , we need to understand some basic terms here. We need to understand what is meant by KRA Nil Returns in terms of taxpayers and KRA iTax Portal.

You need to take note and understand that any Kenyan with a KRA PIN is supposed to file his or her iTax Returns on or before the deadline. So, whether you are employed or unemployed, as long as you have a KRA PIN Number, filing KRA Returns is a must and failure to do so means that you will receive a penalty from Kenya Revenue Authority (KRA).

Any person who has an active KRA PIN Number and does not have any income is supposed to file his or her KRA Nil Returns between 1st January and 30th June of each year. So, you need to forget about the old notion that KRA Returns is for those who are employed, but rather any Kenyan with an active KRA PIN is supposed to be filing KRA Returns each year

What Is KRA Nil Returns?

KRA Nil Returns is a type of Income Tax Return which is filed by taxpayers who have an active KRA PIN Number but do not have any source of income. Source of income in this context means that they do not have any income that is either derived from Business, Employment or Rental.

So, if you dont have a source of Income such as Employment Income, Rental Income or Business Income, Kenya Revenue Authority (KRA) states that you should file KRA Nil Returns using KRA iTax Portal on or before the 30th June Deadline.

The group of taxpayers who file KRA Nil Returns is sometimes referred to as the unemployed or students. So, if you know you have an active KRA PIN that is already on iTax Portal, you need to ensure that you file your KRA Returns on or before the 30th June deadline that is set by Kenya Revenue Authority (KRA). There are nor extensions in KRA Returns period.

Now that we have defined what we mean by KRA Nil Returns above, we need to look at two key questions that most taxpayers have pertaining to KRA Nil Returns on iTax Portal. This includes: Who Is Supposed To File KRA Nil Returns and What Is The Penalty For Not Filing KRA Nil Returns.

- Who Is Supposed To File KRA Nil Returns

- What Is The Penalty For Not Filing KRA Nil Returns

By looking and addressing the above two key questions pertaining to KRA Nil Returns on iTax Portal, we shall be able to lay a strong foundation on the understanding of filing KRA Nil Returns on KRA iTax Portal.

Who Is Supposed To File KRA Nil Returns?

I think this is the most asked question by many taxpayers in Kenya about KRA Nil Returns. The answer to this question normally goes down to any taxpayer who has an active KRA PIN Number but dont have a source of income. Those who are supposed to file KRA Nil Returns includes:

-

Students

-

Unemployed

So, incase you know that you have an active KRA PIN Number that is active on iTax Portal and at the same time you dont have a source of income either Business, Employment or Rental, then you fall in the category of taxpayers in Kenya who need to file KRA Nil Returns on iTax Portal.

It’s obvious you might be a student or an unemployed person, but with an active KRA PIN. You should always ensure that you file your Nil Returns before the 30th June deadline as set by Kenya Revenue Authority (KRA).

What Is The Penalty For Not Filing KRA Nil Returns?

Failure to file any KRA Returns on or before the 30th June Deadline leads to automatic penalty being imposed by Kenya Revenue Authority (KRA) on the taxpayer. The same applies to KRA Nil Returns. Any taxpayer who fails to file their KRA Nil Returns before the 30th June deadline will have a penalty of Kshs. 2,000.00 imposed on them by KRA.

In these tough economic times in Kenya, dishing out Kshs. 2,000.00 to pay for penalties for not filing KRA Returns on time is quite absurd. So, you should stop your ignorance and file your Nil Returns and don’t be a person who follows what the crowd says about no need to file Returns because the Government misuses taxes or Taxes are stolen by corrupt leaders.

Remember filing your Nil Returns lie before you and the Kshs. 2,000.00 penalty. If I were you, I would ensure that I file the KRA Nil Returns at this moment and no need to wait for the last minute rush as it is part of the Kenyan tradition to do things at the last minute.

You never know, iTax Portal might on the last day have server and systems issue which can make you fail to file your KRA Nil Returns, and then you will end up blaming KRA for no good reasons yet you had a whooping 6 months (180 days) to file your KRA Returns on iTax Portal.

