Get to know How to File KRA Returns using P9 Form online today at Cyber.co.ke Portal. File your KRA Returns easily using our step by step guide.

Are you employed and have with you KRA P9 Form? It’s time that you learn How To File KRA Returns Using P9 Form. The process is not that complicated and this article will show you the steps you need to follow to file your KRA Returns today.

In this article, I will be showing you How to File KRA Returns using P9 Form. This guide will be useful for those who are in employment. If you are unemployed, you can check out our blog post on How To File KRA Nil Returns Using KRA iTax Portal.

READ ALSO: How To File KRA Nil Returns Using KRA iTax Portal

Requirements for Filing KRA Returns for those in Employment

For you to be able tof file KRA Returns using P9 Form, you need to have with you some three key requirements. Below are the requirements that you need to have before you can begin filing your annual KRA Returns.

- KRA PIN Number

- iTax Password

- KRA P9 Form

Now, let us break down the above three requirements needed in the process of filing KRA Returns using P9 Form.

-

KRA PIN Number

The KRA PIN Number is the most important thing that you need to have before filing your KRA Returns.

-

iTax Password

This is the password associated with your KRA PIN Number. With your KRA iTax Password, you can be able to log into your iTax account and file returns.

-

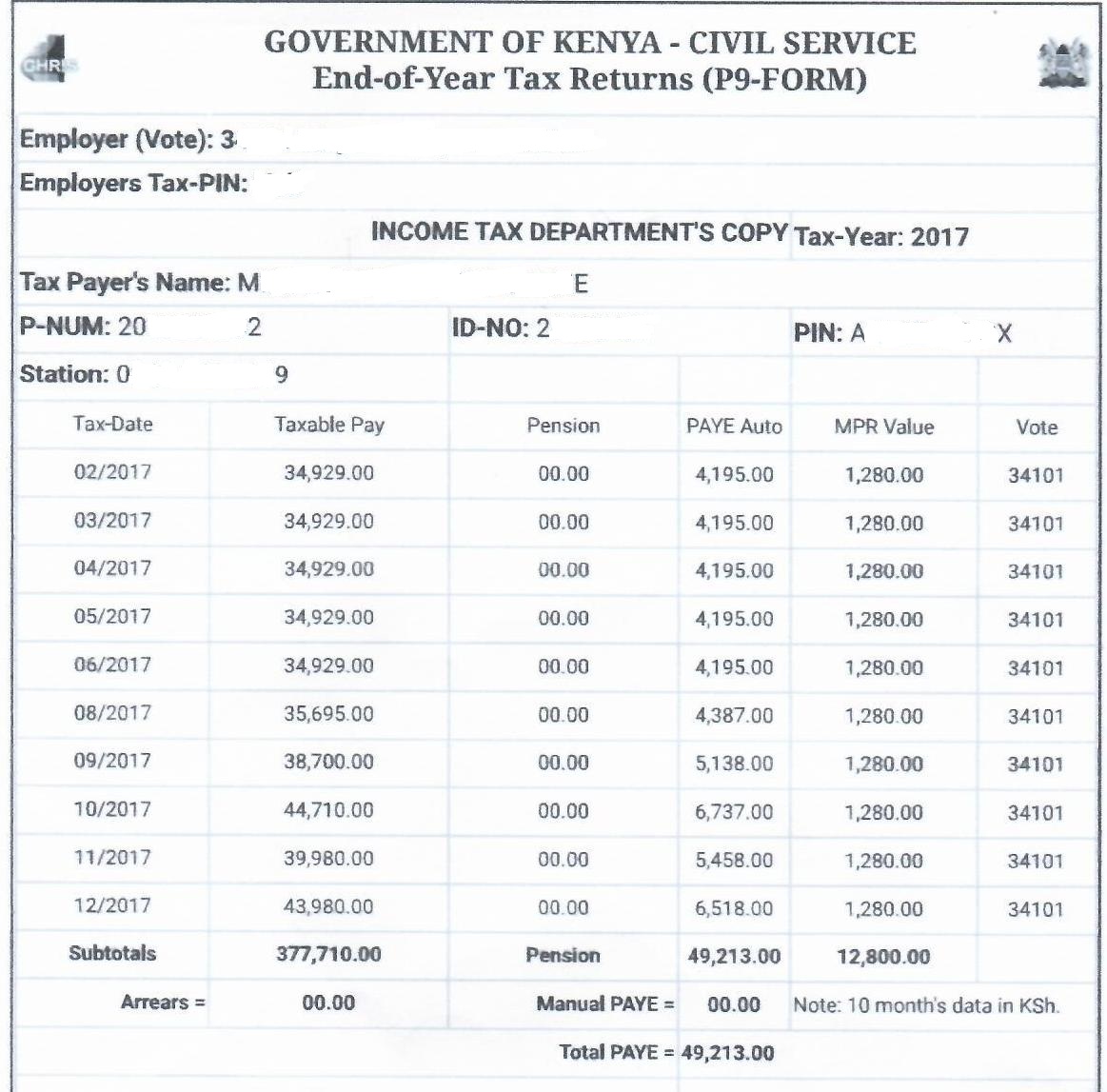

KRA P9 Form

This is a tax deduction form that shows you the Gross Pay, Taxable Pay, PAYE and Personal Relief for the whole year.

How to File KRA Returns using P9 Form

In this blog post, we are going to use KRA P9 Form for an employee under the civil service. Note also that the P9 Form that we are using in this example contains data for 10 months. Normally the P9 Form will contain data for 12 months, but that depends on the deductions and date of employment.

Sample KRA P9 Form Used for Filing KRA Returns on iTax Portal

We shall be using the above KRA P9 Form to file our KRA Returns. This will serve as the guideline of this KRA Returns Filing tutorial.

