The KRA Nil Returns Receipt is a very important document that is normally issued to a taxpayer in Kenya upon successful filing of KRA Nil Returns on iTax. It serves as a confirmation that a taxpayer has successfully filed his or her KRA Nil Returns online using iTax. This document is normally issued as the last step after the filing process once you have filed your returns on iTax. You are normally required to download the KRA Nil Returns once you are done with filing of returns on iTax.

If by any chance you forget to download the KRA Nil Returns Receipt, the good news is that you can easily generate the same KRA Nil Returns Receipt on iTax. Generating KRA Nil Returns Receipt is quite important as it allows you to get the same copy of the returns receipt that you were unable to download after filing your KRA Nil Returns on iTax. So, if you fail to download the returns receipt in the first stage, you can easily generate the same returns receipt online easily.

To be able to generate KRA Nil Returns Receipt, you need to have with you two main requirements i.e. KRA PIN Number and KRA Password (iTax Password). This two form part of the iTax login credentials that you need to use in order to successfully login into your iTax account and be able to generate your KRA Nil Returns Receipt easily.

READ ALSO: How To File KRA Nil Returns For Unemployed On iTax

Requirements Needed In Generating KRA Nil Returns On iTax

The process of generating KRA Nil Returns Receipt on iTax requires one to first login into his or her iTax account by using both KRA PIN Number and KRA Password (iTax Password). Below is a brief description of what the KRA PIN Number and KRA Password entails in relation to the whole process of How To Generate KRA Nil Returns Receipt On iTax.

-

KRA PIN Number

The KRA PIN Number is the most important requirement that you need to have with you when you want to login into iTax so as to be able to generate KRA Nil Returns Receipt. If by any chance you have forgotten or you don’t remember your KRA PIN Number, you can submit KRA PIN Retrieval request online here at CYBER.CO.KE and our support team will be able to assist with the retrieval of your lost or forgotten KRA PIN Number.

At the same time, if you are looking for a new KRA PIN Number, you can get it here in less than 3 minutes by submitting your KRA PIN Registration request at CYBER.CO.KE. Your new KRA PIN Number and KRA PIN Certificate will be sent to your Email Address once the request for KRA PIN Registration has been done and processed by our support team.

-

KRA Password (iTax Password)

The next requirement that you need to have with you in the process of generating KRA Nil Returns Receipt on iTax is your KRA Password (iTax Password), which you will need to access your iTax account. If you don’t know or have forgotten your KRA Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for KRA Password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at CYBER.CO.KE and have your Email Address changed so as to enable your Reset KRA Password.

Did you know that you can easily apply and get your KRA PIN Number and KRA PIN Certificate online in less than 5 minutes by using CYBER.CO.KE today. Get it via email address or even WhatsApp upon submission.

Here at, CYBER.CO.KE, we offer unmatched KRA PIN Registration, KRA PIN Retrieval, KRA PIN Update and KRA PIN Change of Email Address services to Kenyans daily. Fill and submit your request online today.

How To Generate KRA Nil Returns Receipt On iTax

Step 1: Visit iTax

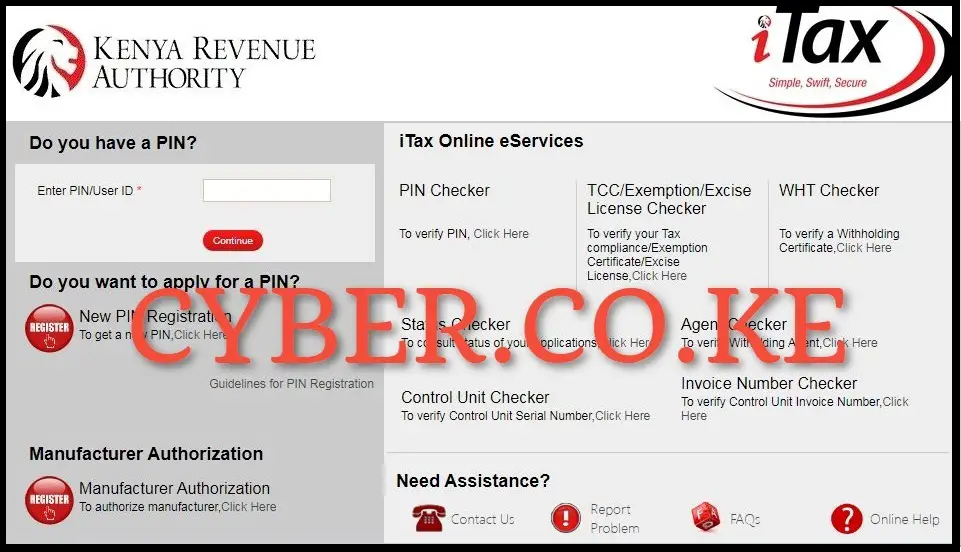

The first step in the process of generating KRA Nil Returns Receipt is to visit iTax by using https://itax.kra.go.ke/KRA-Portal/

