Do you own a business in Kenya and need to file the monthly Turnover Tax Returns on iTax? Learn How To File Turnover Tax Returns In Kenya Using iTax Portal.

If you own and operate a business in Kenya that is eligible for Turnover Tax, then it is time that you start preparing to file the Turnover Tax Returns for the previous month before the 20th day deadline. Getting to know How To File Turnover Returns for your business is very important in this age of Turnover Tax and Presumptive Tax for businesses in Kenya.

In this article, I am going to share with you the step by step guide on How To File Turnover Tax Returns in Kenya using KRA iTax Portal. By the end of this article, as a taxpayer and a business owner in Kenya, you will have learnt and known all the steps that you need to take in order to file your Turnover Tax Returns on KRA iTax Portal.

READ ALSO: How To Calculate Turnover Tax In Kenya Using Turnover Tax Form

Learning How To File Turnover Tax Returns is a must for any taxpayer ow operates a business in Kenya as the Turnover Tax is filed on a monthly basis on or before the 20th day of the next month. So, if you are new to KRA Monthly Returns, then you definitely need to know How To File Turnover Tax Returns since failure to file KRA Turnover Tax Returns attracts a monthly penalty which I believe you don’t want to be imposed with by Kenya Revenue Authority (KRA).

This article will seek to address key aspects and terms related to Turnover Tax Returns such as: What Is Turnover Tax Returns, Who Is Supposed To File Turnover Tax Returns, What Is The Due Date Of Turnover Tax Returns, What Is The Penalty For Failing To File Turnover Tax Returns, Requirements Needed To File Turnover Tax Returns and How To File Turnover Tax Returns In Kenya Using iTax Portal.

To be able to file Turnover Tax Returns, you need to login to iTax Account using KRA PIN Number and KRA Password. The good thing is that incase you have forgotten your KRA PIN Number or even iTax Password (KRA Password), here at Cyber.co.ke Portal we can gladly assist you with that. Incase you have forgotten your KRA PIN, then you can request for KRA PIN Retrieval and have both your KRA PIN Number and KRA PIN Certificate sent to you. Incase you have forgotten your iTax Password, you can request for KRA PIN Change of Email Address so that you can be able to change your KRA Password.

What Is Turnover Tax Returns?

Turnover Tax Return(s) is a form or type of Return that is filed by businesses in Kenya on a monthly basis on or before the 20th day of the next month. Taxpayers need to register first for Turnover Tax Obligation first and once approved, they will be filing the Turnover Tax Returns for their businesses each and every month from their gross sales of the month at the rate of 3%. So, the business owner has to keep the gross sales records so as to enable him or her be able to file the Turnover Tax Returns.

From the above definition, for a taxpayer to be able to file the KRA Turnover Tax Returns on iTax Portal, first they have to amend their source of income to business and register for the Turnover Tax Obligation. Here at Cyber.co.ke Portal, we offer both Business Income Amendment and Turnover Tax Registration services that will save you all the hassle and bassel that you might face when you need to register for Turnover Tax.

Having looked at the definition of KRA Turnover Tax Returns above, we need to understand Who Is Supposed To File Turnover Tax Returns. I had written a full guide on Turnover Tax titled, “The Complete Beginner’s Guide To KRA Turnover Tax (TOT) In Kenya“ you can check it out to get a full understanding of Turnover Tax in Kenya.

Who Is Supposed To File Turnover Tax Returns?

If you own and operate a business in Kenya whose annual gross sales is less than or not expected to exceed Kshs. 5,000,000.00 then you are eligible for Turnover Tax. You need to note that Turnover Tax is filed and paid by taxpayers who own and operate businesses in Kenya. So if you know that your business makes a gross of less than the Kshs. 5,000,000.00 then you need to ensure that you Register for Turnover Tax using the Turnover Tax Registration services at Cyber.co.ke Portal.

So, businesses whose gross sales per year is less than Kshs. 5,000,000.00 are the one who are supposed to be filing and paying the Turnover Tax to Kenya Revenue Authority (KRA) on a monthly basis from the monthly gross sales of the business. It is the duty of the taxpayer or business owner to ensure that they file their Turnover Tax Returns and pay the Turnover Tax for the business each and every month as required by Kenya Revenue Authority (KRA).

Now that you know the group of taxpayers that are supposed to file KRA Turnover Tax Returns on a monthly basis, we need to look at What Is The Due Date Of Turnover Tax Returns. Each tax obligation in Kenya has a due date that the taxpayers need to ensure that they have filed and paid for the tax before the due date of that tax as stipulated in the Income Tax Laws of Kenya.

What Is The Due Date Of Turnover Tax Returns?