Step 1: Visit KRA Portal

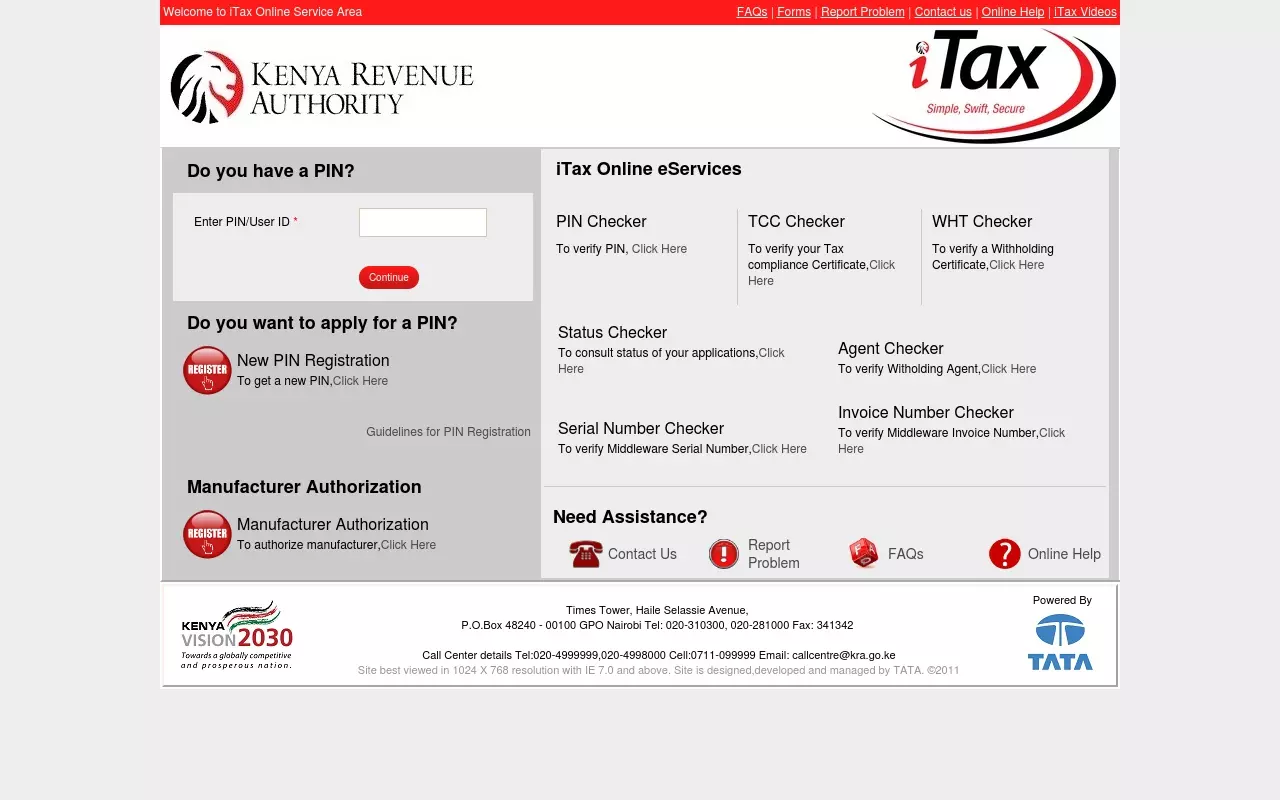

Using your KRA PIN number and iTax Password, Log into your iTax account at https://itax.kra.go.ke/KRA-Portal

Step 2: iTax iPage Dashboard

Once you have successfully logged into your iTax account (iPage) you should see the following as shown above. In your iTax account you can do a variety of tasks online. Our main focus for this blog post will be on KRA Returns using KRA P9 Form.

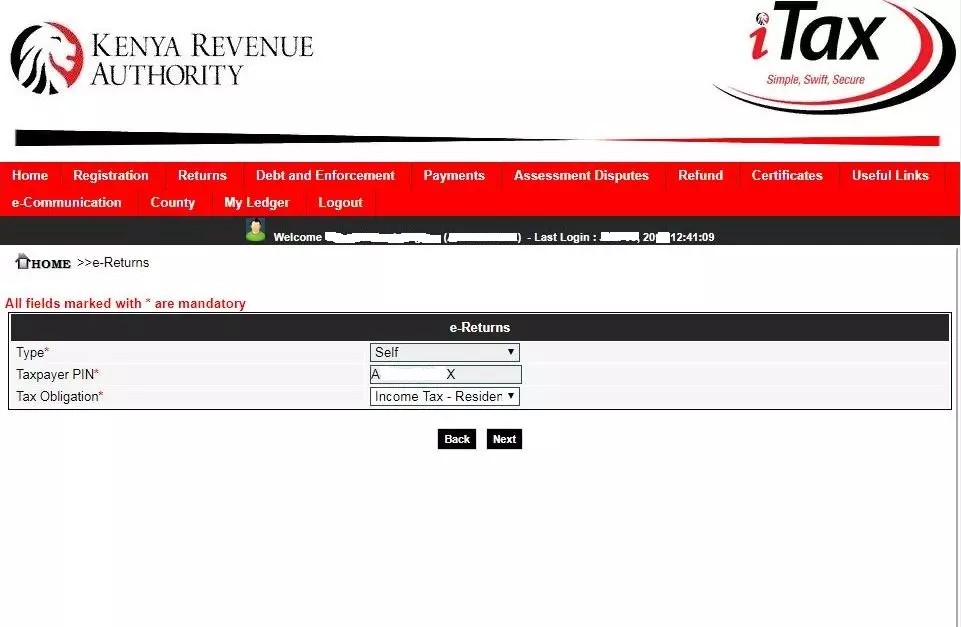

Step 3: Click on Returns tab

Click on the Returns tab and then click File Return tab from the drop down menu appearing as show above.

Step 4: Select Tax Obligation

Here, you are required to select the tax obligation. In this case, we select Income Tax – Resident Individual since we are filing KRA Returns for Kenyan resident with employment income.

