Are you a Student in Kenya looking to file your KRA Returns on iTax Portal? Learn How To File KRA Returns For Students Using iTax Portal.

We are in that season whereby there is a rush by taxpayers in Kenya to ensure that they file their KRA Returns before the 30th June Deadline. Both the Employed and Unemployed, as long they have an Active KRA PIN, filing Returns is a must for each taxpayer, and the same applies to students in Kenya, who have active KRA PIN Numbers.

In this article, I am going to share with you the steps that are involved in How To File KRA Returns For Students Using iTax Portal. This article will be of great value and benefit if you a student in Kenya either in a College or University undertaking your studies. So, if you are a student and have a KRA PIN Number, by the end of this article you will have known how to file your KRA Returns on iTax Portal.

READ ALSO: How To Register For Turnover Tax Using KRA iTax Portal

There has always been a false notion among most Kenyans that if you are a student then you are not supposed to file KRA Returns. This is not true because the Income Tax Laws in Kenya are quite clear that any person or individual whether Employed or Unemployed should be filing their Annual KRA Returns before the 30th June Deadline.

The same applies for students in Kenya, as long as you have an Active KRA PIN Number, you need to be filing your KRA Returns. Everybody who has a KRA PIN has to file KRA Returns. Save yourself from paying a fine and file your KRA Tax Returns early. To be able to File KRA Returns for Students, you need to login to your iTax Account using your KRA PIN Number and iTax Password. But in most cases, many Kenyans either have forgotten their KRA PIN Number or even the email that they used in KRA PIN Portal or KRA Portal (iTax Portal).

The good thing is that incase you have forgotten your KRA PIN Number or even iTax Password (KRA Password), here at Cyber.co.ke Portal we can gladly assist you with that. Incase you have forgotten your KRA PIN, then you can request for KRA PIN Retrieval and have both your KRA PIN Number and KRA PIN Certificate sent to you. Incase you have forgotten your iTax Password, you can request for KRA PIN Change of Email Address so that you can be able to change your KRA Password.

What Is KRA Returns For Students?

KRA Returns For Students is a type of Income Tax Returns that is filed by Students who are still learning either in Colleges or Universities and have an Active KRA PIN Number but do not have any source of Income i.e. Business, Rental or Employment. This type of Return that is filed by students in Kenya who have an active KRA PIN Number but no source of income is called KRA Nil Returns.

You need to take note that there are two sides of the coin when you mention that someone is a student in Kenya. In the context of KRA PIN Number, KRA Returns and iTax Portal, a student is issued with a KRA PIN once they have attained the age of 18 years and have received there National Identity Card.

A student can either be someone who is undertaking his or her studies in College or University either Part Time or Full Time and is not Employed or does not have any source of Income. The side is that a student is someone who is undertaking his or her studies in College or University Part Time and is Employed.

Both the above two categories of students in Kenya have active KRA PIN Numbers, but our focus will be on those students who have KRA PIN Numbers but no source of income. If you are a student with an active KRA PIN Number and also have a source of income, then you can learn how to file your KRA Returns by checking our article on How To File KRA Returns For Employees Using P9 Form.

So, if you are a student in Kenya and have an active KRA PIN Number but no source of income, then you are the one that this article is targetting. You need to learn and know How To File KRA Returns For Students using KRA iTax Portal. By the end of this article, you will have know How To File KRA Returns for Students in Kenya.

Now that we have looked at the basics on KRA Returns for Students in Kenya, we now need to understand some key terms that are related to KRA Returns for Students. These includes: Type of KRA Returns That Students File On KRA iTax Portal, KRA Penalties For Students Who Do Not File Their KRA Returns and Requirements Needed To File KRA Returns For Students on KRA iTax Portal.

Type of KRA Returns That Students File On KRA iTax Portal

The biggest question that most Kenyan Students ask is: I am a student, what type of KRA Return am I supposed to file? Well the answer to this question is quite simple. If you are a student in Kenya, the type of KRA Returns that you should be filing as long as you do not have any source of income is called KRA Nil Returns.

KRA Nil Returns just as the name suggests, means that you are filing Nil or Zero Return because you did not have or or did not make any income in a given year. Since most students are in college or universities, majority have active KRA PIN Number which they got after making application for KRA PIN Registration online at Cyber.co.ke Portal.