Just like any other tax obligations in Kenya, Turnover Tax also has a due date. So, if you operate a business that is eligible to pay Turnover Tax, then you need to know the due date of the KRA Turnover Tax in Kenya. The due date of the Turnover Tax is normally on or before the 20th day of the next month. So you need to ensure that you file Turnover Tax Returns on or before the 20th day of the next month for the Turnover Tax of the previous month.

Let us use an example to explain this. Assuming you have a KRA PIN Number Registered for Turnover Tax in February 2020 and the Turnover Obligation got approved in February 2020, in this case since you were in business for the month of February 2020, you need to file the Turnover Tax Returns for the month of February 2020 in March and also ensure that you file the KRA Turnover Tax Returns and pay the Turnover Tax due on or before the 20th day of March 2020.

I believe you now understand the due date of Turnover Tax Returns and Turnover Tax Payment from the above description. So, just like any other tax obligation in Kenya, failing to file Turnover Tax Returns and pay Turnover Tax due attracts a penalty as illustrated below.

What Is The Penalty For Failing To File Turnover Tax Returns?

Just like any other type of Tax in Kenya, there is a penalty for failing to file Turnover Tax Returns on KRA iTax Portal. The penalty of late filing of Turnover Tax Returns is Ksh. 5000/- per month. But take note that some taxpayers who did not file their KRA Turnover Tax Returns for the month of January 2020 were penalized Kshs. 2,000.00 I don’t understand why but I am still following up with Kenya Revenue Authority (KRA) for clarification on that.

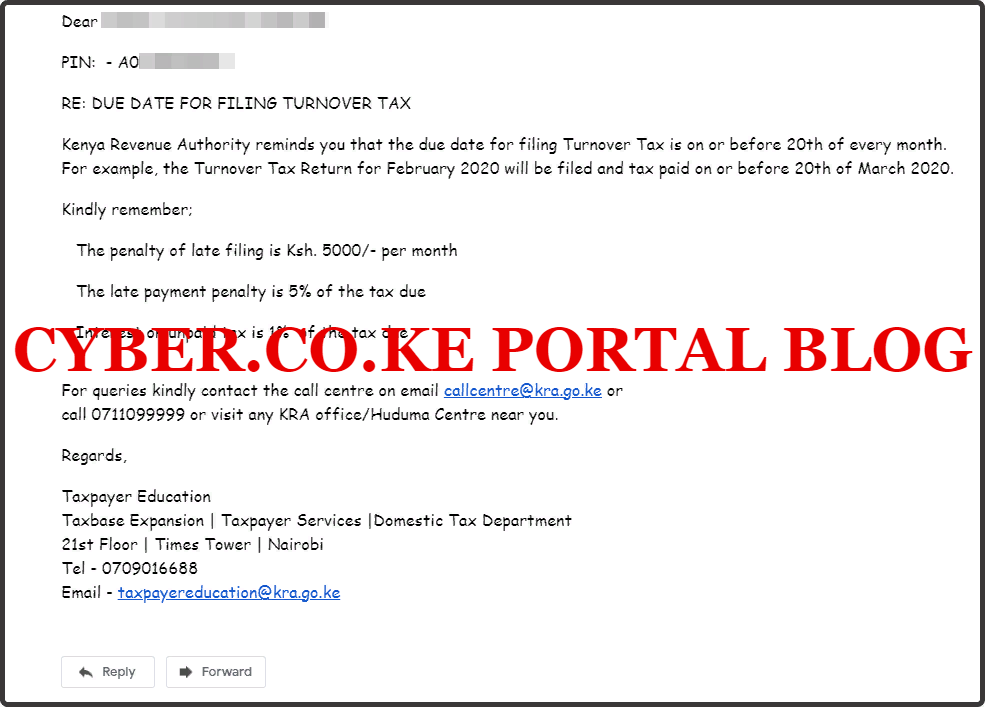

Kenya Revenue Authority (KRA) has made is simpler by sending out notification regarding to filing and payment of Turnover Tax Returns. If you are registered for Turnover Tax, then you should be getting the monthly reminders from KRA asking you to file KRA Turnover Tax Returns and pay the Turnover Tax due. This is as illustrated in the sample message below.

Having looked at the penalty for failing to file Turnover Tax Return, we now need to look at the Requirements Needed To File Turnover Tax Returns. What are those key requirements that you need to have with you before you start the process of filing the Turnover Tax Return on KRA iTax Portal.

Requirements Needed To File Turnover Tax Returns

To be able to file Turnover Tax Return for your business, there are a set of requirements that you need to ensure you have with you before commencing on the process of How To File Turnover Tax Returns using KRA iTax Portal. You need to ensure that you have with you: KRA PIN Number, KRA iTax Password and Total Gross Sales For The Month.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same as the one you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable you Reset KRA iTax Password.