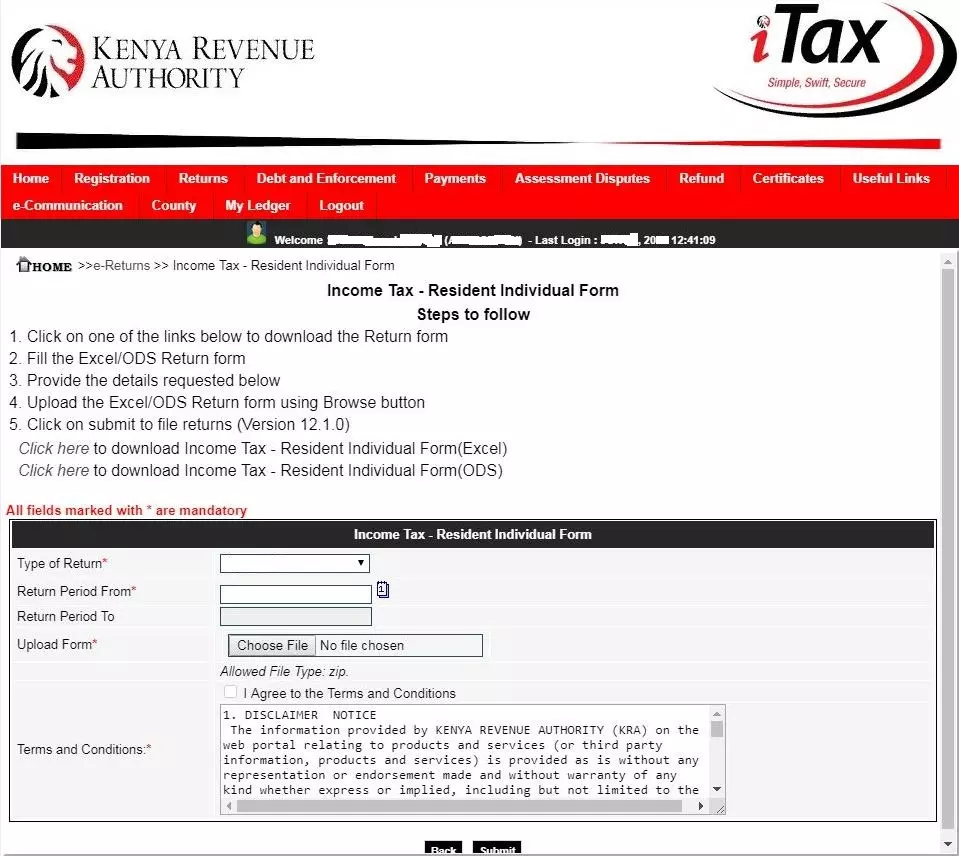

Step 5: Download Income Tax Resident Individual Form

Here, you will need to download the Income Tax Resident Individual Form (Excel). Note that this is a Zipped folder that you will need to Unzip. You can also download it using the provided link below:

>>>> Download IT1 Individual Resident Return XLS <<<<

Step 6: Open the IT1 Individual Resident Return XLS (Excel) Form

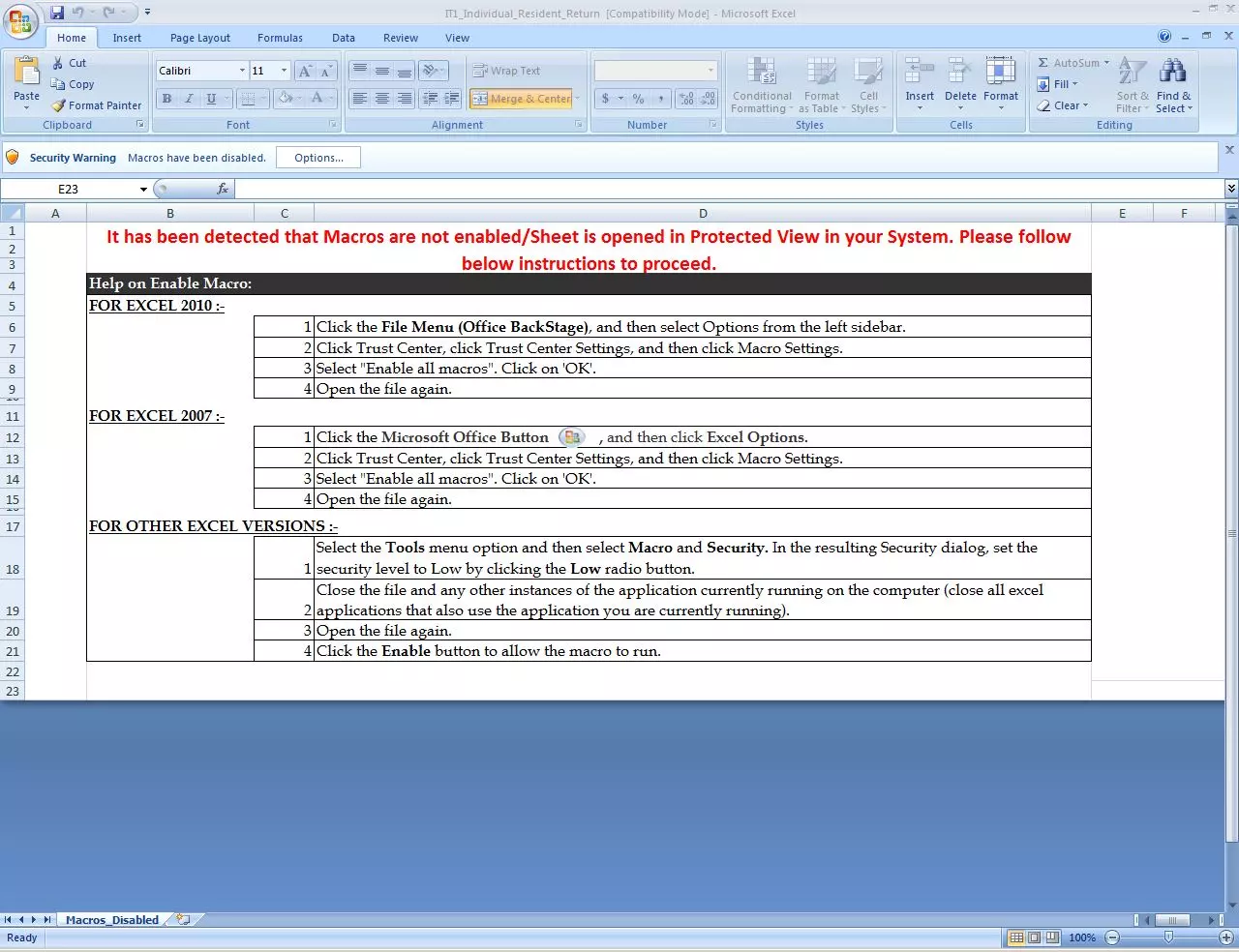

By default Macros on the Excel sheet in Microsoft Excel 2007 is disabled, so you will need to enable Macros on the Excel sheet. If you are using a higher version of Microsoft Office such as Office 2010, it should open easily without asking you anything about enabling Macros.