Step 2: Login Into iTax

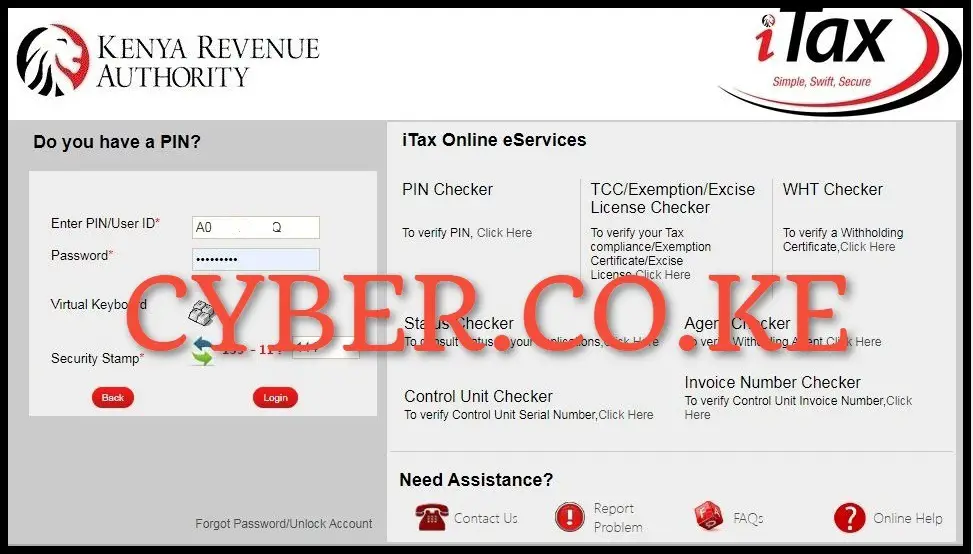

In this step, using both your KRA PIN Number and KRA Password (iTax Password), solve the arithmetic question (security stamp) and click on the “Login” button to login into your iTax account.

Step 3: Click on Useful Links then Consult and Reprint Acknowledgement Receipt and Certificates

Upon successfully logging into your iTax account, click on “Useful Links” followed by “Consult and Reprint Acknowledgement Receipts and Certificates” to begin the process of generating KRA Nil Returns Receipt on iTax.

Step 4: Fill the Consult and Reprint Acknowledgement Receipt Form

In this step, you need to fill in the consult and reprint KRA acknowledgement receipt form. You need to fill in the following important fields on the form; Business Process – Taxpayer Return Processing; Business Sub Process – Original Return Filing; Obligation Name – Income Tax Resident Individual; Tax Period From; 01/01/2022 and Tax Period To: 31/12/2022 (choose the return period that you want the KRA Nil Returns Receipt for). Once you have filled in those details, click on the “Consult” button to load the KRA Returns Acknowledgement Receipt. Note, on the pop up window “Do you want to consult with given details?” click on “OK” button.

Step 5: Download The Generated KRA Nil Returns Receipt

The last step in the process of generating KRA Nil Returns Receipt on iTax, is the downloading of the generated returns receipt. To download the reprinted KRA Nil Returns Receipt on iTax, on the output section of the form just under the “Acknowledgement Number” column, click on the acknowledgement serial number i.e KRA2023***********7, which will in turn initiate the download of KRA Nil Returns Receipt on the iTax.

READ ALSO: How To Reprint KRA Nil Returns Receipt On iTax

The process of generating KRA Nil Returns Receipt on iTax is only possible when you had already filed your returns and forgot to download the returns receipt. This process enables you to generate the same KRA Nil Returns Receipt quickly and easily. You need to ensure that you are able to access your iTax account using both KRA PIN Number and KRA Password (iTax Password). Once you have these two requirements, follow the above main steps on How To Generate KRA Nil Returns Receipt On iTax.

TRENDING BLOG POSTS IN KENYA

CYBER.CO.KE

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

CLICK HERE TO REGISTER KRA PIN NUMBER

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

CLICK HERE TO RETRIEVE KRA PIN CERTIFICATE

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

CLICK HERE TO UPDATE KRA PIN NUMBER

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

CLICK HERE TO CHANGE KRA PIN EMAIL ADDRESS