Students normally apply for KRA PIN Registration at Cyber.co.ke Portal because they need the KRA PIN to either apply for HELB Loans or even open their Bank Accounts. Majority then tend to forget about Filing their KRA Returns before the 30th June Deadline, and this leads to KRA imposing a penalty for late filing.

So, if you know that you are student and still learning but have a KRA PIN Number, you need to ensure that you file your KRA Returns for Students on iTax Portal on time before the 30th June Deadline. A student just needs to file KRA Nil Returns which is not that difficult to do as you will learn from this article. So remember this all the times: (Student + KRA PIN + No Source of Income = KRA Nil Returns).

KRA Penalties For Students Who Do Not File Their KRA Returns

The Kenya Revenue Authority (KRA) states that failure to file KRA Returns for both the Employed and Unemployed attracts a penalty of Kshs. 2,000.00 for each year not filed. The same penalty applies for students in Kenya who do not file KRA Returns or fail to file their KRA Returns.

If you are student and you fail to file your KRA Returns, a penalty of Kshs. 2,000.00 will be automatically applied by the KRA iTax Portal. The implication is that you will need to either apply for KRA Waiver using iTax Portal or in most cases, you will have to pay the penalty.

So, if you do not want to be slapped by the KRA Penalty of Kshs. 2,000.00 you are only left with one choice i.e. file your KRA Returns on time. The implications for not filing KRA Returns for Students is that once you finish your studies in College or University, and need to apply for a job in Kenya, you will need to have a KRA Tax Compliance Certificate.

Majority of students who don’t file KRA Returns normally do not get the Tax Compliance Certificate easily as they have a KRA Penalty which in turns hinders their application for the lucrative Tax Compliance Certificate. So, what lies before you and your student life is that KRA Penalty of Kshs. 2,000.00 if you fail to file KRA Returns for Students.

Requirements Needed To File KRA Returns For Students on KRA iTax Portal

Before filing your KRA Returns for Students on iTax Portal, there are two key requirements that you need to ensure you have with you so as to make your Returns Filing process much smoother. To file KRA Returns for Students, you are goin to need your KRA PIN Number and KRA iTax Password. These two are as highlighted below.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable your Reset KRA iTax Password.

Now that you have with you the two key requirements that are needed to file KRA Returns for Students on iTax Portal, we can now begin to look at the steps that each student in Kenya should take on How To File KRA Returns For Students Using iTax Portal.

How To File KRA Returns For Students Using iTax Portal

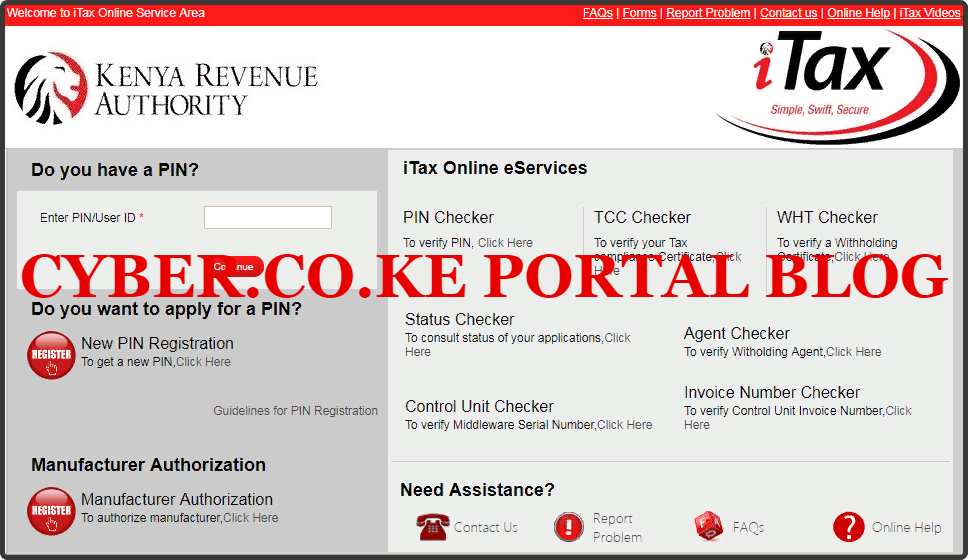

Step 1: Visit KRA Portal

The first step in the process of filing KRA Returns for Students on iTax Portal is to visit the KRA iTax Web Portal using the link provided above in the above description. Note, the above is an external link that will take you to the KRA iTax Portal.