-

Total Gross Sales For The Month

The last and most important requirement in the process of Turnover Tax Returns filing is the Total Gross Sales For The Month. This is basically the total amount of sales that your business generated for the month. Let take an example, assuming the total gross sales for your business for the month of February 2020 was Kshs. 150,000.00 then this is the figure that you will use to calculate the amount of Turnover Tax that you need to pay Kenya Revenue Authority (KRA).

Having looked at the key requirements that are needed in the process of How To File Turnover Tax Returns on iTax Portal, there something that you need to take note in the Turnover Tax Return filing process. The KRA Turnover Tax Return filing is comprised of 6 parts i.e.

- Downloading The Turnover Tax Returns Form

- Filling The Turnover Tax Returns Form

- Uploading The Turnover Tax Returns Form

- Downloading Turnover Tax Acknowledgement Receipt

- Generating Turnover Tax Returns Payment Slip

- Paying Turnover Tax

In this article since we are addressing How To File Turnover Tax Returns, we shall focus on the first 4 parts i.e. Downloading Turnover Tax Returns Form, Filling The Turnover Tax Returns Form, Uploading Turnover Tax Returns Form and Downloading Turnover Tax Returns Acknowledgement Receipt. I shall about the other 2 in my next article. Let us now look at the step by step guide on How To File Turnover Tax Returns on iTax Portal.

How To File Turnover Tax Returns In Kenya Using iTax Portal

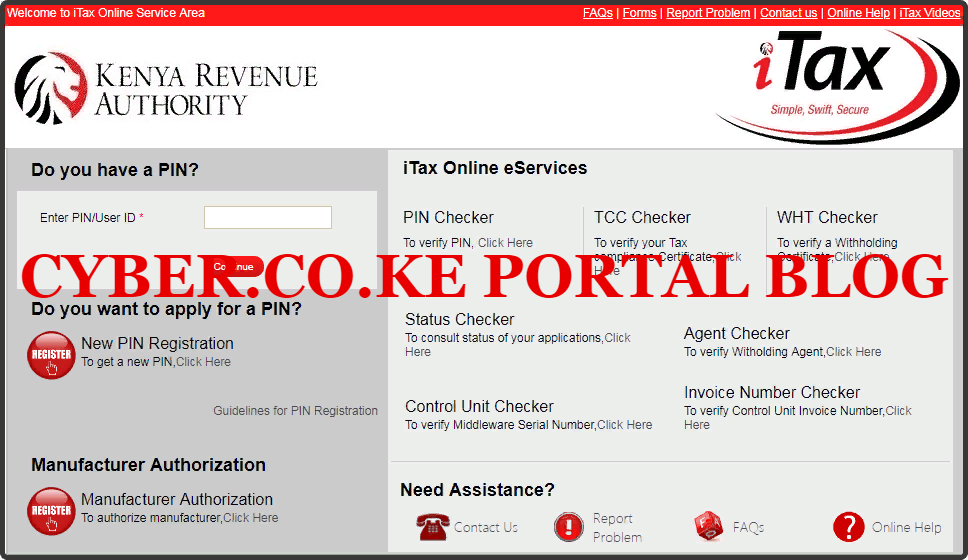

Step 1: Visit KRA Portal

The first step that you need to take in How To File Turnover Tax Returns on iTax Portal is to ensure that you visit the KRA iTax Web Portal using the link provided above in the description. Take note that the above is an external link that will take you to the KRA iTax Portal i.e. link will open in a new tab.

