If you have a KRA PIN Number but don’t have any source of income, you are required to file Nil Returns on KRA Portal. From the term, Nil Returns basically means you don’t have any income to declare to Kenya Revenue Authority (KRA), son filing of Nil Returns is the only option that you have. Not having a source of income in the context of Nil Returns is no income derived from Employment, Business or Rental in Kenya.

The main group of taxpayers who normally fall under the category of Nil Returns filers are the students and the unemployed. They are required to file Nil Returns on KRA Portal on or before the elapse of the set deadline of 30th June of each year. Failure to which a penalty of Kshs. 2,000/= will be imposed for late filing of Nil Returns on KRA Portal. So, it is always important to ensure that you file your KRA Returns as early as possible to avoid the last minute rush and system downtime in the last days of KRA Returns filing period.

For you to be able to file Nil Returns on KRA Portal, there are two main requirements that are involved in the whole process of filing Nil Returns online. This includes the KRA PIN Number and KRA Password (iTax Password). These two form part of the iTax Login Credentials that are needed in order to file your Nil Returns online using KRA Portal quickly and easily. It is very important that every taxpayer to have both his or her KRA PIN Number and KRA Password (iTax Password) which comes in handy when filing Nil Returns on iTax Portal.

READ ALSO: How To Reprint KRA Payment Slip Online (In 5 Steps)

Requirements Needed In Filing Nil Returns On KRA Portal

For you to be able to file Nil Returns using KRA Portal, you need to first have with you the KRA PIN Number and KRA Password (iTax Password). You will need these two so as to be able to login to KRA Portal successfully, as briefly described below.

-

KRA PIN Number

The KRA PIN Number is the most important requirement that you need to have with you when you want to login to KRA Portal (iTax Portal) so as to be able file KRA Nil Returns online. If by any chance you have forgotten or you don’t remember your KRA PIN Number, you can submit KRA PIN Retrieval request online here at CYBER.CO.KE and our support team will be able to assist with the retrieval of your lost or forgotten KRA PIN Number.

At the same time, if you are looking for a new KRA PIN Number, you can get it here in less than 3 minutes by submitting your KRA PIN Registration request at CYBER.CO.KE. Your new KRA PIN Number and KRA PIN Certificate will be sent to your Email Address once the request for KRA PIN Registration has been done and processed by our support team.

-

KRA Password (iTax Password)

The next requirement that you need to have with you in the process of filing KRA Nil Returns on iTax Portal (KRA Portal) is your KRA Password (iTax Password), which you will need to access your KRA Portal account. If you don’t know or have forgotten your KRA Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for KRA Password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at CYBER.CO.KE and have your Email Address changed so as to enable your Reset KRA Password.

Did you know that you can easily apply and get your KRA PIN Number and KRA PIN Certificate online in less than 5 minutes by using CYBER.CO.KE today. Get it via email address or even WhatsApp upon submission.

Here at, CYBER.CO.KE, we offer unmatched KRA PIN Registration, KRA PIN Retrieval, KRA PIN Update and KRA PIN Change of Email Address services to Kenyans daily. Fill and submit your request online today.

How To File Nil Returns On KRA Portal (In 6 Steps)

