Disclaimer: This blog is an independent informational resource. It is not affiliated with any government agency, including Kenya Revenue Authority (KRA).

Did you know that unemployed individuals in Kenya who are not employed either formally or informally are required to file and submit their KRA Returns yearly before the 30th June deadline? Yes, any unemployed person in Kenya with an active KRA PIN must file their KRA Returns by the 30th June deadline set by the Kenya Revenue Authority (KRA) each year. Failure to file KRA Returns for the unemployed incurs a penalty of Kshs. 2,000 for late filing and submission through iTax.

The specific type of return required for all unemployed individuals with a KRA PIN in Kenya is known as KRA Nil Returns or simply put Nil Returns. This category is designated for individuals without any income from business, rental or employment thus the term unemployed. In the context of this blog post, KRA Nil Returns are relevant for those who don’t have any source of income in Kenya, meaning they have no income derived from employment, business or rental. Therefore, if you are unemployed in Kenya, it is essential to file KRA Nil Returns through iTax before the set deadline elapses.

READ ALSO: How To Check If You Have Filed KRA Returns (In 4 Steps)

To successfully file KRA Returns for the unemployed on iTax, there are two key prerequisites to fulfill: your KRA PIN Number and KRA Password (iTax Password). The process involves logging into iTax using both the KRA PIN Number and KRA Password (iTax Password) to facilitate the seamless filing of KRA Returns for unemployed individuals in Kenya.

This article provides a detailed guide for unemployed individuals in Kenya to file their KRA Nil Returns using the iTax portal. Filing KRA Nil Returns is mandatory for all individuals with an active KRA PIN, including those without any source of income. Failure to file these returns by the June 30th deadline results in a penalty of Kshs. 2,000.

Key Highlights from the Article:

-

Importance of Filing KRA Nil Returns:

- All unemployed individuals with an active KRA PIN are legally required to file annual returns, even if they have no income.

- Timely filing prevents penalties and maintains tax compliance.

-

Requirements for Filing:

- KRA PIN Number: A unique identifier for each taxpayer. If forgotten, individuals can request retrieval services through CYBER.CO.KE.

- KRA Password (iTax Password): Necessary for accessing the iTax account. The article provides guidance on resetting the password if it’s forgotten.

-

Step-by-Step Guide to Filing KRA Nil Returns:

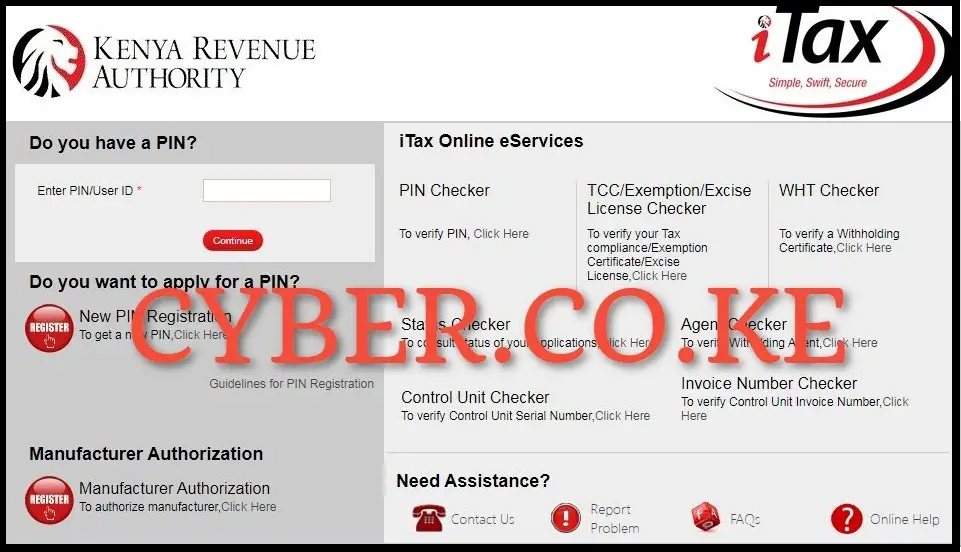

- Step 1: Visit the iTax portal at https://itax.kra.go.ke/KRA-Portal/.

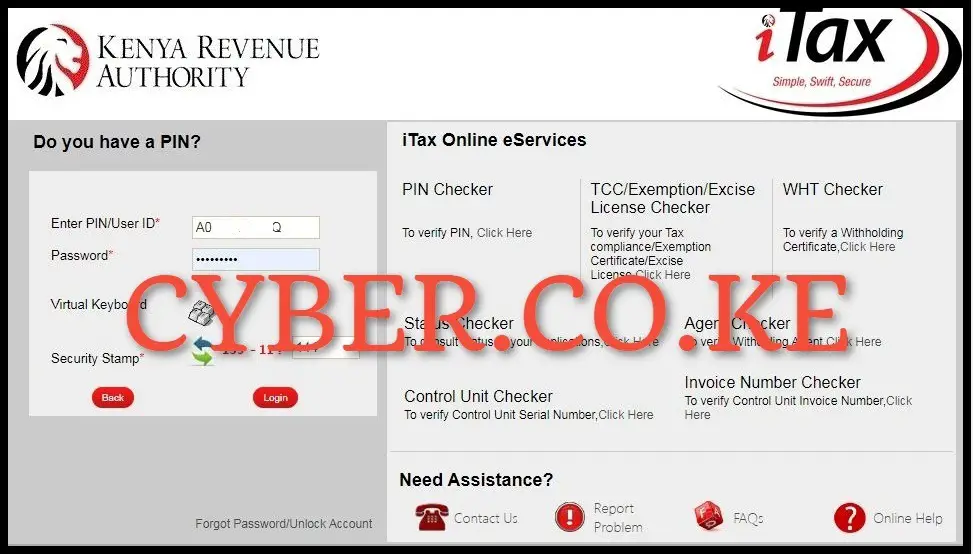

- Step 2: Log in using your KRA PIN and Password.