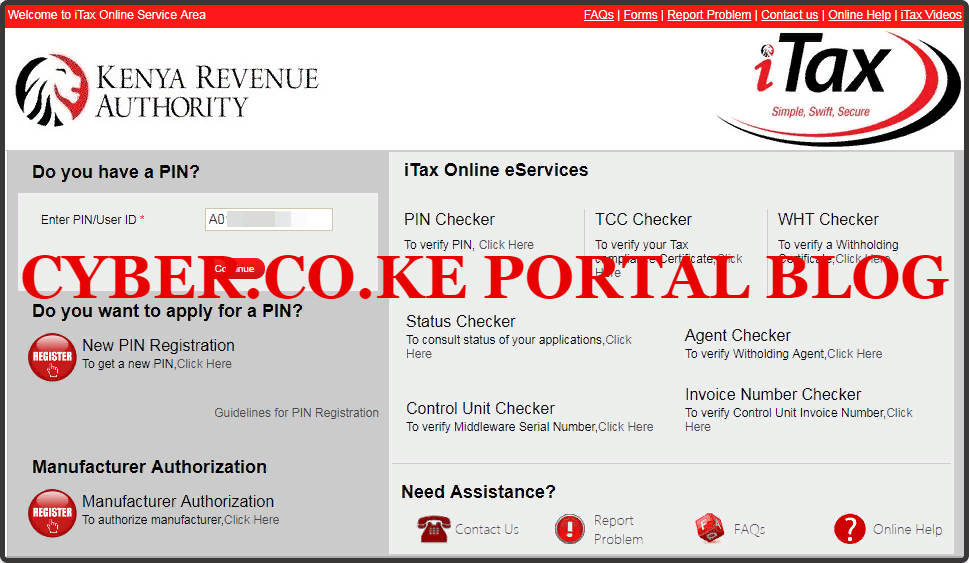

Step 2: Enter Your KRA PIN Number In the PIN/User ID Section

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

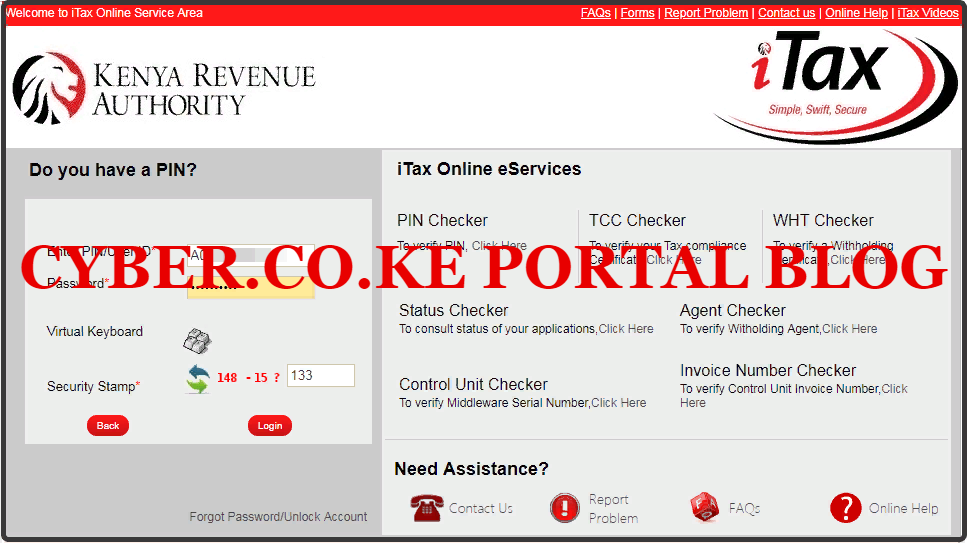

Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: KRA iTax Web Portal Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA iTax Web Portal Account Dashboard. Here upon successful login process, you are able to view a wide range of iTax Portal functionalities.

Step 5: Click On The Returns Menu Tab Followed By File Nil Return

In this step, on the iTax Account menu list, navigate to “Returns” menu tab and click on “File Nil Return”from the drop down menu list. This is as illustrated in the screenshot below.