Another issue that you may experience with the KRA Income Tax Resident Individual Form (Excel) if you are using Microsoft Office 2007, you might be required to download an addon to enable the KRA Excel Sheet open.

>>>> Download 2007 Microsoft Office Suite Service Pack 2 (SP2) <<<<

Step 7: Enable Macros on the IT1 Individual Resident Return XLS (Excel) Form

Once you have successfully enable Macros, the Income Tax Resident Individual Tax Return Excel form should open with ease and allow you input the figures on it with ease.

Step 8: Fill in the required tabs

The tabs that you will be required to fill on the excel sheet includes the following:

- Basic Info

- Employment Income

- Details of PAYE Deducted

- Tax Computation

Note: If you have Withholding Tax (WHT) Credits, then you will need to declare the same on the excel sheet. In our case, we do not have any WHT.

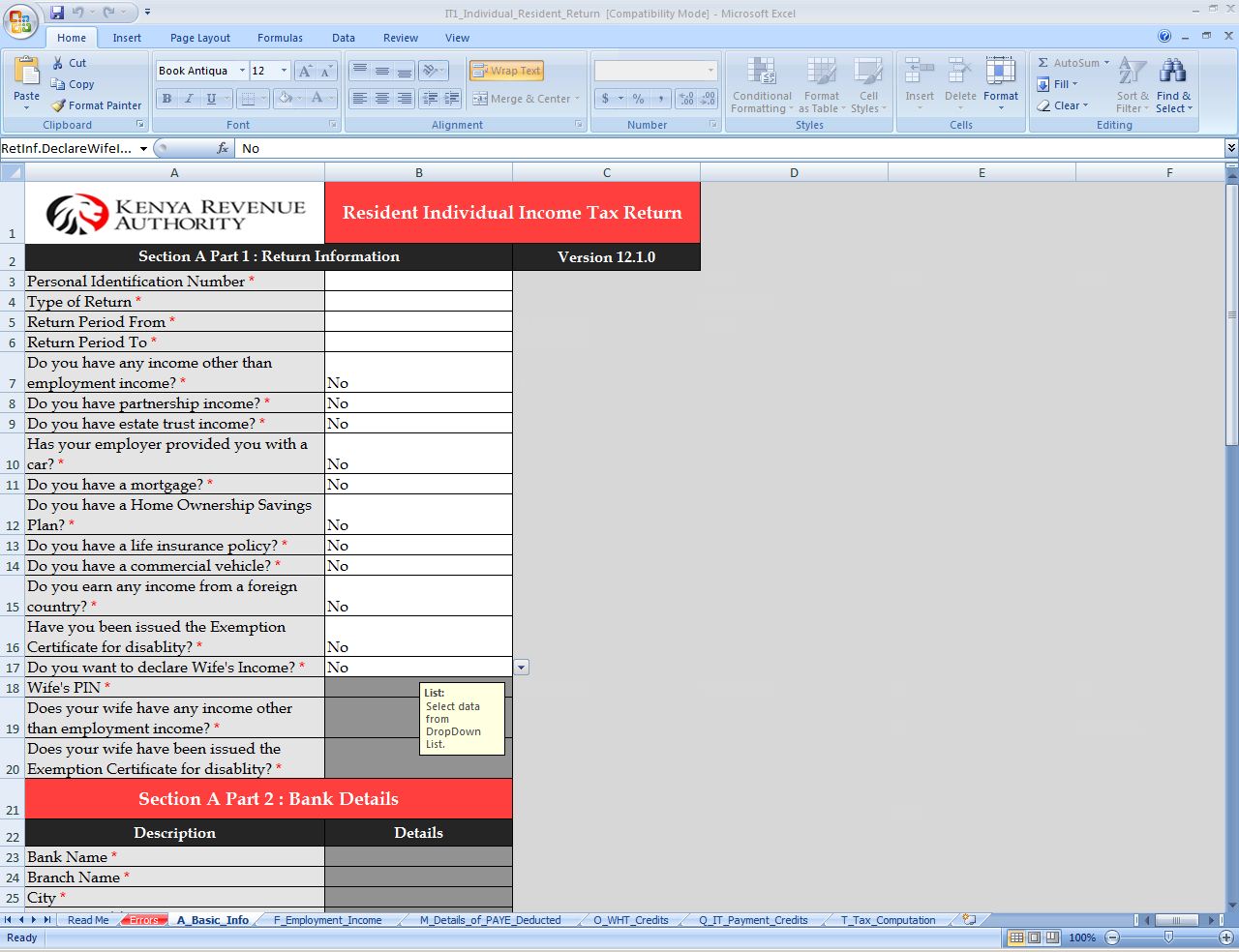

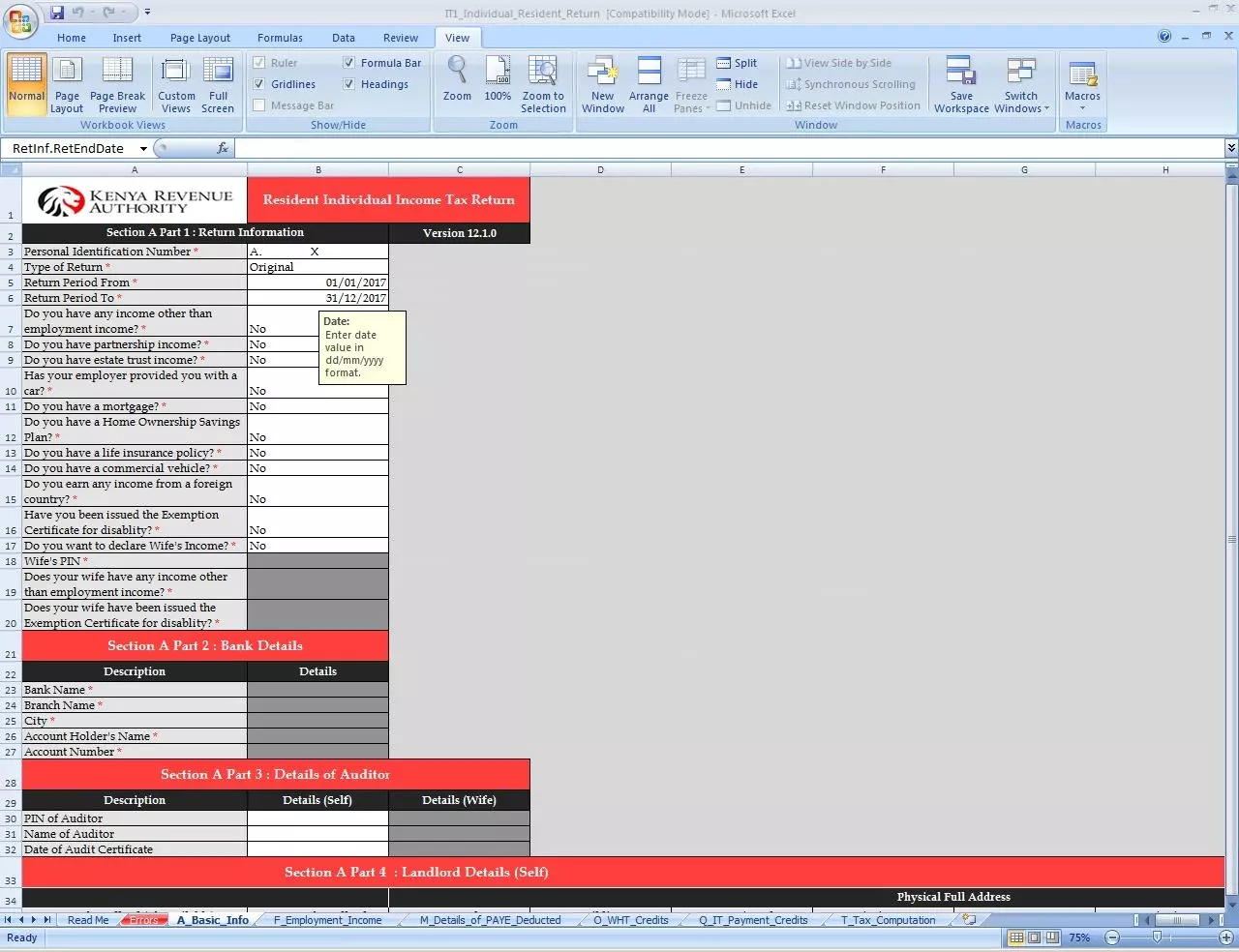

A. Fill in the Basic Info (Section A Part 1 – Return Information)