- Step 3: Navigate to the ‘Returns’ menu and select ‘File Nil Return’.

- Step 4: Choose ‘Income Tax – Resident Individual’ as the tax obligation and proceed.

- Step 5: Complete the e-Return form by entering the appropriate return period and submit.

- Step 6: Download the e-Return Acknowledgement Receipt for your records.

This article emphasizes the necessity of adhering to the June 30th deadline to avoid penalties. It also highlights the services offered by CYBER.CO.KE, such as Registration, Retrieval, Update and Change of Email Address, providing support for individuals who may face challenges during the filing process.

Requirements Needed In Filing KRA Nil Returns For Unemployed

To be able to successfully file KRA Returns for Unemployed on iTax, you need to first ensure that you have both the KRA PIN Number and KRA Password (iTax Password), which form part of the iTax login credentials. Below is a brief description of what KRA PIN Number and KRA Password (iTax Password) entails in relation to the process of How To File KRA Returns For Unemployed On iTax.

1. KRA PIN Number

The KRA PIN Number is the most important requirement that you need to have with you when you want to login into iTax so as to be able file KRA Returns for unemployed. If by any chance you have forgotten or you don’t remember your KRA PIN Number, you can submit KRA PIN Retrieval request online here at CYBER.CO.KE and our support team will be able to assist with the retrieval of your lost or forgotten KRA PIN Number.

At the same time, if you are looking for a new KRA PIN Number, you can get it here in less than 3 minutes by submitting your KRA PIN Registration request at CYBER.CO.KE. Your new KRA PIN Number and KRA PIN Certificate will be sent to your Email Address once the request for KRA PIN Registration has been done and processed by our support team.

2. KRA Password (iTax Password)

The next requirement that you need to have with you in the process of filing KRA Returns for unemployed on iTax is your KRA Password (iTax Password), which you will need to access your iTax account. If you don’t know or have forgotten your KRA Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for KRA Password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at CYBER.CO.KE and have your Email Address changed so as to enable your Reset KRA Password.

Did you know that you can easily apply and get your KRA PIN Number and KRA PIN Certificate online in less than 5 minutes by using CYBER.CO.KE today. Get it via email address or even WhatsApp upon submission.

Here at, CYBER.CO.KE, we offer unmatched KRA PIN Registration, KRA PIN Retrieval, KRA PIN Update and KRA PIN Change of Email Address services to Kenyans daily. Fill and submit your request online today.

How To File KRA Nil Returns For Unemployed

The following are the 6 main steps involved in the process of How To File KRA Nil Returns For Unemployed that you need to follow.

Step 1: Visit iTax (KRA Portal)

For you to be able to file KRA Returns for Unemployed, you first need to visit iTax using https://itax.kra.go.ke/KRA-Portal/

Step 2: Login Into iTax (KRA Portal)

In this step, enter your KRA PIN Number and KRA Password (iTax Password), solve the arithmetic question (security stamp) and then click on the “Login” button to login into your iTax account so as to start the process of filing KRA Returns for Unemployed using iTax.

Step 3: Click on Returns then File KRA Nil Returns

Once you are logged into your iTax account, on the top menu, click on “Returns” then click on “File Nil Returns” from the drop down menu list under KRA Returns.

Step 4: Select KRA Tax Obligation

Next, select the tax obligation that you want to file the KRA Returns for. In this blog post, since we are filing KRA Returns for unemployed using iTax, we select tax obligation labeled “Income Tax – Resident Individual.” Once selected, proceed by clicking the “Next” button.

Step 5: Fill In The Income Tax – Resident Individual Nil e-Return Form

In this step, fill out the Income Tax Resident Individual Nil e-Return form to initiate the KRA Returns filing process for unemployed individuals in Kenya using iTax. If your KRA Returns are in order, input the Return Period From, and the Return Period To will be automatically generated. This automated population occurs only when your KRA Returns filing is current. In our case, set the Return Period From as 01/01/2022, which will automatically set the Return Period To as 31/12/2022. Finally, click on the “Submit” button to proceed.

Step 6: Download KRA Returns Receipt (e-Return Acknowledgement Receipt)

Upon successful filing of the KRA Returns for Unemployed on iTax, you will now have to download the generated KRA Returns Receipt for Unemployed returns filing on iTax. To download the KRA Returns Receipt on iTax for Unemployed individuals in Kenya, simply click on the text link that reads “Download KRA Returns Receipt” to save the KRA Returns Receipt for Students on your device. You also have the option to print a copy of the same KRA Returns Receipt.

READ ALSO: How To Change or Reset iTax Password Online (In 7 Steps)

The outlined six steps above detail the process of filing and submitting KRA Returns for unemployed individuals using iTax. To successfully accomplish this KRA Returns filing process on iTax, make sure you have the requisite iTax login credentials, specifically the KRA PIN Number and KRA Password (iTax Password). Once you have both these essential requirements, follow the main steps outlined above to understand how to file KRA Returns for unemployed individuals in Kenya using iTax.