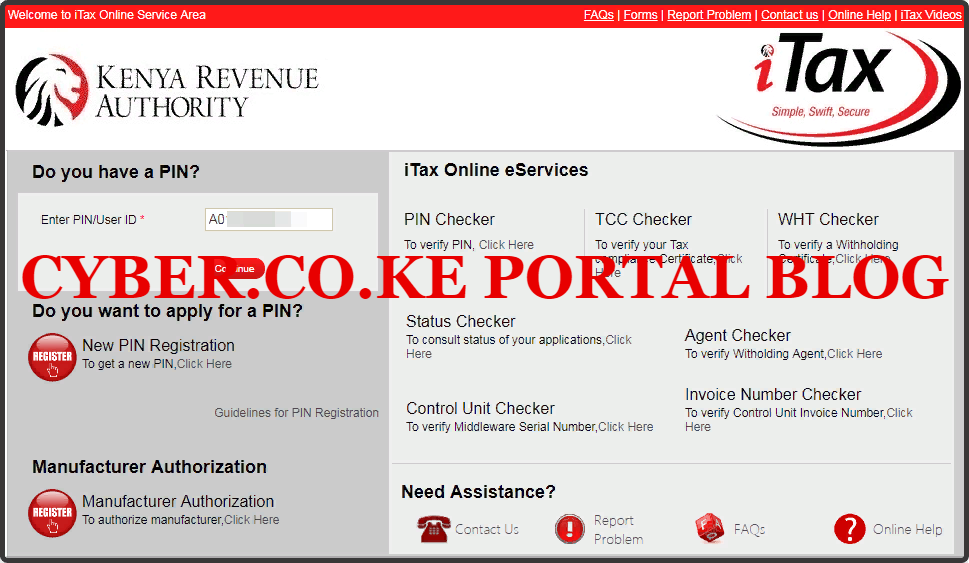

Step 2: Enter Your KRA PIN Number In the PIN/User ID Section

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

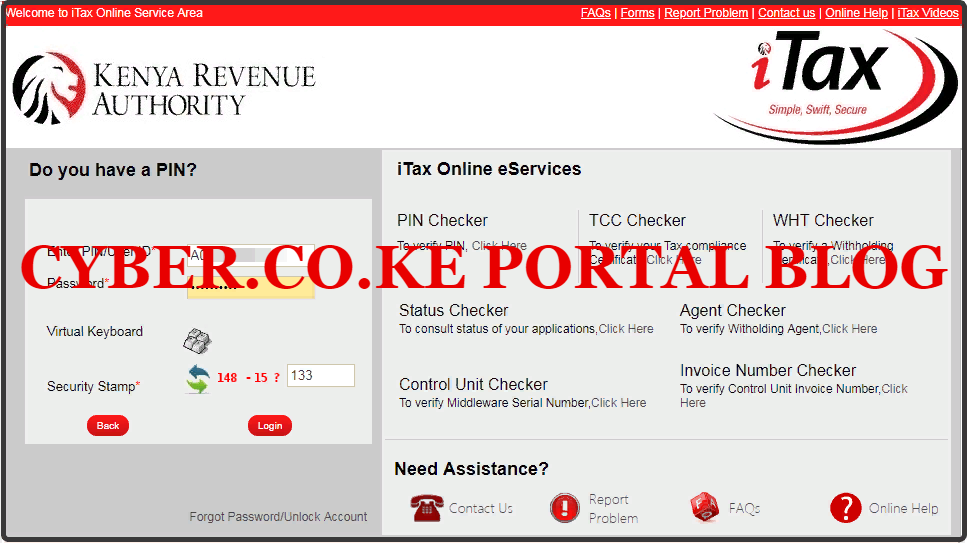

Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: KRA iTax Web Portal Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA iTax Portal Account Dashboard. By entering the correct KRA PIN Number and iTax Password in the KRA Log In process, then you will be able to access you KRA Web Portal Account dashboard. Since we are filing the Turnover Tax Returns we need to download the Turnover Tax Returns Form that will be used in this process, we proceed to Step 5.

Step 5: Click On Returns Menu Tab

Next, you will need to click on the Returns menu tab and from the drop down menu list items, click on File Return. This is because the KRA Turnover Tax Returns Form is located under the Returns section. This is as illustrated below.