Now that we have addressed the two key questions pertaining to KRA Nil Returns, we now need to look at the Requirements needed to file KRA Nil Returns on iTax Portal. These requirements are not that many but only 2. That is KRA PIN Number and KRA iTax Password.

Requirements Needed For Filing KRA Nil Returns

For you to able to file your KRA Nil Returns on KRA iTax Web Portal, you need to ensure that you have with you two key requirements i.e KRA PIN Number and KRA iTax Password. We are going to look at each of these KRA Nil Returns requirements in brief details below.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable your Reset KRA iTax Password.

Once you have ensured that you have with you the above two key requirements that are needed in the process of filing KRA Nil Returns on iTax Portal, we can now start the process of looking at How To File KRA Nil Returns Using KRA iTax Portal .

How To File KRA Nil Returns Using KRA iTax Portal

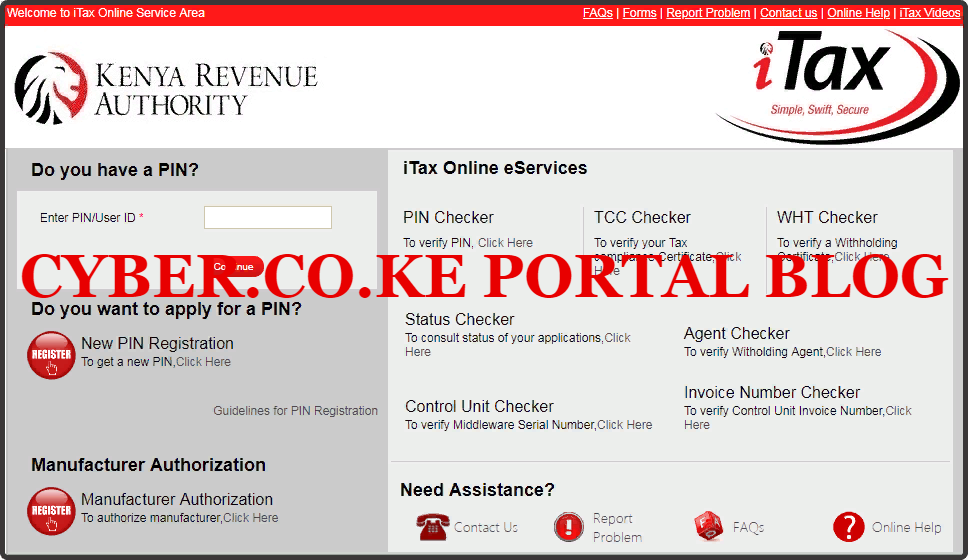

Step 1: Visit KRA Portal

The first step that you need to take is to ensure that you visit the KRA iTax Web Portal using the link provided above in the above description. Note, the above is an external link that will take you to the KRA iTax Portal.