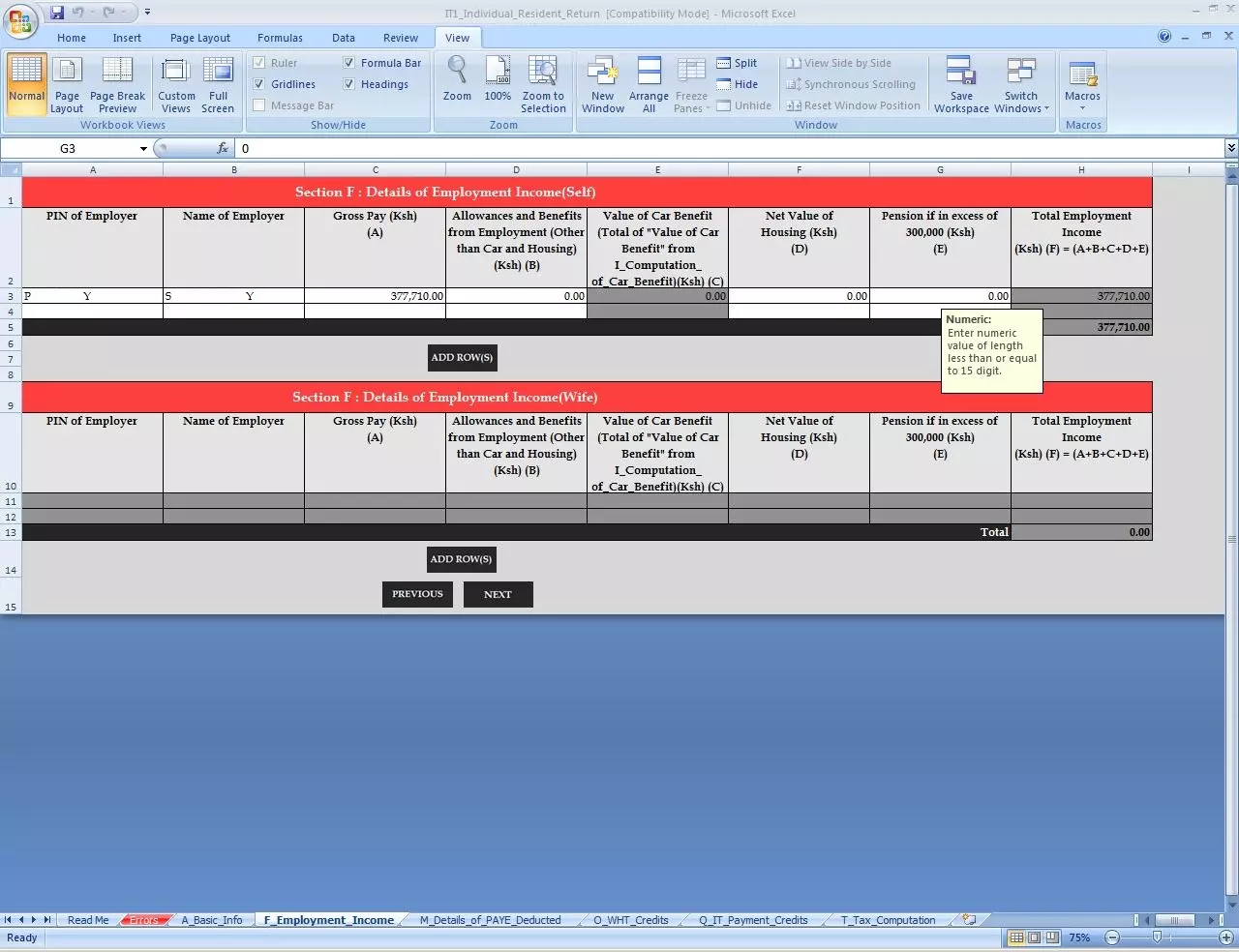

B. Fill in the Employment Income (Section F – Details of Employment {Self})

In this section, you need to provide PIN of Employer, Name of Employer and Gross Pay. The other fields just write 0.00 and proceed.

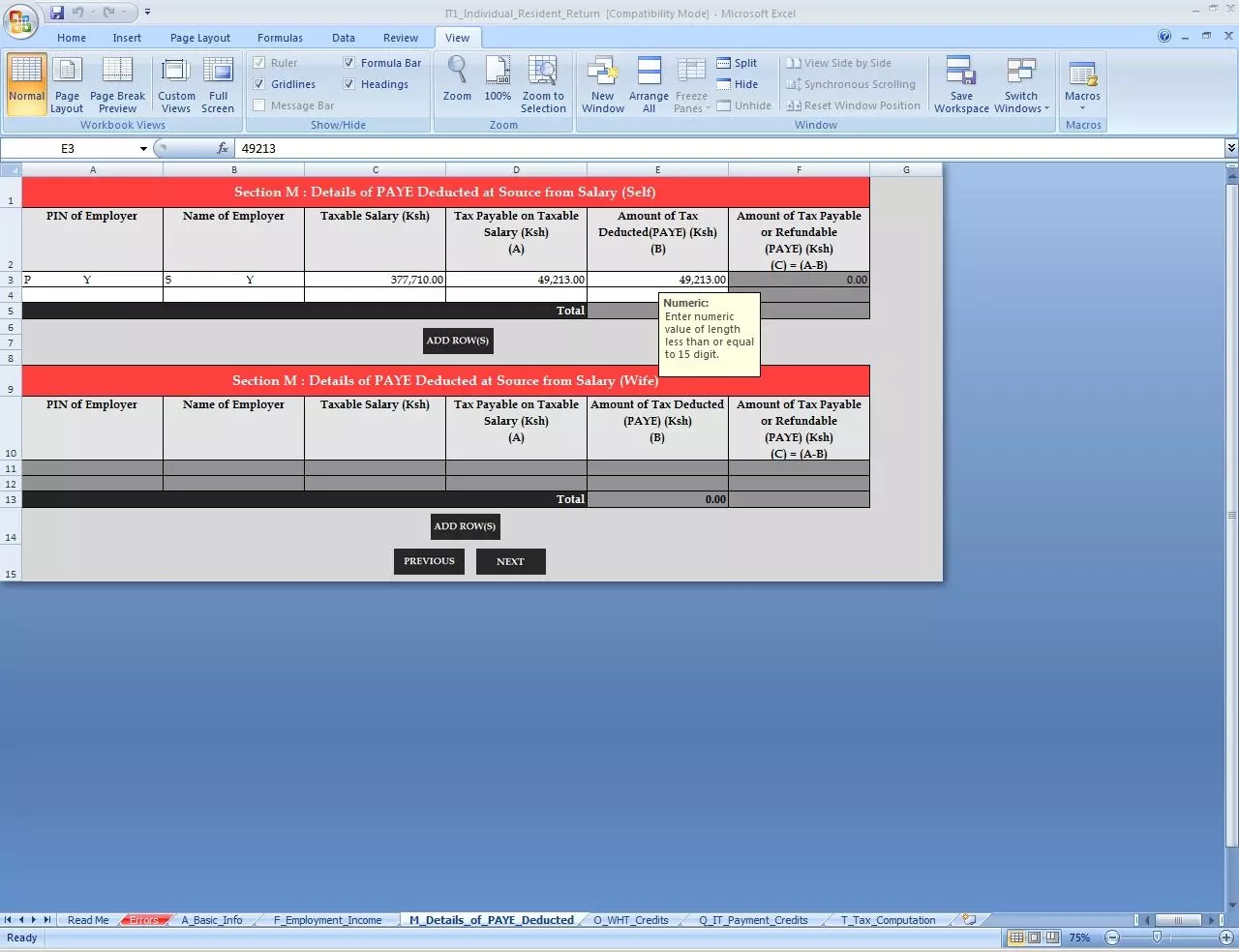

C. Details of PAYE Deducted (Section M – Details of PAYE Deducted at Source from Salary {Self})

In this section, you need to provide PIN of Employer, Name of Employer, Taxable Salary and Amount of Tax Deducted (PAYE).