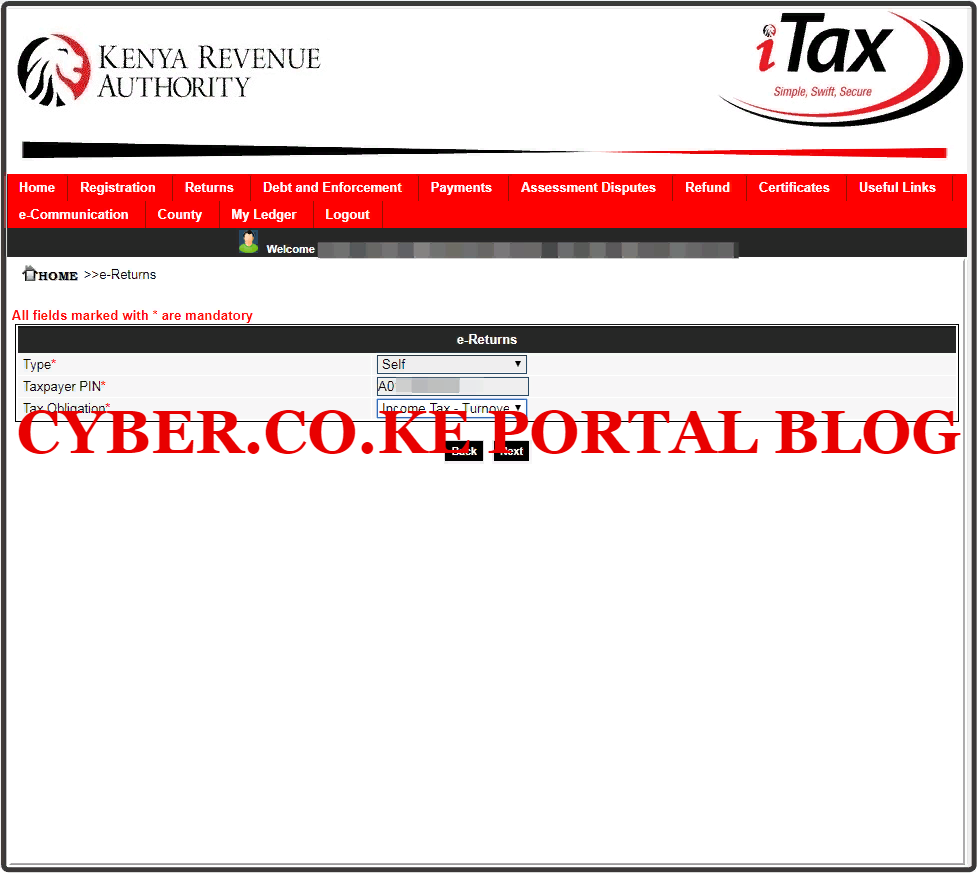

Step 6: Select Tax Obligation As Turnover Tax

In this step, you will need to select the Tax Obligation as Turnover Tax because we need to download the KRA Turnover Tax Returns Form. Once you have entered the Tax Obligation as Turnover Tax, click on the “Next” button.

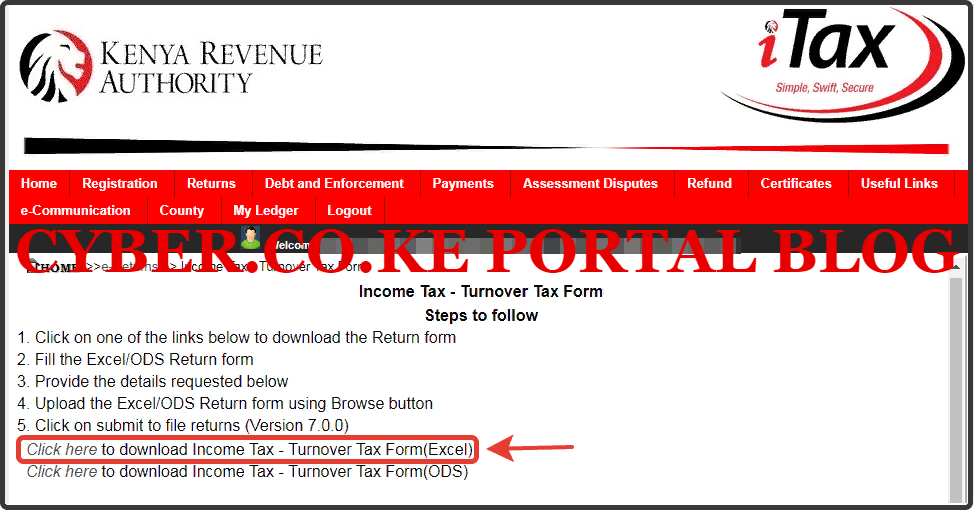

Step 7: Download Turnover Tax Form

In this last step, you will need to download the KRA Turnover Tax Returns Form from your iTax Account. You will note that there are two versions of the Turnover Tax Returns Form i.e. Excel Version and the ODS version. It is highly recommended that you download the Turnover Tax Returns Form Excel Version. You will need to have MS Excel inorder to open the Turnover Tax Returns Form.

Now that we have completed the first pat i.e. Downloading The Turnover Tax Returns Form, we now proceed to the next part that is Filling The Turnover Tax Returns Form.