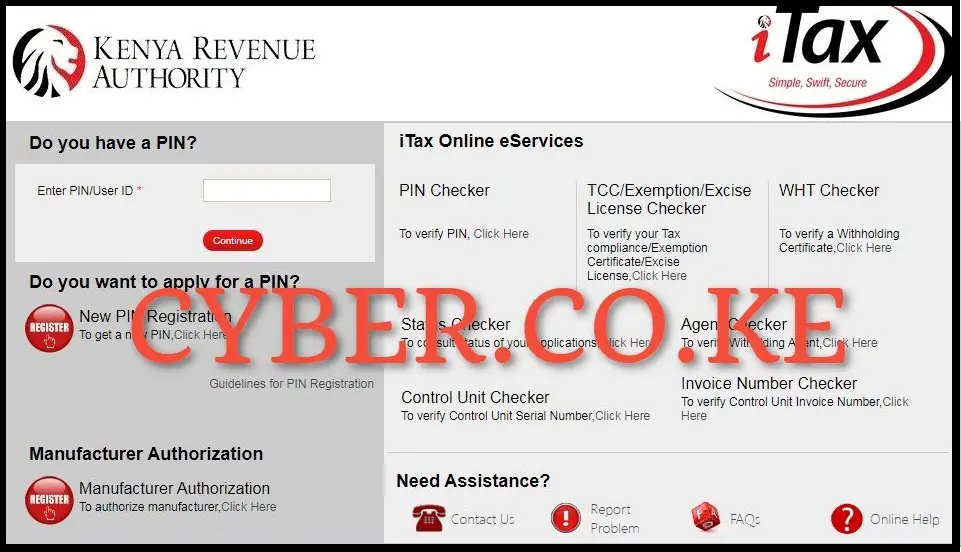

Step 1: Visit KRA Portal

The first step in the whole process of filing Nil Returns on KRA Portal is to visit the KRA Portal by using https://itax.kra.go.ke/KRA-Portal/

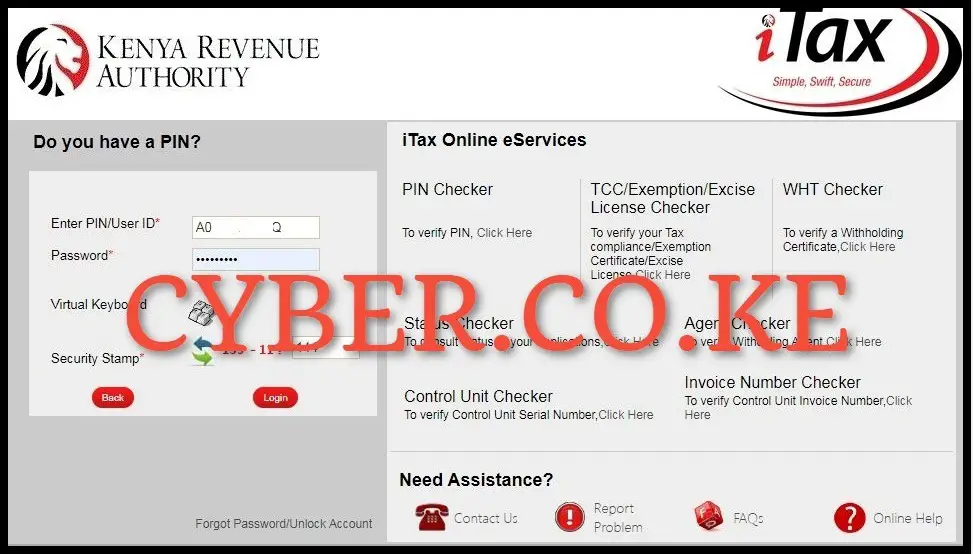

Step 2: Login to KRA Portal

Next, using both your KRA PIN Number and KRA Password (iTax Password), solve the arithmetic question (security stamp) and click on the “Login” button to access your KRA Portal account dashboard.

Step 3: Click on Returns then File Nil Return

In this step, click on the “Returns” menu then “File Nil Return” from the drop down menu list to begin the process of filing Nil Returns on KRA Portal.

Step 4: Select Tax Obligation

Next, you need to select the tax obligation for the KRA Returns that you are filing. In our case, since we are filing Nil Returns on KRA Portal, we select the tax obligation as “Income Tax – Resident Individual” and click on the “Next” button.