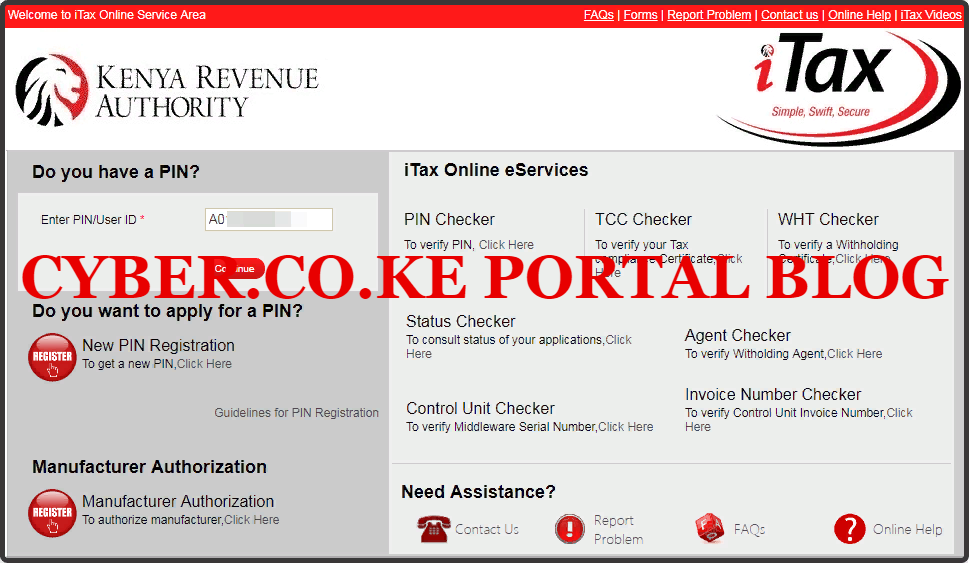

Step 2: Enter Your KRA PIN Number In the PIN/User ID Section

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

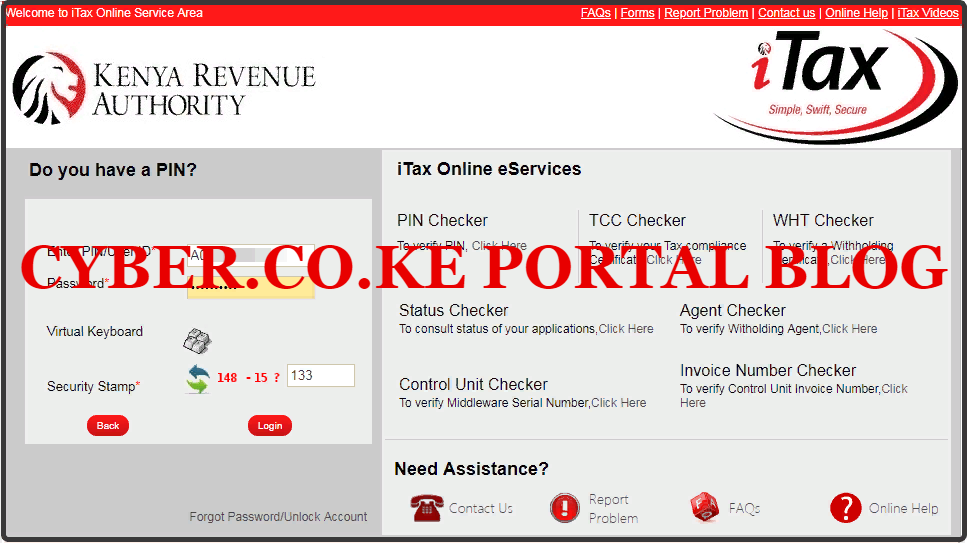

Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: KRA iTax Web Portal Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA iTax Web Portal Account Dashboard. Here upon successful login process, you are able to view a wide range of iTax Portal functionalities.

Step 5: Click On The Returns Menu Tab Followed By File Nil Return

In this step, on the iTax Account menu list, navigate to “Returns” menu tab and click on “File Nil Return” from the drop down menu list. This is as illustrated in the screenshot below.