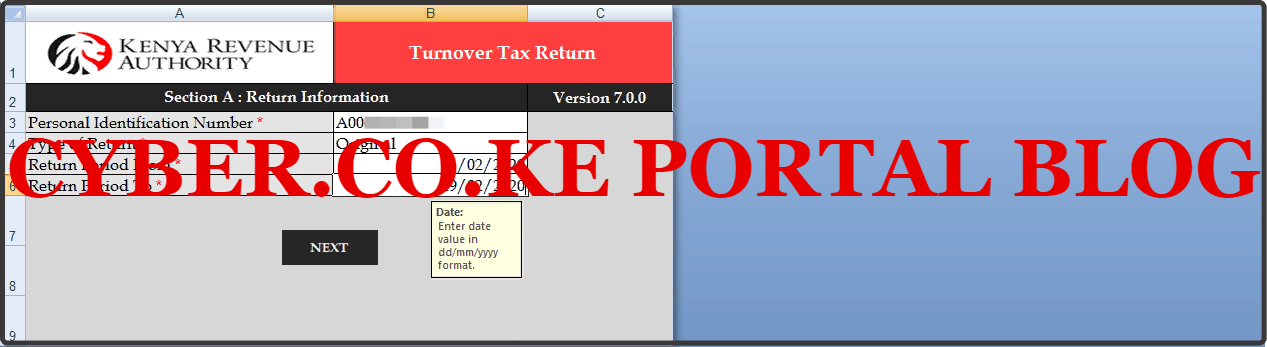

Step 8: Fill In Section A Return Information On The Turnover Tax Return Form

Next, you will need to fill in the Section A with your KRA PIN Number, Type of Return, Return Period From and Return Period To. Once you have filled in the above details, you will now move to the next step where you need to Calculate Turnover Tax using the KRA Turnover Tax Returns Form.

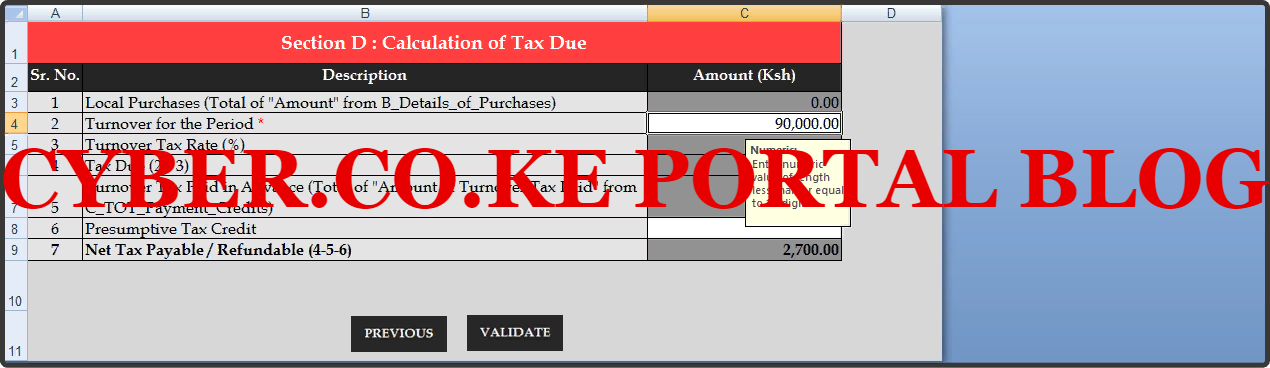

Step 9: Calculate The Turnover Tax

In this step, you are now going to calculate the amount of Turnover Tax that is due from your business gross sales to the Kenya Revenue Authority (KRA). You are going to need the Gross Sales for the previous month i.e. February 2020 so as to use the Turnover Tax Form to calculate Turnover Tax.

As an example, assuming we own a small business whose total gross sales for the month of February 2020 was Kshs. 90,000.00, we shall use the gross sales so as to Calculate Turnover Tax that is due to KRA for the month of February 2020. This is as shown below.

Once you have filled in the details as shown above, you will need to click on the “Validate” button to generate the zipped folder of the Turnover Tax Returns that you are going to need to upload in your KRA iTax Portal Account.