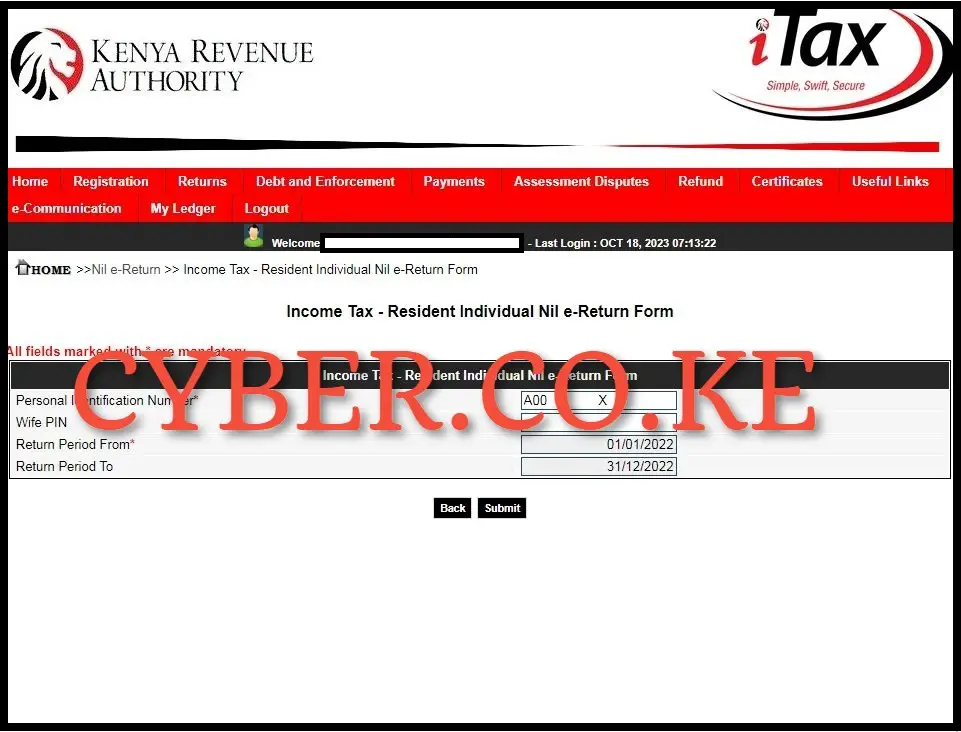

Step 5: Income Tax – Resident Individual Nil e-Return Form

In this step, you need to fill in the Return Period from and it will auto-populate the Return Period To as long as all your KRA Returns are up to date in the KRA Portal. So, we normally use 01/01 to 31/12 of the year that you are filing returns for. Click on the “Submit” button to submit your Nil Returns.

Step 6: Download Nil Returns Acknowledgement Receipt

The last step in the process of filing Nil Returns on KRA Portal is to download the Nil Returns Acknowledgement Receipt which serves as a final confirmation that you have filed your Nil Returns online using KRA Portal. To download the Nil Returns Receipt, just click on the “Download Returns Receipt” text link to save the Nil Returns Acknowledgement Receipt on your device and even print a copy of the KRA Returns Receipt. You can also share the copy of the KRA Returns Receipt to your email address for future references purposes.

READ ALSO: How To Obtain KRA PIN Certificate On iTax (In 5 Steps)

To sum up the process of filing Nil Returns using KRA Portal, you first need to ensure that you are able to access your iTax account using both your KRA PIN Number and KRA Password (iTax Password). Once you are logged into KRA Portal, you can follow the above outlined 6 steps so as to file your Nil Returns online in Kenya correctly. Always remember to file your Nil Returns on or before the set deadline of 30th June each year. File your KRA Returns early to avoid last minute rush and also avoid the penalties imposed for late filing by Kenya Revenue Authority (KRA).

Matthews Ohotto is an Article Writer at CYBER.CO.KE and a Video Creator at Step-by-Step Tutorials Kenya (YouTube). He specializes in crafting insightful Blog Posts and Video Tutorials that empower Kenyans with practical digital skills. He is a holder of Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT).

KRA INDIVIDUAL SERVICES

SUBMIT SERVICE REQUEST

KRA PIN REGISTRATION

Are you looking for KRA PIN Registration services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN RETRIEVAL

Are you looking for KRA PIN Retrieval services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN UPDATE

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN CHANGE OF EMAIL ADDRESS

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA RETURNS SERVICES

SUBMIT SERVICE REQUEST

KRA NIL RETURNS

Are you looking for KRA Nil Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA EMPLOYMENT RETURNS

Are you looking for KRA Employment Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA AMENDED RETURNS

Are you looking for KRA Amended Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA WITHHOLDING TAX RETURNS

Are you looking for KRA Withholding Tax Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.