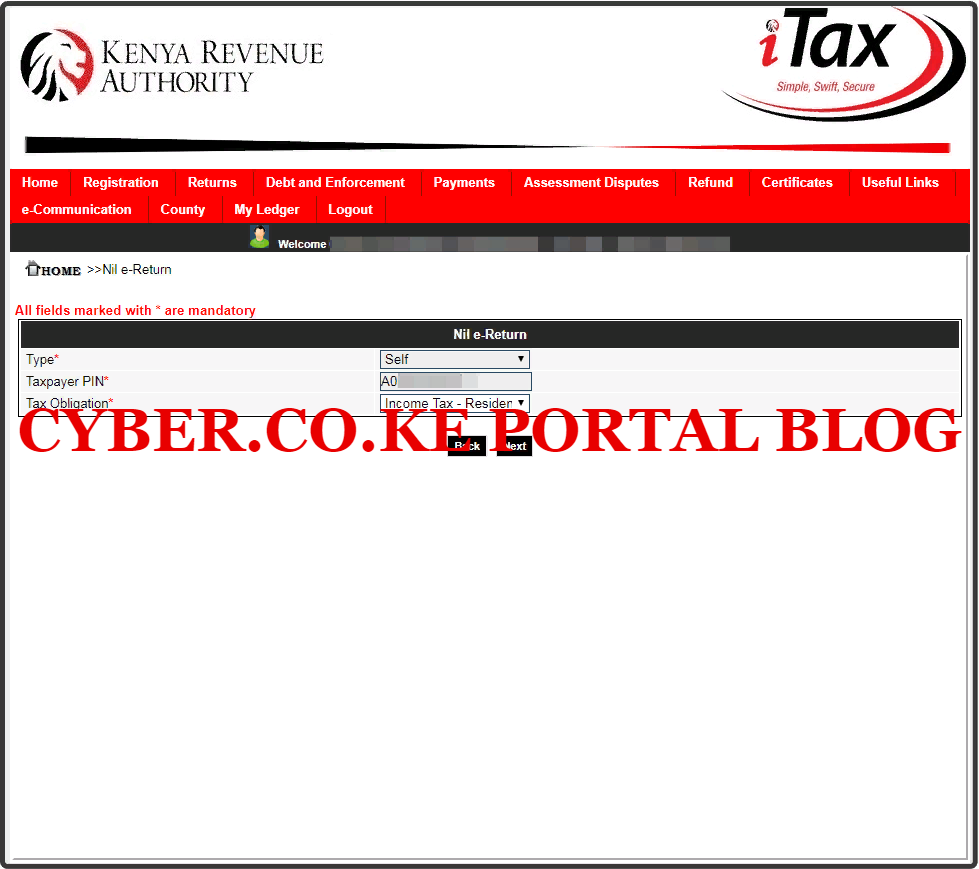

Step 6: Select Tax Obligation As Income Tax Resident Individual

In the Nil e-Return Form, under the Tax Obligation part, select Income Tax Resident Individual since we are filing KRA Nil Return for a Resident Individual. The other two fields i.e Type and Taxpayer are automatically pre-filled by the system.