Step 10: Upload The Generated Zipped Turnover Tax Returns Folder On iTax Portal

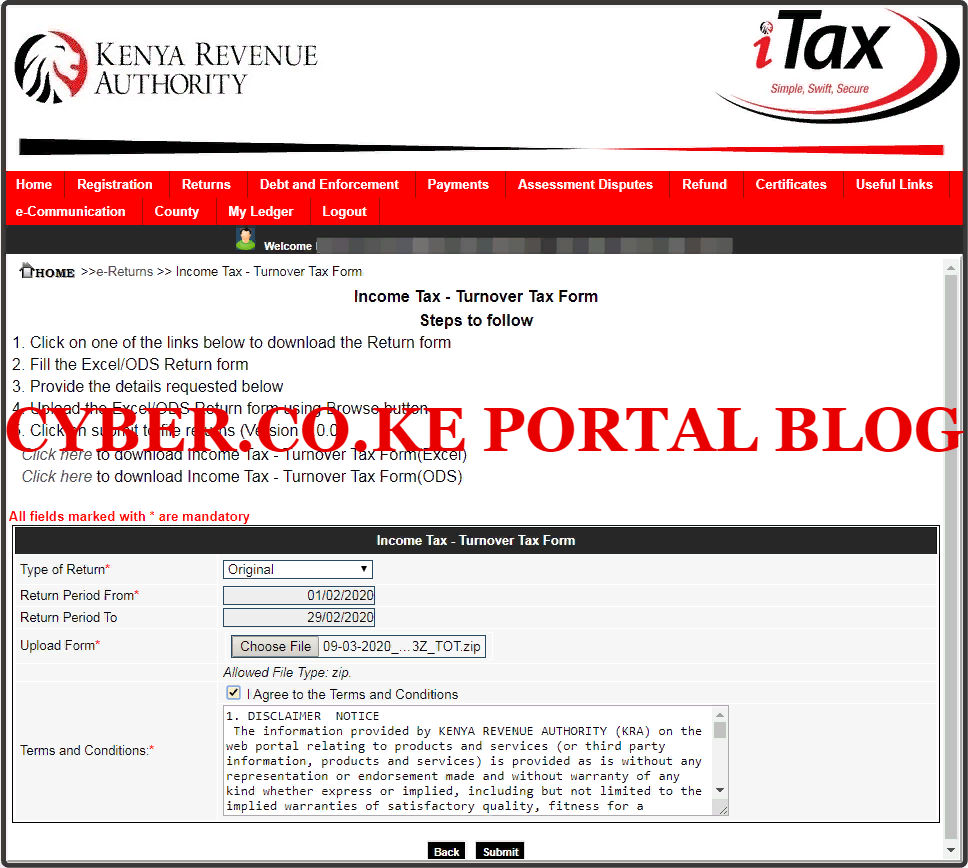

Once you have successfully clicked on the Validate button above, you will now need to upload the generated zipped Turnover Tax Return Form in your KRA iTax Account. During the process of uploading the Turnover Tax Returns Form on iTax Portal, you need to ensure that the Type of Returns is set to Original, Return Period From date i.e. 01/02/2020 and the Return Period To date i.e. 29/02/2020. The dates will change depending on the month that you are filing your Turnover Tax Return for. You can refer to Step 7 above. Once you have uploaded the zipped Turnover Tax Returns Form, tick the check box for “I Agree to the Terms and Conditions” and click on the “Submit” button. This is as shown below.

A popup from itax.kra.go.ke will appear asking you to confirm whether you want to upload the zipped Turnover Tax Returns Form. Click on “YES” Now you proceed to the next part.

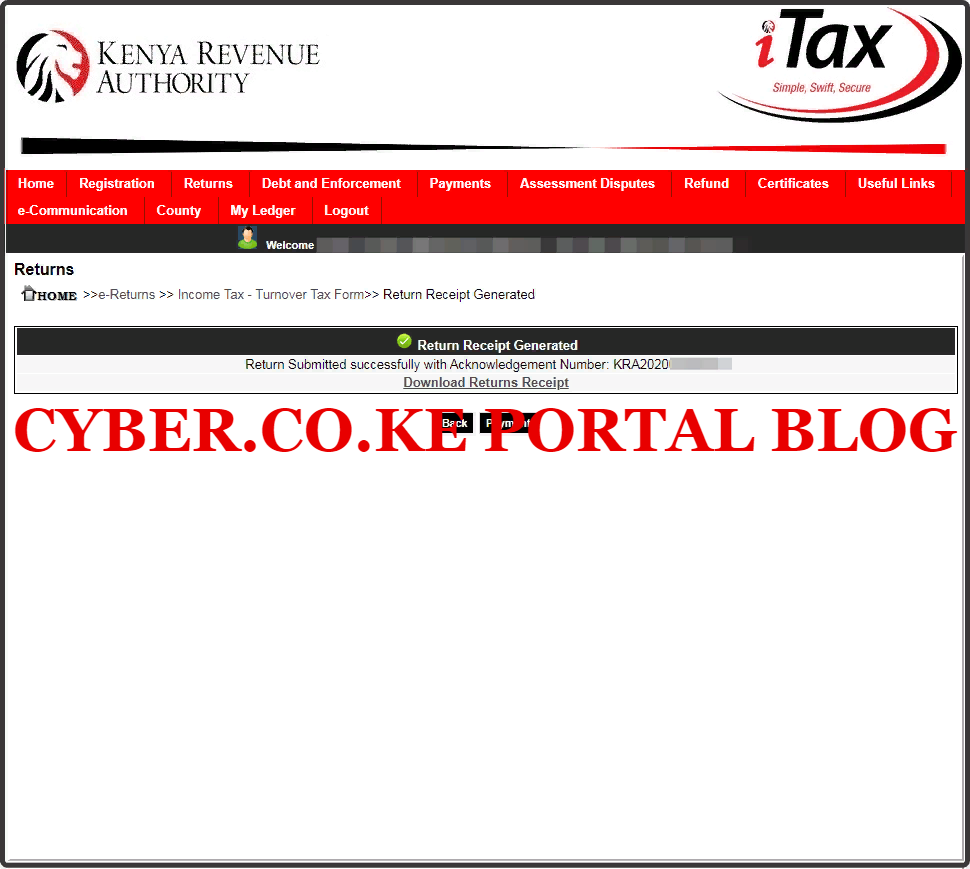

Step 11: Download The Turnover Tax Returns Acknowledgement Receipt

In this step, you will now need to download the Turnover Tax Return Acknowledgement Receipt that has been generated by the iTax Portal after you have successfully uploaded and filed your Turnover Tax Return for the month i.e. February 2020.