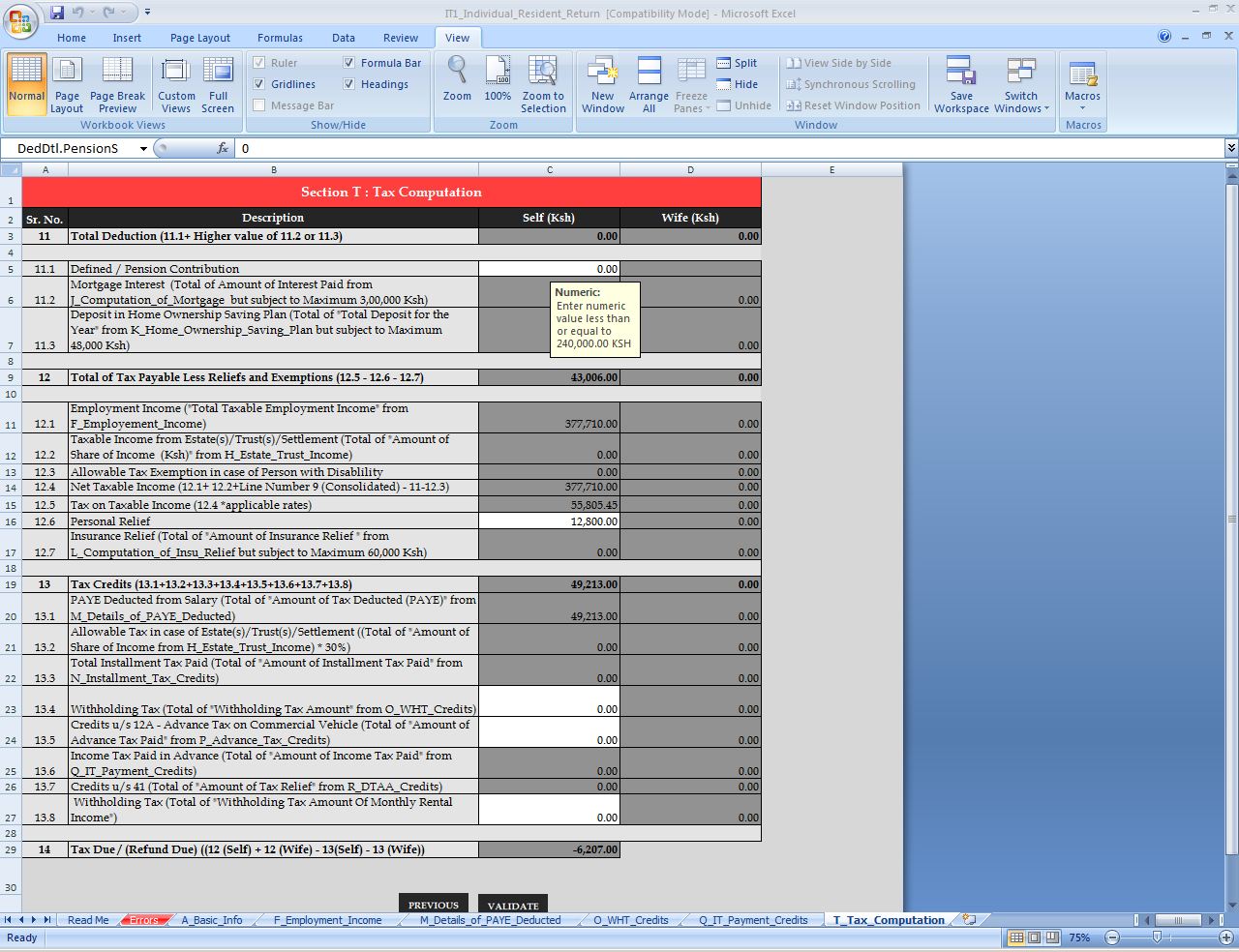

D. Tax Computation (Section T – Tax Computation)

In this last section, you enter the Personal Relief. In our case since the date was for 10 months we enter the personal relief that is displayed on our KRA P9 Form i.e Kshs. 12,800 (for the year 2017 – less two months data). Note that the personal relief for the year 2018 is Kshs. 16,896.

A negative figure in your KRA Return means that you are due for a refund from KRA. (You will be required to enter banking details if you find a negative figure).

A positive figure in your KRA Return means that you owe KRA.

Once done, click on the Validate button to validate the data on the Income Tax Resident Individual Excel sheet.

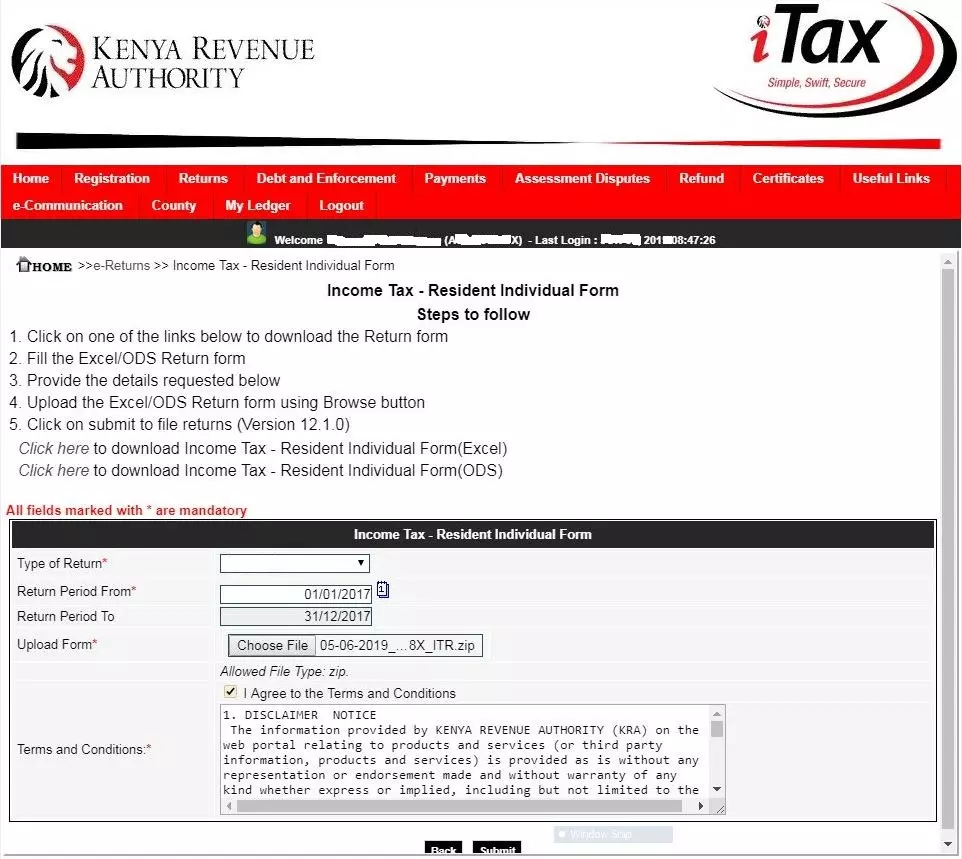

Step 9: Upload Income Tax Resident Individual Excel Form

Once you have uploaded the Income Tax Resident Individual KRA Returns Excel form, click on the submit button.