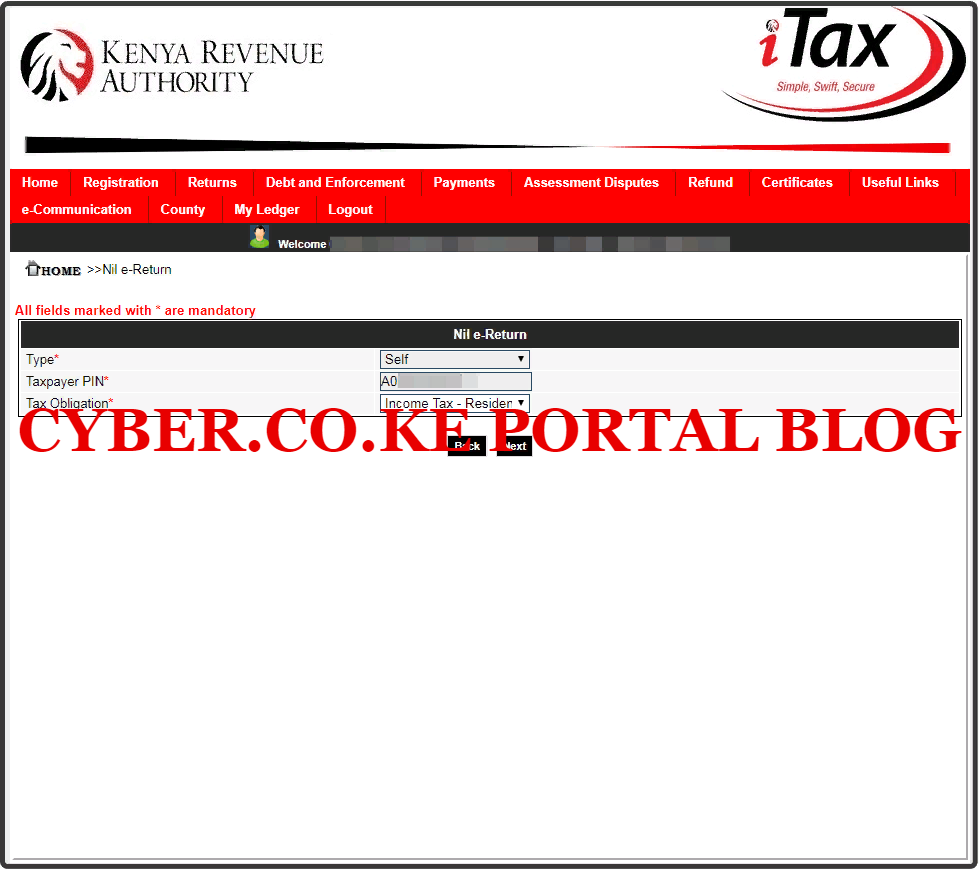

Step 6: Select Tax Obligation As Income Tax Resident Individual

In the Nil e-Return Form, under the Tax Obligation part, select Income Tax Resident Individual since we are filing KRA Nil Return for a Resident Individual. The other two fields i.e Type and Taxpayer are automatically pre-filled by the system.