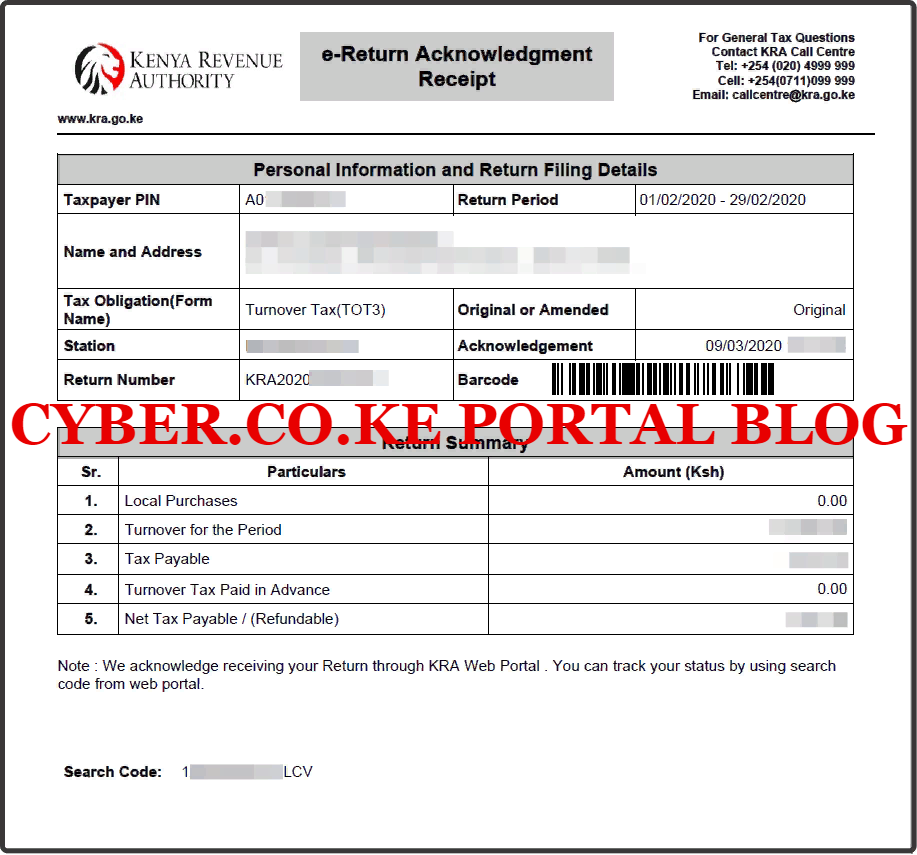

The Turnover Tax Returns Acknowledgement Receipt serves as the final confirmation that you have filed your Turnover Tax for a given month on KRA iTax Portal and the only thing left is payment of the Turnover Tax due. that we I will share in my next article. Below is a screenshot of the Turnover Tax Return Acknowledgement Receipt.

The above steps form the process of How To File Turnover Tax Returns in Kenya using KRA iTax Portal. If you are a business owner, you need to follow the above steps so as to file Turnover Tax Return for your business on iTax Portal. Once you have have filed your KRA Turnover Tax Return using the steps above, you will now be left with the process of Generating Turnover Tax Payment Slip and Paying Turnover Tax that I will cover later on in Cyber.co.ke Portal Blog.

READ ALSO: How To Generate Presumptive Tax Payment Slip Using iTax Portal

If you need any help with KRA Turnover Tax Returns Filing, here at Cyber.co.ke Portal, we have a team of experts who can assist you in ensuring that you file your Turnover Tax Return on time before the deadline. You can submit your order for Turnover Tax Returns Filing today and we shall send you the Turnover Tax Return Acknowledgement Receipt together with the Turnover Tax Payment slip so as to enable you pay the Turnover Tax for your business to Kenya Revenue Authority (KRA).

DON’T MISS OUT. CHECK OUT OUR TRENDING POPULAR BLOG POSTS IN KENYA.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

KRA PIN REGISTRATION

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

KRA PIN RETRIEVAL

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

KRA PIN UPDATE

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

KRA PIN CHANGE OF EMAIL ADDRESS

Stay Tax Compliant in Kenya

Contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.