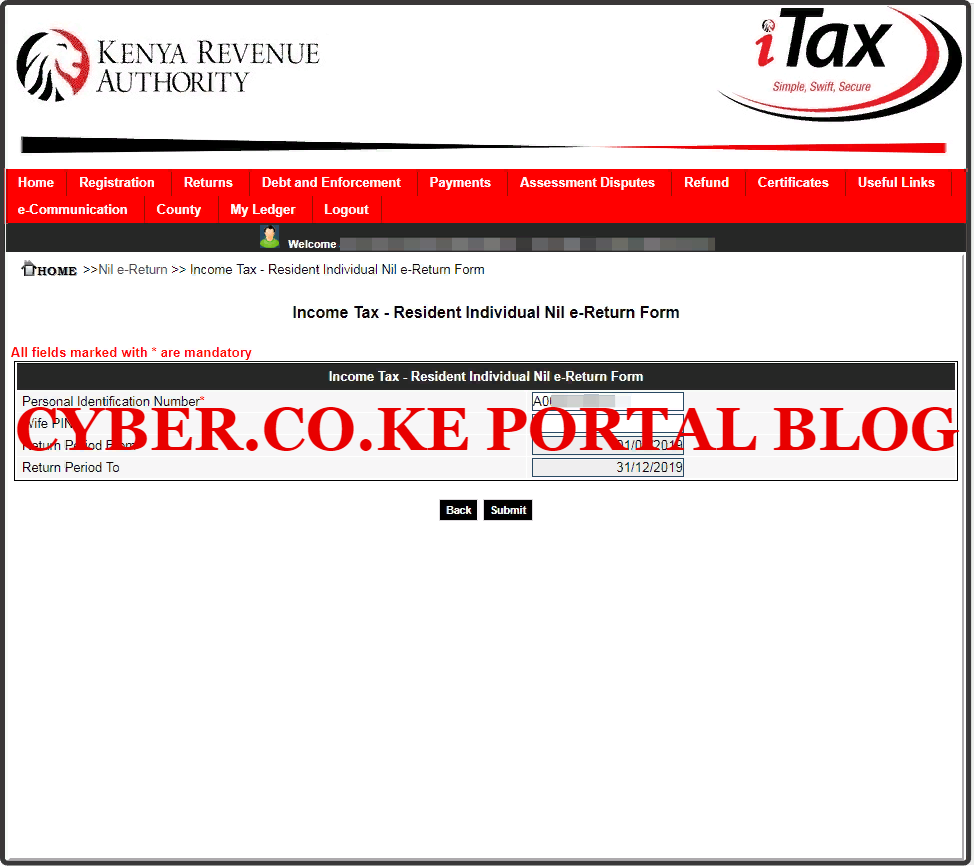

Step 7: Fill In The Income Tax Resident Individual Nil e-Return Form

In this step, on the KRA Nil e-Return Form, you need to select the date for the Return Period From part. Since we are in 2020, we are filing KRA Nil Returns for 2021. So the Return Period From date will be 01/01/2021 and the Return Period To date will be automatically pre-filled by the system to 31/12/2021.

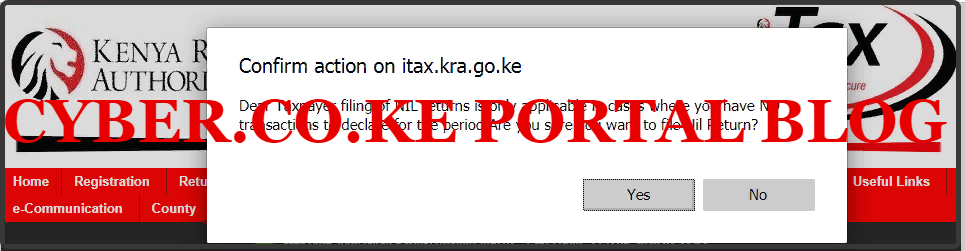

Once you have entered the returns dates 01/01/2021 – 31/12/2021, click on the “Submit” button to submit the KRA Nil Return to Kenya Revenue Authority (KRA). A pop up notification from itax.kra.go.ke will appear as shown below:

The popup message simply states: “Dear taxpayer, filing of Nil Returns is only applicable in cases where you have no transactions to declare for the period. Are you sure you want file Nil Return? Since that is what we are filing here, click on the “Yes” button.