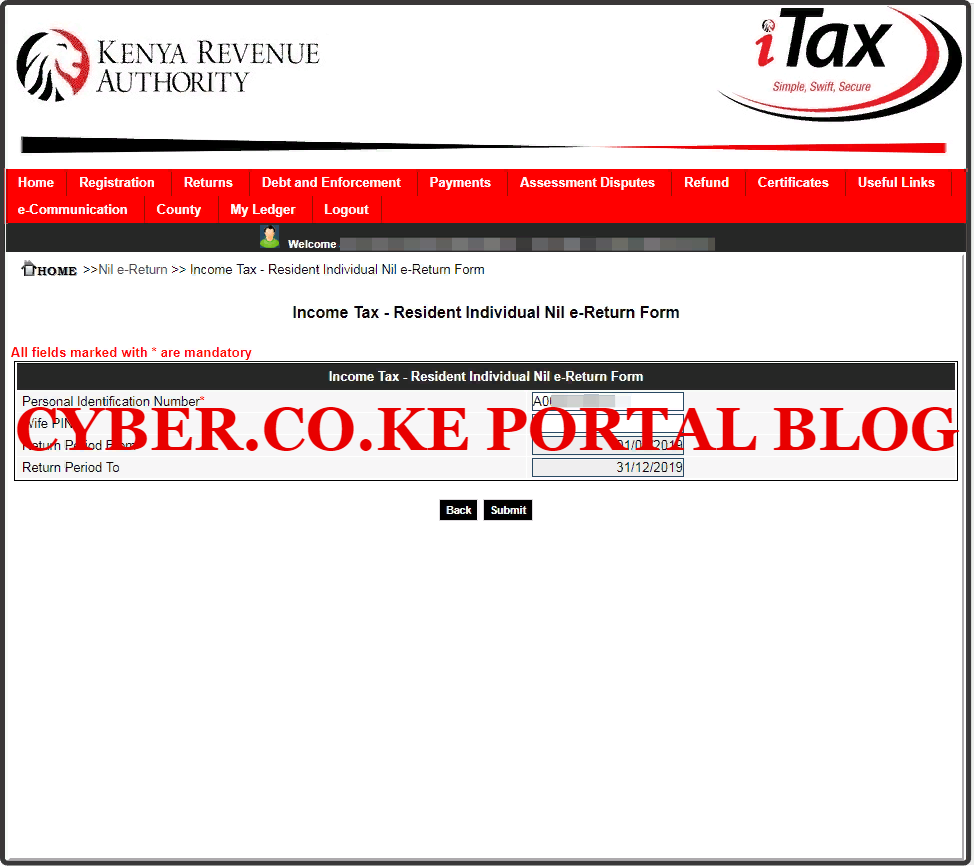

Step 7: Fill In The Income Tax Resident Individual Nil e-Return Form

In this step, on the KRA Nil e-Return Form, you need to select the date for the Return Period From part. Since we are in 2020, we are filing KRA Nil Returns for 2019. So the Return Period From date will be 01/01/2019 and the Return Period To date will be automatically pre-filled by the system to 31/12/2019.

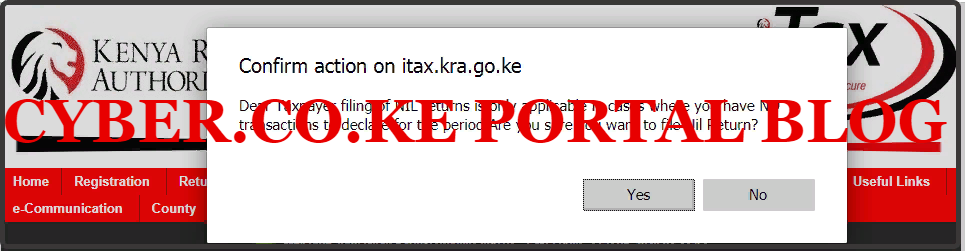

This year 2020, we are filing the KRA Returns for the year 2019. So as a student you need to ensure that you select the appropriate Return Period from. Click on the “Submit” button to submit the KRA Nil Return to Kenya Revenue Authority (KRA). A pop up notification from itax.kra.go.ke will appear as shown below:

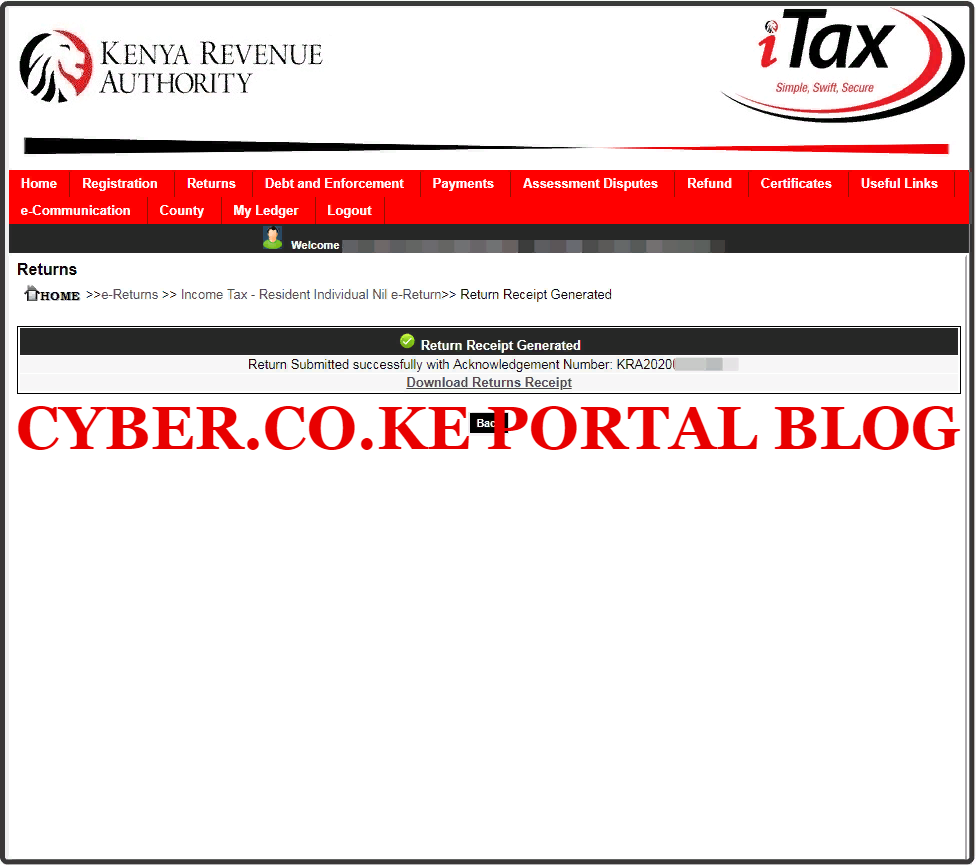

Step 8: Download KRA Nil Returns For Students Receipt

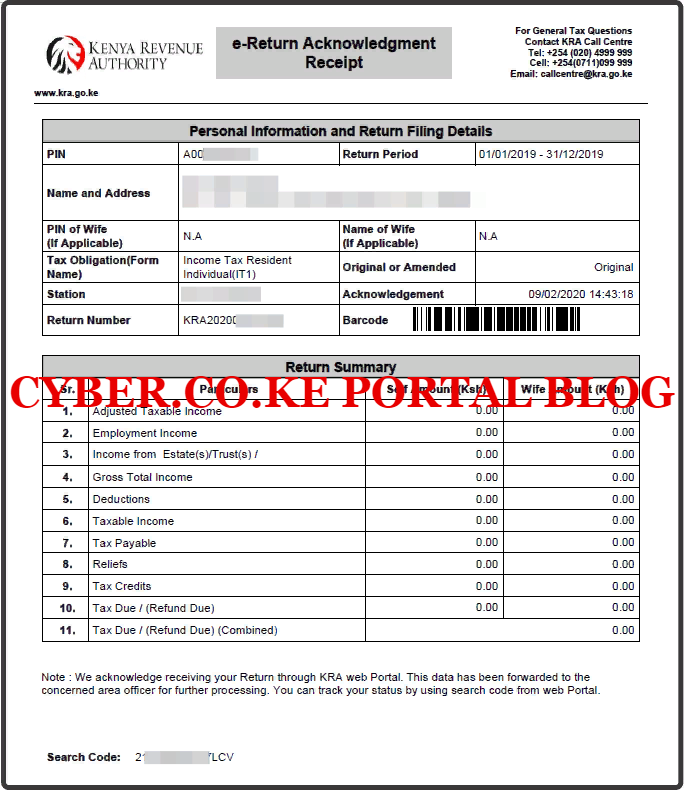

In this last step, you will need to download the KRA Nil Return for Student Receipt that has been generated by the iTax system successfully. This is a final confirming that your KRA Nil Return has been successfully submitted to Kenya Revenue Authority (KRA). An Acknowledgement Number will also be generated for that KRA Nil Return that we have just filed.

Below is the e-Return Acknowledgement Receipt for the KRA Returns for Students which serves as a final confirmation that we have successfully file the KRA Nil Returns for Students on KRA iTax Portal.

So, if you are student in Kenya with a KRA PIN Number and no source of income, you should follow the above steps when you need to file your KRA Returns for Students on KRA iTax Portal. Just remember that for your to file KRA Returns for Students on iTax Portal, you will need to ensure that you have with you KRA PIN Number and KRA iTax Password.

READ ALSO: How To Check And Confirm Your KRA PIN Using iTax PIN Checker

If you are a Student either in College or University and need help or assistance in filing your KRA Returns for Students on iTax, you can submit your order online here at Cyber.co.ke Portal for KRA Nil Returns Filing for Students in Kenya and our support team will gladly help you in filing your KRA Returns for Students request quickly and easily today.

DON’T MISS OUT. CHECK OUT OUR TRENDING POPULAR BLOG POSTS IN KENYA.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

KRA PIN REGISTRATION

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

KRA PIN RETRIEVAL

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

KRA PIN UPDATE

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

KRA PIN CHANGE OF EMAIL ADDRESS

Stay Tax Compliant in Kenya

Contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.