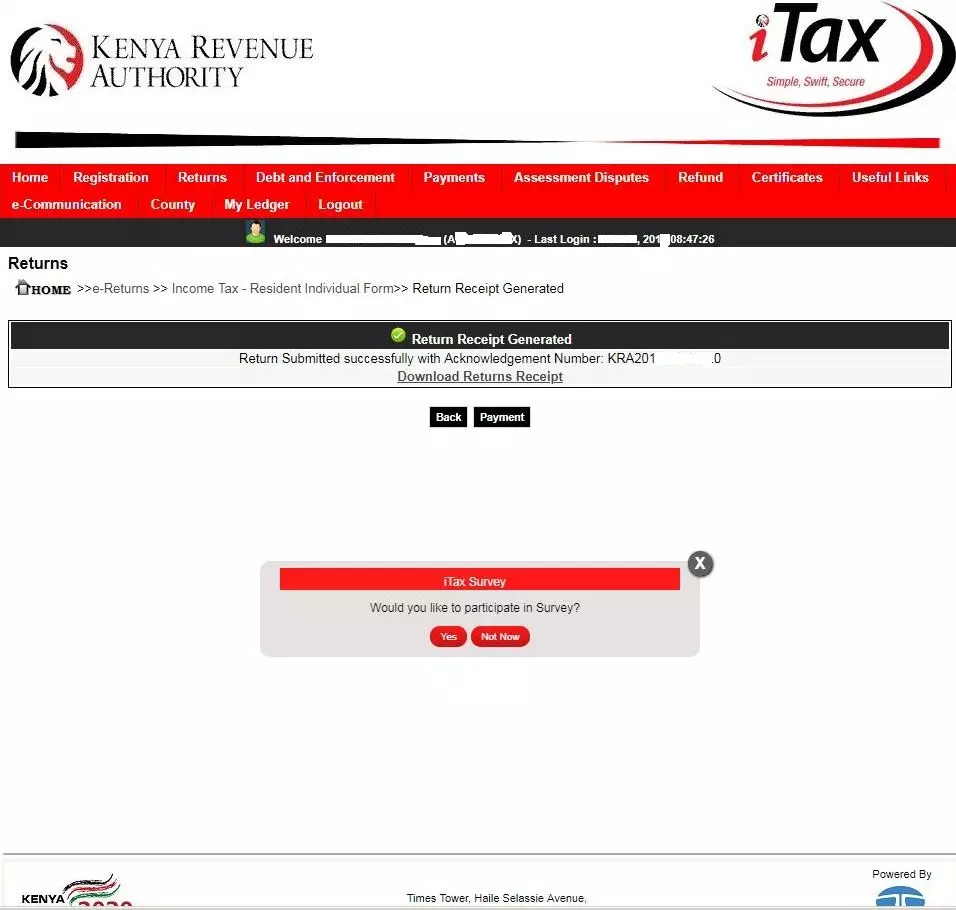

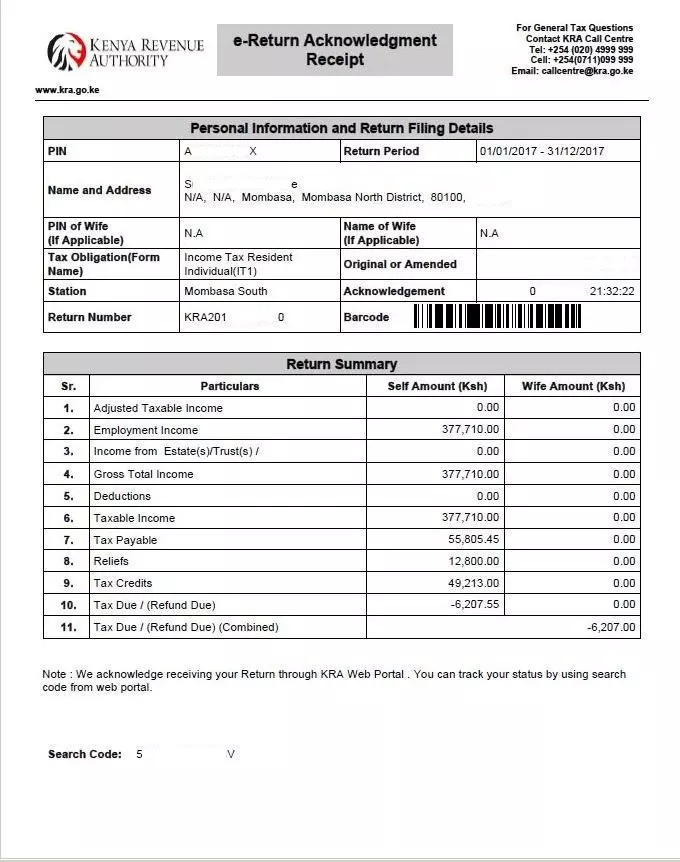

Step 10: Print KRA eReturn Acknowledgement Receipt

Download the KRA Returns eReturn Acknowledgement receipt.

Depending on the calculations on the KRA Returns, sometimes you can get a negative figure or even a positive figure and also even Kshs. 0.00 as the tax due (refund due). In our case, the KRA P9 Form for the year 2017 was used, and it contained data for only ten months.

READ ALSO: How To Retrieve KRA PIN Certificate Using KRA iTax Web Portal

Remember to file your KRA Returns early so as to avoid the penalty of Kshs. 2,000 on late filing of KRA Returns. Avoid the last minute rush, file your KRA Returns today.

DON’T MISS OUT. CHECK OUT OUR TRENDING POPULAR BLOG POSTS IN KENYA.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

KRA PIN REGISTRATION

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

KRA PIN RETRIEVAL

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

KRA PIN UPDATE

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

KRA PIN CHANGE OF EMAIL ADDRESS

Stay Tax Compliant in Kenya

Contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.