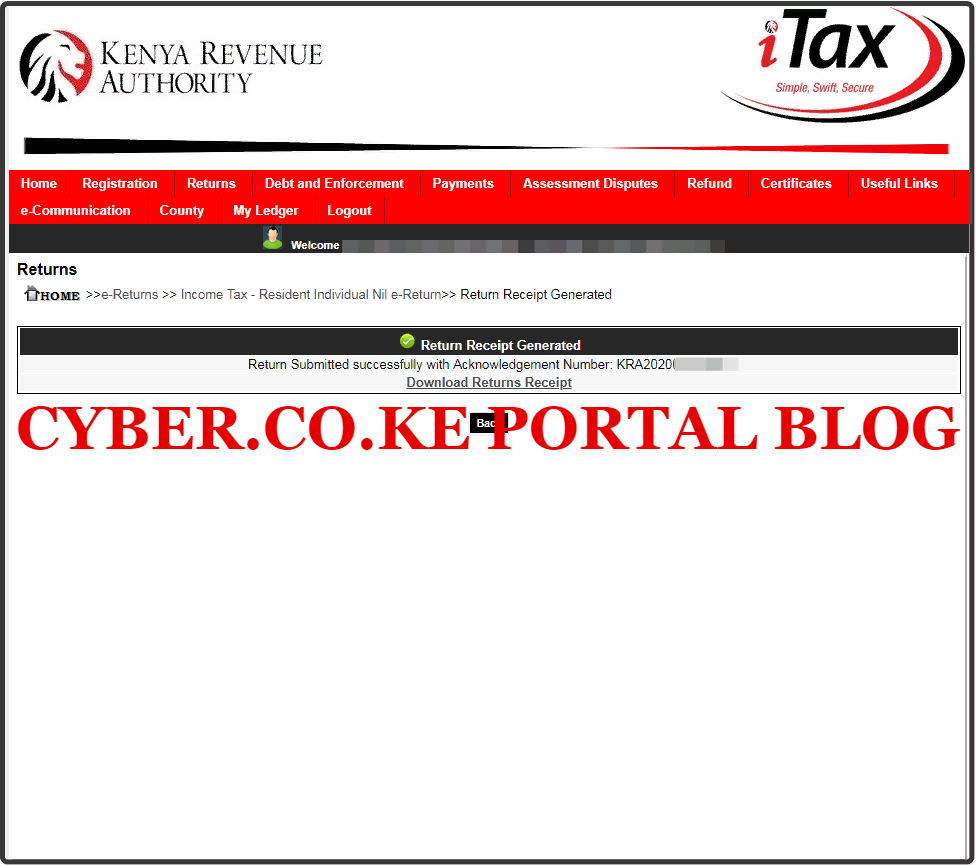

Step 8: Download KRA Nil Returns Receipt

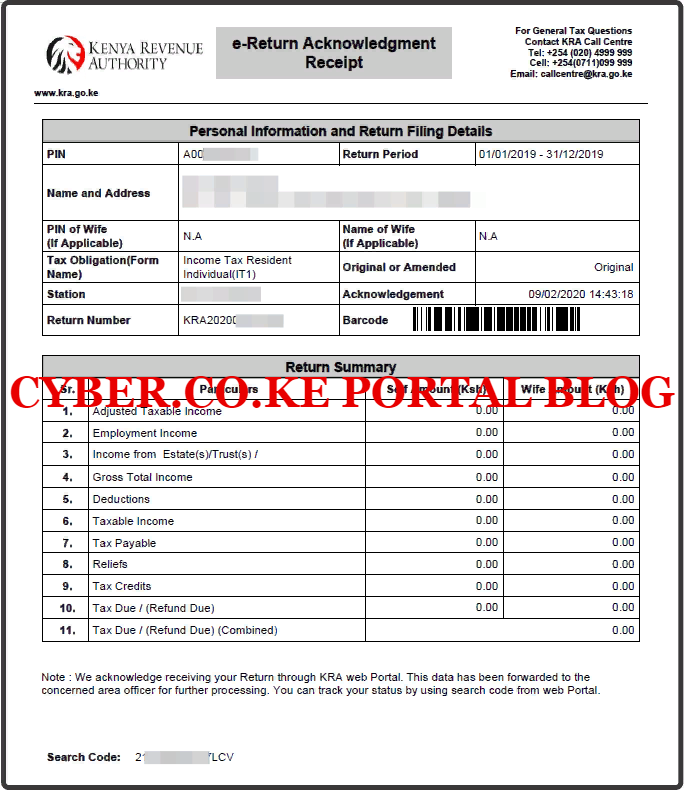

In this last step, you will need to download the KRA Nil Return Receipt that has been generated by the iTax system successfully. This is a final confirming that your KRA Nil Return has been successfully submitted to Kenya Revenue Authority (KRA). An Acknowledgement Number will also be generated for that KRA Nil Return that we have just filed.

Below is the e-Return Acknowledgement Receipt that is a final confirmation that we have successfully file the KRA Nil Returns on KRA iTax Portal.

READ ALSO: KRA PIN Certificate Download Process On KRA iTax Portal

The KRA Nil Returns receipt is the final confirmation that the return for the period ending 31st December 2021 has been filed on iTax successfully before the elapse of the 30th June 2022 deadline set by Kenya Revenue Authority (KRA). That forms the basis of the steps involved in How To File KRA Nil Returns Using KRA iTax Portal.

Matthews Ohotto is an Article Writer at CYBER.CO.KE and a Video Creator at Step-by-Step Tutorials Kenya (YouTube). He specializes in crafting insightful Blog Posts and Video Tutorials that empower Kenyans with practical digital skills. He is a holder of Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT).

KRA INDIVIDUAL SERVICES

SUBMIT SERVICE REQUEST

KRA PIN REGISTRATION

Are you looking for KRA PIN Registration services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN RETRIEVAL

Are you looking for KRA PIN Retrieval services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN UPDATE

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN CHANGE OF EMAIL ADDRESS

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA RETURNS SERVICES

SUBMIT SERVICE REQUEST

KRA NIL RETURNS

Are you looking for KRA Nil Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA EMPLOYMENT RETURNS

Are you looking for KRA Employment Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA AMENDED RETURNS

Are you looking for KRA Amended Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA WITHHOLDING TAX RETURNS

Are you looking for KRA Withholding Tax Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.